Philadelphia Real Estate Tax

Philadelphia's real estate tax is an essential aspect of the city's revenue generation and financial management, impacting both property owners and the overall development of the city. This tax, levied on real property, plays a crucial role in funding public services, infrastructure, and community initiatives. As one of the largest cities in the United States, Philadelphia's tax system is complex and often a topic of discussion among residents and investors alike. Understanding the intricacies of Philadelphia's real estate tax is vital for anyone considering property ownership or investment in the city.

The Fundamentals of Philadelphia’s Real Estate Tax

Philadelphia’s real estate tax, also known as the “property tax,” is an ad valorem tax, meaning it is based on the assessed value of the property. This value is determined by the Philadelphia Office of Property Assessment (OPA), which assesses all properties in the city every eight years. The assessed value is not necessarily the market value of the property, but rather a determined valuation used for tax purposes.

The tax rate in Philadelphia is expressed as a millage rate, where one mill represents one-tenth of a cent. For instance, a millage rate of 10 mills would equate to $1.00 in tax for every $1,000 of assessed property value. The city's millage rate is determined by the Philadelphia City Council, with input from various city departments, and is subject to change annually.

Tax Assessment Process

The OPA employs a team of assessors who physically inspect and assess properties in Philadelphia. These assessments consider factors such as the property’s location, size, condition, and recent sales or construction data. The OPA aims to ensure that all properties are assessed fairly and accurately, following state laws and guidelines.

Property owners have the right to appeal their assessments if they believe the value assigned to their property is inaccurate. The process for an appeal involves a formal request to the Board of Revision of Taxes (BRT), followed by a hearing where the property owner can present their case.

Tax Billing and Payment

The Philadelphia Department of Revenue is responsible for billing and collecting real estate taxes. Property owners typically receive their tax bills twice a year, with payments due in March and October. These bills detail the assessed value of the property, the applicable tax rate, and the total amount due.

Philadelphia offers several payment options, including online payments, payment by phone, and traditional mail-in payments. Property owners can also set up automatic payments or pay through their bank's bill pay service. Late payments are subject to interest and penalties, as outlined in the city's tax code.

| Key Dates | Description |

|---|---|

| March 31st | First-half tax payment due |

| October 31st | Second-half tax payment due |

| November 1st | Penalty period begins for late payments |

Understanding the Tax Rate and Its Impact

The tax rate in Philadelphia is a key determinant of the city’s revenue and its impact on property owners. While the city aims to maintain a competitive tax rate to attract businesses and residents, it also needs to generate sufficient revenue to fund essential services.

Tax Rate Trends

Over the past decade, Philadelphia’s real estate tax rate has experienced both increases and decreases. In general, the city has aimed to keep the tax rate relatively stable to avoid sudden shocks to property owners. However, economic factors, changes in state funding, and budgetary needs can influence the annual tax rate determination.

| Year | Tax Rate (mills) |

|---|---|

| 2023 | 12.67 |

| 2022 | 12.59 |

| 2021 | 12.41 |

| 2020 | 12.41 |

| 2019 | 12.22 |

Impact on Property Owners

For property owners, the real estate tax is a significant expense. The tax rate directly affects the amount they owe, and any changes in the rate can impact their financial planning and investment decisions. Higher tax rates can deter potential buyers or investors, while lower rates can make Philadelphia more attractive for real estate investments.

Additionally, the tax rate's impact is not uniform across all property types. Commercial properties, for instance, may face different tax considerations compared to residential properties. The city offers various tax abatement programs and incentives to encourage specific types of development, which can further complicate the tax landscape for property owners.

Tax Abatement Programs and Incentives

Philadelphia has implemented several tax abatement programs and incentives to promote economic development and encourage certain types of real estate investments. These programs can significantly reduce the real estate tax burden for qualifying properties, making them a critical consideration for property owners and investors.

Key Abatement Programs

- Homestead Exemption: This program provides a tax exemption for owner-occupied residential properties, with a maximum benefit of 1,300. The exemption applies to the first 150,000 of the property’s assessed value.

- 10-Year Tax Abatement: This popular program offers a 10-year tax abatement for new construction and substantial renovations. It encourages the development of new housing, especially in targeted neighborhoods, by exempting the increase in property value from real estate taxes for a period of ten years.

- Net Operating Loss (NOL) Carryforward: This tax incentive allows businesses to carry forward their net operating losses to offset future taxable income. It provides flexibility for businesses, especially those in the early stages, by reducing their tax liability over time.

Eligibility and Application Process

Each abatement program has specific eligibility criteria and an application process. Property owners or developers interested in these programs should consult the guidelines provided by the Philadelphia Department of Revenue and the Office of Property Assessment. Applications are typically required to be submitted before construction begins, and the process may involve interactions with various city departments.

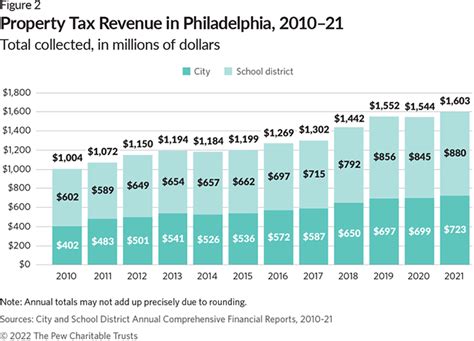

Real Estate Tax and Philadelphia’s Development

Philadelphia’s real estate tax system is intricately linked to the city’s economic development and growth. The tax revenue generated funds a range of essential services and infrastructure projects, which in turn contribute to the city’s overall prosperity and attractiveness for residents and businesses.

Funding Essential Services

Real estate taxes are a primary source of revenue for Philadelphia, contributing significantly to the city’s annual budget. This revenue supports various public services, including police and fire departments, schools, libraries, and public health initiatives. It also funds essential maintenance and improvements to the city’s infrastructure, such as roads, bridges, and public transportation systems.

Impact on Neighborhoods

The real estate tax system can have a notable impact on Philadelphia’s neighborhoods. In areas experiencing redevelopment or revitalization, tax abatements and incentives can encourage new construction and attract residents and businesses. Conversely, neighborhoods with higher tax burdens may face challenges in attracting investment and maintaining their vibrancy.

The city's tax policies, including abatements and incentives, are often designed to address specific neighborhood needs and development goals. For instance, tax incentives may be targeted towards areas identified for revitalization or towards specific industries to stimulate economic growth.

Future Implications and Considerations

As Philadelphia continues to evolve and adapt to changing economic and demographic landscapes, its real estate tax system will likely undergo further refinements and adjustments. The city’s leadership and stakeholders must carefully balance the need for revenue generation with the desire to maintain a competitive and equitable tax environment.

Potential Future Changes

Several factors could influence future changes to Philadelphia’s real estate tax system, including:

- Shifts in state funding or mandates, which could impact the city’s revenue needs and tax rates.

- Changes in federal policies, such as tax reforms, that could affect the real estate market and tax considerations.

- Advancements in technology and data analytics, which could improve the accuracy and efficiency of property assessments.

- Community feedback and input, which play a vital role in shaping tax policies and ensuring they align with the city’s values and goals.

Key Considerations for Property Owners

For property owners and investors, staying informed about potential changes to the tax system is crucial. This includes understanding any proposed amendments to tax rates, assessment practices, or abatement programs. Being proactive in engaging with city officials and staying abreast of community discussions can provide valuable insights into the future direction of Philadelphia’s real estate tax landscape.

Conclusion

Philadelphia’s real estate tax is a complex yet critical component of the city’s financial framework. It shapes the city’s development, impacts property owners and investors, and funds essential services and infrastructure. Understanding this tax system is essential for anyone involved in Philadelphia’s real estate market, whether as a homeowner, developer, or investor.

As the city continues to evolve and adapt, the real estate tax will remain a focal point of discussion and policy refinement. By staying informed and engaged, property owners and stakeholders can actively contribute to shaping Philadelphia's future and ensuring its prosperity.

How often are properties reassessed in Philadelphia for tax purposes?

+Properties in Philadelphia are reassessed every eight years by the Office of Property Assessment. This reassessment ensures that the property’s assessed value remains accurate and up-to-date.

Are there any online tools available to estimate real estate taxes in Philadelphia?

+Yes, the Philadelphia Department of Revenue provides an online tax estimator tool. This tool allows property owners to input their property’s details and get an estimated tax amount based on the current tax rate.

What happens if I miss the tax payment deadline in Philadelphia?

+If you miss the tax payment deadline, you will be subject to interest and penalties as outlined in the city’s tax code. It’s important to stay updated on payment due dates and make timely payments to avoid additional costs.

Are there any tax incentives for green or sustainable development in Philadelphia?

+Yes, Philadelphia offers a Green Building Tax Abatement program. This program provides a 10-year tax abatement for new construction and substantial renovations that meet certain green building standards. It encourages sustainable development and reduces the tax burden for environmentally conscious projects.

Can I appeal my property assessment in Philadelphia?

+Yes, property owners have the right to appeal their assessment if they believe it is inaccurate. The process involves filing an appeal with the Board of Revision of Taxes (BRT) and attending a hearing to present their case.