Import Tax From Japan To Usa

Navigating the intricacies of international trade, particularly when it comes to import taxes, is crucial for businesses and individuals alike. This comprehensive guide delves into the specifics of import tax when importing goods from Japan to the United States, a journey that traverses not only physical distances but also diverse regulatory landscapes.

Understanding Import Tax from Japan to the USA

The imposition of import taxes, often referred to as customs duties, is a fundamental aspect of international trade, serving to protect domestic industries and generate revenue for governments. When importing goods from Japan to the United States, this process becomes a complex interplay of international trade regulations, customs laws, and specific commodity classifications.

At its core, the import tax structure is designed to categorize goods based on their harmonized system codes, which then dictate the applicable duty rates. These rates can vary significantly depending on the nature of the product, its origin, and the current trade agreements between the two countries.

The Role of Harmonized System Codes

The Harmonized System (HS) of tariff classification is a global system used by customs authorities to identify products for the purpose of assessing duties and taxes. Each product is assigned a specific HS code, which consists of a series of numbers that identify the product’s category and subcategory.

For instance, the HS code for unroasted coffee beans is 0901.11, while the code for coffee extracts, whether liquid or solid, is 0901.21. These codes are crucial as they determine the applicable duty rates. The more specific the code, the more accurate the duty assessment.

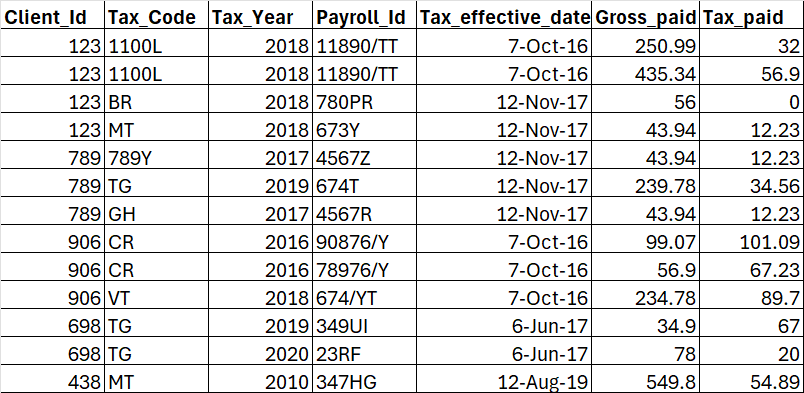

| Product | HS Code | Duty Rate (%) |

|---|---|---|

| Unroasted Coffee Beans | 0901.11 | 8.5 |

| Coffee Extracts | 0901.21 | 14.9 |

| Instant Coffee | 0901.80.00 | 3.5 |

As evident, the duty rates can vary significantly, even within the same product category. This highlights the importance of accurate product classification to ensure compliance and avoid unnecessary costs.

Commodity-Specific Considerations

When importing goods from Japan to the USA, certain commodities require additional attention due to their specific regulations. For instance, the import of agricultural products often involves additional inspections and compliance with USDA regulations. Similarly, textiles and apparel imports are subject to specific rules regarding origin and labeling.

Moreover, the Generalized System of Preferences (GSP) program, which provides duty-free treatment for certain products from designated beneficiary countries, can significantly impact the duty rates for eligible products. Japan is a GSP beneficiary, so certain products originating from Japan may be eligible for duty-free treatment.

Trade Agreements and Tariff Rates

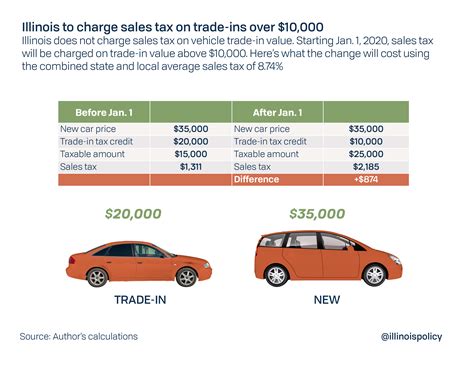

The trade relationship between Japan and the United States is governed by various agreements, each with its own set of rules and preferences. For instance, the United States-Japan Trade Agreement, effective from January 1, 2020, has significantly reduced or eliminated tariffs on a wide range of goods, including agricultural products, industrial goods, and digital trade.

Under this agreement, for instance, the duty on Japanese-origin automobiles has been phased out, with a 2.5% duty on passenger cars and a 25% duty on light trucks and vans, both of which will be eliminated by 2025. This agreement also includes commitments on digital trade, ensuring that neither country will impose customs duties on digital products like music, e-books, and software.

However, it's important to note that these agreements are subject to change and may be influenced by various factors, including political dynamics and economic conditions. Therefore, staying informed about the latest developments in trade policy is crucial for any import/export venture.

The Import Tax Process

The import tax process is a multi-step journey, involving various stages from the moment goods leave Japan to when they clear customs in the United States. Each step requires careful consideration and adherence to specific regulations to ensure a smooth and compliant process.

Step 1: Product Classification and Duty Calculation

The first step in the import tax process is to accurately classify the goods being imported. This involves assigning the appropriate harmonized system codes to the products, as discussed earlier. The HS codes not only determine the applicable duty rates but also influence other aspects of the import process, such as import restrictions and licensing requirements.

Once the products are classified, the next step is to calculate the applicable duty rates. This involves a detailed review of the product's HS code, its country of origin, and any relevant trade agreements or preferences that may apply. The duty rates can be found in the Harmonized Tariff Schedule of the United States, which is a comprehensive guide to the duty rates for all imported goods.

Step 2: Import Documentation and Customs Clearance

Once the products are classified and the duty rates are determined, the next step is to prepare the necessary import documentation. This typically includes a commercial invoice, a bill of lading or air waybill, and any additional documents required based on the nature of the goods, such as phytosanitary certificates for agricultural products or certificates of origin for goods eligible for trade preferences.

Upon arrival at the port of entry in the United States, the goods will undergo customs clearance. This involves presenting the import documentation to the U.S. Customs and Border Protection (CBP) officers, who will review the documents and verify the accuracy of the declared value, country of origin, and other relevant details. The CBP officers may also conduct physical inspections of the goods to ensure they match the description on the import documentation.

Step 3: Payment of Import Taxes and Fees

After the goods have been cleared by customs, the next step is to pay the applicable import taxes and fees. This typically involves a payment to the CBP, which can be made electronically or by other means as specified by the CBP. The payment must be made before the goods can be released from the port of entry and delivered to the importer.

In addition to the import taxes, importers may also be required to pay other fees, such as customs user fees, merchandise processing fees, and any applicable surcharges. These fees are typically calculated as a percentage of the value of the goods or as a flat rate, depending on the nature of the goods and the specific regulations.

Step 4: Compliance with Other Regulations

Beyond the import tax process, importers must also ensure compliance with other regulations that may apply to their specific goods. This can include regulations related to product safety, environmental standards, intellectual property rights, and other specific requirements based on the nature of the goods.

For instance, importers of electronics must ensure compliance with the Consumer Product Safety Improvement Act, which sets strict standards for lead content and other safety measures. Similarly, importers of textiles and apparel must comply with the Textile and Wool Acts, which require accurate labeling and disclosure of the country of origin.

Future Implications and Considerations

As the global trade landscape continues to evolve, the import tax process between Japan and the United States is likely to undergo further changes and developments. Staying informed about these changes is crucial for importers and exporters to ensure compliance and take advantage of any new opportunities.

The Impact of Trade Agreements

The ongoing negotiations and potential future agreements between Japan and the United States can significantly impact the import tax landscape. For instance, any changes to the United States-Japan Trade Agreement or the potential for a broader Trans-Pacific Partnership agreement can lead to further reductions in tariffs and the introduction of new trade preferences.

These agreements can not only reduce the cost of importing goods but also open up new opportunities for trade, particularly in sectors where tariffs have been a significant barrier. For example, the elimination of tariffs on automotive parts and agricultural products under the US-Japan Trade Agreement has already led to increased trade in these sectors.

The Rise of Digital Trade

With the rapid advancement of technology, the digital trade landscape is becoming increasingly important in the global economy. The US-Japan Trade Agreement, for instance, includes commitments on digital trade, ensuring that neither country will impose customs duties on digital products. This has opened up new opportunities for trade in software, music, e-books, and other digital goods.

However, the regulation of digital trade is a complex and evolving field. Importers and exporters must stay informed about the latest developments in this area to ensure compliance and take advantage of the opportunities presented by the digital economy.

The Importance of Supply Chain Management

In the context of import taxes, effective supply chain management can play a crucial role in minimizing costs and ensuring compliance. This involves not only efficient logistics and transportation but also a deep understanding of the import tax process and the ability to adapt to changing regulations.

For instance, strategic decisions such as choosing the right port of entry, optimizing the timing of imports, and managing inventory levels can all impact the overall cost of importing goods. Additionally, effective supply chain management can help mitigate the risks associated with import taxes, such as unexpected delays or additional costs due to non-compliance.

What are the current duty rates for Japanese imports to the USA?

+The duty rates for Japanese imports to the USA vary depending on the product and the applicable trade agreements. For instance, under the US-Japan Trade Agreement, certain products like automobiles have seen a reduction or elimination of tariffs. However, it’s crucial to check the Harmonized Tariff Schedule of the United States for the most accurate and up-to-date duty rates.

How can I determine the HS code for my product?

+Determining the correct HS code for your product is crucial for accurate duty assessment. You can use the Harmonized Tariff Schedule of the United States, which provides a comprehensive guide to HS codes and duty rates. Additionally, consulting with a customs broker or trade specialist can help ensure the correct classification of your product.

Are there any special considerations for importing agricultural products from Japan?

+Yes, importing agricultural products from Japan often involves additional inspections and compliance with USDA regulations. These regulations ensure the safety and quality of imported agricultural goods. It’s important to understand these requirements and ensure compliance to avoid delays or penalties.

What is the role of the Generalized System of Preferences (GSP) in import tax from Japan to the USA?

+The GSP program provides duty-free treatment for certain products from designated beneficiary countries, including Japan. This can significantly reduce the import taxes for eligible products. However, it’s important to note that not all products are eligible, and there are specific rules and requirements for claiming GSP benefits.

How can I stay updated with the latest developments in import tax regulations between Japan and the USA?

+Staying informed about the latest developments in import tax regulations is crucial for compliance and taking advantage of new opportunities. You can follow official sources like the U.S. Customs and Border Protection (CBP) website and the U.S. Trade Representative’s office. Additionally, subscribing to trade publications and joining industry associations can provide valuable insights and updates.