Income Tax In Ct

Welcome to a comprehensive guide on income tax in Connecticut, a crucial aspect of financial planning for residents and businesses alike. Understanding the intricacies of the state's tax system is essential for effective money management and compliance with legal obligations. In this article, we will delve into the specifics of Connecticut's income tax, covering everything from rates and brackets to unique deductions and credits, and offer expert insights to help you navigate this complex landscape.

Connecticut Income Tax: An Overview

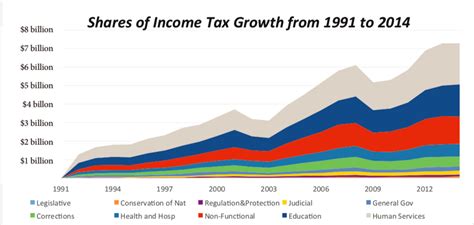

Connecticut, often referred to as the “Constitution State,” imposes an income tax on its residents, non-residents with Connecticut-sourced income, and businesses operating within its borders. The state’s income tax system is progressive, meaning that higher incomes are taxed at increasingly higher rates. This progressive structure aims to distribute the tax burden fairly across different income levels.

The income tax in Connecticut is a significant source of revenue for the state, contributing to various public services and infrastructure projects. The tax rates and regulations are set by the Connecticut Department of Revenue Services (CT DRS), ensuring a consistent and fair taxation process.

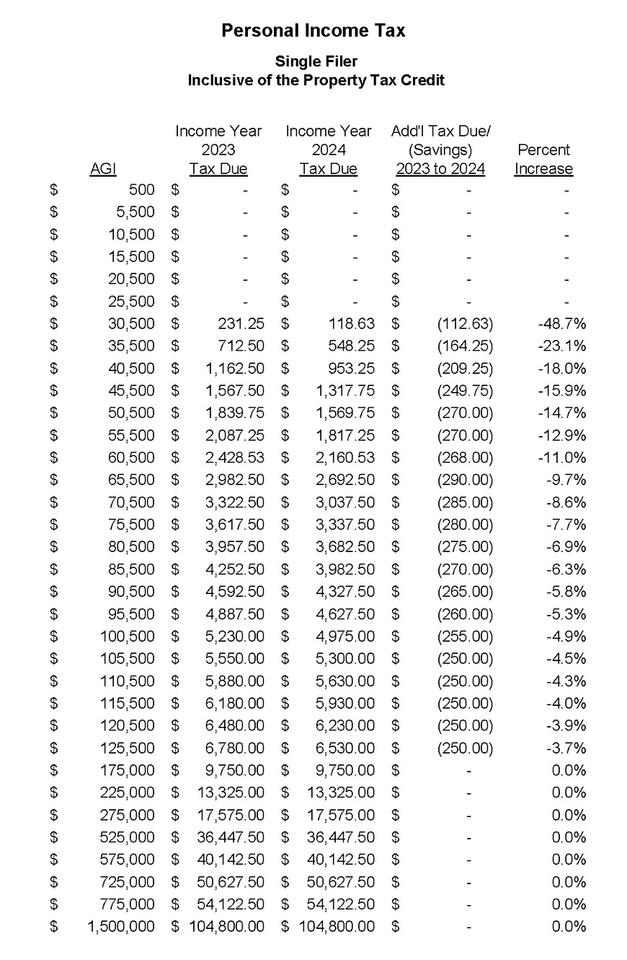

Tax Rates and Brackets

Connecticut’s income tax rates are divided into several brackets, with each bracket representing a specific income range. As of the 2023 tax year, the state’s income tax brackets and rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 3.05% |

| $10,001 - $50,000 | 4.00% |

| $50,001 - $100,000 | 5.00% |

| $100,001 - $200,000 | 6.00% |

| Over $200,000 | 6.99% |

It's important to note that these tax rates are subject to change annually, so it's advisable to refer to the most recent tax guidelines provided by the CT DRS for the most accurate information.

Taxable Income and Exemptions

Connecticut defines taxable income as the total income earned by an individual or business, including wages, salaries, commissions, interest, dividends, and capital gains. However, certain types of income may be exempt from taxation, such as certain types of government benefits or qualified retirement plan distributions.

Additionally, Connecticut offers a personal exemption, which reduces the taxable income for individuals and families. As of 2023, the personal exemption amount is $4,000 for single filers and $8,000 for married couples filing jointly.

Unique Deductions and Credits in Connecticut

Connecticut provides a range of deductions and credits that can help reduce the tax burden for individuals and businesses. These deductions and credits are designed to support specific industries, promote economic growth, and provide relief to certain sectors of the population.

Business Deductions and Credits

Businesses operating in Connecticut can take advantage of several deductions and credits to lower their taxable income. Some notable business-related deductions and credits include:

- Research and Development (R&D) Credit: Businesses engaged in research and development activities may be eligible for a credit against their state income tax liability. This credit aims to encourage innovation and technological advancements.

- Investment Tax Credit: Connecticut offers an investment tax credit to businesses that make significant capital investments in the state. This credit is designed to stimulate economic growth and job creation.

- Energy Efficiency Credit: Businesses that invest in energy-efficient technologies and practices may qualify for this credit, promoting sustainable business practices and reducing environmental impact.

Individual Deductions and Credits

Connecticut residents can also benefit from various deductions and credits to lower their tax burden. Here are some key individual-focused deductions and credits:

- Property Tax Credit: Connecticut offers a property tax credit to homeowners, which can help offset the cost of property taxes. This credit is particularly beneficial for those with limited incomes or fixed incomes.

- Elderly and Disabled Circuit Breaker Credit: This credit is designed to provide relief to elderly and disabled residents who face high property tax burdens relative to their incomes. It can significantly reduce the tax liability for eligible individuals.

- Earned Income Tax Credit (EITC): Connecticut participates in the federal EITC program, offering a refundable tax credit to low- and moderate-income working individuals and families. The EITC aims to reduce poverty and make work more financially rewarding.

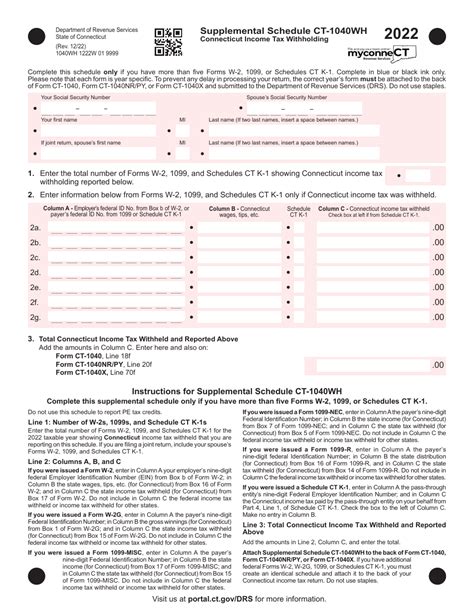

Filing and Payment Process

Connecticut residents and businesses are required to file their income tax returns annually, typically by April 15th (or the following business day if it falls on a weekend or holiday). The filing process can be completed online through the CT DRS website or by mail using the appropriate tax forms.

For those who owe taxes, payment options include electronic funds transfer, credit card, or personal check. It's important to ensure timely payment to avoid penalties and interest charges. The CT DRS offers a convenient online payment system for taxpayers' convenience.

Estimated Tax Payments

If you expect to owe income tax for the current year, you may need to make estimated tax payments throughout the year. These payments are typically required for individuals with income not subject to withholding, such as self-employment income, or for those whose income exceeds the threshold for withholding.

Connecticut has established estimated tax payment due dates, and failure to make these payments on time can result in penalties. It's advisable to consult with a tax professional or refer to the CT DRS guidelines to ensure you're making the correct estimated tax payments.

Expert Insights and Tax Planning Strategies

Navigating Connecticut’s income tax system can be complex, and it’s beneficial to seek expert advice to ensure compliance and optimize your tax position.

Here are some key insights and strategies to consider when planning your tax strategy in Connecticut:

- Maximizing Deductions: Carefully review the deductions and credits available to you, both as an individual and as a business. Ensure you meet all the eligibility criteria and take full advantage of these opportunities to reduce your taxable income.

- Strategic Business Decisions: For businesses, consider the impact of tax implications when making investment decisions. Connecticut's tax credits can provide significant incentives for growth and innovation, so plan your business strategies with these incentives in mind.

- Tax-Efficient Retirement Planning: Connecticut's tax laws provide opportunities for tax-efficient retirement planning. Work with a financial advisor to structure your retirement savings in a way that minimizes your tax liability while maximizing your retirement income.

- Estate Planning and Inheritance Tax: Connecticut imposes an estate tax on certain estates. If you have significant assets, consult with an estate planning attorney to ensure your estate plan is structured to minimize tax liabilities and maximize the inheritance for your beneficiaries.

Future Implications and Tax Policy Changes

The landscape of income tax in Connecticut is subject to change, and staying informed about potential future developments is crucial for effective financial planning.

Here are some key factors to consider when looking ahead:

- Economic Trends: Connecticut's tax rates and brackets are often adjusted to align with economic trends and revenue needs. Keep an eye on economic forecasts and state budget proposals to anticipate potential changes in tax policy.

- Legislative Initiatives: Pay attention to proposed legislation that may impact income tax rates, deductions, or credits. Changes in political leadership or priorities can lead to significant tax reforms, so stay informed about the legislative agenda.

- Federal Tax Policy: Federal tax policies can indirectly influence state tax systems. For instance, changes in federal tax laws may impact the availability or structure of certain deductions and credits in Connecticut. Stay updated on federal tax reforms to understand their potential impact on your state tax obligations.

Conclusion

Understanding and navigating Connecticut’s income tax system is an essential aspect of financial management for residents and businesses. By familiarizing yourself with the tax rates, brackets, deductions, and credits available, you can optimize your tax position and ensure compliance with state regulations.

Staying informed about tax policy changes, economic trends, and legislative initiatives is crucial for long-term financial planning. By seeking expert advice and staying proactive, you can make the most of Connecticut's tax system while contributing to the state's economy and public services.

What is the current income tax rate in Connecticut for 2023?

+The current income tax rate in Connecticut for the 2023 tax year ranges from 3.05% to 6.99%, depending on the income bracket. It’s important to refer to the official tax guidelines for the most accurate and up-to-date information.

Are there any tax incentives for businesses in Connecticut?

+Yes, Connecticut offers a range of tax incentives for businesses, including research and development credits, investment tax credits, and energy efficiency credits. These incentives are designed to promote economic growth and innovation.

How can I reduce my tax liability in Connecticut as an individual?

+To reduce your tax liability, consider maximizing deductions and credits available to you. This may include taking advantage of the property tax credit, elderly and disabled circuit breaker credit, and the earned income tax credit (EITC). Consulting with a tax professional can help you identify the most beneficial strategies for your specific situation.

What are the estimated tax payment due dates in Connecticut?

+Estimated tax payment due dates in Connecticut are typically set for the 15th of April, June, September, and January. However, it’s crucial to refer to the official CT DRS guidelines for the most accurate and up-to-date information on estimated tax payment deadlines.