Legal Tax Service

Legal Tax Service: Navigating Complex Tax Obligations with Expertise and Precision

In the intricate world of taxation, where laws and regulations evolve rapidly, seeking professional guidance is paramount. Legal Tax Service stands as a beacon of expertise, offering tailored solutions to individuals and businesses navigating the complex maze of tax obligations. With a dedicated team of tax professionals, we provide comprehensive services, ensuring compliance, optimizing financial strategies, and offering peace of mind.

The Evolution of Tax Compliance: A Necessity for Modern Enterprises

Tax compliance is no longer a mere bureaucratic formality; it's a strategic imperative for businesses of all sizes. In today's globalized economy, where transactions span borders and tax laws vary widely, the need for expert guidance has never been more critical. Legal Tax Service emerges as a trusted partner, helping enterprises stay abreast of changing regulations, mitigate risks, and optimize their tax strategies.

Our team boasts a wealth of experience, having worked with a diverse range of clients, from startups to established multinational corporations. This breadth of experience allows us to offer tailored solutions, recognizing that each business has unique tax considerations.

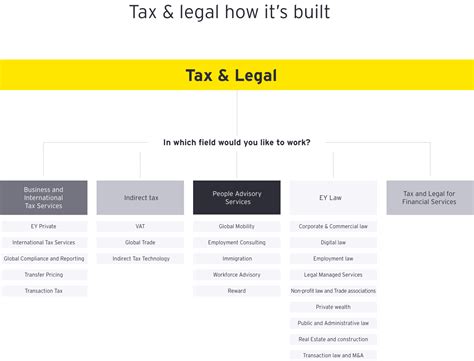

Specialized Services: A Comprehensive Approach

Legal Tax Service offers a holistic suite of services, addressing the diverse needs of our clients. Our specialized offerings include:

- Tax Planning and Strategy: We develop customized plans, optimizing tax liabilities and aligning them with business objectives. Our strategies consider both short-term efficiency and long-term sustainability, ensuring our clients remain competitive and compliant.

- Compliance and Reporting: Our experts ensure accurate and timely tax filings, navigating the complexities of domestic and international tax regulations. We stay abreast of the latest reporting requirements, helping our clients avoid penalties and maintain a clean compliance record.

- Audit and Dispute Resolution: In the event of an audit, our team provides expert representation, defending our clients' interests and ensuring fair outcomes. We also assist in resolving tax disputes, negotiating with tax authorities to reach favorable resolutions.

- Mergers and Acquisitions: For businesses involved in M&A activities, we provide specialized tax advisory services. We assess the tax implications of transactions, structure deals to minimize tax liabilities, and ensure compliance with relevant regulations.

- International Tax: With a global perspective, we guide businesses operating across borders. Our services encompass transfer pricing, cross-border transactions, and international tax planning, helping clients navigate the complexities of international tax laws.

Each of these services is delivered with a client-centric approach, ensuring we understand our clients' unique circumstances and tailor our solutions accordingly. Our goal is not just to meet tax obligations but to turn them into strategic advantages.

A Technological Edge: Enhancing Our Service Delivery

At Legal Tax Service, we recognize the importance of technology in modern tax practice. We've invested in cutting-edge tools and software, allowing us to streamline processes, enhance accuracy, and provide real-time insights to our clients. Our technology-driven approach ensures we can deliver services more efficiently and effectively, meeting the evolving needs of our clients.

Our Key Technology Partners

To achieve this, we've partnered with industry-leading technology providers, including:

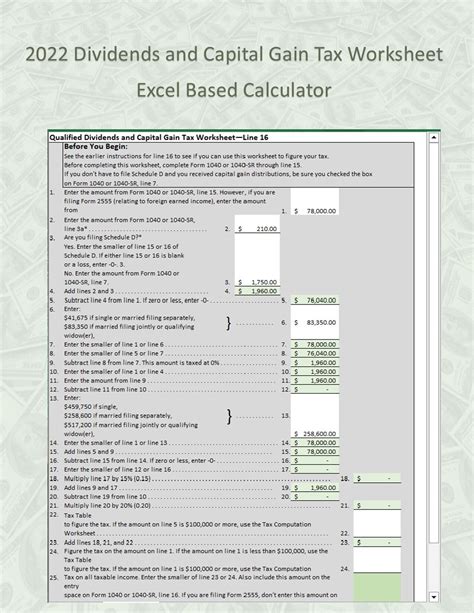

- TaxPrep Software: A powerful tax preparation and filing solution, offering accuracy and efficiency in tax computations and reporting.

- TaxAI: An AI-powered platform that analyzes vast amounts of tax data, providing insights and recommendations to optimize tax strategies.

- GlobalTaxNet: A comprehensive international tax management system, enabling us to navigate complex global tax landscapes with ease.

These partnerships, coupled with our expert team, ensure we stay at the forefront of tax technology, delivering innovative solutions to our clients.

Client Success Stories: Real-World Impact

Our commitment to excellence and client-centric approach has led to numerous success stories. Here are a few highlights:

Startup Success: Navigating Early-Stage Tax Challenges

We worked with a tech startup, Innovation Labs, as they navigated the complex world of tax obligations. Our team provided comprehensive guidance, helping them structure their business to minimize tax liabilities and maximize incentives. Through our tax planning and compliance services, Innovation Labs was able to focus on growth, secure funding, and expand their operations, all while maintaining a healthy tax posture.

International Expansion: Overcoming Tax Barriers

A leading e-commerce platform, GlobalShop, approached us as they prepared to expand their operations internationally. Our international tax experts guided them through the complexities of cross-border transactions, transfer pricing, and foreign tax regulations. Through our strategic advice, GlobalShop was able to establish a robust tax structure, ensuring compliance and minimizing their global tax footprint.

M&A Success: Optimizing Tax Strategies

We assisted a private equity firm in their acquisition of a manufacturing company. Our team provided end-to-end tax advisory services, from due diligence to post-acquisition tax planning. Through our expertise, the firm was able to structure the deal to maximize tax benefits, minimize liabilities, and ensure a smooth transition. The successful acquisition and subsequent tax optimization contributed to the firm's strong financial performance.

The Future of Tax: Our Vision and Commitment

As the tax landscape continues to evolve, driven by technological advancements and changing regulations, Legal Tax Service remains committed to staying ahead of the curve. We continuously invest in our team's professional development, ensuring they are equipped with the latest knowledge and skills. Additionally, we maintain a proactive approach, anticipating tax law changes and their implications, to provide our clients with forward-looking advice.

In the coming years, we envision a more integrated and digital tax landscape. We aim to lead this transformation, leveraging technology to deliver even more efficient and effective services. Our goal is to become the go-to partner for businesses seeking strategic tax advice, helping them turn tax obligations into opportunities for growth and success.

How can Legal Tax Service help my business stay compliant with tax regulations?

+Our team of experts stays updated with the latest tax laws and regulations, ensuring your business remains compliant. We provide strategic guidance, assist with tax planning, and offer timely reminders for tax filings, helping you avoid penalties and maintain a clean compliance record.

What makes Legal Tax Service different from other tax firms?

+At Legal Tax Service, we pride ourselves on our client-centric approach and technological edge. We tailor our services to your unique needs, offering personalized solutions. Additionally, we leverage cutting-edge technology to enhance our service delivery, ensuring accuracy, efficiency, and real-time insights.

How can Legal Tax Service help my business expand internationally?

+Our international tax experts guide businesses through the complexities of cross-border transactions, transfer pricing, and foreign tax regulations. We help structure your business to minimize tax liabilities and ensure compliance with international tax laws, enabling a smooth and successful expansion.

What technology does Legal Tax Service use to enhance its services?

+We’ve partnered with leading technology providers, including TaxPrep Software, TaxAI, and GlobalTaxNet. These tools enable us to streamline processes, enhance accuracy, and provide real-time insights to our clients, ensuring we deliver efficient and effective tax solutions.

How does Legal Tax Service stay updated with changing tax laws and regulations?

+Our team actively monitors changes in tax laws and regulations, ensuring we stay ahead of the curve. We participate in industry events, subscribe to relevant publications, and maintain close relationships with tax authorities to anticipate changes and their implications, allowing us to provide forward-looking advice to our clients.