What Is Sales Tax In Texas

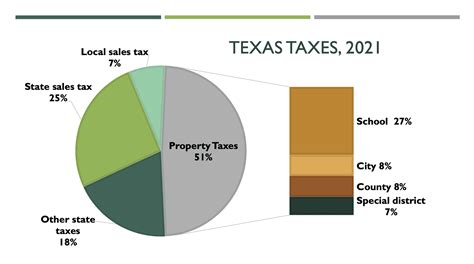

Sales tax in Texas is an essential component of the state's revenue system, playing a crucial role in funding public services and infrastructure. The Texas sales tax is a consumption tax, meaning it is levied on the sale or purchase of goods and certain services. It is a vital source of income for the state, contributing significantly to its budget and overall economic health.

Understanding the Texas Sales Tax Structure

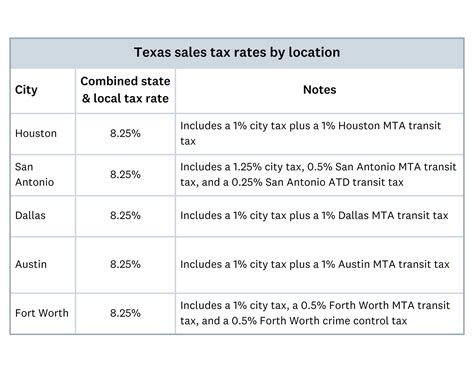

The sales tax in Texas operates on a combined rate, which includes both the state-level tax and any additional local taxes. The state sales tax rate is currently fixed at 6.25%, which serves as the foundation for the overall tax imposed on transactions. However, it’s important to note that this is not the only tax levied in the state.

In addition to the state sales tax, various local jurisdictions, such as cities, counties, and special purpose districts, are authorized to impose their own local option sales taxes. These local taxes can vary significantly, with rates ranging from 0% to 2%, depending on the specific location. As a result, the total sales tax rate can differ from one region to another within the state.

Example of Local Sales Tax Variations

Consider the city of Austin, which imposes a local option sales tax of 1.25%, bringing the total sales tax rate to 7.5%. On the other hand, a rural county with no additional local taxes would have a total sales tax rate of 6.25%, the state-level rate.

| Location | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Austin, TX | 1.25% | 7.5% |

| Rural County, TX | 0% | 6.25% |

These variations in local sales tax rates can have a significant impact on the prices consumers pay for goods and services, depending on their location within the state.

How Sales Tax is Applied in Texas

Sales tax in Texas is applied to a wide range of goods and services, including but not limited to clothing, electronics, groceries, restaurant meals, and various professional services. However, it’s important to note that certain items are exempt from sales tax, such as most groceries and prescription medications.

Businesses operating in Texas are responsible for collecting and remitting sales tax to the Texas Comptroller of Public Accounts, the state agency responsible for tax administration. This includes both brick-and-mortar stores and online retailers, who must comply with the state's sales tax laws, even if they do not have a physical presence in Texas.

Sales Tax and E-commerce

With the rise of e-commerce, Texas has implemented measures to ensure that online retailers also contribute to the state’s sales tax revenue. This includes the collection of sales tax on remote sales, which has become a significant source of revenue for the state. The Texas Comptroller provides resources and guidance to help online businesses understand their sales tax obligations.

Sales Tax Holidays in Texas

To provide relief to taxpayers and encourage spending, Texas occasionally offers sales tax holidays. During these designated periods, certain items are exempt from sales tax, typically including school supplies, clothing, and emergency preparedness items. These holidays are a popular time for consumers to make significant purchases while saving on sales tax.

Recent Sales Tax Holiday Events

-

Back-to-School and Tax-Free Weekend: August 2022 - Clothing and footwear items priced under $100, as well as school supplies and backpacks, were exempt from sales tax.

-

Energy Star Weekend: May 2022 - Certain energy-efficient products, including appliances and electronics, were sales tax-free.

The Texas Comptroller's office announces these tax holidays in advance, providing businesses and consumers with an opportunity to plan and take advantage of the savings.

The Impact of Sales Tax on Texas’ Economy

Sales tax plays a critical role in Texas’ economy, contributing significantly to the state’s revenue and budget. It is a key funding source for essential public services, including education, healthcare, infrastructure development, and public safety.

The stability and reliability of sales tax revenue make it a cornerstone of Texas' fiscal policy. Its broad-based nature ensures that a wide range of economic activities contribute to the state's income, making it an efficient and effective revenue source.

Sales Tax and Economic Development

Furthermore, sales tax revenue supports economic development initiatives, attracting businesses and creating job opportunities. The state’s commitment to a competitive and efficient sales tax system contributes to its attractiveness as a business destination, fostering economic growth and prosperity.

Conclusion: Navigating Texas’ Sales Tax Landscape

Understanding the sales tax system in Texas is essential for both consumers and businesses. The state’s sales tax structure, with its combination of state and local taxes, can result in varying rates across different regions. This complexity underscores the importance of staying informed about the applicable sales tax rates in specific areas.

For businesses, compliance with Texas' sales tax laws is crucial to avoid legal and financial penalties. The Texas Comptroller provides resources and guidance to help businesses navigate the state's tax regulations, ensuring they meet their obligations accurately and efficiently.

In conclusion, sales tax in Texas is a vital component of the state's fiscal framework, funding public services and contributing to economic development. By understanding and adhering to the state's sales tax laws, consumers and businesses can play their part in supporting Texas' economic prosperity.

How often does Texas update its sales tax rates?

+Texas typically updates its sales tax rates through legislative action. While the state sales tax rate has remained stable at 6.25% for some time, local jurisdictions can adjust their local option sales tax rates more frequently, often with voter approval.

Are there any online resources to help businesses calculate sales tax in Texas?

+Yes, the Texas Comptroller’s office provides an online Sales Tax Calculator tool. This calculator helps businesses and individuals estimate the total sales tax on a purchase, considering both state and local rates.

What are the consequences for businesses that fail to collect and remit sales tax in Texas?

+Businesses that fail to collect and remit sales tax can face severe penalties, including fines, interest charges, and even criminal charges in cases of deliberate evasion. It’s crucial for businesses to understand and comply with their sales tax obligations.