City Of Milwaukee Property Taxes

Property taxes in Milwaukee, Wisconsin, are an essential component of the city's financial ecosystem, playing a pivotal role in funding public services and infrastructure development. This comprehensive guide delves into the intricacies of Milwaukee's property tax system, shedding light on how it operates, the factors influencing tax rates, and the impact it has on property owners.

Understanding Milwaukee’s Property Tax System

The property tax system in Milwaukee is designed to allocate a fair share of the tax burden to property owners based on the value of their real estate holdings. This value is determined through a rigorous assessment process, ensuring that each property is taxed according to its market worth. The city’s tax assessor’s office is responsible for conducting these assessments, which are typically carried out every two years.

Once the assessments are complete, the City of Milwaukee uses a uniform tax rate, also known as the mill rate, to calculate the taxes owed by each property owner. This rate is expressed in mills, with one mill representing $1 of tax for every $1,000 of assessed property value. For instance, if a property is valued at $200,000 and the mill rate is 10 mills, the annual property tax would amount to $2,000.

It's important to note that Milwaukee's property tax system is not solely dependent on the city's tax rate. State and county tax rates also come into play, as do various special assessment districts and voter-approved referendums. These additional factors can significantly impact the overall tax bill, making the property tax landscape in Milwaukee a complex interplay of multiple taxing authorities.

Factors Influencing Property Tax Rates

Several key factors contribute to the variability of property tax rates in Milwaukee. One of the primary drivers is the city’s budget. As the city plans its expenditures for the upcoming fiscal year, it must consider the revenue it expects to generate through property taxes. If the budget requires more revenue, the tax rate may increase to meet those needs.

Another significant factor is the property assessment process. As mentioned earlier, property values are assessed every two years. If the value of a property increases, so too will the tax bill, assuming the tax rate remains constant. Conversely, a decrease in property value could lead to a reduction in taxes owed.

Additionally, the state and county tax rates play a crucial role. While the city sets its own tax rate, it operates within a broader tax landscape that includes state and county rates. Changes in these rates can have a direct impact on the overall tax burden for Milwaukee property owners.

Special assessment districts are another consideration. These are areas within the city where specific services or improvements are provided, such as street lighting or sewer upgrades. Property owners within these districts may be subject to additional taxes to fund these projects.

The Impact on Property Owners

For property owners in Milwaukee, understanding the city’s property tax system is essential for financial planning and budgeting. The tax bill can be a significant expense, and changes in the tax rate or property value can have a notable impact on household finances.

One of the key challenges for property owners is staying informed about potential changes to tax rates and assessments. The City of Milwaukee typically holds public hearings and provides opportunities for citizen input during the budget-setting process. Staying engaged in these discussions can help property owners understand the factors influencing their tax bills and potentially influence the decision-making process.

Moreover, property owners should be aware of their rights and responsibilities regarding property tax appeals. If they believe their property has been over-assessed, they have the right to challenge the assessment and potentially reduce their tax burden. The process for appealing assessments is outlined on the city's official website, offering a clear path for property owners to seek redress.

Data and Case Studies

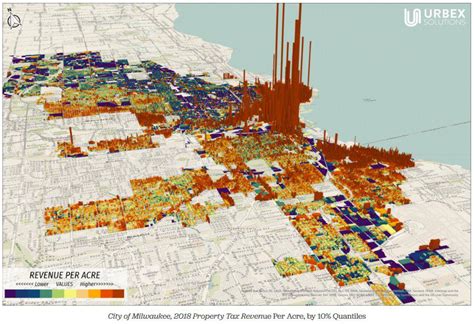

To illustrate the impact of Milwaukee’s property tax system, let’s examine some real-world examples.

Case Study: Residential Property Owner

Consider a homeowner in Milwaukee’s historic Third Ward. Their property, a two-bedroom condominium, was recently assessed at 300,000. With the current mill rate set at 12 mills, their annual property tax would amount to 3,600. This tax is typically paid in two installments, due in January and July, and is included in their monthly mortgage payments.

If the homeowner wishes to challenge their assessment, they can request a review from the city's Board of Assessors. This process involves submitting evidence to support their claim of over-assessment, such as recent sales of comparable properties in the area. If the Board agrees with their appeal, the homeowner's property value could be adjusted downward, resulting in a reduced tax burden.

Case Study: Commercial Property Owner

Now, let’s look at a commercial property owner in Milwaukee’s downtown area. Their office building, valued at $2 million, faces a more complex tax scenario due to the involvement of multiple taxing authorities. In addition to the city’s mill rate, the state and county tax rates, and any special assessment districts, they must also consider tax increments for economic development projects and voter-approved referendums for specific public initiatives.

For instance, a recent referendum passed by Milwaukee County voters authorized an additional tax to fund a public transportation improvement project. This new tax, amounting to 2 mills, adds to the existing mill rate for the commercial property owner. As a result, their annual property tax bill has increased, with a significant portion going towards the transportation initiative.

Future Implications and Trends

Looking ahead, several factors could influence the future of Milwaukee’s property tax system. One key trend is the potential for tax reform at the state level. If the state government decides to adjust its tax rates or distribution formula, it could have a significant ripple effect on Milwaukee’s property tax landscape.

Additionally, the ongoing debate around property tax relief for seniors and low-income homeowners is an important consideration. While Milwaukee has implemented various programs to provide relief, such as the Homestead Credit and the Property Tax Deferral Program, there is ongoing discussion about expanding these initiatives to better support vulnerable populations.

Furthermore, the city's commitment to economic development and infrastructure improvements will continue to shape the property tax landscape. As Milwaukee invests in initiatives like the Milwaukee Streetcar and the redevelopment of the Menomonee Valley, the resulting tax increments and special assessment districts could impact property tax rates for years to come.

Finally, the ever-evolving housing market will play a pivotal role. As Milwaukee's real estate market experiences fluctuations, so too will property values and, consequently, property tax assessments. Staying abreast of these market dynamics is crucial for property owners and city officials alike, as it directly influences the city's financial health and the tax burden on its residents.

How often are property assessments conducted in Milwaukee?

+Property assessments in Milwaukee are typically conducted every two years. This process helps ensure that property taxes are calculated based on the most current and accurate property values.

Can property owners appeal their assessment in Milwaukee?

+Absolutely! Property owners who believe their property has been over-assessed have the right to appeal. The process involves submitting an appeal to the city’s Board of Assessors, providing evidence to support their claim, and potentially attending a hearing to present their case.

What are some of the programs Milwaukee offers for property tax relief?

+Milwaukee has implemented several programs to provide property tax relief, including the Homestead Credit, which offers a credit to homeowners based on their income and property value, and the Property Tax Deferral Program, which allows eligible seniors and disabled homeowners to defer a portion of their property taxes until they sell or transfer the property.

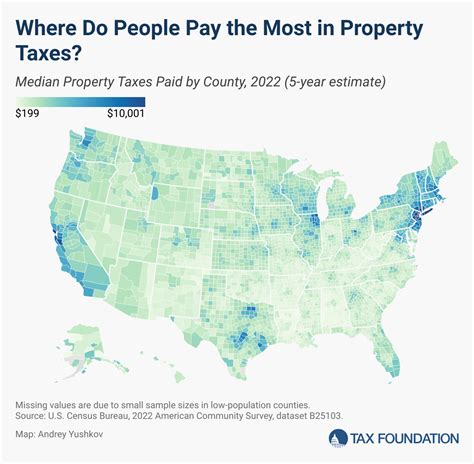

How does Milwaukee’s property tax system compare to other major cities in Wisconsin?

+Milwaukee’s property tax rates can vary significantly compared to other cities in Wisconsin. While Milwaukee’s rates are influenced by a complex interplay of city, state, and county taxes, as well as special assessments, other cities may have different tax structures and rates. It’s important to compare specific property values and tax rates to get an accurate picture of the tax burden in different areas.