Tax Credits And Home Education

In the realm of education, the concept of home education, also known as homeschooling, has gained significant traction and interest in recent years. As an educational alternative, it offers families a unique and personalized approach to learning. However, one of the key concerns for parents considering this option is the financial aspect. This is where tax credits come into play, providing potential relief and support for those who choose to educate their children at home.

The Rise of Home Education

Home education has experienced a notable rise in popularity, particularly in the last decade. Parents are increasingly seeking more control over their children’s educational journey, often driven by a desire for a customized curriculum, a focus on individual learning styles, and a safe and nurturing learning environment. This shift has led to a growing community of homeschoolers, each with their unique stories and motivations.

According to recent statistics, the number of homeschooled students in the United States has risen to approximately 2.5 million, a significant increase from the 1.7 million reported in 2016. This trend is not limited to the US; countries like the UK, Canada, and Australia have also seen a rise in home education, with supportive policies and an increasing recognition of its benefits.

Despite the advantages, home education can present financial challenges. From purchasing curriculum materials and resources to covering the costs of extracurricular activities and field trips, the expenses can add up quickly. This is where tax credits can make a substantial difference, offering much-needed financial support to homeschooling families.

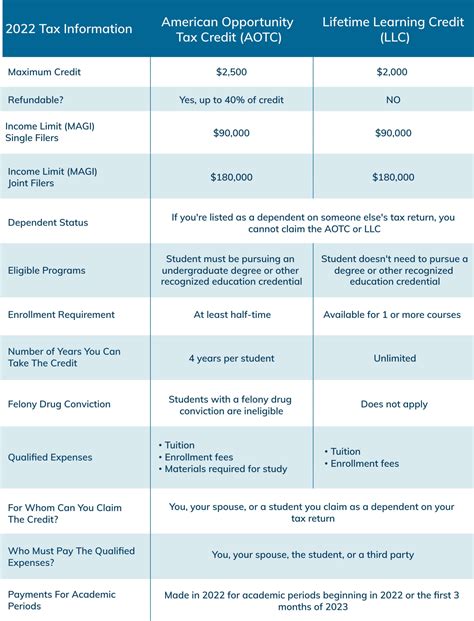

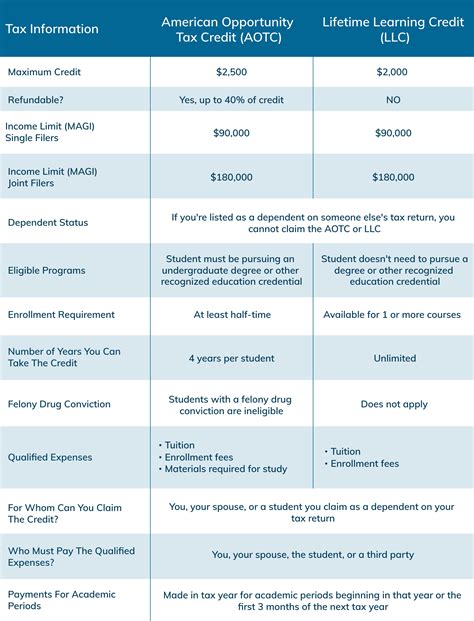

Understanding Tax Credits for Home Education

Tax credits are a form of financial relief provided by governments to eligible individuals or families, often to encourage certain behaviors or to support specific sectors. In the context of home education, tax credits are designed to ease the financial burden on parents who opt for this educational path.

The specifics of tax credits for home education vary depending on the jurisdiction. In some regions, these credits are offered as a direct reduction of the total tax liability, while in others, they might be provided as a refund or a credit against future tax payments. The amount of the credit can also differ, often depending on the number of children being homeschooled and the specific expenses incurred.

Eligibility and Requirements

Eligibility for tax credits typically requires the parent or guardian to be the primary educator for the child. This means that the individual must be actively involved in planning, organizing, and delivering the educational curriculum. In some cases, additional requirements might be in place, such as the need for the homeschooling program to align with certain educational standards or to provide regular progress reports to educational authorities.

Here's a table outlining some of the key eligibility criteria for tax credits related to home education in different countries:

| Country | Eligibility Criteria |

|---|---|

| United States | Varies by state; common requirements include parental involvement, curriculum adherence, and annual assessments. |

| Canada | Varies by province; generally requires a registered homeschooling program and regular educational assessments. |

| United Kingdom | No specific tax credits for homeschooling, but parents can claim expenses for educational materials as a deduction. |

| Australia | Homeschooling is regulated; tax benefits might be available through educational support programs. |

It's crucial for homeschooling families to stay informed about the specific requirements and regulations in their region to ensure they can fully utilize any available tax credits.

Covered Expenses

The expenses that can be claimed under tax credits for home education vary, but they typically include a range of educational materials and resources. This can encompass textbooks, workbooks, online learning platforms, and even educational software. In some cases, expenses related to extracurricular activities, such as sports teams, music lessons, or field trips, might also be eligible for tax credits.

Here's an example of some common expenses that could be covered by tax credits:

- Math and Science textbooks

- Language arts workbooks and curriculum guides

- Online educational platforms (e.g., Khan Academy, IXL)

- Educational software (e.g., typing programs, coding apps)

- Art supplies for creative projects

- Music lesson fees

- Admission fees for educational field trips

However, it's important to note that not all expenses are universally eligible for tax credits. For instance, expenses related to home schooling support groups or co-ops might be treated differently depending on the jurisdiction. It's always recommended to consult with a tax professional or refer to official guidelines to understand the specific rules in your region.

Maximizing Tax Credits for Home Education

To make the most of tax credits for home education, families should adopt a strategic approach to their financial planning and record-keeping. Here are some tips to help maximize the benefits:

Organize Your Expenses

Keep a detailed record of all homeschooling-related expenses. This should include receipts, invoices, and any other documentation that can prove the educational purpose of the expenditure. Digital record-keeping tools can be especially helpful for this purpose, making it easier to categorize and track expenses throughout the year.

Understand Your Local Regulations

Familiarize yourself with the specific regulations and guidelines related to tax credits for home education in your region. This information is often available on government websites or through local homeschooling support groups. Understanding the rules will ensure you can claim all eligible expenses and avoid any potential pitfalls.

Consider Bundled or Annual Purchases

Some expenses, such as curriculum packages or annual membership fees for educational platforms, can be more cost-effective when purchased in bulk or annually. These larger expenses can often be claimed in full during the tax year they were incurred, providing a more significant reduction in your tax liability.

Explore Additional Deductions

In addition to tax credits, there might be other deductions or incentives available for homeschooling families. For instance, some regions offer tax breaks for educational expenses or provide incentives for parents who engage in professional development related to education. Exploring these options can further reduce your overall tax burden.

The Impact of Tax Credits on Home Education

Tax credits for home education can have a significant impact on the financial sustainability of this educational choice. By reducing the financial strain, these credits can make homeschooling a more viable option for a wider range of families, ensuring that educational decisions are driven by personal preferences rather than financial constraints.

Furthermore, tax credits can also contribute to the overall quality of home education. With financial support, parents can invest in higher-quality resources, engage in more diverse educational activities, and seek out professional development opportunities to enhance their own teaching skills. This, in turn, can lead to improved educational outcomes for homeschooled students.

Case Study: The Johnson Family

Consider the Johnson family, who has been homeschooling their three children for the past five years. In the early years, they struggled financially, often having to choose between purchasing new curriculum materials and enrolling their children in extracurricular activities. However, with the introduction of tax credits for home education in their state, they were able to claim a significant portion of their educational expenses.

With the financial relief provided by the tax credits, the Johnson family could invest in more comprehensive curriculum packages, ensuring their children had access to a well-rounded education. They also enrolled their children in music lessons and participated in various field trips, enhancing their learning experience. The tax credits not only made home education more affordable but also improved the quality of their children's education.

Future Outlook and Implications

The future of tax credits for home education looks promising, with an increasing recognition of the value and benefits of this educational approach. As more families embrace home education, there is a growing call for more supportive policies, including expanded tax credits and other forms of financial assistance.

Looking ahead, we can expect to see continued efforts to improve access to home education. This could include simplifying the process of claiming tax credits, expanding the range of eligible expenses, and potentially increasing the amount of the credits to better support homeschooling families. These changes would not only benefit current homeschoolers but also encourage more families to consider this educational option.

In conclusion, tax credits for home education play a crucial role in making this educational path more accessible and sustainable. By understanding the specifics of these credits and adopting strategic financial planning, homeschooling families can make the most of these benefits, ensuring a high-quality education for their children. As the landscape of education continues to evolve, tax credits will remain a vital component in supporting the diverse needs of families seeking alternative educational paths.

Are tax credits available for home education in all countries?

+No, the availability of tax credits for home education varies by country and region. While some countries have specific tax credits or deductions for homeschooling, others may not offer such incentives. It’s essential to research the policies in your specific region to understand the available benefits.

Can I claim tax credits for all homeschooling expenses?

+The expenses eligible for tax credits can vary depending on the jurisdiction. Generally, expenses directly related to educational materials, curriculum, and resources are commonly covered. However, other expenses like support group fees or certain extracurricular activities might have different treatment. It’s best to consult with a tax professional or refer to official guidelines to ensure you claim all eligible expenses.

How can I maximize my tax credits for home education?

+To maximize your tax credits, keep detailed records of all homeschooling expenses, including receipts and invoices. Understand the specific regulations and guidelines in your region, and consider making strategic purchases, such as bundling or annual purchases, to maximize the value of your expenses. Additionally, explore other potential deductions or incentives available for homeschooling families.