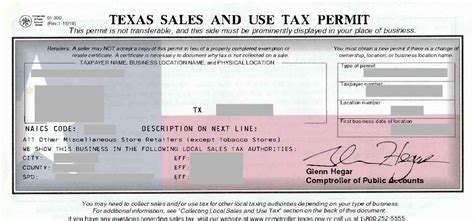

Texas Sales And Use Tax Permit

For businesses operating in the state of Texas, understanding the intricacies of sales and use tax compliance is crucial. The Texas Sales and Use Tax Permit is a fundamental component of conducting business within the state's legal framework. This article aims to provide an in-depth analysis of the Texas Sales and Use Tax Permit, its implications, and the steps involved in obtaining and maintaining it. By delving into the specifics, we aim to equip businesses with the knowledge needed to navigate this essential aspect of their operations in Texas.

The Texas Sales and Use Tax Permit: A Comprehensive Guide

The Texas Sales and Use Tax Permit is a legal document issued by the Texas Comptroller of Public Accounts that authorizes a business to collect and remit sales and use taxes on behalf of the state. It is a critical component of tax compliance for any business engaging in taxable sales or purchases within the state of Texas.

Sales and use taxes are a vital source of revenue for the state, and proper collection and remittance ensure that businesses contribute fairly to the state's infrastructure and services. Failure to comply with these tax obligations can result in significant penalties and legal repercussions.

Understanding the Role of Sales and Use Taxes

Sales tax is a consumption tax imposed on the sale of goods and services. It is typically calculated as a percentage of the sale price and is collected by the seller from the buyer at the point of sale. The collected sales tax is then remitted to the state government.

Use tax, on the other hand, is a complementary tax to sales tax. It is imposed on the use, storage, or consumption of goods or services within the state, even if the sale itself took place outside of Texas. Use tax is particularly relevant for businesses that make purchases from out-of-state vendors, ensuring that these transactions are also subject to taxation.

The sales and use tax system in Texas is designed to ensure fairness and consistency in tax collection, benefiting the state's economy and providing essential funding for various public services.

Eligibility and Requirements for the Texas Sales and Use Tax Permit

To be eligible for a Texas Sales and Use Tax Permit, a business must meet certain criteria. Here are the key requirements:

- Business Registration: The business must be legally registered with the state of Texas. This includes obtaining a Certificate of Formation or similar document, depending on the business entity type.

- Taxable Activities: The business must be engaged in activities that are subject to sales and use taxes. This includes selling tangible goods, providing taxable services, or leasing property within the state.

- Tax Registration Number: Every business applying for a Sales and Use Tax Permit must obtain a Taxpayer Identification Number (TIN) from the Texas Comptroller's office. This unique identifier is essential for tax filing and reporting.

- Financial Information: The business may be required to provide financial information, such as projected sales and estimated tax liability, to demonstrate its ability to manage tax obligations.

- Compliance History: The Texas Comptroller's office considers a business's compliance history with other tax obligations when reviewing permit applications. A clean record can be beneficial in the application process.

Meeting these requirements is essential for businesses to ensure they are eligible for a Sales and Use Tax Permit and can operate legally within the state of Texas.

Application Process: Obtaining the Texas Sales and Use Tax Permit

The process of obtaining a Texas Sales and Use Tax Permit involves several steps, and it is essential to follow the correct procedures to ensure a smooth and timely approval. Here's a detailed breakdown of the application process:

- Register Your Business: Prior to applying for the Sales and Use Tax Permit, ensure that your business is properly registered with the state. This step involves obtaining the necessary legal documentation, such as a Certificate of Formation for limited liability companies (LLCs) or a Corporate Charter for corporations.

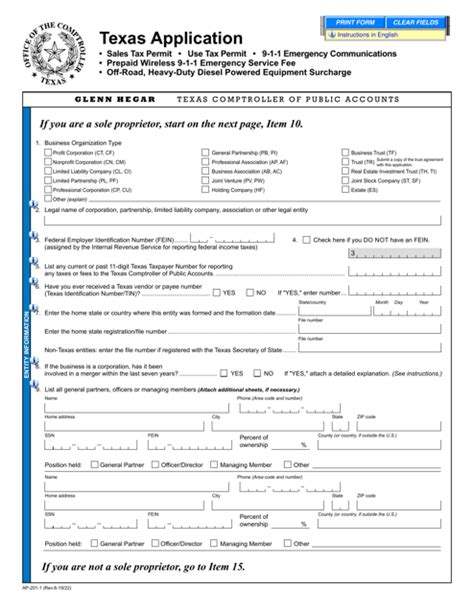

- Obtain a Taxpayer Identification Number (TIN): Every business applying for a Sales and Use Tax Permit must have a unique TIN. You can obtain this number by completing Form AP-201, Application for Texas Taxpayer Number, and submitting it to the Texas Comptroller's office. The TIN is a crucial identifier for tax filing and reporting.

- Complete the Sales and Use Tax Permit Application: Download and fill out Form AP-210, Application for Texas Sales and Use Tax Permit. This form requires detailed information about your business, including the type of business, contact information, and the types of goods or services you offer. Ensure that all information is accurate and up-to-date.

- Submit Supporting Documents: Along with the completed application, you may need to provide additional supporting documents. These could include business licenses, proof of business registration, or other documentation as requested by the Comptroller's office. Make sure to include all required documents to avoid delays in the approval process.

- Pay the Application Fee: There is a non-refundable application fee associated with obtaining a Sales and Use Tax Permit. The fee amount may vary depending on the type of business and the expected tax liability. Ensure you have the necessary funds available to cover this fee.

- Submit the Application: Once you have gathered all the required information and documents, submit your application package to the Texas Comptroller's office. You can submit the application online, by mail, or in person at a local Comptroller's office. Choose the method that is most convenient for your business.

- Wait for Processing: After submitting your application, allow sufficient time for processing. The Comptroller's office typically takes several weeks to review and approve permit applications. During this time, you may receive requests for additional information or clarifications. Respond promptly to ensure a smooth approval process.

- Receive Your Permit: Upon successful approval, you will receive your Texas Sales and Use Tax Permit. This permit will include your unique permit number, which is essential for tax filing and reporting. Keep the permit in a secure location and ensure that all your employees are aware of its importance.

By following these steps and providing accurate and complete information, you can navigate the application process for a Texas Sales and Use Tax Permit efficiently. Remember, timely and accurate tax compliance is crucial for the smooth operation of your business in Texas.

Responsibilities and Obligations of Permit Holders

Obtaining a Texas Sales and Use Tax Permit comes with a set of responsibilities and obligations that businesses must adhere to. These obligations ensure that the state's tax system remains fair and efficient, and they contribute to the overall stability of the economy.

Permit holders are required to:

- Collect Sales Tax: Businesses must collect sales tax from customers at the point of sale for all taxable goods and services. The collected tax must be remitted to the state on a regular basis, typically quarterly or monthly, depending on the business's tax liability.

- File Tax Returns: Permit holders are responsible for filing accurate and timely tax returns. These returns provide a detailed account of sales, purchases, and the corresponding tax liability. Failure to file tax returns can result in penalties and interest charges.

- Recordkeeping: Proper recordkeeping is essential for tax compliance. Businesses must maintain accurate records of sales, purchases, and tax payments. These records should be readily available for audit purposes and should be retained for a minimum of three years.

- Report Changes: Permit holders must notify the Texas Comptroller's office of any significant changes to their business, such as a change of address, ownership, or legal status. Failure to report such changes can lead to penalties and potential permit revocation.

- Pay Taxes Timely: Prompt payment of sales and use taxes is crucial. Late payments may result in penalties and interest, which can quickly accumulate and impact a business's financial health.

By fulfilling these responsibilities, businesses not only maintain their compliance with state tax laws but also contribute to the overall integrity of the tax system. It is in the best interest of both the state and businesses to ensure that sales and use taxes are collected and remitted accurately and on time.

Compliance and Enforcement: Ensuring Tax Obligations Are Met

Compliance with sales and use tax obligations is a critical aspect of doing business in Texas. The Texas Comptroller's office has robust systems in place to ensure that businesses meet their tax responsibilities. Here's an overview of the compliance and enforcement measures:

- Tax Audits: The Comptroller's office conducts audits to verify that businesses are accurately collecting and remitting sales and use taxes. These audits can be random or targeted, depending on various factors such as business size, industry, and historical compliance records.

- Penalty and Interest Charges: Failure to comply with tax obligations can result in significant penalty and interest charges. These charges are imposed on late payments, underpayments, or non-compliance with tax laws. The Comptroller's office calculates these charges based on the severity of the infraction and the duration of non-compliance.

- Enforcement Actions: In cases of severe non-compliance, the Comptroller's office may take enforcement actions. This can include revoking a business's Sales and Use Tax Permit, imposing administrative fines, or even referring the matter to the Attorney General's office for potential criminal prosecution.

- Voluntary Disclosure Program: The Comptroller's office offers a Voluntary Disclosure Program for businesses that have failed to comply with tax obligations. This program provides an opportunity for businesses to come forward, disclose their non-compliance, and work towards resolving the issue. It can result in reduced penalties and a more favorable resolution.

- Education and Outreach: The Comptroller's office actively engages in education and outreach efforts to ensure that businesses understand their tax obligations. This includes providing resources, guidance, and workshops to help businesses navigate the tax system and maintain compliance.

By implementing these compliance and enforcement measures, the Comptroller's office aims to create a fair and equitable tax system. It encourages businesses to take their tax obligations seriously and provides support for those who may need assistance in understanding and meeting their tax responsibilities.

Renewal and Updates: Keeping Your Permit Current

Maintaining a valid Texas Sales and Use Tax Permit is an ongoing responsibility for businesses. Permits are typically valid for a specific period, after which they must be renewed. Here's an overview of the renewal process and other important updates:

- Renewal Period: The renewal period for Sales and Use Tax Permits varies depending on the business's tax liability and other factors. Some permits may need to be renewed annually, while others may have a longer validity period. It is crucial to keep track of your permit's expiration date to ensure timely renewal.

- Renewal Process: The renewal process is generally straightforward. Businesses are typically notified by the Texas Comptroller's office when their permit is approaching expiration. The notification includes instructions on how to renew the permit, which may involve completing a renewal form and submitting it along with any required documentation.

- Changes in Business Operations: If there are significant changes in your business operations, such as a change in ownership, location, or legal status, you must notify the Comptroller's office. These changes may impact your tax obligations and require updates to your permit information.

- Address Changes: It is essential to keep your contact information, especially your mailing address, up-to-date with the Comptroller's office. Failure to receive important notices or correspondence due to an outdated address can lead to compliance issues.

- Online Renewal Options: The Comptroller's office provides convenient online renewal options for many types of permits, including Sales and Use Tax Permits. Online renewal can save time and ensure a more efficient process. Check the Comptroller's website for details on online renewal eligibility and procedures.

By staying informed about the renewal process and promptly addressing any changes in your business operations, you can ensure that your Sales and Use Tax Permit remains current and valid. This not only avoids potential compliance issues but also streamlines your tax obligations, making it easier to manage your business's tax responsibilities.

Conclusion: Navigating the Texas Sales and Use Tax Landscape

Obtaining and maintaining a Texas Sales and Use Tax Permit is a crucial step for businesses operating within the state. It ensures compliance with tax laws and contributes to the overall stability and fairness of the tax system. By understanding the application process, responsibilities, and compliance measures, businesses can navigate the Texas sales and use tax landscape with confidence.

This comprehensive guide has provided an in-depth look at the Texas Sales and Use Tax Permit, offering practical insights and information. Remember, timely and accurate tax compliance is not only a legal obligation but also a responsibility to the state and your business's success. Stay informed, stay compliant, and continue to contribute to the thriving business environment in Texas.

Frequently Asked Questions

What is the purpose of the Texas Sales and Use Tax Permit?

+

The Texas Sales and Use Tax Permit authorizes businesses to collect and remit sales and use taxes on behalf of the state. It ensures that businesses operating in Texas comply with tax laws and contribute to the state’s revenue stream.

How often do I need to renew my Sales and Use Tax Permit?

+

Renewal periods vary based on factors like tax liability. Some permits may need annual renewal, while others may have longer validity. Stay updated on your permit’s expiration date to ensure timely renewal.

What happens if I fail to renew my permit on time?

+

Failure to renew your permit on time may result in penalties and the inability to collect and remit sales tax. It’s crucial to keep track of renewal deadlines to avoid compliance issues.

Are there any online resources to help with the application process?

+

Yes, the Texas Comptroller’s office provides online resources, including guides, forms, and a convenient online renewal option for many permit types. Check their website for detailed information and support.

Can I apply for a Sales and Use Tax Permit if my business is not yet operational?

+

Yes, you can apply for a Sales and Use Tax Permit even if your business is not yet operational. However, ensure that your business is properly registered and meets all other eligibility requirements.