Portland Sales Tax

Welcome to a comprehensive guide on Portland's sales tax system, an essential aspect of doing business in this vibrant city. As a hub of economic activity, Portland has a unique sales tax structure that impacts both local businesses and consumers. In this article, we will delve into the intricacies of Portland's sales tax, exploring its rates, applicability, and the steps businesses need to take to ensure compliance. Whether you're a seasoned entrepreneur or just starting out, understanding the sales tax landscape is crucial for your success.

Understanding Portland's Sales Tax Structure

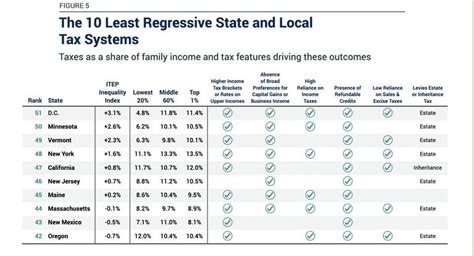

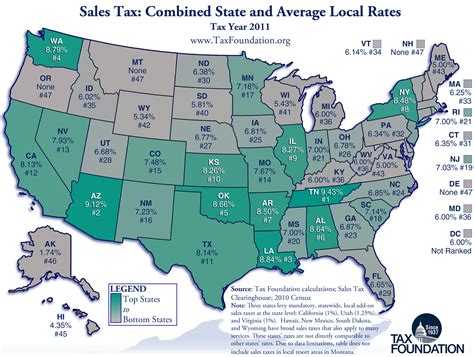

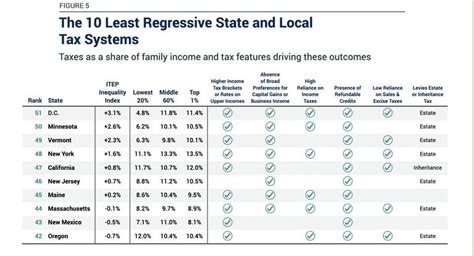

Portland, nestled in the state of Oregon, boasts a robust economy driven by a diverse range of industries, from tech and manufacturing to tourism and sustainable agriculture. While Oregon is known for its unique position as a state without a sales tax, Portland has implemented a localized sales tax system to support its municipal operations and infrastructure development.

The Portland sales tax is a consumption tax levied on retail sales of tangible personal property and certain services within the city limits. It is a critical revenue stream for the city, enabling the funding of essential services, community development projects, and public amenities. Understanding this tax structure is paramount for businesses operating within Portland's borders, as it directly impacts their financial planning and operational strategies.

Sales Tax Rates and Exemptions

The sales tax rate in Portland is 1.7%, which is relatively low compared to many other major cities in the United States. This rate is applied to the majority of retail transactions, including sales of goods and certain services. However, it's important to note that there are specific exemptions and special considerations within this tax structure.

For instance, groceries, including food and beverages purchased for consumption at home, are exempt from the sales tax. This exemption aims to alleviate the tax burden on essential household items, making groceries more affordable for Portland residents. Additionally, certain medical devices and prescription medications are exempt, ensuring that healthcare-related purchases are not subject to this tax.

Moreover, Portland's sales tax applies to online sales as well. This means that businesses selling goods or services online to Portland residents must collect and remit the appropriate sales tax. The city has implemented measures to ensure compliance in the digital marketplace, recognizing the growing trend of e-commerce.

| Sales Tax Category | Rate |

|---|---|

| General Sales Tax | 1.7% |

| Groceries | Exempt |

| Medical Devices | Exempt |

| Prescription Medications | Exempt |

| Online Sales | 1.7% |

Sales Tax Registration and Compliance

For businesses operating within Portland, sales tax registration is a mandatory step. The city requires businesses to obtain a Business Tax Registration Certificate, which serves as a legal permit to conduct commercial activities and collect sales tax. This certificate is issued by the Portland Revenue Bureau, the governmental body responsible for managing the city's tax revenue.

To register for sales tax, businesses typically need to provide information such as their legal business name, physical address, and contact details. They must also designate a responsible person within the organization who will be accountable for sales tax collection and reporting. Once registered, businesses receive a unique taxpayer identification number (TIN) that must be used on all sales tax-related documents and transactions.

Compliance with sales tax regulations is of utmost importance. Businesses are required to collect the appropriate sales tax from customers at the point of sale and remit these funds to the city on a regular basis. The frequency of remittance can vary, with some businesses required to make monthly or quarterly payments, depending on their sales volume and other factors.

To facilitate compliance, the Portland Revenue Bureau provides businesses with detailed guidelines and resources. This includes information on how to calculate sales tax, maintain accurate records, and file sales tax returns. The bureau also offers support through its website, where businesses can find forms, instructions, and frequently asked questions related to sales tax.

Penalties and Enforcement

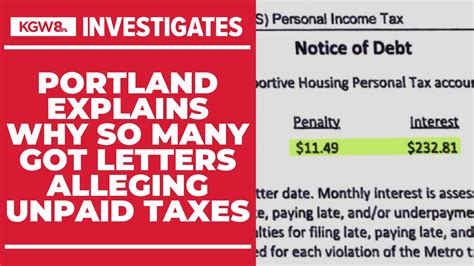

Non-compliance with sales tax regulations can result in significant penalties for businesses. The Portland Revenue Bureau has the authority to impose fines, interest charges, and even criminal penalties for severe cases of tax evasion. These penalties can have a detrimental impact on a business's financial health and reputation.

To enforce compliance, the bureau conducts audits and investigations. These processes involve examining a business's financial records, sales data, and tax filings to ensure accuracy and compliance. Businesses found to be in violation of sales tax regulations may face not only financial penalties but also the potential loss of their business license or other legal consequences.

Impact on Businesses and Consumers

The implementation of a sales tax in Portland has both positive and negative implications for businesses and consumers alike. For businesses, the sales tax provides a stable source of revenue for the city, which in turn can benefit the local economy through infrastructure development and community initiatives.

However, businesses must also factor in the cost of compliance, including the time and resources dedicated to sales tax collection, reporting, and remittance. Additionally, the sales tax can impact pricing strategies, as businesses may need to absorb the tax or pass it on to consumers, potentially affecting their competitiveness in the market.

From a consumer perspective, the sales tax adds an additional cost to their purchases. While the rate is relatively low, it can still impact budgeting and purchasing decisions, especially for those on a tight budget. However, the exemptions on essential items like groceries provide some relief and ensure that basic necessities remain affordable.

To navigate these challenges, businesses can explore various strategies. Some may choose to absorb the sales tax as a cost of doing business, while others may opt to pass it on to consumers through price adjustments. Additionally, businesses can leverage technology and automation to streamline sales tax collection and reporting processes, reducing the administrative burden.

Strategic Considerations for Businesses

In the competitive business landscape of Portland, understanding the sales tax landscape is crucial for strategic decision-making. Here are some key considerations for businesses:

-

Pricing Strategy: Evaluate the impact of the sales tax on your pricing structure. Consider whether you can absorb the tax or if passing it on to consumers is a more feasible option. Monitor competitor pricing to ensure your offerings remain competitive.

-

Cost Optimization: Analyze your operational costs to identify areas where you can streamline expenses. This can help offset the impact of the sales tax on your overall profitability.

-

Technology Integration: Invest in technology solutions that can automate sales tax collection and reporting. This not only saves time and resources but also reduces the risk of errors and ensures compliance.

-

Customer Communication: Be transparent with your customers about the sales tax. Provide clear information on your website, in-store signage, and during the checkout process to avoid any surprises and build trust.

The Future of Sales Tax in Portland

As Portland continues to evolve as a vibrant urban center, the sales tax landscape is likely to undergo changes and adaptations. The city's commitment to infrastructure development, sustainable practices, and community well-being may influence future sales tax policies.

One potential area of exploration is the expansion of sales tax exemptions. The city could consider additional exemptions for environmentally friendly products, local businesses, or services that promote community engagement. Such initiatives could encourage sustainable practices and support small businesses, fostering a more resilient and inclusive economy.

Furthermore, as the digital economy continues to grow, the city may need to adapt its sales tax regulations to address the unique challenges of online commerce. This could involve refining the tax collection process for e-commerce businesses and ensuring fair competition between online and brick-and-mortar retailers.

In conclusion, the Portland sales tax is a vital component of the city's fiscal landscape, providing a stable revenue stream for essential services and development projects. While it presents challenges for businesses and consumers, understanding and navigating this tax structure is essential for success in the Portland market. By staying informed, compliant, and strategic, businesses can thrive in this dynamic urban environment.

Frequently Asked Questions

What is the current sales tax rate in Portland, Oregon?

+The current sales tax rate in Portland is 1.7%.

Are there any sales tax exemptions in Portland?

+Yes, there are specific exemptions in Portland’s sales tax structure. Groceries, medical devices, and prescription medications are exempt from sales tax.

Do online sales fall under Portland’s sales tax jurisdiction?

+Yes, online sales to Portland residents are subject to the city’s sales tax. Businesses selling online must collect and remit the appropriate sales tax.

How can businesses register for sales tax in Portland?

+Businesses can register for sales tax by obtaining a Business Tax Registration Certificate from the Portland Revenue Bureau. This involves providing business details and designating a responsible person for tax matters.

What happens if a business fails to comply with sales tax regulations in Portland?

+Non-compliance with sales tax regulations can result in penalties, interest charges, and potential legal consequences. The Portland Revenue Bureau conducts audits and investigations to enforce compliance.