Daycare Tax Credit

The concept of tax credits for daycare expenses is a significant relief measure for parents, especially those with low to moderate incomes. These credits aim to ease the financial burden of childcare, which can be a substantial expense for many families. Understanding the intricacies of the daycare tax credit system is essential for parents to optimize their tax benefits and make informed financial decisions regarding their children's care.

Understanding the Daycare Tax Credit System

The daycare tax credit system offers financial relief to parents by reducing the overall tax burden they owe to the government. This credit is specifically designed to support families who incur costs for childcare services, including daycare centers, nurseries, and even nannies or babysitters. By claiming this credit, parents can effectively lower their taxable income, leading to a reduced tax liability.

The daycare tax credit is a non-refundable credit, meaning it directly reduces the amount of tax owed, but it does not result in a refund if the credit amount exceeds the tax liability. However, unused credits can often be carried forward to future tax years, providing a valuable opportunity for long-term tax planning.

Eligibility and Qualifications

To qualify for the daycare tax credit, certain criteria must be met. Firstly, the childcare expenses must be incurred for a dependent child under the age of 16, or under the age of 21 if the child has a mental or physical disability. The child’s dependency status and the parent’s relationship to the child must be established as per the Internal Revenue Service (IRS) guidelines.

Secondly, the childcare expenses must be necessary for the parent to work, seek employment, or attend school full-time. This includes expenses incurred during working hours, as well as for additional time spent on work-related activities. It's important to note that expenses for personal or leisure activities are not eligible for the credit.

| Eligibility Category | Qualification Details |

|---|---|

| Age Requirement | Child must be under 16 (or under 21 with a disability) |

| Dependency Status | Child must meet IRS dependency guidelines |

| Work-Related Expenses | Childcare expenses must be work-related |

Additionally, the childcare provider must be legally operating and licensed to provide childcare services. This ensures that the expenses claimed are legitimate and comply with relevant regulations. It's worth mentioning that home-based childcare providers who are not related to the child may also be eligible, provided they meet the necessary criteria.

Calculating the Daycare Tax Credit

The calculation of the daycare tax credit involves determining the eligible expenses and applying the appropriate credit rate. The IRS sets the maximum credit amount and the income thresholds that determine the credit rate. Typically, the credit amount increases as income decreases, providing greater benefits to lower-income families.

Eligible expenses include payments made to childcare centers, day camps, or other licensed providers. These expenses can also include the cost of before- and after-school care, as well as transportation to and from the childcare facility. It's important to note that expenses for extracurricular activities, such as sports or music lessons, are generally not eligible for the credit.

To calculate the credit, parents need to complete the appropriate tax forms, such as Form 2441, Child and Dependent Care Expenses. This form requires detailed information about the childcare expenses, the provider's details, and the parent's income. The credit amount is then calculated based on the eligible expenses and the parent's adjusted gross income.

Maximizing Your Daycare Tax Credit

Maximizing the daycare tax credit involves careful planning and documentation of your childcare expenses. By understanding the eligibility criteria and the calculation process, parents can strategically optimize their tax benefits.

Strategic Planning for Tax Benefits

One effective strategy is to plan your childcare expenses throughout the year. This involves keeping track of all eligible expenses, such as tuition fees, transportation costs, and any other work-related childcare expenses. By doing so, you can ensure that you have accurate records to support your tax credit claim.

Another important consideration is the timing of your childcare expenses. If possible, try to front-load your expenses at the beginning of the tax year. This strategy can maximize your tax benefits by taking advantage of the higher credit rates that often apply to lower income levels.

Additionally, if you have multiple children in your care, it's crucial to allocate your expenses accordingly. The IRS allows for a maximum credit per qualifying child, so ensure that you distribute your expenses appropriately to maximize the credit for each child.

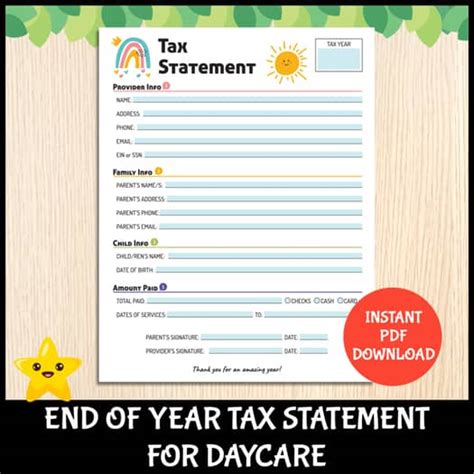

Documentation and Record-Keeping

Proper documentation and record-keeping are essential when it comes to claiming the daycare tax credit. Keep a detailed record of all your childcare expenses, including receipts, invoices, and payment records. These documents will serve as evidence of your expenses and help you accurately calculate your credit.

It's also beneficial to maintain records of your child's dependency status and your relationship to the child. This can include birth certificates, adoption papers, or other relevant legal documents. These records ensure that you meet the dependency requirements for the tax credit.

Furthermore, stay informed about any changes or updates to the daycare tax credit guidelines. The IRS may periodically adjust the income thresholds, credit rates, or eligible expenses. By staying updated, you can ensure that you are taking full advantage of any new benefits or opportunities.

Future Implications and Potential Changes

The daycare tax credit system is subject to potential changes and modifications in the future. These changes may arise from legislative reforms, economic shifts, or societal trends that impact the childcare landscape.

Legislative Reforms and Policy Shifts

Legislative bodies, such as Congress, have the power to amend or revise the tax code, including the daycare tax credit provisions. Changes may include adjusting the income thresholds, altering the credit rates, or even expanding the eligibility criteria to include a broader range of childcare expenses.

Policy shifts can also influence the daycare tax credit system. For instance, if there is a push for increased support for working families, policymakers may advocate for more generous tax credits or additional childcare subsidies. Conversely, budget constraints or shifts in political priorities may lead to a reduction in tax benefits.

Economic and Societal Trends

Economic factors, such as inflation or shifts in the cost of living, can impact the value and effectiveness of the daycare tax credit. As childcare expenses rise, the credit may need to be adjusted to maintain its intended purpose of providing meaningful financial relief to parents.

Societal trends, such as changing family structures or workforce participation rates, can also influence the daycare tax credit system. For example, an increase in dual-income households or single-parent families may lead to a greater demand for childcare support, potentially influencing the design and scope of the tax credit.

Conclusion

The daycare tax credit is a powerful tool for parents to manage their childcare expenses and optimize their tax benefits. By understanding the eligibility criteria, calculation process, and strategic planning opportunities, parents can make the most of this valuable relief measure. As the landscape of childcare and tax policies evolves, staying informed and proactive is key to ensuring that families receive the support they need.

Frequently Asked Questions

What types of childcare expenses are eligible for the tax credit?

+

Eligible expenses include payments to licensed childcare providers, such as daycare centers, nurseries, and nannies. This can also include transportation costs and before- and after-school care. However, expenses for extracurricular activities or personal leisure are generally not covered.

How do I calculate the daycare tax credit amount?

+

The calculation involves determining your eligible expenses and applying the appropriate credit rate based on your income. You’ll need to complete Form 2441, Child and Dependent Care Expenses, which requires detailed information about your childcare expenses and income. The credit amount is then calculated based on these factors.

Can I claim the daycare tax credit if I’m self-employed?

+

Yes, self-employed individuals can also claim the daycare tax credit if they meet the eligibility criteria. This includes having a qualifying dependent child and incurring eligible childcare expenses to enable work or job search activities.

What happens if I have multiple children in my care?

+

You can claim the daycare tax credit for each qualifying child, up to a maximum credit per child. It’s important to allocate your expenses appropriately to maximize the credit for each child, ensuring you stay within the eligible expense limits.

Are there any income limits for claiming the daycare tax credit?

+

Yes, there are income thresholds that determine the credit rate you can claim. Generally, the credit amount increases as income decreases, providing greater benefits to lower-income families. It’s important to check the latest guidelines to understand the applicable income limits for your situation.