Is Net Before Or After Taxes

Determining whether net income is calculated before or after taxes is a crucial aspect of financial planning and understanding one's financial position. The concept of net income, often referred to as the "bottom line," plays a significant role in various financial scenarios, from personal budgeting to corporate financial statements. In this comprehensive guide, we will delve into the intricacies of net income, its calculation, and its relationship with taxes.

Understanding Net Income: The Bottom Line

Net income represents the amount of money an individual or business has earned after all expenses and deductions have been accounted for. It is the final figure that remains once all the financial calculations are complete. For individuals, net income is typically the take-home pay after deductions such as taxes, insurance, and retirement contributions. In the case of businesses, net income reflects the profit made after deducting operational costs, overhead expenses, and taxes.

The Calculation of Net Income

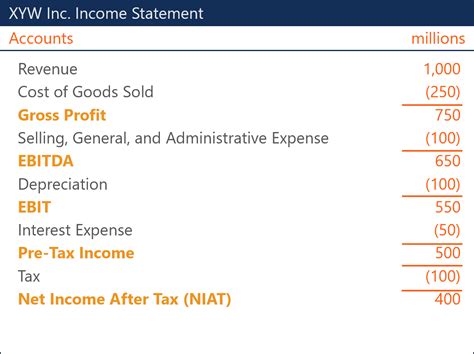

Calculating net income involves a series of steps. For individuals, the process begins with gross income, which includes all earnings before any deductions. From there, various deductions are applied, such as federal and state taxes, social security contributions, and any other mandatory withholdings. The remaining amount after these deductions is the net income.

For businesses, the calculation of net income is more complex. It involves subtracting all operating expenses, cost of goods sold, depreciation, interest expenses, and taxes from the total revenue. This process provides a clear picture of the business's profitability.

| Step | Description |

|---|---|

| 1 | Calculate Gross Income: Start with the total income earned before any deductions. |

| 2 | Apply Deductions: Subtract expenses like taxes, insurance, and contributions. |

| 3 | Determine Net Income: The remaining amount is the net income. |

Taxes and Net Income: A Complex Relationship

The relationship between taxes and net income is a critical aspect to consider. Taxes are a significant deduction from gross income, and their impact on net income varies depending on the tax jurisdiction and the individual’s or business’s financial situation.

For individuals, tax deductions can vary based on factors such as marital status, number of dependents, and income level. Some deductions, like those for retirement contributions, can reduce the taxable income, resulting in a lower tax burden. However, other deductions, such as state and local taxes, directly reduce the net income.

In the case of businesses, taxes can be even more complex. Businesses may have to contend with corporate income taxes, payroll taxes, sales taxes, and various other levies. The tax structure and the business's financial performance significantly influence the final net income figure.

The Impact of Tax Strategies on Net Income

Tax planning and strategy play a vital role in optimizing net income. Both individuals and businesses can employ various tactics to minimize their tax liability and maximize their net income.

Individual Tax Strategies

Individuals can take advantage of tax-efficient savings plans, such as 401(k)s or IRAs, which allow for tax-free growth and potential tax deductions. Additionally, understanding tax credits and deductions, such as those for education expenses or healthcare costs, can further reduce the tax burden.

For example, let's consider a hypothetical individual named Sarah. By contributing the maximum amount to her 401(k) plan, Sarah can reduce her taxable income and lower her tax liability. This strategy not only helps her save for retirement but also increases her net income.

Business Tax Strategies

Businesses have a range of tax strategies at their disposal. These may include optimizing depreciation schedules, utilizing tax-advantaged investments, and taking advantage of tax incentives for research and development or job creation. Additionally, businesses can structure their operations to benefit from tax-efficient jurisdictions or consider tax-efficient supply chain management.

A real-world example of a successful tax strategy is seen in many multinational corporations. By strategically locating their operations in countries with favorable tax rates, these businesses can significantly reduce their tax burden, thereby increasing their net income and overall profitability.

The Future of Net Income and Taxes

As tax laws and economic conditions evolve, the concept of net income and its relationship with taxes will continue to be a dynamic and ever-changing aspect of financial planning. Staying informed about tax reforms and financial strategies is essential for both individuals and businesses to ensure they are maximizing their net income and financial well-being.

For instance, with the introduction of new tax laws, such as the Tax Cuts and Jobs Act in the United States, individuals and businesses must adapt their financial strategies to navigate the changing tax landscape. This may involve reevaluating investment strategies, adjusting retirement plans, or optimizing business operations to comply with the new regulations.

Staying Informed and Adapting

To stay ahead of the curve, individuals and businesses should seek expert advice and stay updated on tax reforms and financial trends. Financial advisors, accountants, and tax professionals can provide valuable insights and guidance to help navigate the complexities of net income and tax calculations.

FAQs

What is the difference between gross income and net income?

+Gross income is the total income earned before any deductions, while net income is the income remaining after all deductions, including taxes, have been applied.

How do taxes impact net income for individuals?

+Taxes directly reduce net income for individuals. The amount of tax liability depends on factors like income level, marital status, and deductions claimed.

Can businesses minimize their tax liability to increase net income?

+Yes, businesses can employ various tax strategies, such as optimizing depreciation schedules or utilizing tax-advantaged investments, to minimize their tax liability and increase their net income.