New Jersey Property Tax Records

Welcome to an in-depth exploration of New Jersey Property Tax Records, a topic that holds significant importance for residents, investors, and anyone interested in the state's real estate market. This article aims to provide a comprehensive guide, shedding light on the intricacies of property taxes in the Garden State. With a focus on specificity and real-world examples, we delve into the mechanisms, rates, and implications of property taxation in New Jersey, offering a valuable resource for anyone seeking clarity on this essential aspect of homeownership.

Unraveling the Complexity: An Overview of New Jersey Property Taxes

Property taxes in New Jersey are a vital component of the state’s revenue system, playing a crucial role in funding local services and infrastructure. The state’s taxation system is renowned for its complexity, which can often be a source of confusion for both new and established residents. Understanding the nuances of property taxes is not just a matter of financial management but also a key to unlocking the full potential of one’s real estate investments.

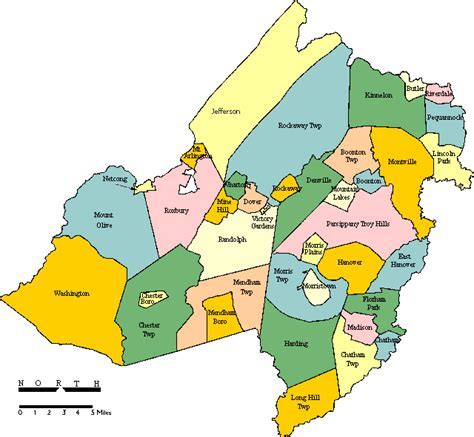

New Jersey's property tax system operates on a local level, with each of the state's 565 municipalities responsible for assessing and collecting taxes. This decentralized approach results in a wide variation in tax rates and assessment practices across the state, making it essential for property owners to have a clear understanding of the specific rules and regulations applicable to their locality.

Key Factors Influencing Property Taxes in New Jersey

Several key factors contribute to the calculation of property taxes in the state. These include the assessed value of the property, which is determined by local tax assessors, and the tax rate, which is set by the local government. The tax rate is often expressed as a millage rate, representing the amount of tax owed for every $1,000 of assessed value.

For instance, if a property is assessed at $300,000 and the millage rate is 3%, the annual property tax bill would amount to $9,000. This is calculated by multiplying the assessed value by the millage rate (3%) and then dividing by 1,000.

| Assessed Value | Millage Rate | Annual Property Tax |

|---|---|---|

| $300,000 | 3% | $9,000 |

The Role of Assessments in New Jersey Property Taxes

Property assessments are a critical component of the New Jersey property tax system. These assessments determine the value of a property for tax purposes, and they are carried out by local tax assessors. The process of assessment involves evaluating the property’s physical characteristics, recent sales data of comparable properties, and market trends to arrive at a fair and equitable value.

It's important for property owners to understand that assessments are not always accurate reflections of a property's true value. Various factors, such as changes in the local real estate market, improvements made to the property, or even errors in the assessment process, can lead to discrepancies between the assessed value and the property's actual market value. When such discrepancies occur, property owners have the right to appeal their assessment, a process we will delve into later in this article.

Assessment Cycles and Their Impact

New Jersey’s assessment cycles vary widely across municipalities, with some towns conducting reassessments annually, while others may do so every two or three years, or even less frequently. This inconsistency can lead to significant differences in property tax bills for homeowners in different parts of the state. For instance, if a property’s assessed value remains unchanged while the local tax rate increases, the property owner may experience a substantial hike in their tax bill, even if the property’s market value has not appreciated.

Consider the case of a homeowner in a municipality with a three-year assessment cycle. If the local tax rate increases by 5% each year, the homeowner's tax bill could potentially surge by 15% over the course of those three years, even if the property's assessed value remains static.

| Year | Tax Rate | Assessment Cycle | Potential Tax Increase |

|---|---|---|---|

| Year 1 | 3% | No Change | 0% |

| Year 2 | 3.15% | No Change | 5% |

| Year 3 | 3.30% | No Change | 5% |

| Total Increase | 15% |

Tax Rates: A Complex Landscape

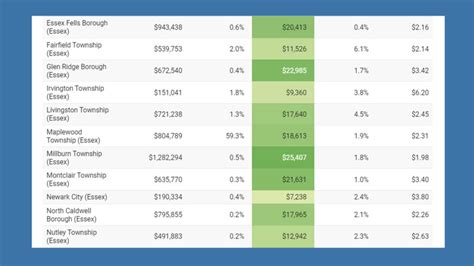

New Jersey’s property tax rates are a dynamic and multifaceted aspect of the state’s tax system. While the millage rate is a common metric for expressing tax rates, it’s important to understand that this rate can vary significantly across the state’s municipalities. This variation is influenced by a multitude of factors, including the local government’s budgetary needs, the cost of providing services, and the overall economic climate of the area.

The Impact of Local Services and Budgetary Needs

The cost of local services, such as education, public safety, and infrastructure maintenance, is a significant driver of property tax rates. Municipalities with higher expenses, whether due to the cost of living, the complexity of local government operations, or the need to maintain a high standard of public services, often require a higher tax rate to fund these services adequately.

For instance, a municipality with a robust school system and a high standard of living may have a higher millage rate compared to a neighboring town with fewer services and a lower cost of living. This disparity in tax rates can lead to substantial differences in property tax bills for homeowners in different parts of the state, even if their properties have similar assessed values.

| Municipality | Millage Rate | Description |

|---|---|---|

| Town A | 3% | High-performing schools, extensive public services |

| Town B | 2.5% | Basic services, lower cost of living |

Economic Factors and Their Influence

The economic climate of an area also plays a pivotal role in determining property tax rates. Municipalities with a strong economic base, driven by factors like a diverse job market, robust local industries, and high employment rates, may have a more stable tax base and thus, potentially lower tax rates. Conversely, areas experiencing economic downturns or relying heavily on a single industry may face higher tax rates to sustain local services and infrastructure.

For example, a town with a thriving technology sector might have a lower millage rate compared to a neighboring municipality heavily reliant on a single manufacturing industry that has recently faced economic challenges.

The Appeal Process: Navigating Assessment Discrepancies

Property owners in New Jersey have the right to appeal their property assessments if they believe the assessed value is inaccurate or unfair. This process is an essential safeguard, ensuring that property taxes are levied based on an equitable and accurate assessment of a property’s value. While the appeal process can be complex and time-consuming, it provides a critical avenue for homeowners to challenge assessments that may be causing undue financial hardship.

Understanding the Appeal Process

The appeal process typically begins with a formal request to the local tax assessor’s office, where the property owner outlines the reasons why they believe the assessment is inaccurate. This could be based on a discrepancy between the assessed value and the property’s market value, an error in the assessment process, or a comparison with similar properties in the area that have a lower assessed value.

Once the appeal is filed, the assessor's office will review the case and may request additional information or documentation from the property owner. If the assessment is upheld, the property owner can then proceed to the next level of appeal, which often involves an administrative hearing or a formal review by a county tax board.

Key Considerations for a Successful Appeal

To increase the chances of a successful appeal, property owners should gather compelling evidence to support their case. This may include recent sales data of comparable properties, professional appraisals, and detailed records of any improvements or modifications made to the property that could impact its value. It’s also beneficial to understand the assessment methodology used by the local tax assessor’s office and to identify any potential errors or inconsistencies in the assessment process.

Consider the case of a homeowner who recently renovated their property, adding significant value through upgrades. If the local tax assessor's office fails to account for these improvements in the property's assessment, the homeowner has a strong case for an appeal, as the assessed value is no longer reflective of the property's true worth.

The Future of New Jersey Property Taxes: Trends and Predictions

As we look ahead, several trends and developments are shaping the future of property taxes in New Jersey. These include ongoing efforts to streamline the assessment process, implement more equitable assessment methodologies, and explore alternative funding mechanisms to reduce the reliance on property taxes. Understanding these trends is crucial for property owners, investors, and policymakers alike, as they can significantly impact the state’s real estate market and the financial well-being of its residents.

Streamlining Assessments for Greater Equity

There is a growing recognition among policymakers and stakeholders in New Jersey that the current assessment system, with its wide variation in practices and timing across municipalities, can lead to inequities in property tax burdens. Efforts are underway to standardize assessment practices and timing, with the goal of achieving greater consistency and fairness in property tax assessments statewide. This includes exploring technologies and methodologies that can improve the accuracy and efficiency of assessments, while also reducing the administrative burden on local governments.

Exploring Alternative Funding Sources

The heavy reliance on property taxes in New Jersey has led to calls for diversifying the state’s revenue streams. Policymakers are exploring various alternatives, such as increasing sales taxes, implementing new user fees, or leveraging public-private partnerships to fund local services and infrastructure. While these alternatives may not directly impact property tax rates, they can reduce the pressure on property taxes and provide much-needed relief for homeowners and investors.

The Impact of Economic Shifts

The economic landscape of New Jersey, like that of any state, is subject to change. Economic shifts, whether driven by national trends, global markets, or local factors, can have a significant impact on property tax rates and assessments. As industries evolve, populations shift, and the cost of living fluctuates, property tax rates may need to adjust to maintain the funding levels necessary for local services and infrastructure.

For instance, if a major industry in a particular region of New Jersey experiences a downturn, leading to job losses and a decline in the local economy, the municipality may need to increase tax rates to compensate for the loss in revenue. Conversely, a thriving economy could lead to lower tax rates as the increased economic activity boosts the tax base and provides more funding for local services.

Conclusion: Navigating the Complexities of New Jersey Property Taxes

In conclusion, understanding the intricacies of New Jersey property taxes is essential for anyone with a stake in the state’s real estate market. From the complexities of assessments and tax rates to the appeal process and future trends, this article has provided a comprehensive guide to navigating the unique challenges and opportunities presented by New Jersey’s property tax system.

As we've explored, the process of assessing and levying property taxes in New Jersey is influenced by a multitude of factors, from local services and budgetary needs to economic shifts and assessment methodologies. While this complexity can be daunting, it's important to remember that property owners have rights and avenues for appeal, ensuring that property taxes are levied fairly and equitably.

Staying informed about these issues, understanding the specific rules and regulations applicable to one's locality, and seeking expert advice when needed are all key steps in effectively managing property taxes in New Jersey. By doing so, property owners can not only ensure compliance with the law but also maximize the value of their real estate investments and contribute to the economic vitality of the Garden State.

How often are property assessments conducted in New Jersey?

+Assessment cycles vary widely across municipalities in New Jersey. Some towns conduct reassessments annually, while others may do so every two or three years, or even less frequently. It’s important for property owners to stay informed about their municipality’s assessment cycle to anticipate potential changes in their tax bills.

What is a millage rate, and how is it calculated?

+A millage rate represents the amount of tax owed for every 1,000 of assessed property value. It's expressed as a percentage and is used to calculate the annual property tax bill. For example, if a property is assessed at 300,000 and the millage rate is 3%, the annual property tax would be 9,000 (calculated as 300,000 x 3% = $9,000).

How can I appeal my property assessment in New Jersey?

+To appeal your property assessment, you need to file a formal request with the local tax assessor’s office, outlining the reasons why you believe the assessment is inaccurate. This could be based on a discrepancy between the assessed value and the property’s market value, an error in the assessment process, or a comparison with similar properties in the area. It’s beneficial to gather compelling evidence, such as recent sales data, professional appraisals, and records of any improvements made to the property.

What are some key trends shaping the future of property taxes in New Jersey?

+Key trends include efforts to streamline assessments for greater equity, explore alternative funding sources to reduce reliance on property taxes, and adapt to economic shifts that can impact property tax rates. These trends are aimed at creating a more sustainable and equitable property tax system in New Jersey.