San Jose California Property Tax

In the vibrant city of San Jose, California, property taxes play a significant role in the local economy and are a key consideration for homeowners and investors alike. With its thriving technology industry and diverse population, San Jose has become a hub of economic activity, making an understanding of its property tax system essential.

This article aims to provide an in-depth exploration of San Jose's property tax landscape, offering a comprehensive guide for residents, prospective homeowners, and real estate professionals. By delving into the intricacies of the tax assessment process, exemption programs, and strategies for effective tax management, we aim to empower readers with the knowledge to navigate this critical aspect of homeownership in the Silicon Valley.

Understanding the Basics: San Jose’s Property Tax Structure

San Jose, like the rest of California, operates under a system of ad valorem property taxation, where the amount of tax levied is directly proportional to the assessed value of the property. This means that as property values rise or fall, so do the associated tax obligations.

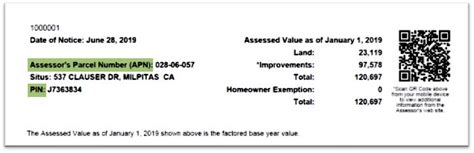

The property tax cycle in San Jose typically begins with the annual assessment of real estate properties. This assessment is conducted by the Santa Clara County Assessor's Office, which determines the fair market value of each property within the county, including San Jose.

The assessed value is then used to calculate the property tax liability for the year. The tax rate, known as the tax rate area (TRA), is established by the city and county governments and can vary based on the location of the property within San Jose.

The formula for calculating property taxes in San Jose is as follows:

| Assessed Value | x | Tax Rate Area (TRA) | = | Property Tax Liability |

|---|

For example, if a property in San Jose has an assessed value of $1,000,000 and the applicable TRA is 1.2%, the annual property tax liability would be $12,000.

The Role of Proposition 13: A Pillar of California Property Tax Law

California’s Proposition 13, passed in 1978, is a cornerstone of the state’s property tax system and has significant implications for San Jose homeowners. This landmark legislation introduced two critical changes to the property tax landscape:

- Tax Rate Reduction: Proposition 13 reduced the maximum property tax rate from 2.6% to 1%.

- Assessment Limits: It introduced a cap on the annual increase of assessed property values, limiting it to a maximum of 2% per year, unless the property changes ownership.

These provisions have led to a more stable and predictable property tax environment for homeowners in San Jose and across California. However, it's important to note that while Proposition 13 provides stability, it also means that property tax assessments may not reflect current market values, particularly in rapidly appreciating real estate markets like San Jose.

Property Tax Assessment Process in San Jose

The property tax assessment process in San Jose is overseen by the Santa Clara County Assessor’s Office, which is responsible for evaluating and determining the taxable value of all real property within the county. This includes residential, commercial, and industrial properties.

The assessment process typically involves the following steps:

- Physical Inspection: County assessors may conduct periodic physical inspections of properties to verify their condition, features, and improvements. This helps ensure accurate assessments.

- Data Collection: Assessors gather data on recent sales of comparable properties in the area. This information is crucial for determining fair market values.

- Assessment Notice: Property owners receive an annual assessment notice detailing the assessed value of their property. This notice also outlines the owner's right to appeal the assessment if they believe it is inaccurate.

- Appeal Process: If a property owner disagrees with the assessed value, they have the right to appeal. The appeal process is typically a multi-step procedure, involving informal reviews and formal hearings before the Assessment Appeals Board.

Tax Exemptions and Relief Programs in San Jose

San Jose, in collaboration with Santa Clara County, offers several property tax exemption programs designed to provide relief to eligible homeowners. These programs aim to reduce the tax burden for specific groups and can significantly impact a homeowner’s annual property tax liability.

The Homeowners’ Property Tax Exemption

One of the most significant tax relief programs in San Jose is the Homeowners’ Property Tax Exemption. This exemption provides eligible homeowners with a reduction in their property’s assessed value, resulting in lower property taxes. To qualify, homeowners must meet certain criteria, including:

- Being the owner-occupant of the property.

- Using the property as their primary residence.

- Having an adjusted gross income that does not exceed specific thresholds set by the state.

The exemption amount varies based on the homeowner's income level, with higher exemptions available for lower-income households. For example, homeowners with an adjusted gross income of $30,000 or less may be eligible for an exemption of up to $7,000, reducing their property's assessed value by that amount.

Senior Citizen Property Tax Postponement Program

The Senior Citizen Property Tax Postponement Program is another crucial relief program in San Jose. This program allows eligible senior citizens (62 years or older) to postpone the payment of their property taxes until a later date, such as when the property is sold or the homeowner passes away.

To qualify, seniors must meet the following requirements:

- Be at least 62 years old.

- Use the property as their primary residence.

- Have a combined household income of $35,500 or less (adjusted annually for inflation).

- Own a property with a market value of $3 million or less.

The postponed property taxes accrue interest at a rate of 7% annually, but seniors can choose to defer the interest payments as well, making this program a valuable option for those on fixed incomes.

Disabled Veterans’ Property Tax Exemption

San Jose also offers a Disabled Veterans’ Property Tax Exemption program to honor and support veterans who have served our country. This exemption provides a reduction in the assessed value of the veteran’s primary residence, leading to lower property taxes.

To be eligible, veterans must meet the following criteria:

- Be a veteran with a service-connected disability rated at 100% by the U.S. Department of Veterans Affairs.

- Own and occupy the property as their primary residence.

- Have a combined household income that does not exceed specific thresholds set by the state.

The exemption amount varies based on the veteran's income level, with higher exemptions available for lower-income households. For instance, a disabled veteran with an adjusted gross income of $40,000 or less may be eligible for an exemption of up to $12,000, reducing their property's assessed value significantly.

Strategies for Effective Property Tax Management in San Jose

Navigating the property tax landscape in San Jose can be complex, but there are several strategies that homeowners can employ to effectively manage their tax obligations.

Understanding Assessment Notices

Property owners in San Jose receive annual assessment notices detailing the assessed value of their property. It’s crucial to carefully review these notices, as they provide valuable information about the property’s assessed value, tax rate area, and any applicable exemptions or assessments.

If there are any discrepancies or if the assessed value seems inaccurate, property owners have the right to appeal. The appeal process is a formal procedure, and it's advisable to seek professional guidance or assistance from organizations like the Santa Clara County Assessor's Office or local tax professionals.

Exploring Tax Relief Programs

San Jose offers a range of tax relief programs, as outlined earlier, which can provide significant savings for eligible homeowners. These programs are designed to support homeowners in various situations, from low-income households to senior citizens and disabled veterans.

It's important for homeowners to stay informed about these programs and understand their eligibility criteria. By taking advantage of these relief measures, homeowners can reduce their tax burden and make homeownership more affordable.

Stay Informed about Market Trends

San Jose’s real estate market is dynamic, with property values fluctuating based on various factors. Staying informed about market trends can help homeowners understand the context of their property’s assessed value and anticipate potential changes in their tax obligations.

Regularly monitoring real estate listings, sales data, and market analyses can provide valuable insights into the local market. This information can be especially useful when considering an appeal or when planning for future tax obligations.

Conclusion: Navigating San Jose’s Property Tax Landscape

Understanding and effectively managing property taxes is a crucial aspect of homeownership in San Jose, California. With its unique tax structure, influenced by Proposition 13, and a range of tax relief programs, San Jose offers both stability and opportunities for tax savings.

By familiarizing themselves with the assessment process, exploring eligible tax relief programs, and staying informed about market trends, homeowners can make informed decisions and effectively manage their property tax obligations. Whether it's appealing an assessment, applying for an exemption, or simply understanding the annual assessment notice, knowledge is power when it comes to navigating San Jose's property tax landscape.

For more information and resources, homeowners and real estate professionals can turn to the Santa Clara County Assessor's Office, which provides comprehensive guidance and support on property tax matters. Additionally, staying engaged with local government initiatives and community organizations can provide valuable insights into the evolving tax landscape in San Jose.

What is the average property tax rate in San Jose, California?

+The average property tax rate in San Jose can vary based on the location and specific characteristics of the property. However, the standard tax rate in Santa Clara County, which includes San Jose, is set at 1.0826% as of 2023. This rate can be higher or lower depending on various factors, including special assessments or local voter-approved bonds.

How often are property taxes assessed in San Jose?

+Property taxes in San Jose, and throughout California, are assessed annually. The assessment is typically based on the property’s value as of January 1st of the assessment year. This means that homeowners receive their property tax bill once a year, and the amount is calculated based on the previous year’s assessed value.

Are there any property tax breaks or exemptions available in San Jose?

+Yes, San Jose, along with Santa Clara County, offers several property tax exemption programs. These include the Homeowners’ Property Tax Exemption, the Senior Citizen Property Tax Postponement Program, and the Disabled Veterans’ Property Tax Exemption. These programs provide relief to eligible homeowners by reducing their property’s assessed value, resulting in lower property taxes.

How can I appeal my property tax assessment in San Jose?

+If you believe your property’s assessed value is inaccurate, you have the right to appeal. The process typically involves submitting an appeal application to the Santa Clara County Assessment Appeals Board, providing supporting evidence, and potentially attending a hearing. It’s recommended to seek guidance from the Santa Clara County Assessor’s Office or a tax professional for a successful appeal.