Sales Tax In Colorado

Sales tax in Colorado is a crucial aspect of the state's economy, contributing significantly to its revenue generation. Understanding the sales tax landscape is essential for businesses and consumers alike, as it impacts pricing strategies, budgeting, and compliance with state regulations. In this comprehensive guide, we will delve into the specifics of sales tax in Colorado, covering its structure, rates, exemptions, and the implications for various industries.

Understanding the Colorado Sales Tax System

Colorado’s sales tax system is a vital component of its revenue stream, with a well-defined structure that impacts businesses and consumers statewide. The state’s sales tax is administered by the Colorado Department of Revenue, which oversees the collection and distribution of tax revenues. This department plays a pivotal role in ensuring compliance and providing guidance to taxpayers.

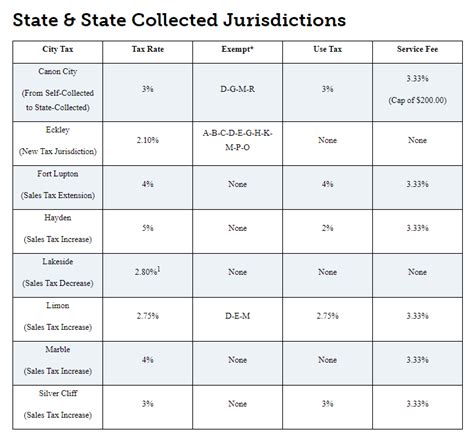

The sales tax in Colorado operates on a combined rate system, where the state sales tax rate is combined with local and municipal tax rates to determine the total sales tax applicable in a specific jurisdiction. This system ensures that tax rates can vary across the state, accommodating the diverse needs of different regions.

Key Components of the Colorado Sales Tax

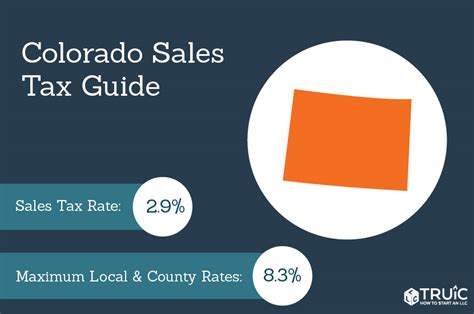

- State Sales Tax Rate: The state of Colorado imposes a base sales tax rate of 2.9%, which serves as the foundation for the combined rate.

- Local Sales Tax Rates: In addition to the state rate, local governments and municipalities have the authority to levy their own sales taxes, resulting in a wide range of rates across the state. These local rates are typically lower than the state rate, but they can significantly impact the total sales tax burden.

- Use Tax: Colorado also enforces a use tax, which applies to goods purchased outside the state but used or consumed within Colorado. This tax ensures that out-of-state purchases are not exempted from taxation, creating a level playing field for in-state businesses.

- Special Sales Tax Districts: Certain areas in Colorado are designated as special sales tax districts, often with higher tax rates to fund specific projects or initiatives. These districts can include tourist destinations, urban renewal areas, or other designated locations.

| Type of Tax | Rate | Description |

|---|---|---|

| State Sales Tax | 2.9% | Statewide sales tax rate applied to most goods and services. |

| Local Sales Tax | Varies | Municipalities and counties can levy additional sales taxes, resulting in varying rates across the state. |

| Use Tax | 2.9% | Applies to goods purchased out-of-state and used within Colorado, ensuring equitable taxation. |

| Special District Sales Tax | Varies | Certain areas have higher tax rates to fund specific projects or initiatives. |

Sales Tax Rates Across Colorado

Colorado’s sales tax rates vary significantly from one location to another, primarily due to the influence of local sales taxes. While the state sales tax rate remains consistent at 2.9%, local governments have the autonomy to impose their own tax rates, resulting in a complex web of sales tax structures.

Metropolitan Areas: Denver and Beyond

In the bustling metropolitan areas of Colorado, such as Denver and its surrounding counties, the sales tax rates are often higher compared to more rural regions. This is primarily due to the additional taxes levied by the municipalities and counties to fund various public services and infrastructure projects.

For instance, in the city and county of Denver, the combined sales tax rate stands at 8.31%, which includes the state sales tax rate of 2.9% and additional local taxes. This rate is applicable to most goods and services purchased within the city limits, making it one of the higher sales tax rates in the state.

Rural Communities: Lower Rates, Simplified Taxation

In contrast, rural communities in Colorado often have simpler tax structures and lower sales tax rates. These areas typically rely on a smaller tax base and may have fewer public services to fund, resulting in reduced tax burdens for businesses and consumers.

Take, for example, the small town of Montrose in western Colorado. Here, the combined sales tax rate is 6.9%, significantly lower than that of Denver. This rate includes the state sales tax and a smaller local tax, reflecting the town's more streamlined tax system.

| Location | Combined Sales Tax Rate | Components |

|---|---|---|

| Denver | 8.31% | State Tax (2.9%) + Local Taxes |

| Montrose | 6.9% | State Tax (2.9%) + Local Taxes |

| Boulder | 8.0% | State Tax (2.9%) + Local Taxes |

| Colorado Springs | 7.4% | State Tax (2.9%) + Local Taxes |

Sales Tax Exemptions and Special Considerations

Colorado’s sales tax system is not a one-size-fits-all approach. The state offers a range of exemptions and special considerations that can significantly impact the tax burden for specific industries, businesses, and consumers.

Food and Groceries: A Mixed Bag

The sales tax treatment of food and groceries in Colorado is a complex matter. While most prepared foods and restaurant meals are subject to the full sales tax rate, there are certain exemptions for groceries and staple foods.

For instance, unprepared foods, such as raw produce, meat, and dairy products, are generally exempt from sales tax. This exemption extends to certain non-food items commonly purchased at grocery stores, like pet food, toiletries, and cleaning supplies. However, it's essential to note that this exemption does not apply to convenience stores or gas stations, where these items may be subject to sales tax.

Exemptions for Specific Industries

Colorado offers industry-specific sales tax exemptions that can provide significant relief to certain businesses. These exemptions are designed to support specific economic sectors and promote growth in targeted industries.

One notable example is the sales tax exemption for manufacturing machinery and equipment. This exemption, available to qualified manufacturers, encourages investment in the state's manufacturing sector by reducing the tax burden on capital purchases. It's a strategic move by the state to foster economic growth and attract new manufacturing businesses.

Sales Tax Holidays: A Temporary Relief

Colorado occasionally implements sales tax holidays, during which specific items are exempt from sales tax for a limited time. These holidays are typically scheduled around major shopping events, such as back-to-school season or holiday shopping, and are designed to stimulate consumer spending.

For instance, Colorado has previously offered sales tax holidays for back-to-school supplies, allowing families to stock up on essential items like notebooks, backpacks, and school uniforms without incurring sales tax. These holidays provide a temporary respite from the sales tax burden and can significantly reduce the cost of necessary purchases.

The Impact of Sales Tax on Businesses

Sales tax has a profound impact on businesses operating in Colorado, influencing their pricing strategies, profitability, and compliance requirements. For businesses, navigating the state’s sales tax system is a critical aspect of their financial management and overall success.

Pricing Strategies and Competitive Advantage

The sales tax rate in a particular area can significantly influence a business’s pricing strategies. In regions with higher sales tax rates, businesses may need to adjust their pricing to remain competitive while accounting for the additional tax burden. This can lead to dynamic pricing models, where businesses continually evaluate their pricing to stay attractive to consumers.

For instance, a business operating in Denver, with its higher sales tax rate, may need to promote value-added services or bundle products to offset the increased tax cost. This approach ensures that the business remains competitive and can maintain its market share despite the higher tax rate.

Compliance and Administrative Burden

Compliance with sales tax regulations is a significant responsibility for businesses in Colorado. The state’s sales tax system, with its combined rates and local variations, can create a complex compliance landscape. Businesses must accurately calculate and remit sales taxes, ensuring they are compliant with state and local regulations.

To navigate this complexity, many businesses leverage sales tax software and automation tools. These solutions help businesses stay compliant by automatically calculating and tracking sales taxes based on the applicable rates. This reduces the administrative burden and minimizes the risk of errors, which can lead to significant penalties.

Tax Collection and Remittance

Businesses in Colorado are responsible for collecting and remitting sales taxes on behalf of the state and local governments. This process involves integrating sales tax calculations into their point-of-sale systems and ensuring accurate reporting to the appropriate tax authorities.

For larger businesses with complex operations, this process can be resource-intensive, requiring dedicated staff or outsourcing to tax professionals. Smaller businesses may face challenges due to limited resources, making it essential to explore efficient and cost-effective solutions for tax collection and remittance.

Consumer Perspective: Navigating Sales Tax

For consumers in Colorado, understanding the sales tax system is crucial for making informed purchasing decisions and managing their budgets effectively. Sales tax can significantly impact the cost of goods and services, influencing consumer behavior and spending patterns.

Budgeting and Comparison Shopping

Sales tax can add a substantial amount to the final cost of a purchase, especially in areas with higher tax rates. Consumers need to factor in sales tax when budgeting for major purchases, ensuring they have sufficient funds to cover the total cost, including tax.

Additionally, comparison shopping becomes even more critical when sales tax is considered. Consumers may find that the same item is priced differently across stores, not only due to varying retail strategies but also because of different sales tax rates in different locations. This highlights the importance of researching and comparing prices before making a purchase decision.

Avoiding Surprises at Checkout

One of the most significant challenges for consumers is avoiding unexpected sales tax charges at checkout. While most retailers clearly display sales tax amounts, there may be instances where tax rates are not prominently featured, leading to surprises at the final stage of the purchase.

To avoid such surprises, consumers should familiarize themselves with the sales tax rates in their area and estimate the tax component for major purchases. Online tools and calculators can be valuable resources for estimating sales tax, helping consumers plan their spending more accurately.

Tax Savings and Strategic Shopping

Consumers in Colorado can take advantage of sales tax exemptions and special offers to save on their purchases. For example, during sales tax holidays, consumers can stock up on essential items without incurring sales tax, leading to significant savings.

Additionally, understanding industry-specific exemptions can lead to strategic shopping. For instance, if a consumer is planning to purchase a new vehicle, they may consider timing their purchase to coincide with a sales tax holiday for vehicles, which can result in substantial savings.

Future Implications and Potential Changes

The sales tax landscape in Colorado is subject to change, with potential modifications to rates, exemptions, and regulations. These changes can be driven by a variety of factors, including economic trends, political decisions, and the evolving needs of the state’s economy.

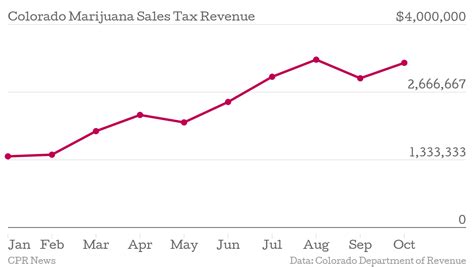

Economic Factors and Tax Revenues

Colorado’s sales tax system is a significant contributor to the state’s revenue stream, and changes in the economy can impact the need for tax adjustments. During economic downturns, the state may consider raising sales tax rates to generate additional revenue and support public services. Conversely, in times of economic prosperity, there may be pressure to lower tax rates to stimulate consumer spending and investment.

Political Considerations and Policy Changes

Political decisions play a pivotal role in shaping the sales tax system. Elected officials and policymakers can propose changes to sales tax rates, exemptions, or the overall tax structure to align with their economic and social agendas. These changes can have far-reaching implications for businesses and consumers, influencing the state’s fiscal health and economic growth.

Potential Reforms and Modernization

As the economy evolves and technology advances, there may be calls for modernizing the sales tax system in Colorado. This could involve streamlining tax rates, simplifying compliance processes, or adopting new technologies for tax collection and enforcement. Such reforms aim to make the sales tax system more efficient, fair, and responsive to the needs of the modern economy.

For instance, the rise of e-commerce and online sales has presented challenges for sales tax collection. Colorado, like many other states, may explore ways to ensure that online sales are subject to appropriate taxes, potentially leading to new regulations or partnerships with online marketplaces.

What is the current state sales tax rate in Colorado?

+The current state sales tax rate in Colorado is 2.9%, which serves as the foundation for the combined sales tax rate in different jurisdictions.

Are there any plans to change the sales tax rates in Colorado in the near future?

+While there are no immediate plans to change the sales tax rates, economic and political factors can influence such decisions. It’s essential to stay informed about any proposed changes through official channels and local media.

How do I know which sales tax rate applies to my business or purchase?

+The applicable sales tax rate depends on your location and the nature of your business or purchase. You can use online tools and resources provided by the Colorado Department of Revenue to determine the correct sales tax rate for your specific situation.

Are there any upcoming sales tax holidays in Colorado?

+Sales tax holidays in Colorado are typically announced in advance and are subject to legislative approval. It’s advisable to check the official website of the Colorado Department of Revenue or local news sources for updates on any upcoming sales tax holidays.