Texas Houston Sales Tax

Sales tax in Texas, and specifically in the city of Houston, is an essential aspect of the state's economy and plays a crucial role in funding various public services and infrastructure projects. The sales tax system in Texas is unique and differs from many other states in the US, making it a topic of interest for both residents and businesses alike. In this comprehensive guide, we will delve into the intricacies of Texas sales tax, focusing on Houston, to provide a clear understanding of the rates, regulations, and their impact on the local economy.

Understanding Texas Sales Tax: An Overview

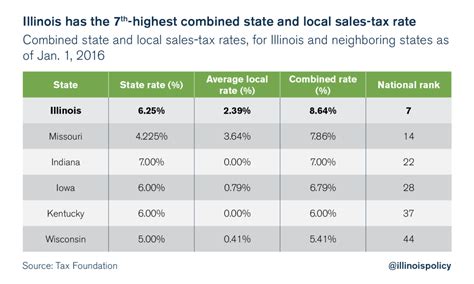

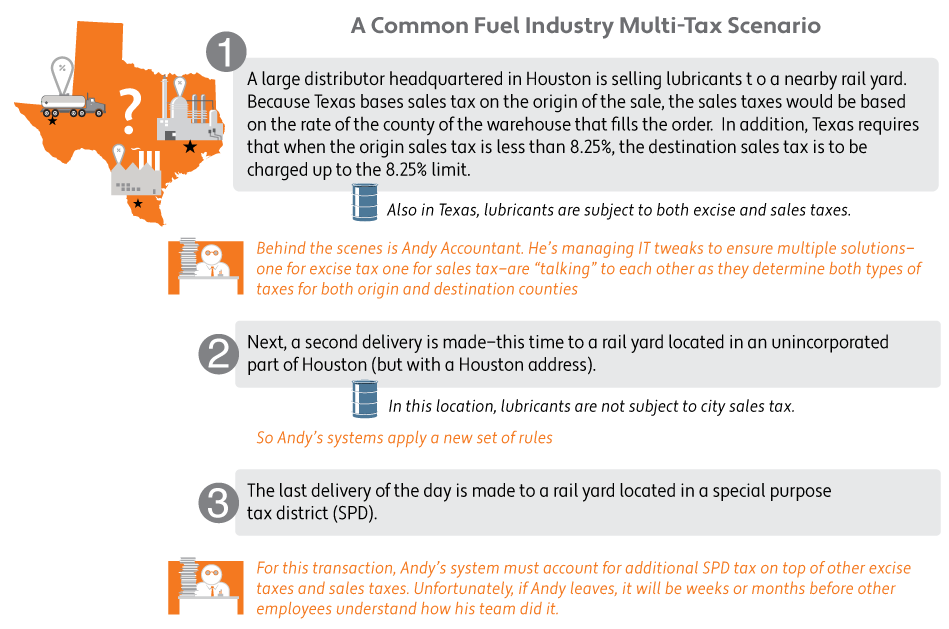

Texas is known for its robust economy and diverse industries, and sales tax is a vital revenue source for the state. Unlike many states with a single sales tax rate, Texas employs a dual-rate system, consisting of a state sales tax and a local sales tax, often referred to as the combined sales tax rate. This system allows for variations in tax rates across different counties and cities, including Houston.

The state sales tax in Texas is currently set at 6.25%, which is applied to most tangible goods and some services. However, it's important to note that certain jurisdictions, including Houston, may impose additional local sales taxes, thereby increasing the overall tax burden on consumers.

Local Sales Tax in Houston

Houston, being the largest city in Texas and a significant economic hub, has its own local sales tax rate, which is 1.75%. This rate is in addition to the state sales tax, resulting in a combined sales tax rate of 8% for Houston residents and businesses. The local sales tax in Houston is used to fund critical infrastructure projects, education, and other essential public services.

It's worth mentioning that Houston's local sales tax rate is relatively high compared to other major cities in Texas. For instance, Dallas has a local sales tax rate of 1.25%, while San Antonio's rate is 1.5%. These variations in local sales tax rates across cities can impact businesses and consumers, influencing their decisions on where to locate or shop.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Texas | 6.25% |

| Houston (City) | 1.75% |

| Harris County | 0.5% |

| Municipalities (e.g., Pasadena, Baytown) | Varies |

| Special Purpose Districts (e.g., Transportation) | Varies |

| Combined Rate in Houston | 8% |

Sales Tax Exemptions and Special Considerations in Texas

While the sales tax system in Texas is relatively straightforward, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can significantly impact the overall tax liability and provide opportunities for savings.

Food and Grocery Sales Tax

One notable exemption in Texas is the sales tax on most food items. This exemption, known as the groceries exemption, applies to food purchased for home consumption. However, it’s important to note that certain food items, such as prepared foods or those consumed on-premises, may still be subject to sales tax.

In Houston, the groceries exemption is particularly beneficial for residents, as it allows them to save on essential food items. This exemption is designed to ease the tax burden on households and ensure that basic necessities remain affordable.

Sales Tax Holidays

Texas also offers sales tax holidays, which are designated periods when certain items are exempt from sales tax. These holidays are typically held on specific weekends and provide an opportunity for consumers to save on essential purchases. In Houston, sales tax holidays are often promoted as a way to boost local economies and encourage shopping during specific seasons.

Online Sales and Remote Sellers

With the rise of e-commerce, Texas has implemented regulations for online sales and remote sellers. These regulations ensure that online retailers collect and remit sales tax on transactions with Texas customers. Houston, being a major e-commerce hub, is affected by these regulations, and businesses operating in the city must comply with the state’s online sales tax requirements.

Impact of Sales Tax on Houston’s Economy

Sales tax plays a pivotal role in shaping Houston’s economic landscape. The revenue generated from sales tax contributes significantly to the city’s budget, funding critical services and infrastructure projects. Let’s explore how sales tax impacts Houston’s economy and its residents.

Funding Essential Services

The sales tax revenue in Houston is allocated to various public services, including education, public safety, healthcare, and transportation. This funding ensures that Houston residents have access to quality services and infrastructure, contributing to the city’s overall economic development and livability.

Economic Development and Growth

Houston’s high sales tax rate, while presenting challenges for businesses, also provides opportunities for economic growth. The revenue generated from sales tax can be reinvested in the local economy, attracting new businesses and creating jobs. Additionally, the city’s ability to fund infrastructure projects, such as roads and public transit, enhances Houston’s competitiveness as a business destination.

Consumer Behavior and Shopping Patterns

The sales tax rate in Houston can influence consumer behavior and shopping patterns. Residents may consider the tax burden when making purchasing decisions, especially for high-value items. Additionally, the sales tax rate can impact online shopping habits, with consumers potentially seeking out retailers in lower-tax jurisdictions.

However, it's important to note that Houston's diverse economy and strong consumer base often mitigate the impact of sales tax on shopping patterns. The city's vibrant culture, entertainment options, and business activities contribute to a resilient local economy.

Compliance and Filing Requirements for Businesses

For businesses operating in Houston, understanding and complying with sales tax regulations is crucial. The Texas Comptroller’s Office provides guidance and resources to help businesses navigate the sales tax landscape.

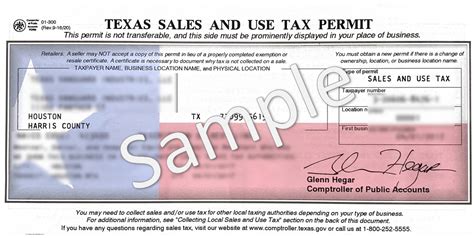

Registering for Sales Tax

Businesses in Houston, whether brick-and-mortar or online, must register with the Texas Comptroller’s Office to obtain a Sales and Use Tax Permit. This permit allows businesses to collect and remit sales tax on taxable transactions. The registration process involves providing essential business information and selecting a filing frequency.

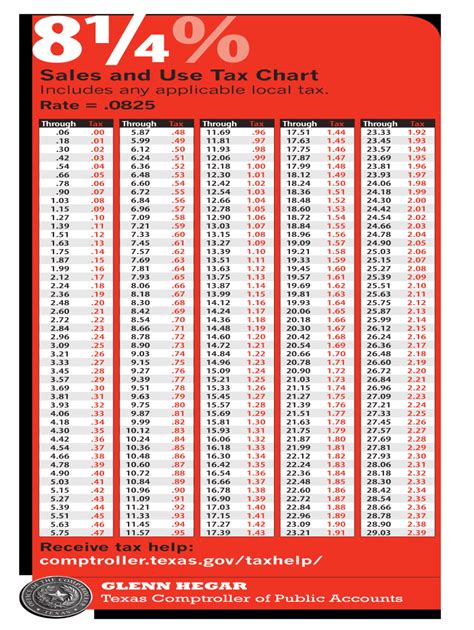

Sales Tax Collection and Remittance

Once registered, businesses in Houston are responsible for collecting the applicable sales tax rate on taxable sales. This includes both the state sales tax and any local sales taxes, such as Houston’s 1.75% rate. Businesses must then remit the collected sales tax to the Texas Comptroller’s Office according to their filing frequency, which can be monthly, quarterly, or annually.

Recordkeeping and Reporting

Proper recordkeeping is essential for businesses to ensure compliance with sales tax regulations. Businesses must maintain records of taxable sales, including the amount of sales tax collected, to facilitate accurate reporting. These records are crucial during audits and for ensuring transparency in tax reporting.

Future Outlook and Potential Changes

As Houston continues to evolve and adapt to economic changes, the sales tax landscape may also undergo transformations. Here’s a glimpse into the potential future of sales tax in Houston and its impact on the local economy.

Potential Tax Reform

There have been ongoing discussions and proposals for tax reform in Texas, including the sales tax system. While it’s challenging to predict the exact nature of any reforms, potential changes could include simplifying the sales tax structure, revising tax rates, or introducing new exemptions. These reforms aim to make the tax system more efficient and responsive to the needs of businesses and consumers.

Impact on Economic Development

Any changes to the sales tax system in Houston could have significant implications for economic development. Lower tax rates or revised structures could attract new businesses and investments, while also potentially impacting the city’s revenue stream. Balancing the needs of businesses and ensuring adequate funding for public services is a delicate task that policymakers must navigate.

Technological Advancements and E-Commerce

The rise of e-commerce and technological advancements continue to shape the sales tax landscape. As online shopping becomes increasingly prevalent, the challenge of collecting sales tax from remote sellers remains a focus for tax authorities. Houston, being a major e-commerce hub, will need to adapt to these changes and ensure compliance with evolving regulations.

What is the current combined sales tax rate in Houston, Texas?

+The combined sales tax rate in Houston is 8%, which includes the state sales tax rate of 6.25% and the local sales tax rate of 1.75%.

Are there any sales tax exemptions in Houston for specific items?

+Yes, Houston, like the rest of Texas, offers exemptions for certain items. For example, most food purchased for home consumption is exempt from sales tax. Additionally, Texas has designated sales tax holidays for specific items, such as school supplies.

How often do businesses in Houston need to file sales tax returns?

+The filing frequency for sales tax returns in Houston depends on the business’s tax liability. Typically, businesses with higher tax liabilities file monthly, while those with lower liabilities file quarterly or annually. However, it’s important for businesses to consult the Texas Comptroller’s Office for specific guidelines.

Are there any plans for sales tax reform in Texas?

+While there have been discussions and proposals for tax reform in Texas, including the sales tax system, no specific reforms have been implemented as of yet. The focus has been on simplifying the tax structure and ensuring fairness for businesses and consumers.

How does Houston’s sales tax rate compare to other major cities in Texas?

+Houston’s local sales tax rate of 1.75% is relatively high compared to other major cities in Texas. For instance, Dallas has a local sales tax rate of 1.25%, while San Antonio’s rate is 1.5%. These variations in local sales tax rates can impact businesses and consumers’ decisions.