Delaware State Tax Refund

Delaware is known for its business-friendly environment and a unique tax system that has attracted many companies to establish their headquarters within the state. One of the key advantages of doing business in Delaware is its favorable tax climate, which includes a low corporate income tax rate and the absence of certain taxes, such as a state sales tax. For individuals, understanding Delaware's tax system is crucial, especially when it comes to tax refunds.

The Delaware State Tax System

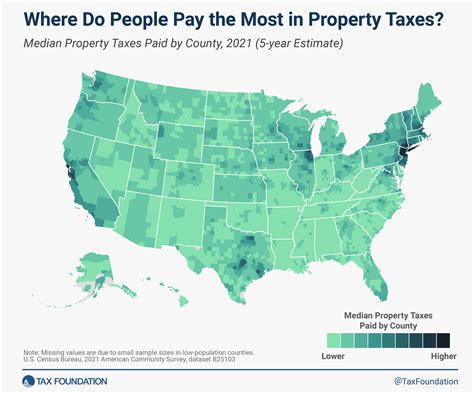

Delaware’s tax system is designed to encourage economic growth and investment. It is characterized by a competitive corporate income tax rate and a lack of burdensome taxes on businesses and individuals. The state’s tax structure plays a significant role in its economic prosperity and makes it an attractive location for companies and residents alike.

Key Tax Characteristics of Delaware

Delaware boasts a robust and business-friendly tax system. Here are some of its notable characteristics:

- Low Corporate Income Tax Rate: Delaware has a corporate income tax rate of 8.7%, which is one of the lowest in the nation. This competitive rate attracts businesses and encourages them to establish their presence in the state.

- No Sales Tax: Unlike many other states, Delaware does not impose a sales tax on retail transactions. This absence of a sales tax provides a significant advantage for both businesses and consumers, making goods and services more affordable.

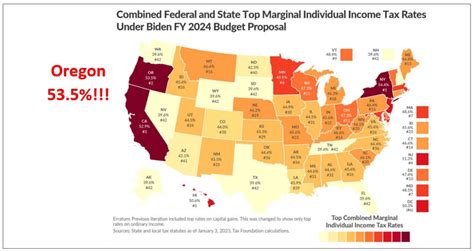

- Low Personal Income Tax Rates: Delaware’s personal income tax rates are also relatively low, with a top marginal rate of 6.6%. This means individuals can keep a higher percentage of their income, which can be beneficial when it comes to tax refunds.

- No Inheritance or Estate Taxes: Delaware does not impose inheritance or estate taxes, which is a significant advantage for individuals planning their estates and businesses considering their long-term financial strategies.

- Tax Incentives and Credits: The state offers various tax incentives and credits to attract businesses and support economic development. These incentives can provide significant savings for eligible companies.

Delaware’s Individual Income Tax Refunds

For individuals, understanding Delaware’s tax refund process is essential. Delaware offers tax refunds to residents who have overpaid their taxes during the year. These refunds are typically issued to individuals who have had tax withheld from their paychecks or made estimated tax payments in excess of their actual tax liability.

Tax Refund Eligibility and Calculation

To be eligible for a tax refund in Delaware, individuals must have paid more taxes than they owed based on their taxable income and applicable deductions and credits. The amount of the refund depends on several factors, including the individual’s tax bracket, deductions, and any applicable tax credits.

The calculation of a tax refund involves comparing the total taxes paid throughout the year with the actual tax liability calculated based on the individual’s income and tax situation. If the total taxes paid exceed the liability, the difference is refunded to the taxpayer.

| Tax Year | Total Taxes Paid | Actual Tax Liability | Refund Amount |

|---|---|---|---|

| 2022 | $5,000 | $4,500 | $500 |

| 2023 | $6,200 | $5,800 | $400 |

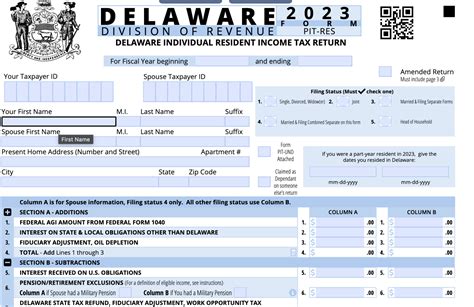

Claiming a Tax Refund in Delaware

To claim a tax refund in Delaware, individuals must file a tax return using the appropriate form, which is typically Form 200-01 for individual income tax. The deadline for filing tax returns in Delaware is April 15th, similar to the federal deadline. However, it’s important to note that tax refund processing times can vary, and individuals should allow sufficient time for their refund to be processed.

Tips for Maximizing Your Delaware Tax Refund

Here are some strategies to consider when aiming to maximize your tax refund in Delaware:

- Take Advantage of Deductions: Delaware offers various deductions, such as the standard deduction and itemized deductions, which can reduce your taxable income. Ensure you understand the deductions you’re eligible for and claim them appropriately.

- Explore Tax Credits: Delaware provides tax credits for certain expenses, such as education and energy-efficient improvements. Research and claim any applicable tax credits to reduce your tax liability.

- Consider Estimated Tax Payments: If you expect to owe taxes throughout the year, making estimated tax payments can help you avoid penalties and potentially increase your refund.

- Review Your Withholdings: Ensure that the tax withholdings from your paycheck align with your expected tax liability. Adjusting your withholdings can help prevent overpaying taxes and maximize your refund.

- Consult a Tax Professional: For complex tax situations or to ensure you’re taking full advantage of all available deductions and credits, consider seeking advice from a qualified tax professional.

FAQs

When can I expect to receive my Delaware state tax refund?

+The processing time for Delaware state tax refunds can vary. Generally, refunds are issued within 6-8 weeks after filing your tax return. However, it’s essential to note that factors like the complexity of your return or any errors can impact the processing time.

Are there any income thresholds for claiming a tax refund in Delaware?

+Delaware does not have specific income thresholds for claiming a tax refund. However, your eligibility for a refund depends on your taxable income, deductions, and credits. If your total taxes paid exceed your actual tax liability, you may be eligible for a refund.

Can I track the status of my Delaware tax refund online?

+Yes, you can track the status of your Delaware tax refund online through the Delaware Division of Revenue’s website. You’ll need to provide your social security number and the refund amount shown on your return to access the refund status information.