Palm Beach County Sales Tax

Understanding the intricacies of sales tax regulations is essential for businesses and consumers alike, especially when it comes to specific regions like Palm Beach County. Sales tax, a consumption tax imposed on retail sales of goods and services, varies across different jurisdictions. In this comprehensive guide, we will delve into the specifics of Palm Beach County's sales tax, covering its rates, exemptions, collection, and other relevant aspects. By the end of this article, you'll have a thorough understanding of the sales tax landscape in this vibrant Florida county.

Palm Beach County Sales Tax: An Overview

Palm Beach County, located in the southeastern part of Florida, is known for its beautiful beaches, vibrant culture, and thriving business environment. With a diverse economy and a population of over 1.5 million people, the county plays a significant role in the state’s economy. Understanding the sales tax structure in Palm Beach County is crucial for both local businesses and consumers, as it directly impacts their financial obligations and strategies.

The sales tax system in Palm Beach County is governed by a combination of state and local laws. Florida has a state sales tax rate, which serves as the base for all county and municipal taxes. On top of this state rate, Palm Beach County imposes an additional county tax, and some municipalities within the county may also have their own local taxes. This layered tax structure can make it complex for businesses and consumers to navigate, but it is essential to ensure a fair and effective tax system.

For businesses operating in Palm Beach County, sales tax is an integral part of their daily operations. They are responsible for collecting and remitting the appropriate tax amounts to the relevant tax authorities. Failure to comply with sales tax regulations can result in significant penalties and legal consequences. Therefore, it is crucial for businesses to have a comprehensive understanding of the sales tax rates, exemptions, and reporting requirements specific to Palm Beach County.

Consumers, on the other hand, are impacted by sales tax in terms of their purchasing power and overall financial planning. When making purchases in Palm Beach County, they must consider the applicable sales tax rates, which can vary depending on the type of goods or services being acquired. Understanding these rates helps consumers budget effectively and make informed decisions about their spending.

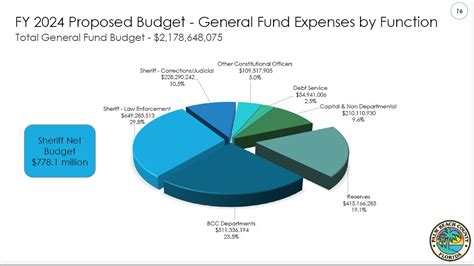

Sales Tax Rates in Palm Beach County

The sales tax rates in Palm Beach County consist of a combination of state, county, and municipal taxes. As of 2023, the current rates are as follows:

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6% |

| Palm Beach County Sales Tax | 1% |

| Municipal Taxes | Varies by municipality (up to 1.5%) |

The state sales tax rate of 6% is a standard across Florida and is applied to most tangible personal property and certain services. Palm Beach County adds a 1% county sales tax on top of the state rate, bringing the total countywide sales tax to 7% for most transactions.

It's important to note that municipal sales taxes can vary significantly within Palm Beach County. Some cities and towns have their own additional sales taxes, which can range from 0.5% to 1.5%. These municipal taxes are often used to fund specific local projects or initiatives. To determine the exact sales tax rate for a particular municipality, it is recommended to check with the local government or tax authorities.

Municipal Sales Tax Rates

Here are some examples of municipal sales tax rates in Palm Beach County:

| Municipality | Sales Tax Rate |

|---|---|

| West Palm Beach | 1.5% |

| Boca Raton | 1% |

| Delray Beach | 1% |

| Lake Worth Beach | 1% |

| Boynton Beach | 1% |

These rates are subject to change, so it's essential to stay updated with the latest information from the respective municipal authorities.

Sales Tax Exemptions and Special Considerations

While the sales tax rates provide a general framework, there are certain exemptions and special considerations that can impact the tax liability for both businesses and consumers in Palm Beach County.

Exemptions for Specific Goods and Services

Florida, including Palm Beach County, exempts certain goods and services from sales tax. These exemptions are designed to promote specific industries or provide relief to consumers in certain situations. Some common exemptions include:

- Groceries: Most unprepared food items are exempt from sales tax in Florida.

- Prescription Drugs: Medications dispensed by pharmacies are exempt from sales tax.

- Residential Rent: Rent for residential properties is not subject to sales tax.

- Manufacturing Equipment: Machinery and equipment used in manufacturing processes are often exempt.

- Certain Agricultural Sales: Sales of agricultural products and supplies may be exempt under specific conditions.

It's crucial for businesses to understand these exemptions thoroughly to avoid overcharging their customers and facing potential penalties. Consumers, on the other hand, can benefit from these exemptions by saving on certain essential purchases.

Tourist Development Tax

In addition to sales tax, Palm Beach County also imposes a Tourist Development Tax (TDT) on certain transactions. This tax is typically applied to short-term rentals, such as hotel rooms, vacation homes, and similar accommodations. The TDT rate varies but is usually around 5% of the rental amount. It is important for both businesses and travelers to be aware of this additional tax when planning or providing tourism-related services.

Sales Tax Holidays

Florida occasionally offers sales tax holidays, which are specific periods when certain items are exempt from sales tax. These holidays are designed to encourage consumer spending and provide temporary relief from tax obligations. Palm Beach County, along with other counties in Florida, participates in these events. During sales tax holidays, consumers can purchase eligible items without paying sales tax, making it an ideal time for certain large purchases.

Sales Tax Collection and Remittance

For businesses operating in Palm Beach County, collecting and remitting sales tax is a critical responsibility. Here’s an overview of the process:

Registering for Sales Tax

To collect and remit sales tax, businesses must first register with the Florida Department of Revenue (DOR). The registration process involves providing detailed information about the business, including its legal name, address, and tax identification number. Once registered, the business receives a unique sales tax permit, which must be displayed at all physical locations.

Sales Tax Calculation

Businesses are required to calculate the applicable sales tax for each transaction based on the rates mentioned earlier. The tax is typically calculated as a percentage of the total sale price, including any applicable discounts or promotions. It’s crucial to ensure accuracy in tax calculation to avoid discrepancies and potential audits.

Sales Tax Remittance

Sales tax collected from customers must be remitted to the Florida DOR on a regular basis. The frequency of remittance can vary depending on the business’s sales volume and other factors. Most businesses are required to remit sales tax monthly or quarterly. The remittance process involves submitting the collected tax amounts, along with the appropriate forms, to the DOR by the due date.

Filing Sales Tax Returns

In addition to remitting the tax, businesses must also file sales tax returns with the DOR. These returns provide detailed information about the sales tax collected, including breakdowns by tax jurisdiction and any applicable exemptions. Accurate and timely filing of sales tax returns is essential to maintain compliance with Florida’s tax laws.

Compliance and Penalties

Compliance with sales tax regulations is crucial for businesses operating in Palm Beach County. The Florida Department of Revenue takes a proactive approach to ensuring tax compliance and may conduct audits to verify the accuracy of tax filings and remittances. Non-compliance can result in significant penalties and interest charges, which can have a detrimental impact on a business’s financial health.

Penalties for Non-Compliance

The penalties for non-compliance with sales tax regulations in Florida can vary depending on the severity of the violation. Common penalties include:

- Late Payment Penalty: A penalty is applied for late remittance of sales tax, typically around 5% of the unpaid tax.

- Interest Charges: Interest accrues on unpaid sales tax balances, often at a rate of 12% per year.

- Failure to File Penalty: Businesses that fail to file sales tax returns on time may face a penalty of up to $500.

- Willful Neglect or Fraud: More severe penalties, including criminal charges, may be imposed for intentional tax evasion or fraud.

It's important for businesses to prioritize sales tax compliance to avoid these penalties and maintain a positive relationship with tax authorities.

Tips for Sales Tax Compliance

To ensure compliance with Palm Beach County’s sales tax regulations, businesses can consider the following tips:

- Stay Informed: Keep up-to-date with any changes in sales tax rates, exemptions, and regulations. Subscribe to relevant newsletters or follow tax authority updates.

- Implement Robust Accounting Practices: Establish a reliable accounting system that accurately tracks sales, tax calculations, and remittances.

- Train Staff: Ensure that all staff members involved in sales and tax calculations are well-trained and aware of their responsibilities.

- Regularly Review Tax Returns: Conduct internal audits to verify the accuracy of sales tax returns before submission.

- Seek Professional Advice: Consult with tax professionals or accountants who specialize in sales tax compliance to ensure you are on the right track.

Future Implications and Trends

The sales tax landscape in Palm Beach County, like any other jurisdiction, is subject to change and evolution. As economic conditions and government policies shift, sales tax rates and regulations may undergo adjustments. Staying informed about these potential changes is crucial for both businesses and consumers to adapt their strategies accordingly.

Potential Rate Changes

While sales tax rates in Palm Beach County have remained relatively stable in recent years, there is always a possibility of future rate adjustments. These changes can be influenced by various factors, such as economic growth, budgetary constraints, or political decisions. Businesses and consumers should monitor local news and official announcements to stay aware of any proposed rate changes.

Expanding Exemptions

Florida, including Palm Beach County, has shown a trend of expanding sales tax exemptions for certain goods and services. This is often done to support specific industries, encourage economic growth, or provide relief to consumers. Keeping an eye on these exemptions can help businesses and consumers maximize their tax savings.

Digital Economy Impact

The rise of the digital economy and e-commerce has presented new challenges for sales tax collection and enforcement. As more transactions move online, tax authorities are adapting their strategies to ensure compliance in the digital realm. Businesses engaged in e-commerce should be aware of the evolving regulations and consider implementing robust tax compliance solutions.

Remote Worker Considerations

With the increasing popularity of remote work, businesses with remote employees in Palm Beach County should be mindful of their tax obligations. Sales tax nexus, which determines a business’s tax collection responsibilities in a particular jurisdiction, can be established through remote worker presence. Businesses should consult with tax professionals to understand their obligations when it comes to remote workers and sales tax.

Conclusion

Navigating the sales tax landscape in Palm Beach County requires a comprehensive understanding of the rates, exemptions, and regulations. For businesses, compliance with sales tax laws is not only a legal obligation but also a strategic necessity to maintain a positive relationship with customers and tax authorities. Consumers, on the other hand, benefit from understanding sales tax rates to make informed purchasing decisions.

By staying informed about the latest sales tax developments, businesses and consumers can adapt their strategies to maximize efficiency and savings. Whether it's utilizing tax-exemptions, planning purchases during sales tax holidays, or implementing robust tax compliance systems, a proactive approach to sales tax management is key.

FAQ

Are there any upcoming changes to the sales tax rates in Palm Beach County?

+

As of my knowledge cutoff in September 2023, there were no announced changes to the sales tax rates in Palm Beach County. However, it’s always recommended to stay updated with local news and official announcements, as tax rates can be subject to change.

How can I find the specific sales tax rate for a particular municipality in Palm Beach County?

+

You can contact the tax office or city hall of the specific municipality to inquire about their sales tax rate. Alternatively, you can visit the official websites of the municipalities, as they often provide information on tax rates and other relevant tax details.

Are there any upcoming sales tax holidays in Palm Beach County, and what items are typically exempt during these holidays?

+

Sales tax holidays are typically announced in advance by the state government. You can check the Florida Department of Revenue’s website or follow local news sources to stay informed about upcoming sales tax holidays. The exempt items during these holidays can vary but often include back-to-school supplies, hurricane preparedness items, and energy-efficient appliances.

How often do I need to remit sales tax as a business operating in Palm Beach County?

+

The frequency of sales tax remittance depends on your business’s sales volume and other factors. Most businesses are required to remit sales tax monthly or quarterly. You can determine your specific remittance frequency by consulting with the Florida Department of Revenue or a tax professional.

What are the consequences for businesses that fail to comply with sales tax regulations in Palm Beach County?

+

Non-compliance with sales tax regulations can result in various penalties, including late payment penalties, interest charges, and failure to file penalties. In severe cases of willful neglect or fraud, businesses may face criminal charges. It’s crucial for businesses to prioritize sales tax compliance to avoid these consequences.