Sales Tax In Maine

The topic of sales tax in Maine is an important one for both residents and businesses in the state. Maine, like many other states in the US, imposes a sales and use tax on the sale of tangible personal property and certain services. Understanding the sales tax system is crucial for individuals and businesses to comply with tax regulations and ensure fair taxation practices. This comprehensive guide will delve into the specifics of Maine's sales tax, providing an in-depth analysis of its rates, applicability, exemptions, and more.

Understanding Maine’s Sales Tax System

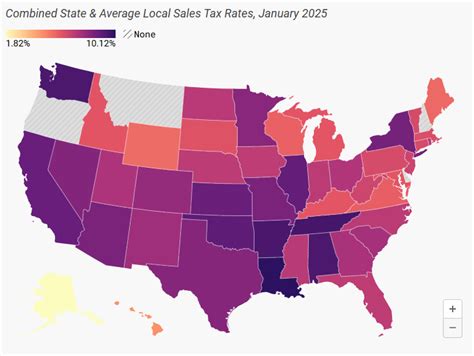

Maine’s sales tax is a state-level tax, but it also allows local governments, including municipalities and counties, to impose additional sales taxes. This means that the total sales tax rate can vary depending on the location within the state. The state sales tax is set at a uniform rate across Maine, but local taxes can add up, making the effective tax rate unique to each jurisdiction.

The Maine Revenue Service, a division of the Maine Department of Administrative and Financial Services, is responsible for administering and collecting sales and use taxes in the state. This agency provides resources and guidelines for taxpayers to understand their obligations and ensures compliance with the state's tax laws.

Sales Tax Rates in Maine

As of [current year], the state sales tax rate in Maine is set at 5.5%. This rate is applied to most retail sales of tangible personal property and certain services. However, it’s important to note that Maine also has a Use Tax, which is similar to a sales tax but applies to purchases made outside the state for use within Maine. The use tax rate matches the sales tax rate, ensuring that there is no tax advantage for out-of-state purchases.

In addition to the state sales tax, there are 326 municipalities in Maine that have the authority to impose local option sales taxes. These local taxes can range from 0% to 5%, bringing the total sales tax rate in some areas up to 10.5%. For example, the city of Portland, Maine's largest city, has a local sales tax rate of 1.5%, making the combined sales tax rate in Portland 7%.

| Type | Tax Rate |

|---|---|

| State Sales Tax | 5.5% |

| Local Sales Tax (Maximum) | 5% |

| Total Sales Tax (Maximum) | 10.5% |

Sales Tax Exemptions and Special Considerations

Maine’s sales tax system includes a variety of exemptions and special provisions. These exemptions are designed to promote specific policies, support certain industries, or alleviate the tax burden on essential goods and services. Here are some key exemptions and considerations:

- Food and Groceries: Prepared food and beverages are subject to sales tax, but most grocery items are exempt. This exemption helps make essential food items more affordable for residents.

- Clothing and Footwear: Clothing and footwear purchases under a certain threshold are exempt from sales tax. This threshold is currently set at $200, meaning items costing $200 or less are tax-free.

- Manufacturing and Resale: Sales of tangible personal property for manufacturing or resale purposes are exempt from sales tax. This encourages economic growth and supports businesses engaged in production and distribution.

- Medical Devices: Certain medical devices, such as hearing aids and prosthetic devices, are exempt from sales tax to make these essential items more accessible to individuals with medical needs.

- Agricultural Sales: Sales of agricultural products, including livestock, crops, and farm equipment, are exempt from sales tax, promoting the state's agricultural industry.

- Online Sales: Maine has specific regulations for online sales, including a requirement for out-of-state retailers to collect and remit sales tax if they have a certain level of sales or presence in the state. This ensures fairness for in-state businesses.

Compliance and Reporting for Businesses

Businesses operating in Maine have specific obligations when it comes to sales tax. They are responsible for collecting the appropriate sales tax from customers, remitting it to the Maine Revenue Service, and maintaining accurate records. Failure to comply with sales tax regulations can result in penalties and interest charges.

To assist businesses with their sales tax obligations, the Maine Revenue Service provides resources and guidelines. This includes information on registration, tax rates, and filing requirements. Businesses can also use sales tax software or outsourcing services to ensure accurate tax calculations and compliance.

Sales Tax Registration and Filing

Businesses that make taxable sales in Maine are required to register with the Maine Revenue Service. The registration process involves providing business details, such as the business name, address, and taxpayer identification number. Once registered, businesses receive a certificate of registration and a unique account number.

Registered businesses must file sales tax returns regularly, typically on a monthly or quarterly basis. The filing frequency depends on the business's sales volume and can be determined during the registration process. Sales tax returns involve reporting the total taxable sales and the corresponding tax collected during the reporting period.

Businesses can file their sales tax returns electronically through the Maine Revenue Service's online portal. This portal also allows for the payment of sales tax liabilities, providing a convenient and secure method for tax compliance.

Sales Tax and Consumer Rights

For consumers in Maine, understanding sales tax is crucial for making informed purchasing decisions. Sales tax can significantly impact the final cost of goods and services, and consumers have the right to expect accurate tax calculations from businesses.

When making a purchase, consumers should receive a clear breakdown of the sales tax amount on their receipt. This transparency ensures that consumers know exactly how much tax they are paying and allows them to verify the accuracy of the calculation. If a consumer believes they have been overcharged, they can contact the Maine Revenue Service or the business directly to resolve the issue.

Online Shopping and Sales Tax

With the rise of online shopping, it’s important for Maine residents to understand how sales tax applies to their online purchases. Maine has regulations in place to ensure that online retailers collect and remit sales tax for sales made to Maine residents. This means that even if a purchase is made from an out-of-state retailer, the appropriate sales tax should be included in the total cost.

However, it's worth noting that not all online retailers may comply with Maine's sales tax laws. In such cases, consumers may be responsible for paying the use tax on their out-of-state purchases. The Maine Revenue Service provides guidance on use tax reporting and payment, ensuring that consumers understand their obligations.

Future Implications and Changes

Maine’s sales tax system is subject to potential changes and reforms. The state’s legislature and government agencies may consider adjustments to tax rates, exemptions, or administrative procedures to align with changing economic conditions and policy priorities.

For instance, there have been discussions about expanding sales tax exemptions to promote specific industries or support certain initiatives. Additionally, with the increasing complexity of online sales and the rise of e-commerce, Maine may need to adapt its sales tax regulations to ensure fairness and compliance in the digital marketplace.

Staying informed about potential changes is crucial for both businesses and consumers. The Maine Revenue Service and other government resources provide updates on any proposed or enacted changes to the sales tax system.

Conclusion

Maine’s sales tax system is a critical component of the state’s revenue generation and economic policy. It ensures that businesses and consumers contribute fairly to the state’s financial well-being while also providing incentives and support through various exemptions and special considerations.

For businesses, compliance with sales tax regulations is essential for maintaining good standing with the state and avoiding penalties. For consumers, understanding sales tax helps them make informed choices and ensures they are not overburdened by unnecessary tax obligations. Together, businesses and consumers play a vital role in Maine's tax system, contributing to the state's economic growth and development.

How often do businesses need to file sales tax returns in Maine?

+

The filing frequency for sales tax returns in Maine depends on the business’s sales volume. Generally, businesses with higher sales volumes are required to file more frequently. The Maine Revenue Service determines the filing frequency during the registration process.

Are there any special considerations for remote sellers in Maine?

+

Yes, Maine has specific regulations for remote sellers, including out-of-state retailers. These sellers are required to collect and remit sales tax if they have a certain level of sales or presence in the state. This ensures fairness for in-state businesses and proper tax collection.

What happens if a business fails to comply with sales tax regulations in Maine?

+

Failure to comply with sales tax regulations in Maine can result in penalties and interest charges. The Maine Revenue Service may impose fines and take legal action against non-compliant businesses. It’s crucial for businesses to understand their obligations and seek assistance if needed.