Ramsey County Property Tax

Welcome to our comprehensive guide on the Ramsey County Property Tax system, where we delve into the intricate world of property assessments, tax rates, and the impact they have on residents and businesses alike. With a focus on accuracy and clarity, this article aims to provide you with an in-depth understanding of the property tax landscape in Ramsey County.

Unraveling the Ramsey County Property Tax System

Ramsey County, located in the vibrant state of Minnesota, boasts a diverse range of properties, from historic homes to modern commercial spaces. Understanding the property tax system in this region is crucial for property owners, investors, and residents who wish to navigate the financial responsibilities associated with owning real estate.

The Assessment Process: A Key Component

At the heart of the Ramsey County Property Tax system lies the assessment process, a critical step in determining the value of each property. The County Assessor’s Office plays a pivotal role in this process, ensuring fair and accurate evaluations. Here’s a breakdown of how it works:

- Property Inspection: Assessor's staff conduct thorough inspections of properties, taking into account various factors such as size, age, condition, and recent improvements.

- Market Analysis: The assessor's office conducts a comprehensive market analysis to determine the fair market value of properties. This involves studying recent sales data, comparing similar properties, and considering economic trends.

- Noticing and Appealing: Property owners are provided with notice of their assessed values. If they believe the assessment is inaccurate, they have the right to appeal the decision through a formal process.

The assessment process is a meticulous endeavor, aiming to ensure that property taxes are levied fairly and equitably across the county.

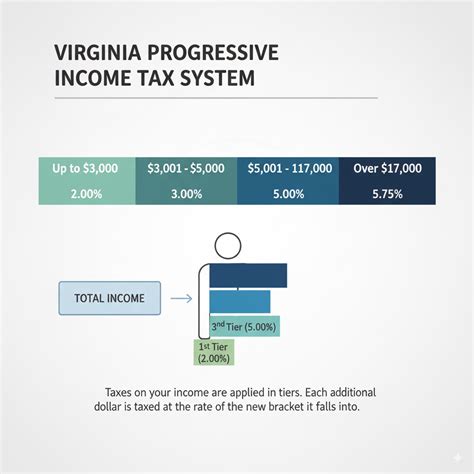

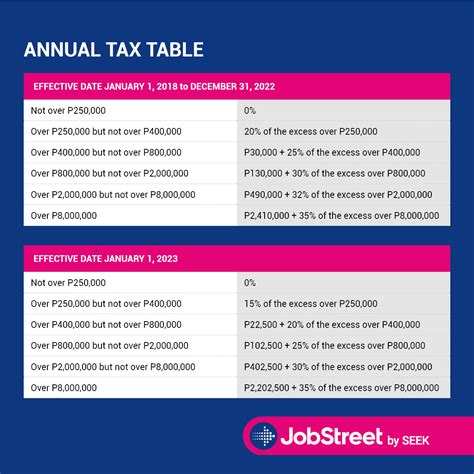

Tax Rates: Understanding the Numbers

The property tax rate in Ramsey County is determined by a combination of factors, including the county’s budget, state laws, and the assessed value of properties. Here’s a simplified breakdown of the tax rate calculation:

| Component | Description |

|---|---|

| Tax Levy | The total amount of taxes needed to fund county operations and services, including schools, public safety, and infrastructure. |

| Tax Rate per $1,000 | This rate is determined by dividing the tax levy by the total taxable market value of all properties in the county. It represents the tax amount per $1,000 of assessed value. |

| Taxable Value | The taxable value of a property is calculated as a percentage of its assessed value. In Minnesota, this percentage is known as the "class rate" and varies based on the property type. |

For instance, let's consider a residential property with an assessed value of $250,000 and a class rate of 35%. The taxable value would be calculated as follows: $250,000 x 0.35 = $87,500. The tax rate per $1,000, let's say it's $15, would result in a tax bill of $1,312.50 for this property.

Payment Options and Due Dates

Ramsey County offers convenient payment options for property taxes. Residents can choose to pay in full or opt for installment plans. The due dates for property tax payments are typically aligned with the fiscal year, with specific deadlines set by the county.

It's essential for property owners to stay informed about these deadlines to avoid late fees and penalties. The county provides various payment methods, including online payments, mail-in payments, and in-person payments at designated locations.

Impact on the Community

The property tax system in Ramsey County plays a vital role in funding essential services and infrastructure projects. Property taxes contribute to the maintenance and improvement of schools, roads, parks, and public safety initiatives. By understanding the property tax landscape, residents can appreciate the direct impact their contributions have on the community’s well-being.

Online Resources and Support

Ramsey County understands the importance of transparency and accessibility when it comes to property taxes. The county’s official website provides a wealth of resources, including online property tax lookup tools, payment portals, and detailed information on assessment processes and tax rates. Property owners can easily access their account information, view assessment details, and stay informed about any changes or updates.

Additionally, the county offers support through dedicated helplines and in-person assistance at taxpayer service centers. These resources ensure that property owners can navigate the property tax system with ease and address any concerns or queries they may have.

Stay Informed, Stay Empowered

Understanding the Ramsey County Property Tax system empowers property owners to make informed decisions about their real estate holdings. By staying updated on assessment processes, tax rates, and payment options, residents can ensure they are meeting their financial obligations while also contributing to the growth and development of their community.

Frequently Asked Questions

How often are property assessments conducted in Ramsey County?

+Property assessments in Ramsey County are typically conducted every year to ensure accurate and up-to-date valuations. The county assessor’s office strives to provide fair and equitable assessments, taking into account market trends and property changes.

Can I appeal my property assessment if I believe it is inaccurate?

+Absolutely! Property owners have the right to appeal their assessments if they disagree with the determined value. The appeals process is designed to provide a fair and impartial review. It’s important to gather evidence and supporting documentation to strengthen your case.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline may result in late fees and penalties. It’s crucial to stay informed about the due dates and payment options to avoid any financial repercussions. The county typically provides grace periods, but it’s best to pay on time to avoid additional costs.

Are there any tax exemptions or discounts available for certain properties in Ramsey County?

+Yes, Ramsey County offers various tax exemptions and discounts to eligible property owners. These include homestead exemptions, military exemptions, and senior citizen discounts. It’s advisable to check with the county assessor’s office or tax authority to determine your eligibility and understand the application process.