What Is California Use Tax

California Use Tax is a crucial aspect of the state's tax system, often misunderstood or overlooked by residents and businesses alike. This article aims to provide a comprehensive understanding of what California Use Tax entails, its purpose, how it works, and its implications for taxpayers. By the end of this article, readers should have a clear grasp of this essential tax component and its role in California's economy.

Understanding California Use Tax

California Use Tax is a consumption tax levied on the use, storage, or consumption of tangible personal property purchased from out-of-state vendors. It complements the state’s sales tax and ensures that all purchases made by California residents, regardless of where the purchase occurs, are subject to tax. In essence, it bridges the gap left by sales tax, preventing tax evasion and ensuring a level playing field for in-state and out-of-state businesses.

The California Board of Equalization (BOE) is responsible for administering the state's tax laws, including the collection and enforcement of Use Tax. This tax is particularly relevant in the era of e-commerce, where online purchases from out-of-state vendors are common, and traditional sales tax collection methods may not apply.

How California Use Tax Works

California Use Tax operates on a self-assessment basis. When a California resident makes an out-of-state purchase, whether online or through mail-order, they are responsible for calculating and remitting the appropriate Use Tax. This tax is typically due when the purchased goods are brought into California and used, stored, or consumed within the state.

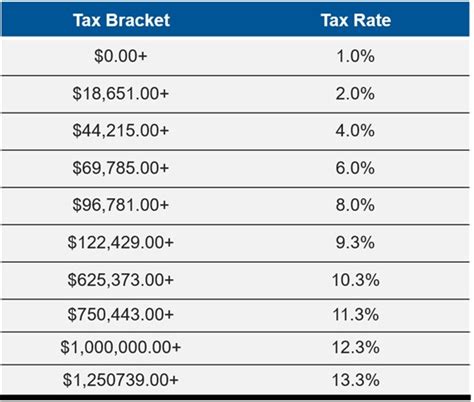

The tax rate for Use Tax mirrors the sales tax rate of the buyer's location in California. For instance, if a resident of Los Angeles purchases goods online from an out-of-state vendor, they would owe Use Tax at the Los Angeles County sales tax rate, currently 9.5% (as of January 2023). This rate includes the state tax of 7.25% and any applicable local and district taxes.

| Tax Type | Rate |

|---|---|

| California State Sales Tax | 7.25% |

| Los Angeles County Sales Tax (2023) | 9.5% |

| Use Tax (Equivalent to Los Angeles County Sales Tax) | 9.5% |

It's important to note that Use Tax is not limited to online purchases. It also applies to tangible personal property purchased out of state and brought into California for personal use, such as a car bought from a dealer in another state or goods purchased during a vacation trip.

Use Tax and E-commerce

The rise of e-commerce has significantly impacted the relevance and application of California Use Tax. With the convenience of online shopping, many consumers are unaware of their Use Tax obligations, leading to potential tax evasion. To address this, the state has implemented various measures, including:

- Marketplace Facilitator Laws: These laws require online marketplaces, such as Amazon and eBay, to collect and remit sales tax on behalf of third-party sellers. This simplifies the tax collection process and ensures compliance.

- Tax Notification and Reminder Programs: The BOE provides tools and resources to educate consumers about their Use Tax responsibilities. These include tax notification emails and in-app notifications during the checkout process.

- Voluntary Disclosure Programs: The state offers opportunities for taxpayers to voluntarily disclose and pay any owed Use Tax without penalties. This encourages compliance and helps taxpayers stay on the right side of the law.

Despite these efforts, enforcing Use Tax remains a challenge, especially with the sheer volume of online transactions. As a result, many California residents may inadvertently underreport or neglect their Use Tax obligations.

Use Tax Audits and Enforcement

The BOE has the authority to audit taxpayers and assess penalties for non-compliance with Use Tax laws. Audits may focus on specific industries, high-value purchases, or patterns of non-payment. Penalties for underpayment or non-payment of Use Tax can be significant and may include interest, late payment penalties, and even criminal charges for willful evasion.

To avoid issues with the BOE, taxpayers should maintain accurate records of their out-of-state purchases and ensure they remit the appropriate Use Tax. It's advisable to seek professional tax advice to understand one's obligations and ensure compliance.

The Future of California Use Tax

As e-commerce continues to evolve, so too will the strategies and approaches to managing California Use Tax. The state is likely to explore new technologies and partnerships to streamline tax collection and improve compliance. This could include further integration with online marketplaces, real-time tax calculation tools, and more sophisticated audit techniques.

Additionally, the ongoing debate surrounding the taxation of online sales and the potential for a federal online sales tax law could have significant implications for California's Use Tax system. A federal law could standardize the collection of sales and Use Tax across states, simplifying the process for taxpayers and reducing the administrative burden on businesses.

In conclusion, California Use Tax is a vital component of the state's tax system, ensuring fair taxation of all purchases made by residents. With the increasing popularity of e-commerce, understanding and complying with Use Tax obligations is more important than ever. By staying informed and taking a proactive approach to tax compliance, taxpayers can navigate the complexities of California's tax landscape with confidence.

How often should I pay California Use Tax?

+California Use Tax is typically paid annually when filing your state tax return. However, if your Use Tax liability exceeds $500, you may be required to make quarterly payments.

Are there any exemptions from California Use Tax?

+Yes, certain purchases are exempt from Use Tax. These include purchases made for resale, purchases made by government entities or certain non-profits, and purchases specifically exempt under California law.

Can I deduct California Use Tax from my federal taxes?

+No, California Use Tax is a state tax and cannot be deducted from federal taxes. However, you may be able to deduct certain state and local taxes, including sales tax, on your federal tax return.