Tax Air Freight

In the world of international trade and logistics, air freight plays a crucial role in ensuring the swift and efficient movement of goods across borders. However, the complexities of tax regulations can often add an extra layer of challenge to this process. Understanding the intricacies of tax air freight is essential for businesses engaged in global commerce, as it directly impacts their operational costs and profitability. This comprehensive guide aims to delve into the world of tax air freight, offering a detailed analysis of its mechanisms, implications, and strategies to navigate this complex landscape.

The Complex Web of Tax Air Freight

Tax air freight involves a myriad of tax considerations, each with its own set of rules and regulations. These taxes can significantly impact the overall cost of air freight, making it a critical aspect for businesses to understand and manage effectively. The primary taxes associated with air freight include:

1. Import Duties and Taxes

Import duties and taxes are levied on goods entering a country and are often based on the value, weight, or type of goods being imported. These duties are a significant source of revenue for many governments and can vary widely depending on the country of origin, the nature of the goods, and the prevailing trade agreements.

For instance, consider the import of electronic components from China to the United States. The goods may be subject to a variety of import duties, including tariffs on specific types of electronics, value-added taxes (VAT), and additional surcharges. These duties can quickly add up, impacting the overall cost of the air freight.

2. Export Taxes and Levies

Export taxes are imposed on goods leaving a country and are often designed to protect domestic industries or generate revenue. These taxes can be particularly complex, as they may vary based on the destination country, the nature of the goods, and the exporter’s status.

Take, for example, a European manufacturer exporting luxury automobiles to Canada. The export process may involve paying export taxes based on the value of the vehicles, as well as additional levies to comply with environmental regulations. These taxes not only impact the exporter's revenue but also influence the overall competitiveness of their products in the global market.

3. Value-Added Taxes (VAT)

VAT is a consumption tax levied on the sale of goods and services. It is typically calculated as a percentage of the value added at each stage of production and distribution. In the context of air freight, VAT can be a significant cost component, especially for high-value goods.

Imagine a fashion retailer importing designer clothing from Italy to the United Kingdom. The VAT applicable in the UK is charged on the value of the goods at the time of importation, adding a substantial amount to the overall cost. Proper management of VAT, including claiming refunds where applicable, is crucial for businesses to maintain their profitability.

4. Excise Taxes

Excise taxes are imposed on specific goods, often those considered harmful or luxury items, such as tobacco, alcohol, and high-end electronics. These taxes are typically levied at a fixed rate or as a percentage of the value of the goods.

Consider the import of luxury watches from Switzerland to Australia. In addition to import duties and VAT, the importer may also need to account for excise taxes on these high-end items, which can significantly increase the landed cost of the goods.

Navigating the Tax Landscape: Strategies and Considerations

Understanding the complex web of tax air freight is just the first step. To effectively manage these taxes and minimize their impact on business operations, several strategies and considerations come into play.

1. Tax Compliance and Documentation

Ensuring tax compliance is crucial to avoid legal and financial penalties. Businesses must maintain accurate records, including invoices, customs declarations, and tax receipts, to support their tax obligations. Proper documentation also facilitates the refund or recovery of overpaid taxes.

For instance, a multinational corporation importing medical equipment from Germany to the United States should ensure that all relevant documents, such as the Harmonized System (HS) codes and the country of origin declaration, are accurately completed and submitted to the relevant authorities.

2. Tax Planning and Strategy

Developing a robust tax planning strategy is essential to minimize the impact of taxes on air freight costs. This involves understanding the tax regimes of both the exporting and importing countries, identifying potential tax reliefs or incentives, and structuring transactions to optimize tax efficiency.

A company specializing in the import of organic produce from South America to Europe may benefit from exploring tax incentives for sustainable practices. By understanding the applicable tax regulations and potential reliefs, the company can structure its operations to take advantage of these incentives, thereby reducing its overall tax burden.

3. Tax Refunds and Recoveries

Many countries offer tax refund or recovery mechanisms for certain types of goods or situations. For example, some countries provide VAT refunds for exported goods, while others offer duty drawback programs. Understanding these refund mechanisms and ensuring eligibility can help businesses recover a portion of their tax expenses.

A manufacturer exporting automotive parts to multiple countries may be eligible for VAT refunds in certain jurisdictions. By properly claiming these refunds, the manufacturer can reduce its overall tax costs and improve its cash flow.

4. Utilizing Trade Agreements and Preferences

Trade agreements, such as the North American Free Trade Agreement (NAFTA) or the European Union’s preferential trade arrangements, can significantly impact tax air freight. These agreements often provide reduced or eliminated tariffs on goods originating from member countries, making it crucial for businesses to understand and leverage these preferences.

A Canadian company exporting software to the United States can benefit from NAFTA's provisions, which eliminate tariffs on digital products. By correctly declaring the origin of their goods and complying with the agreement's rules, the company can avoid additional tax costs associated with import duties.

Performance Analysis and Future Implications

The performance of tax air freight strategies can be measured and analyzed to identify areas of improvement and ensure ongoing efficiency. Key performance indicators (KPIs) in this context may include the accuracy of tax calculations, the success rate of tax refund claims, and the overall tax burden as a percentage of the total cost of goods.

For example, a global logistics company may track the success rate of its tax refund claims, aiming for a 90% success rate over a year. By regularly analyzing these KPIs, the company can identify trends, such as countries with higher refund success rates or goods categories that consistently face challenges in claiming refunds. This data-driven approach allows for continuous improvement in tax management strategies.

Looking ahead, the future of tax air freight is likely to be shaped by several key factors. Firstly, the increasing focus on digital trade and e-commerce is likely to drive the need for more efficient and transparent tax systems, particularly in the context of cross-border transactions. Secondly, the ongoing trend of global trade liberalization and the proliferation of free trade agreements will continue to impact tax structures, potentially reducing barriers and simplifying tax processes.

Additionally, the advancement of technology, such as blockchain and AI, may play a significant role in enhancing tax compliance and efficiency. These technologies can automate certain tax processes, improve data accuracy, and enhance transparency, making tax air freight management more streamlined and effective.

In conclusion, the world of tax air freight is a complex yet crucial aspect of global trade. By understanding the various taxes involved, developing effective strategies, and staying abreast of regulatory changes, businesses can navigate this landscape with confidence. Continuous learning, adaptation, and a proactive approach to tax management are key to ensuring competitiveness and profitability in the dynamic world of international trade.

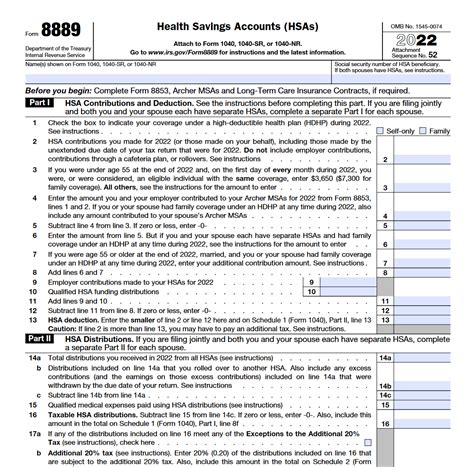

| Tax Category | Average Rate (%) |

|---|---|

| Import Duties | 5-20% |

| Export Taxes | 2-15% |

| Value-Added Tax (VAT) | 15-25% |

| Excise Taxes | 10-30% |

How can businesses ensure they are compliant with tax regulations in air freight?

+

Businesses should stay updated with the tax regulations of both the exporting and importing countries. This includes understanding the applicable taxes, the documentation requirements, and any trade agreements or preferences that may impact their operations. Regular consultation with tax professionals and legal advisors can help ensure compliance and mitigate risks.

What are some common challenges businesses face in managing tax air freight?

+

Common challenges include the complexity of tax regulations, the need for accurate documentation, and the time-consuming process of claiming tax refunds. Additionally, keeping abreast of frequent regulatory changes and ensuring tax compliance across multiple jurisdictions can be a significant challenge for businesses engaged in global trade.

How can businesses optimize their tax costs in air freight?

+

Businesses can optimize tax costs by leveraging tax planning strategies, exploring tax incentives and reliefs, and utilizing trade agreements to their advantage. Regularly reviewing and updating tax strategies based on changing regulations and market conditions is also crucial for cost optimization.