Cook County Property Tax Bill

Property taxes are a significant expense for homeowners and property owners alike, and understanding the billing process and payment options is crucial for effective financial management. In Cook County, Illinois, the property tax system is a complex yet essential aspect of local governance, impacting both residential and commercial properties. This comprehensive guide aims to demystify the Cook County Property Tax Bill, offering insights into the assessment process, billing cycles, and strategies for managing tax obligations efficiently.

Understanding the Cook County Property Tax Assessment

The Cook County property tax system operates on an assessment-based model, where the Cook County Assessor’s Office is responsible for determining the assessed value of each property within the county. This value is a critical factor in calculating the property tax bill, as it represents the taxable value of the property. The assessment process considers various factors, including:

- Market Value: The Assessor's Office analyzes recent sales of comparable properties to estimate the market value of each property.

- Physical Characteristics: Factors like size, age, condition, and any improvements made to the property are taken into account.

- Economic Conditions: The local economy, including factors like employment rates and income levels, can influence property values.

- Legal Factors: Zoning regulations and any legal restrictions on the property's use are considered.

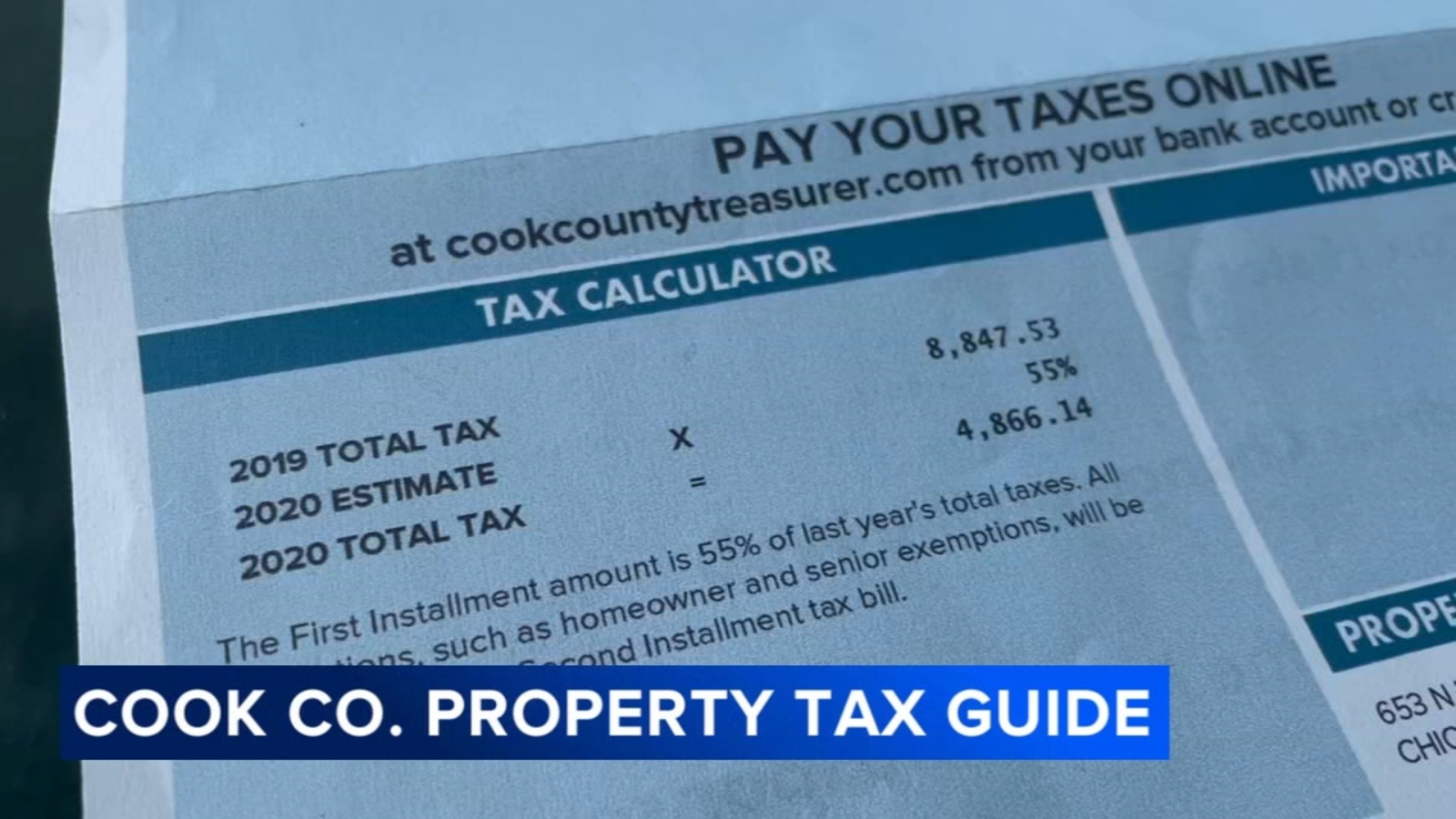

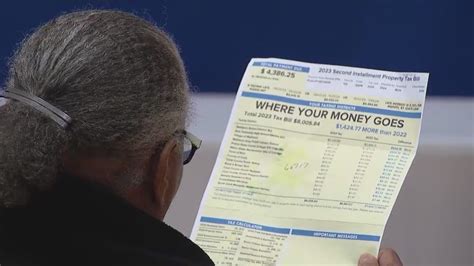

Once the assessed value is determined, it is multiplied by the tax rate, which is set by local taxing bodies, including municipalities, school districts, and special purpose districts. This calculation results in the property tax liability, which is then divided into installments for billing purposes.

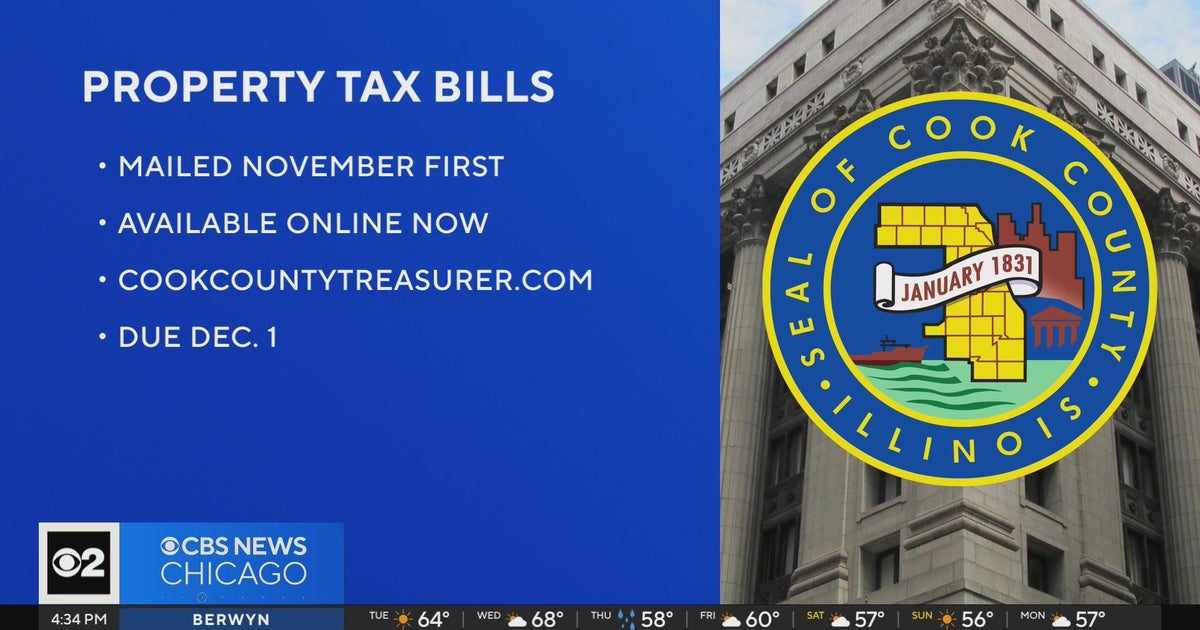

Cook County Property Tax Billing Cycles

In Cook County, property tax bills are issued twice a year, with each installment covering a specific period. The billing cycles are as follows:

First Installment

- Due Date: The first installment is typically due on March 1st of each year.

- Covering Period: This installment covers the tax liability for the first half of the calendar year, from January 1st to June 30th.

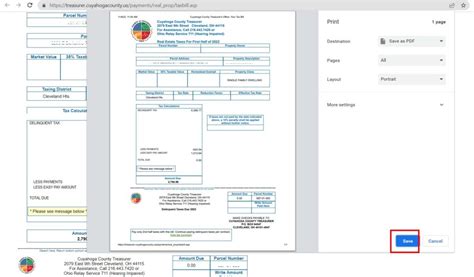

- Payment Options: Property owners have several payment methods available, including online payment, mail-in payment, and in-person payment at designated locations.

Second Installment

- Due Date: The second installment is due on August 1st of each year.

- Covering Period: This installment covers the tax liability for the second half of the calendar year, from July 1st to December 31st.

- Late Payment Penalties: Late payments beyond the due date may incur penalties and interest charges. It’s essential to stay updated on the payment deadlines to avoid additional costs.

Property owners are responsible for ensuring timely payment of both installments to avoid late fees and potential legal consequences. The Cook County Treasurer's Office provides detailed information on payment options and deadlines through its official website.

Strategies for Efficient Property Tax Management

Managing property taxes effectively can help homeowners and property owners optimize their financial strategies. Here are some key strategies to consider:

Stay Informed About Assessments

Understanding the assessment process and keeping track of your property’s assessed value is crucial. Property owners have the right to appeal their assessed value if they believe it is inaccurate. The Cook County Assessor’s Office provides resources and guidelines for property owners to review and challenge their assessments.

Explore Tax Relief Programs

Cook County offers various tax relief programs aimed at assisting eligible property owners. These programs may provide reduced tax rates, exemptions, or deferrals for specific categories of property owners, such as seniors, veterans, and individuals with disabilities. Researching and applying for relevant tax relief programs can significantly impact your tax liability.

Utilize Payment Plans

For property owners facing financial challenges, the Cook County Treasurer’s Office provides payment plan options. These plans allow property owners to pay their tax bills over an extended period, making it more manageable to meet their tax obligations. It’s essential to inquire about payment plan eligibility and terms to ensure compliance.

Consider Tax-Efficient Property Upgrades

Certain property improvements can impact your property’s assessed value. When planning upgrades or renovations, consider the potential tax implications. Some improvements may increase your property’s value, leading to higher tax bills. However, strategically planned upgrades can also enhance energy efficiency, which may qualify for tax credits or incentives.

Stay Updated on Tax Law Changes

Tax laws and regulations can evolve, impacting property tax calculations and payment processes. Stay informed about any changes to Cook County’s property tax system, including new exemptions, deductions, or assessment methods. Consulting with tax professionals or staying connected with local government updates can provide valuable insights.

Table: Cook County Property Tax Assessment Factors

| Assessment Factor | Description |

|---|---|

| Market Value | Based on recent sales of comparable properties |

| Physical Characteristics | Size, age, condition, and improvements |

| Economic Conditions | Local economy and employment rates |

| Legal Factors | Zoning regulations and legal restrictions |

FAQ

How often are property assessments conducted in Cook County?

+

Property assessments in Cook County are conducted every three years. However, the Assessor’s Office may perform interim assessments for certain properties if there are significant changes or improvements made.

Can I appeal my property’s assessed value?

+

Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or excessive. The Cook County Assessor’s Office provides an online appeal process, and property owners can also schedule an informal hearing to discuss their assessment.

What happens if I miss the property tax bill payment deadline?

+

Late payments may result in additional penalties and interest charges. It’s crucial to stay updated on payment deadlines to avoid these fees. The Cook County Treasurer’s Office provides information on late payment options and potential payment plans.

Are there any tax relief programs available for seniors or veterans in Cook County?

+

Yes, Cook County offers several tax relief programs for eligible seniors, veterans, and individuals with disabilities. These programs may provide reduced tax rates or exemptions. It’s recommended to research and apply for these programs to take advantage of potential tax savings.

How can I stay updated on changes to Cook County’s property tax laws and regulations?

+

Subscribing to updates from the Cook County Treasurer’s Office and Assessor’s Office websites is an excellent way to stay informed. Additionally, local news sources and tax professional networks often provide insights into any changes to the property tax system.