Virginia State Tax Forms

When it comes to tax season, individuals and businesses in Virginia must navigate a range of state tax forms to fulfill their obligations. The Virginia Department of Taxation provides various forms and resources to ensure compliance with state tax laws. In this comprehensive guide, we will delve into the world of Virginia state tax forms, exploring the key documents, their purposes, and the steps involved in navigating the tax filing process.

Understanding Virginia State Tax Forms

Virginia’s tax system encompasses a range of taxes, including income tax, sales and use tax, corporate income tax, and various other taxes and fees. To report and pay these taxes accurately, taxpayers must utilize the appropriate state tax forms. These forms serve as a means of communication between taxpayers and the Virginia Department of Taxation, allowing for the disclosure of financial information and the calculation of tax liabilities.

Key Virginia State Tax Forms

Here are some of the most commonly used Virginia state tax forms and their purposes:

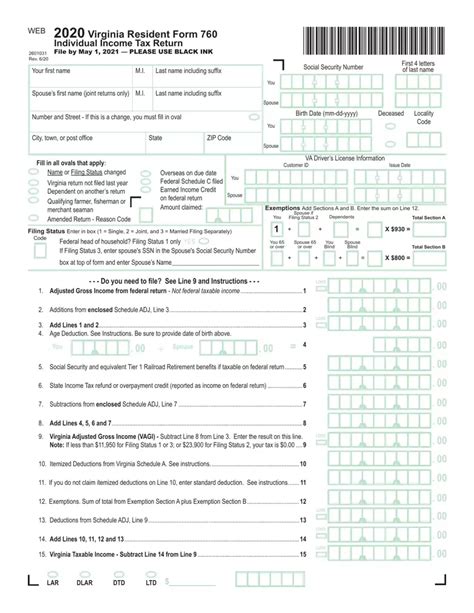

- Form 760: Individual Income Tax Return - This form is for Virginia residents and nonresidents to report their income, deductions, and credits. It is used to calculate and pay state income tax.

- Form 760PY: Individual Estimated Tax Payment Voucher - Taxpayers who expect to owe state income tax can use this form to make quarterly estimated tax payments. It ensures taxpayers stay compliant throughout the year.

- Form 760-ES: Individual Estimated Income Tax Payment Voucher - Similar to Form 760PY, this form is used for estimated tax payments. It provides a convenient way to pay taxes when income is earned throughout the year.

- Form 760-COR: Amended Individual Income Tax Return - If a taxpayer needs to correct errors or make changes to a previously filed return, they can use this form to amend their individual income tax return.

- Form ST-101: Sales and Use Tax Return - Businesses engaged in retail sales, leasing, or renting of tangible personal property in Virginia must use this form to report and pay sales and use tax.

- Form ST-102: Use Tax Return - Individuals and businesses that make purchases from out-of-state vendors and owe use tax can use this form to report and pay the tax.

- Form 500: Corporate Income Tax Return - This form is for corporations to report their income, expenses, and tax liabilities. It is used to calculate and pay corporate income tax in Virginia.

- Form 500PY: Corporate Estimated Tax Payment Voucher - Corporations can use this form to make quarterly estimated tax payments, ensuring they remain compliant with their tax obligations.

Navigating the Virginia Tax Filing Process

Filing state taxes in Virginia involves a series of steps to ensure accuracy and compliance. Here’s a simplified breakdown of the process:

- Gather Information - Collect all necessary documents, including W-2s, 1099s, business records, and any other relevant financial information.

- Select the Right Forms - Determine which tax forms are applicable to your situation based on your income, business activities, and other factors. Refer to the Virginia Department of Taxation’s website for guidance.

- Complete the Forms - Carefully fill out the chosen forms, providing accurate and honest information. Pay attention to any instructions or worksheets associated with the forms.

- Calculate Taxes Owed - Use the provided calculations or tax tables to determine your tax liability. Ensure you understand any credits, deductions, or exemptions you may be eligible for.

- Make Tax Payments - If you owe taxes, you can make payments online, by mail, or through authorized payment processors. Ensure you meet the deadlines to avoid penalties.

- File Your Return - Submit your completed tax forms to the Virginia Department of Taxation by the due date. You can file electronically or by mail.

- Review and Keep Records - Once your return is filed, review it to ensure accuracy. Keep copies of your filed return and supporting documents for future reference.

It's important to note that the Virginia Department of Taxation provides resources and assistance to taxpayers. Their website offers detailed instructions, frequently asked questions, and contact information for further support. Additionally, tax professionals and software tools can assist with the filing process, ensuring compliance and accuracy.

| Form | Due Date |

|---|---|

| Form 760 (Individual Income Tax) | May 1st (for tax year ending December 31st) |

| Form 760PY/760-ES (Estimated Tax Payments) | Four quarterly due dates: June 15th, September 15th, December 15th, and March 15th |

| Form ST-101 (Sales and Use Tax) | Monthly, quarterly, or annually, depending on filing frequency |

| Form 500 (Corporate Income Tax) | April 15th (for tax year ending December 31st) |

| Form 500PY (Corporate Estimated Tax Payments) | Four quarterly due dates: June 15th, September 15th, December 15th, and March 15th |

FAQ

How do I determine my Virginia residency status for tax purposes?

+Virginia residency for tax purposes is determined based on various factors, including the amount of time spent in the state, the intent to establish a domicile, and the maintenance of a permanent place of abode. Refer to the Virginia Department of Taxation’s guidelines on residency to clarify your status.

Can I file my Virginia state taxes electronically?

+Yes, the Virginia Department of Taxation offers electronic filing options for individual and business taxpayers. You can file your tax return online through their website or use tax preparation software that supports electronic filing for Virginia state taxes.

What if I miss the tax filing deadline? Are there any extensions available?

+If you miss the tax filing deadline, you should file your return as soon as possible to avoid penalties. The Virginia Department of Taxation may grant extensions for valid reasons, but it’s essential to request an extension before the due date. Contact them to discuss your specific situation.

How can I pay my Virginia state taxes if I don’t owe them electronically?

+If you don’t owe Virginia state taxes, you don’t need to take any action. However, if you overpaid or have a refund coming, you can claim it by filing the appropriate tax forms. The refund will be processed and mailed to you by the Virginia Department of Taxation.