Capital Gains Tax In Washington

Welcome to a comprehensive guide on the topic of Capital Gains Tax in the state of Washington. This article aims to delve into the intricacies of this tax, providing an in-depth analysis and expert insights for individuals and businesses navigating the financial landscape of the Evergreen State. As we explore the various aspects, from tax rates to exemptions and planning strategies, we will uncover the unique features that make Washington's capital gains tax system an important consideration for financial planning.

Understanding Capital Gains Tax in Washington

Capital gains tax is a crucial component of the state’s revenue system, impacting individuals and businesses alike. In Washington, this tax is levied on the profits made from the sale of assets, such as stocks, real estate, or other investments. It is a key consideration for those looking to invest and grow their wealth within the state.

Washington's approach to capital gains taxation is distinct, with a focus on simplicity and fairness. The state operates under a single tax rate structure, which applies uniformly to all capital gains, regardless of the asset type or the duration of ownership. This simplifies the tax calculation process and ensures consistency for taxpayers.

The current capital gains tax rate in Washington is set at 7.0% for the 2023 tax year. This rate applies to all net capital gains, which are calculated as the difference between the selling price and the original cost of the asset. This tax is separate from the state's income tax, which is a flat rate of 6.5% for individuals and businesses.

It's important to note that Washington does not distinguish between short-term and long-term capital gains, as is the case in some other states. This means that all capital gains, regardless of holding period, are subject to the same tax rate. This approach ensures that investors are not incentivized to hold assets for specific durations solely for tax purposes.

Exemptions and Special Considerations

While Washington’s capital gains tax system is straightforward, there are certain exemptions and considerations that taxpayers should be aware of. One notable exemption is for gains on the sale of a principal residence. Washington, like many other states, exempts capital gains from the sale of a primary residence, up to a certain limit.

For the 2023 tax year, individuals can exclude up to $250,000 of capital gains from the sale of their primary residence, while married couples filing jointly can exclude up to $500,000. This exemption encourages homeownership and provides a financial benefit for individuals looking to sell their primary residence.

Additionally, Washington offers a special tax treatment for certain types of business assets. Gains on the sale of qualified small business stock (QSBS) are eligible for a reduced tax rate. This provision aims to encourage investment in small businesses and foster economic growth within the state.

| Asset Type | Capital Gains Tax Rate |

|---|---|

| General Capital Gains | 7.0% |

| Sale of Primary Residence | Exempt (up to $250,000 for individuals, $500,000 for joint filers) |

| Qualified Small Business Stock (QSBS) | Reduced Rate (dependent on holding period) |

Planning Strategies and Considerations

Understanding the nuances of Washington’s capital gains tax system is crucial for effective financial planning. Here are some strategies and considerations to keep in mind when navigating this tax landscape:

Timing of Asset Sales

Given the state’s uniform tax rate for capital gains, the timing of asset sales can be a critical factor. Selling assets when their value is at its peak can maximize gains, but it also triggers the capital gains tax. Taxpayers should consider the potential tax implications and plan their asset sales strategically.

For example, if an individual has held an asset for an extended period and its value has significantly appreciated, selling it at the right time can provide a substantial return. However, this gain will be subject to the 7.0% capital gains tax rate. Proper timing can help manage the tax liability and optimize the overall financial outcome.

Utilizing Exemptions

Washington’s exemptions, particularly for the sale of a primary residence, offer a significant opportunity for taxpayers to reduce their capital gains tax burden. Individuals and couples can take advantage of these exemptions by timing their home sales appropriately and ensuring they meet the eligibility criteria.

For instance, a married couple who has owned and lived in their home for several years may consider selling it when they are ready to downsize or relocate. By doing so, they can potentially exclude up to $500,000 of capital gains from taxation, providing a substantial financial benefit.

Investing in Qualified Small Businesses

The reduced tax rate for gains on qualified small business stock (QSBS) presents an attractive opportunity for investors. This provision encourages investment in small businesses by providing a lower tax rate on the eventual sale of these stocks. Investors should explore opportunities to invest in eligible small businesses to take advantage of this tax benefit.

It's important to note that the reduced rate for QSBS depends on the holding period. Gains on stocks held for more than five years qualify for a 0% tax rate, while those held for shorter periods may be subject to a reduced rate. Investors should consult with tax professionals to understand the specific requirements and plan their investments accordingly.

Seeking Professional Advice

The complexities of capital gains tax, especially in the context of Washington’s unique system, can be challenging to navigate alone. Seeking advice from tax professionals, such as certified public accountants (CPAs) or financial advisors, can provide valuable insights and ensure compliance with state tax laws.

These professionals can offer tailored advice based on an individual's or business's specific financial situation. They can help identify potential tax-saving strategies, maximize the use of exemptions, and ensure that all necessary forms and documentation are completed accurately. Engaging the expertise of tax professionals is a prudent step to ensure a smooth and compliant tax process.

Impact on Investment Decisions

Washington’s capital gains tax system has a significant influence on investment decisions within the state. Investors, whether individuals or businesses, must consider the potential tax implications when evaluating investment opportunities.

Assessing Investment Returns

When evaluating potential investments, investors should factor in the capital gains tax rate to determine the actual return on investment. The 7.0% tax rate in Washington can significantly impact the overall profitability of an investment. Investors must carefully consider the after-tax return to ensure the investment aligns with their financial goals.

For example, if an investor is considering a stock that has the potential for a 15% annual return, they must account for the capital gains tax. After deducting the 7.0% tax, the effective return would be approximately 14.05% (assuming no other deductions or credits). This adjusted return should be the basis for investment decisions.

Comparing Investment Options

Washington’s capital gains tax rate can influence the relative attractiveness of different investment options. Investors should compare the potential returns and tax implications of various investments to make informed decisions. Some investments, such as those eligible for the QSBS reduced tax rate, may offer more favorable tax treatment.

For instance, an investor might consider investing in a local startup that is eligible for the QSBS provision. This investment could offer the potential for significant capital gains, and with the reduced tax rate, the after-tax return could be more attractive compared to other investment options. Such comparisons are crucial in making sound investment choices.

Long-Term Planning

Washington’s uniform capital gains tax rate encourages long-term investment strategies. By holding assets for extended periods, investors can potentially increase their returns while minimizing the impact of capital gains tax. This approach aligns with the state’s focus on encouraging stable and long-term investments.

For example, an investor who purchases a piece of real estate with the intention of holding it for an extended period may benefit from the long-term appreciation of the property. Over time, the property's value may increase significantly, and when the investor eventually sells, the capital gains tax will be applied to the net gain. However, the longer holding period can result in a more favorable tax liability.

Future Implications and Potential Changes

As with any tax system, Washington’s capital gains tax structure is subject to potential changes and developments. Here are some considerations for the future:

Economic Factors

The state’s economic health and growth can impact the capital gains tax rate. In times of economic prosperity, the state may consider increasing the tax rate to generate additional revenue. Conversely, during economic downturns, the rate might be adjusted to stimulate investment and economic activity.

For instance, if Washington experiences a period of robust economic growth, the state government might consider raising the capital gains tax rate to fund essential services and infrastructure projects. On the other hand, during a recession, the state might opt to lower the rate temporarily to encourage investment and support economic recovery.

Legislative Changes

The capital gains tax structure is subject to legislative changes, which can impact the tax rate and applicable exemptions. Taxpayers should stay informed about any proposed or enacted changes to the tax code to ensure compliance and take advantage of any new provisions.

For example, there have been ongoing discussions in Washington about introducing a progressive capital gains tax system, similar to the federal income tax structure. Such a change would mean that capital gains would be taxed at different rates depending on the taxpayer's income level. This proposal has gained traction among some lawmakers but faces opposition from others. Stay tuned for updates on this potential development.

Tax Reform Initiatives

Washington, like many states, periodically reviews its tax system to ensure fairness and effectiveness. Tax reform initiatives may propose changes to the capital gains tax structure, including the introduction of new rates, exemptions, or incentives. These initiatives aim to align the tax system with the state’s economic goals and ensure a balanced approach to taxation.

One notable tax reform initiative in Washington is the "Fair Share Tax" proposal. This proposal aims to introduce a new tax bracket for high-income earners, including a capital gains tax component. The additional revenue generated from this tax would be earmarked for specific programs, such as education and healthcare. While this proposal has gained support from some advocacy groups, it faces challenges in gaining legislative approval.

Conclusion

Washington’s capital gains tax system, with its single rate structure and targeted exemptions, offers a unique and straightforward approach to taxation. It provides taxpayers with a clear understanding of their obligations and encourages strategic financial planning. By leveraging the available exemptions and exploring investment opportunities, individuals and businesses can optimize their financial strategies within the state.

As the state's economic landscape evolves, the capital gains tax structure will continue to be a critical consideration for investors and taxpayers. Staying informed about potential changes and seeking professional advice will ensure that financial decisions are made with a comprehensive understanding of the tax implications. With a well-informed approach, taxpayers can navigate Washington's capital gains tax system successfully and maximize their financial outcomes.

How often does Washington update its capital gains tax rate?

+Washington typically reviews its tax rates annually, and any changes are effective for the upcoming tax year. The state legislature can propose and enact changes to the capital gains tax rate, which are then reflected in the state’s tax code.

Are there any plans to introduce a progressive capital gains tax in Washington?

+There have been discussions and proposals to introduce a progressive capital gains tax system in Washington, similar to the federal income tax structure. However, as of the 2023 tax year, Washington operates under a uniform tax rate for capital gains.

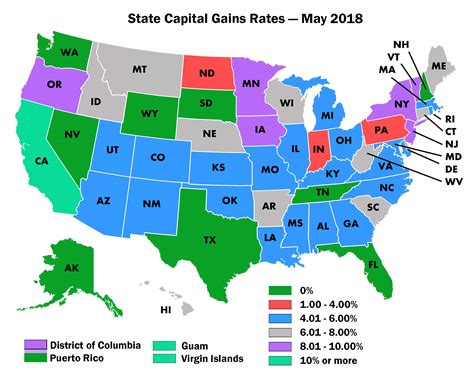

How does Washington’s capital gains tax compare to other states?

+Washington’s 7.0% capital gains tax rate is relatively moderate compared to some other states. Certain states have higher rates, while others differentiate between short-term and long-term capital gains, applying different tax rates accordingly. Washington’s simplicity and uniformity set it apart.

Are there any other tax benefits or incentives for investors in Washington?

+Yes, Washington offers various tax benefits and incentives to encourage investment and economic growth. These include tax credits for research and development, film production, and renewable energy projects. Additionally, the state provides tax exemptions for certain business assets, such as manufacturing equipment.