Arizona State Sales Tax

Welcome to a comprehensive guide on Arizona's sales tax system. In this expert-led exploration, we will delve into the intricacies of Arizona's sales tax, providing you with a deep understanding of its mechanics, rates, and impact on businesses and consumers alike. With a focus on specificity and relevance, this article aims to equip you with the knowledge needed to navigate Arizona's tax landscape.

Arizona’s Sales Tax System: An Overview

Arizona, like many states in the US, imposes a sales tax on the sale of goods and certain services. This tax is a crucial revenue source for the state, contributing significantly to its overall budget. The sales tax system in Arizona is a complex interplay of state and local taxes, with rates varying across jurisdictions.

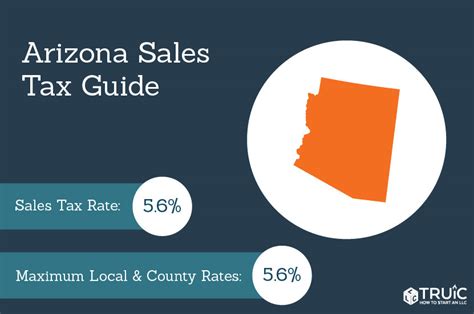

The state of Arizona currently levies a 5.6% state sales tax rate, which is applied uniformly across the state. However, it's important to note that this is just the base rate, and local governments have the authority to impose additional sales taxes, leading to variations in the overall tax burden.

Understanding Local Sales Tax Rates

Local governments in Arizona, including cities, counties, and special districts, have the power to levy their own sales taxes. These local taxes are often referred to as transaction privilege taxes or TPTs in Arizona’s legal jargon. The local sales tax rates can vary significantly, with some areas imposing no additional tax, while others adding a substantial percentage to the state rate.

For instance, the city of Phoenix, Arizona's capital, imposes an additional 2% local sales tax, bringing the total sales tax rate to 7.6% within city limits. On the other hand, the city of Tucson has a local sales tax rate of 2.625%, resulting in a combined state and local sales tax rate of 8.225% in that jurisdiction.

| Jurisdiction | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Phoenix | 2% | 7.6% |

| Tucson | 2.625% | 8.225% |

| Scottsdale | 1.7% | 7.3% |

| Mesa | 2.1% | 7.7% |

| Chandler | 1.5% | 7.1% |

Taxable Goods and Services

Arizona’s sales tax applies to a broad range of goods and services, including retail sales, rentals, and leases. However, there are certain exemptions and special tax treatments for specific items and industries. For instance, groceries, prescription drugs, and some medical devices are exempt from sales tax in Arizona.

Additionally, certain services, such as professional services like legal and accounting, are generally not subject to sales tax. However, the tax treatment can vary depending on the specific nature of the service and the industry it serves.

Sales Tax Registration and Compliance

Businesses operating in Arizona are required to register for a Transaction Privilege Tax License if they meet certain thresholds. This license allows businesses to collect and remit sales tax on behalf of the state and local governments. The registration process involves providing detailed information about the business, its activities, and its expected sales volume.

Compliance with Arizona's sales tax regulations is critical for businesses to avoid penalties and maintain a positive relationship with the state. This includes accurate tax calculations, timely remittances, and proper record-keeping. The Arizona Department of Revenue provides resources and guidelines to assist businesses in understanding their tax obligations.

Impact on Businesses and Consumers

Arizona’s sales tax system has a direct impact on both businesses and consumers. For businesses, the sales tax can affect pricing strategies, competitive positioning, and overall profitability. The varying local tax rates can create a complex environment for businesses operating across multiple jurisdictions, requiring careful planning and tax management.

For consumers, the sales tax adds to the cost of goods and services. The impact is particularly noticeable in areas with higher local tax rates. However, it's important to note that sales tax is often a more transparent and visible form of taxation compared to other types of taxes, providing consumers with a clear understanding of their contribution to the state's revenue.

Analysis and Future Implications

Arizona’s sales tax system, with its combination of state and local taxes, presents a unique landscape for businesses and consumers. The varying tax rates across jurisdictions add a layer of complexity that requires careful navigation.

For businesses, understanding and managing these variations is crucial for effective tax planning and compliance. This includes staying updated with any changes in tax rates or regulations, ensuring accurate tax calculations, and maintaining a robust tax management system. The impact of sales tax on pricing and competitiveness cannot be overstated, especially in industries with thin margins.

Consumers, on the other hand, bear the direct brunt of sales tax. While the tax provides a transparent view of their contribution to state revenue, it can also influence purchasing decisions, particularly for big-ticket items or frequent purchases. The varying local tax rates can create disparities in the cost of living across different areas of the state.

Looking ahead, the future of Arizona's sales tax system is tied to economic trends, political decisions, and technological advancements. As e-commerce continues to grow, the state may need to adapt its tax regulations to accommodate online sales and ensure fair competition between brick-and-mortar and online retailers. Additionally, advancements in tax software and automation can simplify tax compliance for businesses, making it easier to manage complex tax landscapes like Arizona's.

In conclusion, Arizona's sales tax system, with its blend of state and local taxes, offers a nuanced insight into the state's fiscal policy. While it presents challenges, particularly for businesses, it also provides a robust revenue stream for the state and its local governments. Understanding and navigating this system is key to success for businesses and consumers alike, ensuring compliance, competitiveness, and a fair tax burden.

What is the current state sales tax rate in Arizona?

+

The current state sales tax rate in Arizona is 5.6%.

Can local governments in Arizona impose their own sales taxes?

+

Yes, local governments in Arizona have the authority to levy additional sales taxes, known as transaction privilege taxes (TPTs), leading to variations in the overall sales tax rate across the state.

Are there any items exempt from sales tax in Arizona?

+

Yes, certain items like groceries, prescription drugs, and some medical devices are exempt from sales tax in Arizona.

How do businesses register for sales tax in Arizona?

+

Businesses in Arizona must register for a Transaction Privilege Tax License if they meet certain thresholds. The registration process involves providing detailed information about the business and its activities.

What are the potential impacts of varying local sales tax rates on businesses and consumers in Arizona?

+

Varying local sales tax rates can impact businesses by affecting pricing strategies and competitiveness. For consumers, it can influence purchasing decisions and create disparities in the cost of living across different areas of the state.