Does Wyoming Have State Income Tax

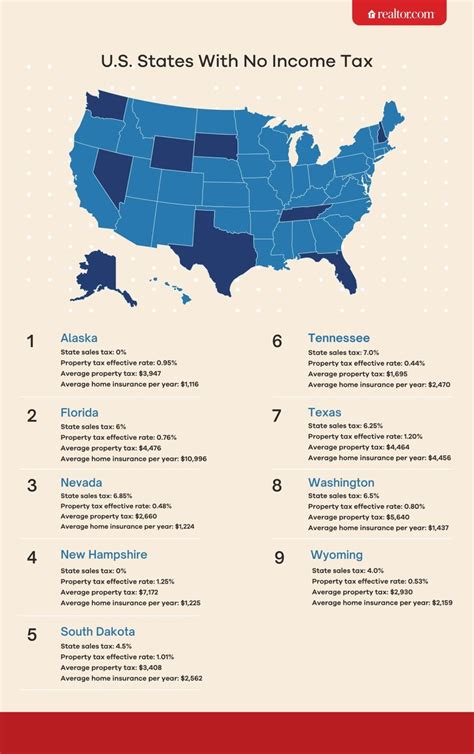

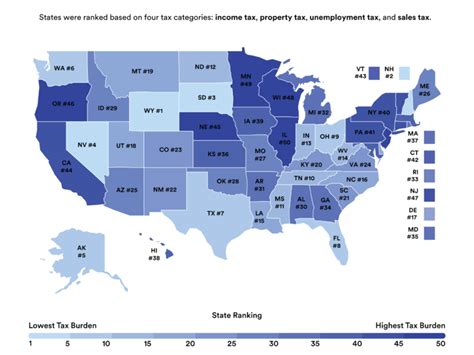

When it comes to state taxes, Wyoming stands out as one of the most tax-friendly states in the United States. With its unique approach to taxation, Wyoming has become an attractive destination for individuals and businesses seeking to minimize their tax liabilities. In this article, we will delve into the specifics of Wyoming's tax system, exploring the absence of a state income tax and its implications.

Wyoming: A State Without Income Tax

Wyoming is one of the few states in the country that does not impose an income tax on its residents. This means that individuals who live and work in Wyoming are not required to pay any state-level income tax on their earnings. It is a significant advantage for taxpayers, as income tax can be a substantial burden in many other states.

The decision to eliminate state income tax was made by the Wyoming legislature, recognizing the potential benefits it could bring to the state's economy and its residents. By forgoing income tax revenue, Wyoming aims to create a more competitive and attractive business environment, encouraging economic growth and job creation.

The Impact on Individuals

For Wyoming residents, the absence of a state income tax means a significant boost to their disposable income. With no income tax deductions, individuals can keep a larger portion of their earnings, providing them with more financial flexibility and the ability to save or invest more. This can have a positive impact on overall economic growth as well, as increased disposable income often leads to higher consumer spending.

Additionally, Wyoming's tax structure benefits retirees and those on fixed incomes. Since income tax is a progressive tax, individuals with lower incomes often pay a smaller percentage of their earnings in taxes. By eliminating income tax, Wyoming ensures that retirees and those with lower incomes are not disproportionately burdened by state taxes.

| Comparison of State Income Tax Rates | Wyoming | Average State |

|---|---|---|

| Income Tax Rate | 0% | 5.19% |

| Number of Tax Brackets | 0 | 6.7 on average |

Attracting Businesses and Investment

Wyoming’s tax-friendly environment is not limited to individuals; it also extends to businesses. The absence of a state income tax makes Wyoming an attractive destination for companies looking to reduce their tax liabilities. By choosing to operate in Wyoming, businesses can save on corporate income taxes, which can significantly impact their bottom line and overall profitability.

Moreover, Wyoming's tax structure encourages businesses to invest in the state. With a lower tax burden, companies have more capital to allocate towards expansion, research and development, and job creation. This, in turn, benefits the local economy and contributes to a thriving business environment.

Alternative Revenue Streams

While Wyoming does not collect income tax, it has implemented other sources of revenue to fund state operations. One of the primary sources is the Mineral Severance Tax, which is levied on the extraction of minerals, such as coal and natural gas, from the state’s abundant natural resources. Wyoming also generates revenue through sales and use taxes, as well as various fees and licenses.

The Mineral Severance Tax is particularly significant, as Wyoming is a leading producer of coal and natural gas. This tax provides a stable and substantial revenue stream for the state, allowing it to maintain essential services and infrastructure without relying heavily on income tax.

Wyoming’s Tax Structure and Economic Implications

Wyoming’s decision to forgo state income tax has had a notable impact on its economy. By creating a low-tax environment, the state has experienced significant economic growth and development. The absence of income tax has made Wyoming an appealing destination for businesses and individuals, leading to increased investment and job opportunities.

Furthermore, Wyoming's tax structure has contributed to a thriving real estate market. The state's tax-friendly environment, combined with its natural beauty and recreational opportunities, has attracted homebuyers and investors seeking a high quality of life without the burden of high taxes. This has resulted in a robust housing market and increased property values.

A Stable and Competitive Economy

Wyoming’s tax system has played a crucial role in fostering a stable and competitive economy. The state’s reliance on diverse revenue streams, including the Mineral Severance Tax and other taxes, has allowed it to weather economic downturns more effectively. By not relying solely on income tax, Wyoming has mitigated the potential impact of fluctuations in personal income levels during economic recessions.

Additionally, Wyoming's tax structure has attracted various industries, including energy, tourism, and manufacturing. The absence of income tax has made it easier for businesses to establish and expand operations, leading to a diverse and resilient economic base. This diversification has contributed to Wyoming's overall economic stability and its ability to adapt to changing market conditions.

The Future of Wyoming’s Tax Policy

Looking ahead, Wyoming’s tax policy is likely to remain focused on maintaining a low-tax environment. The state’s leaders recognize the advantages of a competitive tax structure and its positive impact on economic growth. However, as economic conditions and market dynamics evolve, Wyoming may need to adapt its tax system to address emerging challenges and opportunities.

One area of potential consideration is the state's reliance on mineral-related taxes. While these taxes have been a significant source of revenue, the energy industry is subject to market fluctuations and external factors. Wyoming may need to explore additional revenue streams to ensure long-term fiscal sustainability and maintain its tax-friendly status.

How does Wyoming’s tax structure compare to other states?

+Wyoming’s tax structure is unique compared to most other states. While many states rely heavily on income tax as a primary revenue source, Wyoming has eliminated income tax altogether. This sets Wyoming apart and makes it one of the most tax-friendly states in the country.

What are the potential drawbacks of not having a state income tax?

+One potential drawback is that Wyoming may have limited resources for certain public services and infrastructure projects. Without income tax revenue, the state relies heavily on other taxes and fees, which may not always provide sufficient funding. Additionally, the absence of income tax could make it more challenging to implement progressive tax policies aimed at addressing income inequality.

How does Wyoming fund its public services and infrastructure without income tax?

+Wyoming funds its public services and infrastructure through a combination of taxes, including sales tax, property tax, and the Mineral Severance Tax. The state also receives federal funding for certain programs and projects. Additionally, Wyoming has a history of prudent financial management, which has helped maintain a stable budget and allocate resources effectively.