Sarasota Property Tax

Property taxes are an essential aspect of homeownership, and understanding the specifics of these taxes is crucial for any homeowner. In this comprehensive guide, we will delve into the world of Sarasota property taxes, uncovering the ins and outs of this topic. From the assessment process to the tax rates, we will explore the key elements that impact property owners in Sarasota.

The Sarasota Property Tax System

Sarasota, a vibrant city nestled on the Gulf Coast of Florida, boasts a unique property tax system that is governed by both state and local regulations. The property tax system in Sarasota serves as a primary source of revenue for the city and its surrounding counties, contributing to the funding of essential public services and infrastructure development.

Assessment Process

The property assessment process is a critical component of the Sarasota property tax system. Each year, the Sarasota County Property Appraiser’s Office is tasked with determining the just value of all taxable properties within the county. This value, often referred to as the “assessed value,” forms the basis for calculating property taxes.

The assessed value is determined through a meticulous process that considers various factors, including the property's location, size, age, and recent sales data. The appraiser's office employs a combination of physical inspections, market analysis, and statistical models to ensure an accurate assessment. This process aims to ensure fairness and consistency across all properties within the county.

| Assessment Category | Assessment Details |

|---|---|

| Residential Properties | Assessed at the lower of the property's just value or the previous year's assessed value, plus any improvements made. |

| Commercial Properties | Valued based on their income-producing potential, market value, and location-specific factors. |

| Agricultural Properties | Benefit from a special assessment classification, with values determined by the property's agricultural use. |

Property owners in Sarasota have the right to appeal their assessed values if they believe the appraisal is inaccurate or unfair. The appeals process provides an opportunity for property owners to present evidence and challenge the appraised value, ensuring a fair and transparent system.

Tax Rates and Millage

Once the assessed values are determined, the property taxes are calculated using the applicable tax rates, often referred to as the “millage rate.” The millage rate represents the tax amount per $1,000 of assessed value. In Sarasota, the tax rates are set by various taxing authorities, including the county government, school districts, and special districts.

The millage rate is typically divided into two components: the ad valorem tax and the non-ad valorem assessments. The ad valorem tax is based on the property's assessed value and is used to fund general government operations, schools, and other essential services. Non-ad valorem assessments, on the other hand, are specific charges for services like solid waste collection or stormwater management.

The millage rate in Sarasota can vary depending on the specific location of the property and the services it receives. For instance, properties located within city limits may have higher millage rates due to the additional services and infrastructure provided by the municipality.

| Taxing Authority | Millage Rate (per $1,000) |

|---|---|

| Sarasota County | 4.78 |

| Sarasota City | 3.76 |

| School District | 7.50 |

| Special Districts (e.g., Fire Rescue) | Varies |

Tax Exemptions and Discounts

Sarasota offers various tax exemptions and discounts to eligible property owners, aiming to provide relief and support to certain segments of the community. These exemptions and discounts can significantly reduce the property tax burden for qualifying homeowners.

One notable exemption is the Homestead Exemption, which is available to permanent residents of Florida who own and occupy their primary residence. This exemption reduces the assessed value of the property by a fixed amount, resulting in lower property taxes. Additionally, Sarasota offers exemptions for disabled veterans, surviving spouses of military personnel, and certain agricultural properties.

The city also provides a Senior Citizen Discount, which offers a reduction in the millage rate for homeowners aged 65 or older. This discount aims to support Sarasota's aging population and make homeownership more affordable.

| Exemption/Discount | Eligibility | Benefit |

|---|---|---|

| Homestead Exemption | Permanent Florida residents occupying their primary residence | Reduced assessed value by $50,000 |

| Senior Citizen Discount | Homeowners aged 65 or older | Reduced millage rate by 25% |

| Disabled Veterans Exemption | Veterans with service-connected disabilities | Exemption from certain taxes |

Payment Options and Due Dates

Property tax payments in Sarasota are typically due in two installments. The first installment is due by March 31st, and the second installment is due by September 30th. However, it’s important to note that the due dates may vary slightly depending on the specific taxing authority.

Sarasota offers various payment options to accommodate different preferences and circumstances. Property owners can pay their taxes online, by mail, or in person at the tax collector's office. Additionally, electronic funds transfer (EFT) and automatic withdrawal options are available for those who prefer a more convenient and automated payment method.

It's crucial for property owners to stay informed about the due dates and payment options to ensure timely payment and avoid any penalties or late fees.

Impact of Sarasota Property Taxes

Sarasota property taxes play a significant role in shaping the local economy and community. The revenue generated from these taxes is vital for funding public services, infrastructure projects, and educational initiatives.

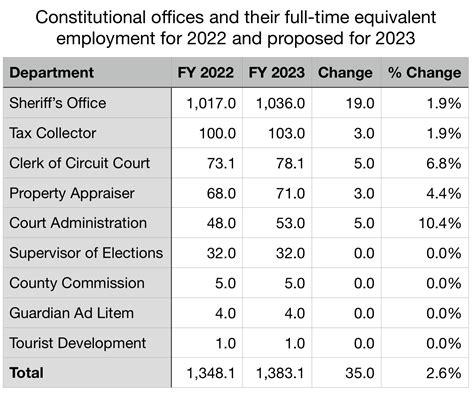

Funding Public Services

The property tax revenue is a key source of funding for essential public services in Sarasota. These services encompass a wide range of areas, including public safety, emergency response, parks and recreation, and community development.

For instance, the property taxes contribute to the salaries and equipment of police officers, firefighters, and emergency medical services personnel. They also support the maintenance and improvement of public parks, libraries, and recreational facilities, enhancing the overall quality of life for residents and visitors alike.

Infrastructure Development

Sarasota’s property taxes are instrumental in driving infrastructure development and improvement projects. The revenue is used to construct and maintain roads, bridges, and other critical infrastructure elements that support the city’s growth and connectivity.

Additionally, property taxes fund water and sewer systems, ensuring access to clean and reliable water supplies for residents and businesses. These infrastructure investments not only enhance the city's functionality but also contribute to its economic development and attractiveness to potential residents and investors.

Educational Initiatives

A significant portion of the property tax revenue in Sarasota is allocated to educational initiatives. This funding supports the local school districts, allowing them to provide quality education to students across the county.

Property taxes contribute to teacher salaries, classroom resources, and the maintenance and improvement of school facilities. They also fund extracurricular programs, technology upgrades, and initiatives aimed at enhancing student learning and overall academic achievement.

Tips for Sarasota Property Owners

Navigating the Sarasota property tax system can be complex, but there are several strategies and resources available to help property owners manage their tax obligations effectively.

Understanding Assessments

Stay informed about the assessment process and regularly review your property’s assessed value. Compare it with similar properties in your area to ensure accuracy. If you believe your assessment is incorrect, consider appealing it through the established process.

Utilize Exemptions and Discounts

Research and apply for any applicable tax exemptions or discounts for which you may be eligible. These can provide significant savings on your property taxes and ease the financial burden of homeownership.

Explore Payment Options

Familiarize yourself with the various payment options available and choose the one that best suits your preferences and financial situation. Consider setting up automatic payments to ensure timely payments and avoid any late fees.

Stay Informed and Engaged

Stay updated on any changes or adjustments to the property tax system in Sarasota. Attend local government meetings, follow relevant news, and engage with your community to understand the tax landscape and its impact on your property.

How often are property assessments conducted in Sarasota?

+Property assessments in Sarasota are conducted annually. The Sarasota County Property Appraiser's Office is responsible for determining the just value of all taxable properties within the county each year.

Are there any ways to reduce my property taxes in Sarasota?

+Yes, Sarasota offers various tax exemptions and discounts to eligible property owners. These include the Homestead Exemption, Senior Citizen Discount, and exemptions for disabled veterans and certain agricultural properties. It's important to research and apply for any applicable exemptions to reduce your property tax burden.

What happens if I miss the property tax payment deadline in Sarasota?

+Missing the property tax payment deadline can result in late fees and penalties. It's important to stay informed about the due dates and payment options to avoid any financial consequences. Consider setting up automatic payments or reminders to ensure timely payments.

How can I appeal my property's assessed value in Sarasota?

+If you believe your property's assessed value is inaccurate or unfair, you have the right to appeal. The process typically involves submitting an appeal application, providing supporting evidence, and attending a hearing. It's recommended to consult the Sarasota County Property Appraiser's Office for detailed instructions and guidance on the appeal process.

Understanding the Sarasota property tax system is essential for homeowners in the area. By familiarizing themselves with the assessment process, tax rates, and available exemptions, property owners can effectively manage their tax obligations and contribute to the vibrant community of Sarasota.