Illinois State Tax Refund Status

If you're an Illinois resident awaiting your state tax refund, understanding the process and keeping track of its status can provide peace of mind. This comprehensive guide aims to elucidate the steps involved in checking the status of your Illinois state tax refund, offering a thorough and detailed explanation.

Navigating the Illinois State Tax Refund Process

The Illinois Department of Revenue (IDOR) manages the state’s tax refund system, ensuring a streamlined and secure process. While the refund journey can vary based on individual circumstances, a general understanding of the process can be beneficial.

Key Steps in the Illinois State Tax Refund Process

- Filing Your Tax Return: This is the initial step, where you provide all relevant financial information for the tax year in question.

- Processing Your Return: After filing, the IDOR reviews your return for accuracy and completeness. This stage can take several weeks.

- Refund Approval: Once your return is processed and approved, the IDOR authorizes the refund.

- Refund Issuance: The approved refund is then issued, typically within a few weeks of approval.

- Receipt of Refund: Finally, you receive your refund, either by direct deposit or check, depending on your preferred method.

Understanding the Illinois State Tax Refund Timeline

The Illinois state tax refund process generally follows a predictable timeline, with some variations based on individual cases. Here’s a breakdown of the typical timeline:

- Filing to Processing: After filing your tax return, it typically takes 4-6 weeks for the IDOR to process it. This timeframe can be longer if your return is complex or requires additional review.

- Processing to Approval: Once your return is processed, the approval stage can take an additional 2-4 weeks. Again, this may vary based on the complexity of your return or any potential issues identified during processing.

- Approval to Issuance: After approval, the IDOR usually issues refunds within 2-3 weeks. However, it’s important to note that this timeframe can be impacted by factors like the volume of refunds being processed or any potential delays in the system.

- Issuance to Receipt: Once your refund is issued, it can take up to 10 days for direct deposit refunds to appear in your account. For check refunds, the delivery time can vary depending on your location and postal service efficiency.

Checking Your Illinois State Tax Refund Status

Knowing how to check the status of your Illinois state tax refund is crucial. Here’s a step-by-step guide to help you through the process:

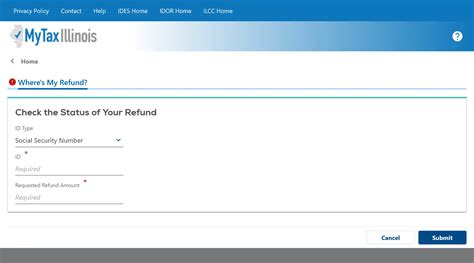

- Online Status Check: The IDOR offers an online status check tool on its website. You’ll need your Social Security Number (SSN), date of birth, and the amount of your expected refund.

- Phone Status Check: If you prefer, you can also call the IDOR’s automated refund status line at (217) 782-3333. This option provides a convenient way to check your refund status without the need for an internet connection.

- Mail Status Check: In some cases, you may need to contact the IDOR by mail. This method is typically used when there are issues with your refund that require further investigation.

Common Issues and Troubleshooting

While the Illinois state tax refund process is generally straightforward, issues can occasionally arise. Here are some common problems and potential solutions:

- Processing Delays: If your refund is taking longer than expected, it’s worth checking for potential processing delays. These can be due to factors like system updates or a high volume of returns.

- Refund Errors: Errors in your tax return can lead to delays or issues with your refund. Double-check your return for accuracy and completeness to avoid these problems.

- Refund Status Not Available: If you’re unable to access your refund status online, it could be due to a technical issue or a delay in updating the system. In such cases, it’s best to wait a few days and try again.

Tips for a Smooth Illinois State Tax Refund Process

To ensure a smooth and efficient Illinois state tax refund process, consider the following tips:

- File Electronically: Electronic filing is faster and more accurate than paper filing. It also reduces the risk of errors and delays.

- Choose Direct Deposit: Opting for direct deposit as your refund method can speed up the process. It’s a secure and efficient way to receive your refund.

- Check Your Return for Errors: Before filing, carefully review your tax return for accuracy. This can help prevent potential delays or issues with your refund.

- Keep Important Documents: Retain all relevant tax documents, such as your W-2 and 1099 forms, for at least three years. This can be helpful if you need to reference them during the refund process or for future tax purposes.

The Future of Illinois State Tax Refunds

The Illinois Department of Revenue is continually working to improve the state tax refund process. In recent years, they have implemented several initiatives to enhance efficiency and security, such as:

- Enhanced Online Services: The IDOR has invested in improving its online services, including a more user-friendly website and enhanced security measures.

- Refined Processing Systems: The department has implemented advanced technologies to streamline the processing of tax returns, reducing the time it takes to issue refunds.

- Increased Security Measures: With the rise of identity theft and fraud, the IDOR has strengthened its security protocols to protect taxpayer information and prevent unauthorized access.

Conclusion: Your Illinois State Tax Refund

Navigating the Illinois state tax refund process can be straightforward with the right information and tools. By understanding the steps involved, staying informed about potential delays or issues, and following best practices, you can ensure a smooth and timely refund process. Remember, the IDOR is committed to providing efficient and secure services, and with ongoing improvements, the process is only becoming more streamlined and secure.

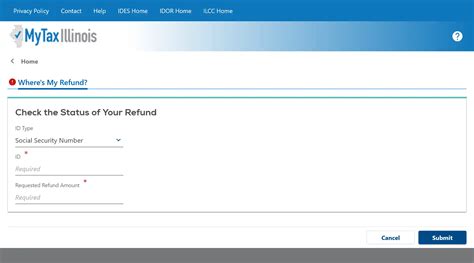

How can I check the status of my Illinois state tax refund online?

+To check your Illinois state tax refund status online, visit the IDOR’s website and navigate to the “Where’s My Refund?” section. You’ll need your SSN, date of birth, and the amount of your expected refund.

What should I do if my Illinois state tax refund is delayed?

+If your Illinois state tax refund is delayed, first check for potential processing delays or system updates. If the delay persists, contact the IDOR’s customer service for further assistance.

How can I receive my Illinois state tax refund faster?

+To receive your Illinois state tax refund faster, consider electronic filing and direct deposit as your refund method. These options are more efficient and can reduce processing time.

What documents should I keep for Illinois state tax purposes?

+For Illinois state tax purposes, it’s recommended to keep all relevant tax documents, such as W-2 and 1099 forms, for at least three years. These documents can be crucial if you need to reference them during the refund process or for future tax filings.

How does the IDOR enhance security for Illinois state tax refunds?

+The IDOR has implemented various security measures to protect taxpayer information and prevent fraud. These include advanced encryption technologies, secure data storage systems, and robust identity verification processes.