Property Taxes Cuyahoga County

Property taxes are an essential aspect of local governance and finance, playing a crucial role in funding public services and infrastructure. In Cuyahoga County, Ohio, understanding the intricacies of property taxes is vital for both homeowners and investors. This comprehensive guide will delve into the specifics of property taxes in Cuyahoga County, shedding light on assessment processes, tax rates, and strategies to manage these financial obligations effectively.

Property Tax Assessment in Cuyahoga County

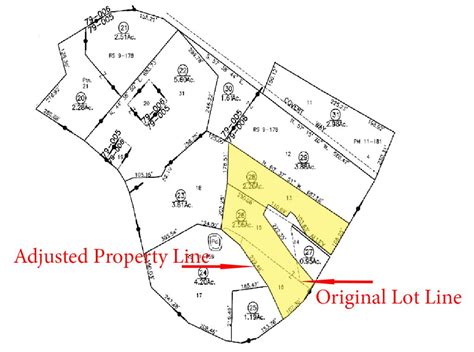

The property tax system in Cuyahoga County operates on a systematic and transparent process. The Cuyahoga County Fiscal Officer’s Office is responsible for assessing the value of properties within the county. This assessment determines the tax liability for each property owner. The valuation process considers various factors, including the property’s location, size, improvements, and recent sales data of comparable properties.

One notable aspect of property tax assessment in Cuyahoga County is the use of the Computer-Assisted Mass Appraisal (CAMA) system. This advanced technology ensures accuracy and consistency in valuations. The CAMA system employs algorithms and data analytics to analyze market trends and property characteristics, providing a fair and uniform basis for taxation.

Property owners in Cuyahoga County receive a Notice of Valuation annually, which details the assessed value of their property. This notice serves as a critical tool for understanding one's tax liability and provides an opportunity for property owners to review and appeal the assessment if they believe it is inaccurate.

Assessment Appeals Process

The Cuyahoga County Fiscal Officer’s Office offers a transparent and accessible appeals process. Property owners who disagree with their assessed value can file an appeal within a specified timeframe. The appeal process involves submitting supporting documentation, such as recent property appraisals or comparative sales data, to substantiate the claim for a lower valuation.

The Fiscal Officer's Office reviews each appeal individually, considering the evidence presented. If the appeal is successful, the assessed value of the property may be adjusted, leading to a potential reduction in property taxes. This process ensures that property owners have a fair opportunity to challenge assessments and contribute to a more equitable tax system.

| Assessment Appeal Deadlines | Filing Period |

|---|---|

| General Real Property | April 1st - June 30th |

| Mobile Homes | June 1st - July 31st |

Property Tax Rates and Calculation

Property tax rates in Cuyahoga County are determined by a combination of local and state factors. The tax rate is expressed as a millage rate, which represents the amount of tax owed per $1,000 of assessed property value. This rate is set annually by local governments and school districts within the county.

For instance, in a typical year, the millage rate in Cuyahoga County might be set at 65 mills. This means that for every $1,000 of assessed property value, a property owner would owe $65 in property taxes. The actual tax liability is then calculated by multiplying the assessed value of the property by the millage rate.

The taxable value of a property is typically a percentage of its assessed value. In Cuyahoga County, the taxable value is generally 35% of the assessed value. This means that for a property with an assessed value of $200,000, the taxable value would be $70,000 (35% of $200,000). The property tax due would then be calculated as follows: $70,000 (taxable value) x 65 mills (millage rate) = $4,550.

Taxing Authorities and Millage Rates

Property taxes in Cuyahoga County are collected by various taxing authorities, including local governments, school districts, and special assessment districts. Each authority sets its own millage rate, which contributes to the overall tax liability for property owners.

The specific millage rates can vary significantly across the county, depending on the services and infrastructure needs of each jurisdiction. For example, a property located in a suburban school district with excellent educational facilities might have a higher millage rate compared to a rural area with fewer services.

Property owners can access detailed information on the millage rates applicable to their specific property by contacting the Cuyahoga County Fiscal Officer's Office or utilizing online tax lookup tools provided by the county.

Strategies for Managing Property Taxes

Understanding and effectively managing property taxes is crucial for homeowners and investors in Cuyahoga County. Here are some strategies to consider:

Stay Informed and Engage with Local Authorities

Attend local government meetings, stay updated on tax policies, and participate in community discussions. By staying informed, property owners can anticipate changes in tax rates and understand the factors influencing their assessments.

Utilize Tax Exemptions and Deductions

Cuyahoga County offers various tax exemptions and deductions to eligible property owners. These include homestead exemptions, senior citizen exemptions, and deductions for military veterans. Research and apply for these benefits to reduce your tax liability.

Consider Property Tax Abatement Programs

Cuyahoga County, in collaboration with local governments, sometimes offers property tax abatement programs to encourage economic development and attract new residents. These programs can provide temporary or permanent tax relief for eligible properties. Stay informed about these initiatives and take advantage of any applicable abatements.

Engage Professional Tax Advisors

For complex property portfolios or unique circumstances, engaging a professional tax advisor or accountant specializing in real estate taxes can provide valuable insights. They can help optimize tax strategies, navigate the assessment and appeal process, and ensure compliance with local regulations.

Future Implications and Tax Reform

The landscape of property taxes in Cuyahoga County is subject to ongoing discussions and potential reforms. As the county continues to evolve and adapt to changing economic and social dynamics, property tax policies may undergo revisions to ensure fairness and sustainability.

One potential area of focus is the implementation of a current agricultural use valuation (CAUV) program, which would provide tax incentives for landowners to maintain their properties for agricultural purposes. This could encourage sustainable land use and support local farming communities.

Additionally, there are ongoing discussions around property tax reforms aimed at promoting equity and fairness. These reforms may involve reevaluating assessment methodologies, exploring alternative revenue streams, or implementing targeted tax relief programs for specific demographics.

Property owners and stakeholders in Cuyahoga County should stay engaged in these conversations and advocate for tax policies that align with their interests and the overall economic well-being of the community.

Conclusion

Property taxes in Cuyahoga County are a vital component of local governance and community development. By understanding the assessment process, tax rates, and available strategies, property owners can navigate their tax obligations effectively. Stay informed, engage with local authorities, and consider professional advice to optimize your property tax management.

How often are property assessments conducted in Cuyahoga County?

+

Property assessments in Cuyahoga County are conducted annually. The Fiscal Officer’s Office sends out Notices of Valuation to property owners, detailing the assessed value of their property for the upcoming tax year.

Can I dispute my property’s assessed value?

+

Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate. The appeals process is open to all property owners, and it involves submitting supporting evidence to substantiate the claim for a lower valuation.

How are millage rates determined in Cuyahoga County?

+

Millage rates in Cuyahoga County are set by local governments, school districts, and special assessment districts. These entities consider factors such as budget requirements, services provided, and the overall financial needs of the community when determining the millage rate.

Are there any tax relief programs available for senior citizens in Cuyahoga County?

+

Yes, Cuyahoga County offers the Homestead Exemption program, which provides a reduction in property taxes for eligible senior citizens. To qualify, individuals must be at least 65 years old, meet certain income requirements, and occupy the property as their primary residence.

Can I pay my property taxes online in Cuyahoga County?

+

Yes, Cuyahoga County offers online payment options for property taxes. Property owners can visit the Cuyahoga County Treasurer’s Office website to make secure online payments using a credit card, debit card, or electronic check. This convenient option eliminates the need for in-person visits and provides a quick and efficient way to manage tax payments.