Colorado Sales Tax For Cars

Colorado, known for its diverse landscapes and vibrant cities, has a unique approach to sales tax, especially when it comes to vehicle purchases. Understanding the intricacies of Colorado's sales tax system is crucial for anyone looking to buy a car in the Centennial State. In this comprehensive guide, we will delve into the specifics of Colorado sales tax for cars, covering everything from the tax rates to the exemptions and the steps involved in the car-buying process. Whether you're a resident or a visitor, this article will provide you with the knowledge to navigate the tax landscape and make informed decisions when purchasing a vehicle in Colorado.

Understanding Colorado’s Sales Tax System

Colorado’s sales tax system operates under a comprehensive tax code that applies to various goods and services, including vehicle sales. The state’s sales tax is a consumption tax, meaning it is levied on the purchase of tangible personal property and certain services. This tax contributes to the state’s revenue and is used to fund various public services and infrastructure projects.

The sales tax in Colorado is administered by the Colorado Department of Revenue, which ensures compliance and collects the tax from businesses and individuals. The tax rate is not a flat percentage but varies depending on the type of transaction and the location where the purchase is made. This variability is a key aspect of Colorado's sales tax system and can significantly impact the final cost of a vehicle purchase.

Sales Tax Rates in Colorado

Colorado’s sales tax rates can be broken down into two primary components: the state sales tax and the local sales tax. The state sales tax is a uniform rate applied across the state, while the local sales tax varies by jurisdiction. This local tax is often referred to as the local option tax and is imposed by cities, counties, and special districts.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 2.9% |

| Local Sales Tax | Varies by Location (0% - 4.5%) |

The combination of the state and local sales tax rates results in a total sales tax rate that can range from 2.9% to over 7% depending on the specific location of the purchase. This variability is important to consider when comparing vehicle prices across different regions in Colorado.

How Sales Tax is Calculated for Vehicle Purchases

When purchasing a vehicle in Colorado, the sales tax is calculated based on the purchase price of the vehicle, including any additional fees and taxes that are part of the transaction. This can include title fees, registration fees, and any optional add-ons or upgrades to the vehicle. The tax is applied to the total purchase price, and the resulting amount is added to the final cost of the vehicle.

For example, if you purchase a car for $30,000 and the total sales tax rate in your location is 4.5%, the sales tax amount would be calculated as follows:

Sales Tax Amount = Purchase Price * Sales Tax Rate

Sales Tax Amount = $30,000 * 0.045 = $1,350

So, in this case, the sales tax on the vehicle would be $1,350, and the total cost of the vehicle would be $31,350.

Vehicle Sales Tax Exemptions in Colorado

While Colorado’s sales tax applies to most vehicle purchases, there are certain exemptions and special cases that can reduce or eliminate the sales tax liability. Understanding these exemptions is crucial for buyers who may qualify for tax savings.

Trade-In Vehicles

When trading in an old vehicle as part of the purchase of a new one, the sales tax in Colorado is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This is known as the trade-in credit and can significantly reduce the sales tax owed.

For example, if you trade in a vehicle valued at $10,000 and purchase a new vehicle for $30,000, the sales tax is calculated on the difference of $20,000. If the total sales tax rate is 4.5%, the sales tax amount would be:

Sales Tax Amount = ($30,000 - $10,000) * 0.045 = $765

So, in this case, the sales tax on the new vehicle would be $765, which is lower than it would be without the trade-in credit.

Military Exemptions

Colorado offers special exemptions for active-duty military personnel and their spouses. These exemptions can apply to the purchase of a vehicle and may reduce or eliminate the sales tax liability. To qualify, individuals must meet specific criteria and provide documentation to the dealership or tax authority.

Other Exemptions

Colorado also provides sales tax exemptions for certain types of vehicles, such as those used exclusively for agricultural or mining purposes. Additionally, there are exemptions for disabled individuals who require specialized vehicles. These exemptions are designed to accommodate specific needs and situations, and they can significantly impact the overall cost of vehicle ownership.

Steps to Pay Sales Tax When Buying a Car in Colorado

Paying sales tax when purchasing a car in Colorado involves several steps to ensure compliance with the state’s tax laws. Here is a comprehensive guide to help you through the process:

Step 1: Research Sales Tax Rates

Before making a vehicle purchase, it’s essential to research the sales tax rates in the specific location where the transaction will take place. As mentioned earlier, sales tax rates can vary significantly across Colorado, so knowing the exact rate is crucial for accurate budgeting.

You can find information on sales tax rates by visiting the Colorado Department of Revenue's website or contacting your local tax authority. Be sure to consider both the state and local sales tax rates to get an accurate picture of the total tax liability.

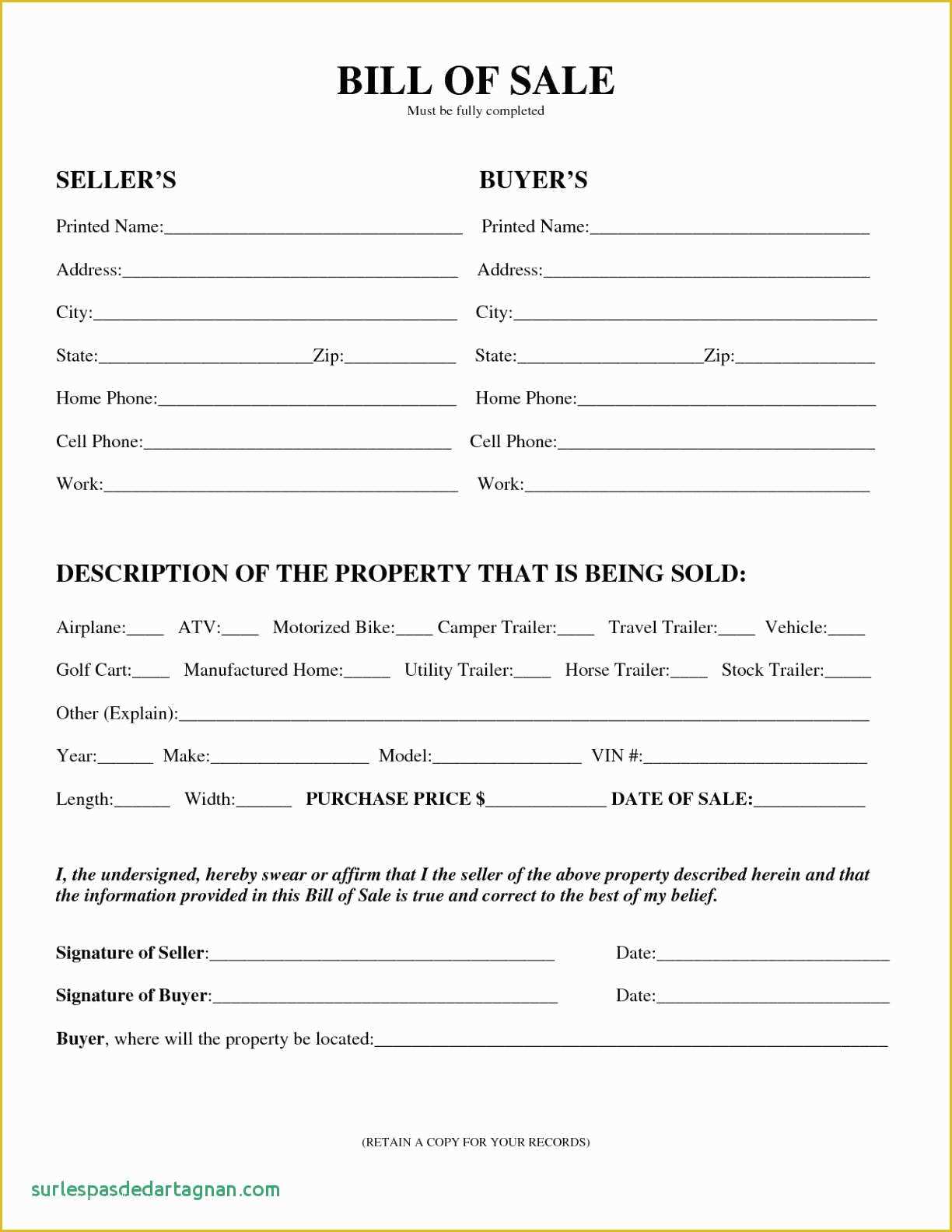

Step 2: Determine the Purchase Price

Negotiate and finalize the purchase price of the vehicle with the dealer or seller. This should include all fees, options, and add-ons that are part of the transaction. It’s important to understand the breakdown of the purchase price to accurately calculate the sales tax.

Step 3: Calculate the Sales Tax

Using the purchase price and the applicable sales tax rates, calculate the sales tax amount. This can be done manually or with the help of online calculators. Ensure that you account for any applicable exemptions or credits, such as trade-in values or military exemptions.

Step 4: Provide Necessary Documentation

Gather and provide any required documentation to the dealership or tax authority. This may include proof of identity, residency, and any exemptions you are claiming. Be prepared to present supporting documents, such as military ID or disability certifications.

Step 5: Pay the Sales Tax

Pay the calculated sales tax amount to the dealership or the appropriate tax authority. This payment is typically made at the time of purchase and can be done through various methods, including cash, check, or electronic transfer. Ensure that you receive a receipt or confirmation of payment for your records.

Step 6: Complete the Vehicle Registration

Once the sales tax is paid, you can proceed with registering the vehicle. This involves submitting the necessary paperwork, including proof of insurance, to the Colorado Division of Motor Vehicles (DMV). The registration process ensures that your vehicle is legally operated on Colorado roads.

Comparing Sales Tax Rates Across Colorado

Colorado’s diverse geography and local governments result in varying sales tax rates across the state. Understanding these variations is crucial for buyers who may be considering purchases in different regions. Here’s a look at some of the major cities and their corresponding sales tax rates:

| City | Total Sales Tax Rate |

|---|---|

| Denver | 7.62% |

| Colorado Springs | 6.72% |

| Aurora | 7.32% |

| Fort Collins | 7.32% |

| Boulder | 7.72% |

| Pueblo | 7.2% |

As you can see, the total sales tax rate can vary significantly, even among neighboring cities. This variation highlights the importance of considering sales tax when comparing vehicle prices across different regions in Colorado.

Future Implications and Considerations

Colorado’s sales tax system for vehicles is subject to ongoing changes and updates. As the state’s economy and tax policies evolve, it’s essential to stay informed about any modifications to the sales tax rates and exemptions. Here are some key considerations for the future:

Potential Rate Changes

Sales tax rates in Colorado are subject to legislative changes, and there may be proposals to adjust the rates to fund specific initiatives or address budget concerns. Staying informed about any proposed changes is crucial for accurate financial planning when purchasing a vehicle.

Online Vehicle Purchases

With the rise of online vehicle sales platforms, understanding how sales tax applies to these transactions is essential. Colorado has specific guidelines for online purchases, and buyers should be aware of their obligations when buying a car remotely. This includes considerations for delivery, registration, and tax payments.

Electric Vehicle Incentives

Colorado is committed to promoting the adoption of electric vehicles (EVs). As such, there may be future incentives or tax credits available for EV purchases. Keeping an eye on these incentives can significantly impact the overall cost of owning an electric vehicle in Colorado.

Conclusion

Understanding Colorado’s sales tax system for vehicle purchases is a crucial aspect of the car-buying process in the Centennial State. By navigating the varying tax rates, exemptions, and payment processes, buyers can make informed decisions and ensure compliance with the state’s tax laws. This comprehensive guide has provided a detailed look at the specifics of Colorado sales tax for cars, empowering buyers with the knowledge to navigate the tax landscape and make confident choices when purchasing a vehicle.

Frequently Asked Questions

What happens if I don’t pay the sales tax on my vehicle purchase in Colorado?

+

Failing to pay the sales tax on a vehicle purchase in Colorado can result in legal consequences and penalties. The Colorado Department of Revenue has the authority to enforce tax compliance, and buyers may face fines, interest charges, and even legal action if they do not pay the required sales tax. It’s important to fulfill your tax obligations to avoid these issues.

Can I negotiate the sales tax rate when buying a car in Colorado?

+

No, the sales tax rate in Colorado is set by law and cannot be negotiated. However, you can negotiate the purchase price of the vehicle, which indirectly affects the sales tax amount. Lowering the purchase price can result in a reduced sales tax liability, so it’s beneficial to negotiate the best deal possible.

Are there any online resources to calculate sales tax for vehicle purchases in Colorado?

+

Yes, the Colorado Department of Revenue provides an online sales tax calculator that can help you estimate the sales tax for a vehicle purchase. This tool takes into account the purchase price and the applicable sales tax rates to provide an accurate estimate. It’s a useful resource for budgeting and financial planning.