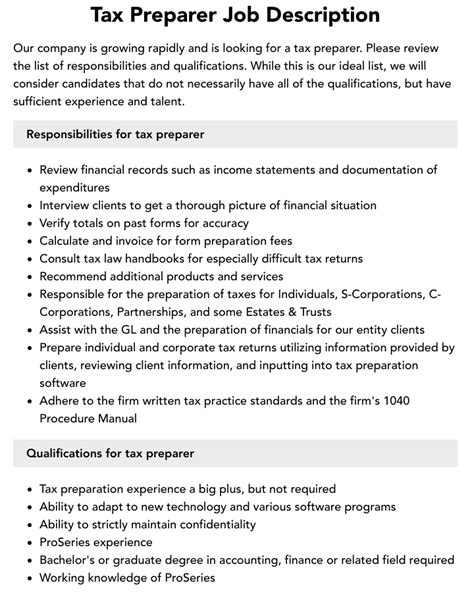

Tax Preparer Job Description

Tax preparers play a crucial role in the financial ecosystem, offering invaluable assistance to individuals and businesses in navigating the complex world of taxes. With tax laws and regulations evolving constantly, their expertise becomes even more vital. This article delves into the intricacies of the tax preparer profession, exploring the diverse responsibilities, necessary qualifications, and the significant impact they have on the financial well-being of their clients.

The Role of a Tax Preparer: Unraveling Complexity

A tax preparer, also known as a tax professional or tax consultant, is a skilled individual responsible for assisting clients in the preparation and filing of their tax returns. This role goes beyond simple data entry; it involves a deep understanding of tax laws, regulations, and the ability to apply this knowledge to unique client situations. Whether it’s an individual with a straightforward income or a complex business entity, tax preparers provide tailored solutions to ensure compliance and optimize tax outcomes.

Core Responsibilities and Expertise

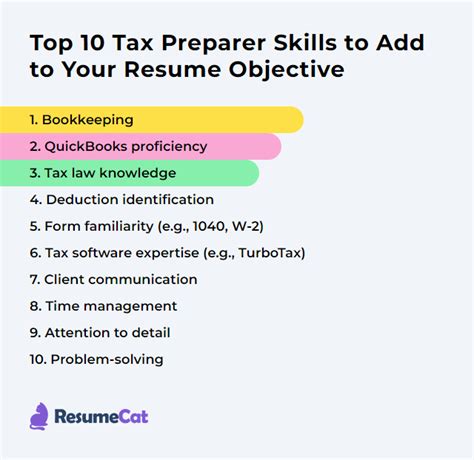

The day-to-day duties of a tax preparer encompass a wide range of tasks, each requiring a specific skill set. Here’s a breakdown of their key responsibilities:

- Data Collection and Analysis: Tax preparers gather financial information from clients, including income statements, expense records, and investment details. They meticulously analyze this data to identify relevant tax deductions, credits, and opportunities for tax savings.

- Preparation of Tax Returns: Using specialized software and their expertise, tax preparers accurately prepare and file tax returns. This involves calculating taxes owed, applying appropriate tax codes, and ensuring all forms are completed correctly.

- Compliance and Accuracy: Tax laws are intricate and ever-changing. Tax preparers must stay updated with the latest regulations to ensure their clients’ tax returns are compliant and error-free. This includes keeping abreast of new tax laws, amendments, and court rulings that may impact tax obligations.

- Client Communication and Support: Effective communication is paramount. Tax preparers provide clear explanations of tax-related concepts to their clients, ensuring they understand their financial obligations and rights. They also offer guidance and support throughout the tax preparation process, addressing any concerns or queries.

- Representation and Advocacy: In certain situations, tax preparers may represent their clients before tax authorities, such as the Internal Revenue Service (IRS) or state tax agencies. This involves defending the client’s interests, negotiating on their behalf, and resolving any tax-related issues that may arise.

| Key Responsibilities | Description |

|---|---|

| Data Collection | Gathering financial data from clients, including income, expenses, and investments. |

| Tax Return Preparation | Using specialized software to prepare accurate and compliant tax returns. |

| Compliance and Accuracy | Staying updated with tax laws to ensure error-free and compliant tax filings. |

| Client Communication | Providing clear explanations and support to clients throughout the tax process. |

| Representation and Advocacy | Representing clients before tax authorities and defending their financial interests. |

Qualifications and Training: Building a Foundation of Knowledge

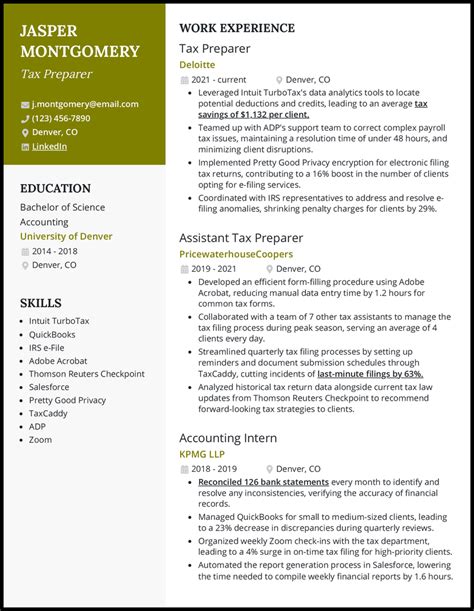

The path to becoming a tax preparer involves a combination of education, certifications, and practical experience. While the specific requirements may vary by jurisdiction, here’s an overview of the typical qualifications needed:

- Education: A bachelor’s degree in accounting, finance, or a related field is often preferred. However, some tax preparers may have an associate’s degree or a certificate in tax preparation, demonstrating their proficiency in tax laws and regulations.

- Certifications: Various certifications are available to tax preparers, enhancing their credibility and expertise. The most well-known is the Enrolled Agent (EA) designation, offered by the Internal Revenue Service (IRS). EAs are authorized to represent taxpayers before the IRS for any tax issues, including audits, collections, and appeals.

- Continuing Education: Tax laws are dynamic, and tax preparers must stay current with any changes. Most jurisdictions require tax preparers to complete a certain number of continuing education hours annually to maintain their certifications and stay informed about the latest tax regulations.

- Practical Experience: While education and certifications provide a strong foundation, practical experience is invaluable. Many tax preparers start their careers by working under the supervision of experienced professionals, gaining hands-on experience in tax preparation and client management.

The Value of Expertise: A Case Study

Consider the case of Mr. Johnson, a small business owner who sought the assistance of a tax preparer for his annual tax filing. With a complex business structure and multiple income streams, Mr. Johnson’s tax situation was far from straightforward. The tax preparer, through their expertise, was able to identify several deductions and credits that Mr. Johnson was eligible for, significantly reducing his tax liability.

Not only did the tax preparer save Mr. Johnson a substantial amount of money, but they also provided valuable advice on tax-efficient business practices. This included recommendations on investment strategies, employee benefits, and expense tracking, all of which had a positive impact on Mr. Johnson’s business and personal finances.

The Impact on Clients: A Holistic Approach to Financial Well-being

Tax preparers have a profound impact on the financial well-being of their clients. Beyond simply preparing tax returns, they offer strategic financial guidance that can shape their clients’ financial futures. Here’s how their expertise benefits individuals and businesses:

- Compliance and Peace of Mind: Tax preparers ensure their clients are compliant with tax laws, alleviating the stress and anxiety associated with potential audits or penalties. With accurate and timely tax filings, clients can focus on their core activities without the worry of tax-related issues.

- Maximizing Deductions and Credits: Tax preparers are adept at identifying deductions and credits that clients may be eligible for. By claiming these, clients can reduce their tax liability, freeing up financial resources for other investments or personal goals.

- Strategic Financial Planning: Tax preparers provide valuable insights into tax-efficient strategies. For businesses, this may include advice on business structure, investment opportunities, or expense management. For individuals, it could involve guidance on retirement planning, education savings, or estate planning.

- Resolving Tax Disputes: In the event of a tax dispute or audit, tax preparers can represent their clients before tax authorities. Their expertise and advocacy skills help resolve issues, minimize penalties, and protect the client’s financial interests.

The Future of Tax Preparation: Technology and Innovation

The tax preparation industry is evolving rapidly, with technological advancements playing a significant role. Here’s a glimpse into the future of tax preparation and the opportunities it presents:

- AI and Automation: Artificial intelligence (AI) and automation are transforming the way tax returns are prepared. Advanced software can now handle complex calculations and data analysis, reducing the risk of errors and streamlining the tax preparation process. Tax preparers can leverage these tools to enhance their efficiency and accuracy.

- Digital Platforms and Remote Services: The COVID-19 pandemic accelerated the adoption of digital tax preparation platforms. These platforms offer convenience and accessibility, allowing clients to submit their financial information and communicate with tax preparers remotely. Tax preparers can now serve a wider client base, regardless of geographical boundaries.

- Data Analytics and Insights: With access to vast amounts of data, tax preparers can employ advanced analytics to identify trends, patterns, and opportunities for their clients. This data-driven approach allows for more precise tax planning and strategic financial guidance.

Conclusion: The Indispensable Role of Tax Preparers

Tax preparers are essential professionals in the financial world, offering expertise and guidance that go beyond tax preparation. Their role is multifaceted, encompassing data analysis, compliance, client support, and advocacy. With their deep understanding of tax laws and regulations, they provide invaluable assistance to individuals and businesses, ensuring compliance, optimizing tax outcomes, and contributing to their financial success.

As the tax landscape continues to evolve, the demand for skilled tax preparers will remain strong. With a combination of education, certifications, and practical experience, tax preparers are well-equipped to navigate the complexities of the tax system, providing peace of mind and strategic financial insights to their clients.

How do I become a tax preparer?

+Becoming a tax preparer typically involves obtaining a relevant degree in accounting or finance, earning certifications like the Enrolled Agent (EA) designation, and gaining practical experience. Continuing education is also essential to stay updated with tax laws.

What are the benefits of using a tax preparer?

+Tax preparers offer expertise in tax laws, ensuring compliance and accuracy. They can identify deductions and credits, optimize tax outcomes, and provide strategic financial guidance. Additionally, they can represent clients in tax disputes, offering peace of mind.

How often should I consult a tax preparer?

+The frequency of consulting a tax preparer depends on your individual or business needs. It’s recommended to consult one annually for tax filing, but you may also benefit from periodic check-ins for tax planning and strategic financial advice.

What should I look for when choosing a tax preparer?

+When choosing a tax preparer, consider their qualifications, certifications, and experience. Look for someone who specializes in your specific tax needs, whether it’s personal or business taxes. Read reviews and seek recommendations to ensure you find a reputable and trustworthy professional.