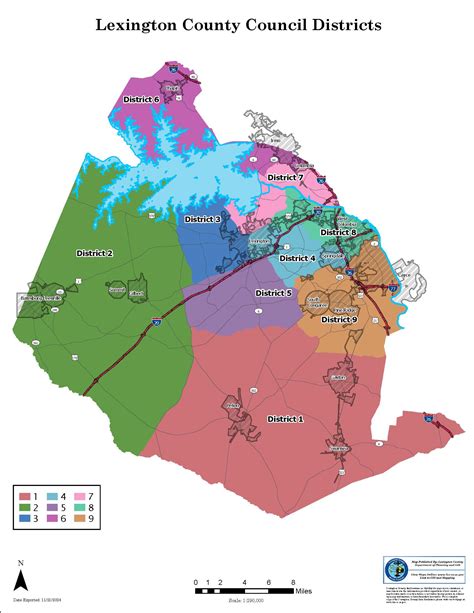

Lexington County Tax Map

Welcome to this comprehensive guide on the Lexington County Tax Map, a vital resource for property owners, investors, and anyone interested in understanding the tax assessment and property information system of Lexington County, South Carolina. This article aims to provide an in-depth exploration of the tax map, its features, and its importance in the local real estate landscape.

Understanding the Lexington County Tax Map

The Lexington County Tax Map is an extensive digital database that serves as a crucial tool for property assessment, tax administration, and land management within the county. Developed and maintained by the Lexington County Assessor’s Office, this map system offers a wealth of information to its users, including:

- Detailed property boundaries and parcel information.

- Current and historical tax assessment data.

- Land use classifications and zoning details.

- Photographic imagery and aerial views.

- Public access to real property records.

By leveraging this tax map, residents, businesses, and government entities can access a centralized repository of property-related data, ensuring transparency, efficiency, and accuracy in tax assessments and land management.

Key Features and Functionality

The Lexington County Tax Map offers a user-friendly interface, enabling easy navigation and data retrieval. Some of its notable features include:

- Interactive Map: Users can zoom, pan, and explore the map to locate specific properties, view boundaries, and access detailed property information.

- Parcel Search: A powerful search tool allows users to find properties by address, owner name, or parcel ID, providing quick access to assessment records and related data.

- Historical Data: The tax map maintains a historical record of property assessments, enabling users to track changes over time and compare past assessments with current values.

- Aerial Imagery: High-resolution aerial photographs provide a visual context, aiding in property identification and offering a comprehensive view of the land and its surroundings.

- Land Use and Zoning: Detailed land use and zoning information is available, helping users understand the permitted uses and development potential of each property.

With these features, the Lexington County Tax Map empowers users to make informed decisions, whether they are researching properties for investment, planning land development, or simply curious about their own property's assessment.

| Feature | Description |

|---|---|

| Interactive Map | Dynamic and user-friendly map interface for easy navigation and property exploration. |

| Parcel Search | Powerful search tool to locate properties by address, owner, or parcel ID. |

| Historical Data | Access to past assessments, enabling trend analysis and comparison. |

| Aerial Imagery | High-resolution photographs for visual property identification and context. |

| Land Use/Zoning | Detailed information on permitted land uses and zoning regulations. |

Tax Assessment Process and Transparency

Lexington County’s tax assessment process is designed to ensure fairness and accuracy in property taxation. The county follows a systematic approach, regularly reassessing properties to maintain equitable tax burdens among property owners.

Assessment Methodology

The Lexington County Assessor’s Office employs a combination of market analysis, property inspections, and data collection to determine the assessed value of each property. This value is then used to calculate the property tax owed by the owner.

Key factors influencing the assessment include:

- Market value of similar properties in the area.

- Property characteristics such as size, age, condition, and improvements.

- Zoning and land use regulations.

- Local economic conditions and property market trends.

By considering these factors, the assessor's office aims to provide an accurate representation of each property's value, ensuring a fair and consistent tax assessment process.

Transparency and Public Access

Lexington County prioritizes transparency in its tax assessment practices. The county offers public access to tax records and assessment data through the online tax map, allowing property owners and interested parties to review their assessments and compare them with similar properties.

This transparency fosters trust in the tax assessment system and empowers property owners to understand their tax obligations and the factors influencing their assessments.

Benefits of the Lexington County Tax Map

The implementation and maintenance of the Lexington County Tax Map bring a multitude of benefits to the county, its residents, and businesses.

Efficient Property Management

The tax map streamlines property management processes for the county government. It enables efficient record-keeping, data retrieval, and property assessment, reducing administrative burdens and improving overall efficiency.

Fair and Accurate Taxation

By providing a centralized and accessible database of property information, the tax map ensures fair and accurate taxation. It facilitates consistent assessment practices, minimizing the potential for errors and ensuring equitable tax burdens.

Empowering Property Owners

The tax map empowers property owners by giving them direct access to their assessment records and property information. This transparency allows owners to understand their tax obligations, dispute assessments if necessary, and make informed decisions regarding their properties.

Promoting Economic Development

For businesses and investors, the Lexington County Tax Map serves as a valuable tool for market analysis and property research. It provides a comprehensive dataset, enabling informed investment decisions and contributing to the county’s economic growth and development.

Future Implications and Innovations

As technology advances, the Lexington County Tax Map is expected to evolve and integrate new features and capabilities. Some potential future developments include:

- Enhanced data visualization and mapping tools for improved user experience.

- Integration of 3D modeling and virtual tours for a more immersive property exploration.

- Advanced analytics and machine learning to improve assessment accuracy and efficiency.

- Mobile accessibility, allowing users to access the tax map on-the-go.

These innovations will further enhance the tax map's value, making it an even more powerful resource for property management, assessment, and economic development in Lexington County.

How often are properties reassessed in Lexington County?

+

Properties in Lexington County are reassessed every five years as part of the county’s regular reassessment cycle. This process ensures that property values remain current and fair.

Can property owners appeal their tax assessment?

+

Yes, property owners have the right to appeal their tax assessment if they believe it is inaccurate or unfair. The Lexington County Assessor’s Office provides guidelines and procedures for appealing assessments.

How can I access the Lexington County Tax Map online?

+

The Lexington County Tax Map is accessible through the county’s official website. You can find a direct link to the tax map portal on the Assessor’s Office webpage.

What information can I find about my property on the tax map?

+

The tax map provides detailed information about your property, including its assessed value, tax records, land use, zoning, and other relevant data. It serves as a comprehensive resource for property owners.

Are there any privacy concerns with the tax map data?

+

Lexington County takes data privacy seriously. The tax map adheres to strict data protection regulations, ensuring that sensitive information is handled securely and in accordance with legal requirements.