Tax Director

The role of a Tax Director is an integral position within the corporate world, often serving as a crucial link between a company's financial operations and its legal and regulatory obligations. With an ever-changing tax landscape, the expertise and strategic insights provided by a Tax Director are invaluable. This article aims to delve into the responsibilities, qualifications, and impact of Tax Directors, providing a comprehensive guide to this critical role.

The Tax Director’s Role: A Strategic Perspective

A Tax Director is a senior-level professional responsible for overseeing all tax-related matters within an organization. They act as both a leader and a strategist, ensuring compliance with tax laws and regulations while also identifying opportunities to minimize tax liabilities. This role demands a deep understanding of tax laws, financial analysis, and strategic thinking.

The primary responsibilities of a Tax Director can be categorized as follows:

- Compliance and Reporting: Ensuring accurate and timely tax filings, including income tax, payroll tax, sales tax, and any other applicable taxes. This involves working closely with accounting and finance teams to gather data and prepare tax returns.

- Tax Strategy and Planning: Developing tax strategies that align with the organization's financial goals. This includes identifying tax-efficient structures, keeping abreast of tax law changes, and suggesting strategic transactions to optimize tax positions.

- Risk Management: Identifying and mitigating tax-related risks, including potential audits and non-compliance issues. Tax Directors often lead or advise on tax audits, ensuring the organization's interests are protected.

- Leadership and Team Management: Leading and mentoring a team of tax professionals, including tax analysts, accountants, and specialists. This involves setting goals, providing guidance, and ensuring the team's continuous professional development.

- Internal and External Communication: Acting as the primary point of contact for tax matters, both internally and externally. This includes communicating with tax authorities, external auditors, and legal advisors, as well as providing tax updates and insights to senior management and the board.

The Tax Director role is often a highly influential one within an organization, as their decisions can significantly impact the company's financial health and strategic direction.

Qualifications and Skills for Tax Directors

The qualifications and skills required for a Tax Director position are extensive and often include:

- Education: A bachelor's degree in accounting, finance, or a related field is typically the minimum requirement. However, many Tax Directors hold advanced degrees such as a Master of Taxation or a Juris Doctor with a tax specialization.

- Professional Certifications: Certifications like the Certified Public Accountant (CPA), Certified Management Accountant (CMA), or the Enrolled Agent (EA) are highly valued. Additionally, specialized tax certifications such as the Certified Tax Counselor (CTC) or the Accredited Tax Advisor (ATA) can be advantageous.

- Experience: Significant experience in tax-related roles is essential. This often includes several years in public accounting, tax consulting, or corporate tax departments. Prior experience in leadership or management roles is often preferred.

- Technical Skills: Proficiency in tax software and tools, financial analysis, and data management is crucial. Tax Directors should be adept at using advanced Excel functions and tax research databases.

- Soft Skills: Effective communication, leadership, and interpersonal skills are vital. Tax Directors must be able to explain complex tax concepts to non-tax professionals and collaborate with various teams and stakeholders.

The combination of technical expertise, strategic thinking, and leadership abilities makes Tax Directors a critical asset to any organization.

Impact and Contributions of Tax Directors

The impact of a Tax Director extends beyond compliance and tax savings. Their strategic insights and leadership can drive an organization’s financial success and overall strategic direction.

Financial Benefits

Tax Directors play a pivotal role in minimizing tax liabilities, which can significantly boost a company’s bottom line. By identifying tax-efficient structures, claiming available tax credits and incentives, and implementing strategic tax planning, Tax Directors can help organizations save substantial amounts in taxes.

| Strategy | Potential Savings |

|---|---|

| Research & Development Tax Credits | $100,000 - $500,000 annually |

| Cost Segregation Studies | 2% - 8% of asset value |

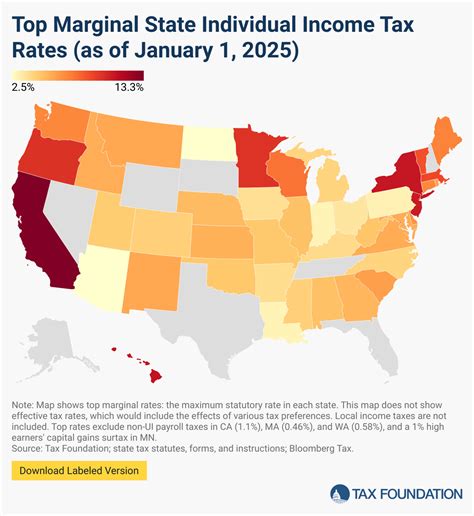

| State Tax Incentives | Varies by state and industry, up to millions in savings |

Strategic Insights

Tax Directors provide valuable insights into the financial health and potential of an organization. Their understanding of tax laws and regulations allows them to identify opportunities for growth and expansion, such as tax-efficient business structures or tax-advantaged investments.

Risk Mitigation

By staying abreast of tax law changes and potential risks, Tax Directors ensure the organization remains compliant and avoids costly penalties. Their proactive approach to risk management can save organizations from significant financial and reputational damage.

The Future of Tax Directorship

The role of a Tax Director is evolving with the increasing complexity of tax laws and the digital transformation of tax functions. As tax regulations become more intricate, the demand for specialized tax expertise will continue to grow. Additionally, the rise of digital tax solutions and data analytics is transforming the way tax functions are managed, requiring Tax Directors to adapt and integrate these technologies into their strategies.

In conclusion, the role of a Tax Director is a critical and influential one within any organization. Their expertise, strategic insights, and leadership contribute significantly to an organization's financial health and strategic direction. As tax landscapes continue to evolve, the need for skilled Tax Directors will only increase, making this role a vital component of modern business operations.

What is the average salary range for a Tax Director?

+Salaries for Tax Directors can vary significantly based on factors such as industry, company size, and location. On average, Tax Directors earn between 150,000 to 300,000 annually, with potential for higher earnings in specialized industries or with extensive experience.

What are some common challenges faced by Tax Directors?

+Tax Directors often face challenges such as keeping up with rapidly changing tax laws, managing complex tax structures, dealing with cross-border tax issues, and ensuring compliance in a highly regulated environment. Additionally, effective communication of tax strategies and insights to non-tax professionals can be a challenge.

How does a Tax Director’s role differ from that of a CFO (Chief Financial Officer)?

+While both roles are critical to an organization’s financial health, a Tax Director’s focus is primarily on tax-related matters, ensuring compliance and minimizing tax liabilities. A CFO, on the other hand, has a broader scope, overseeing all financial operations, including accounting, budgeting, financial planning, and strategic financial decision-making.