Pa Tax Return

The Pennsylvania Department of Revenue handles the state's tax administration, ensuring compliance with state tax laws and regulations. The PA Tax Return process involves various forms and requirements specific to the Commonwealth of Pennsylvania. This guide will delve into the intricacies of filing your Pennsylvania tax return, covering everything from tax forms to potential deductions and credits, and providing insights to help you navigate this essential financial obligation efficiently.

Understanding the PA Tax Return Process

Pennsylvania’s tax system encompasses a range of taxes, including income tax, sales and use tax, corporate net income tax, and more. For individuals, the primary focus is on personal income tax, which is calculated based on your earnings and the tax rates applicable to your filing status and income bracket. The PA tax return process is designed to ensure residents and businesses contribute fairly to the state’s revenue, funding essential services and initiatives.

Key Forms and Documents

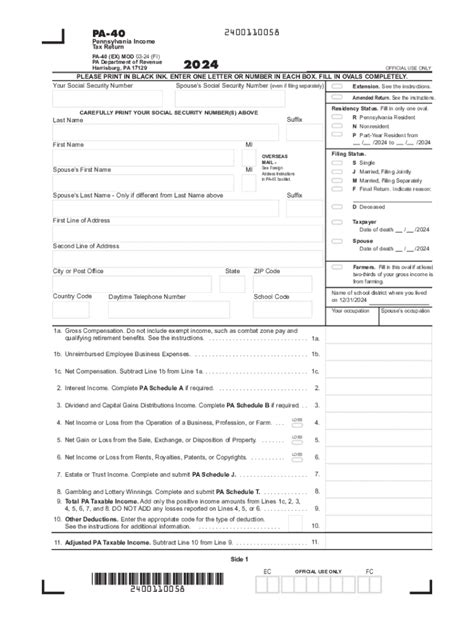

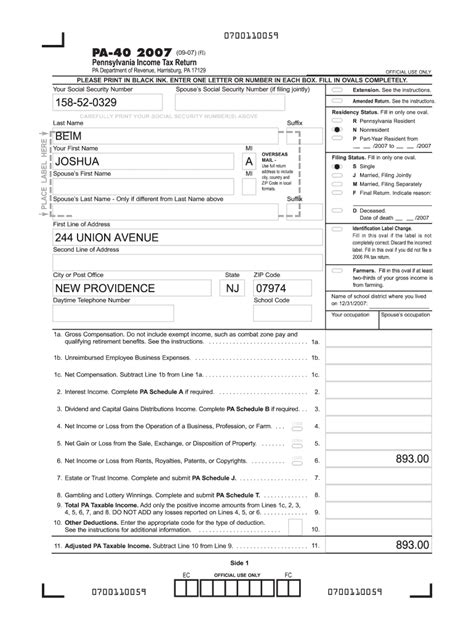

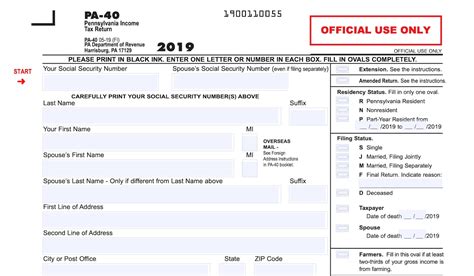

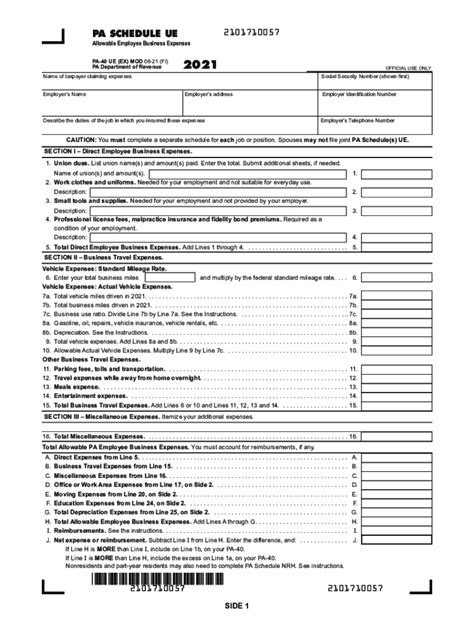

To file your PA tax return accurately, you’ll need to gather specific forms and documents. The primary form for individual income tax is the PA-40, which serves as the standard personal income tax return. This form requires detailed information about your income, deductions, and credits. Additionally, you might need other schedules and forms depending on your unique financial circumstances.

For instance, if you have business income or losses, you may need to complete the PA-40B schedule. Those with rental property income or losses will require the PA-40R schedule. If you're claiming credits, such as the Property Tax/Rent Rebate or the PA Sales Tax Credit, you'll need to include the appropriate forms and supporting documentation.

It's crucial to keep all relevant tax documents organized and readily accessible. This includes W-2 forms from your employer(s), 1099 forms for any self-employment or investment income, and records of deductions and expenses. Maintaining a well-organized system can streamline the tax return preparation process and reduce the likelihood of errors.

| Form/Schedule | Description |

|---|---|

| PA-40 | Standard personal income tax return |

| PA-40B | Schedule for business income/losses |

| PA-40R | Schedule for rental property income/losses |

| Property Tax/Rent Rebate Form | Claim form for property tax or rent rebate |

| PA Sales Tax Credit Form | Form to claim the sales tax credit |

Filing Options and Deadlines

Pennsylvania offers several methods for filing your tax return, including online filing, e-filing through authorized software providers, or traditional paper filing. The state encourages electronic filing as it’s faster, more secure, and reduces the potential for errors. When filing online, you can choose to use the Department of Revenue’s own system or select from various authorized e-file providers.

The tax return filing deadline for Pennsylvania typically aligns with the federal deadline, which is April 15th. However, it's essential to note that this deadline can change based on the day of the week and certain circumstances. Always verify the exact deadline for the current tax year to ensure timely filing and avoid penalties.

Pennsylvania Income Tax Rates and Brackets

Pennsylvania employs a progressive income tax system, meaning the tax rate you pay increases as your income rises. As of the 2023 tax year, Pennsylvania has four income tax brackets, with rates ranging from 3.07% to 3.70%.

| Income Bracket | Tax Rate |

|---|---|

| First $35,300 | 3.07% |

| $35,300 - $88,250 | 3.32% |

| $88,250 - $150,000 | 3.52% |

| Income over $150,000 | 3.70% |

It's important to calculate your taxable income accurately, as it determines which tax bracket you fall into and, consequently, the applicable tax rate. Always refer to the official tax rate schedule for the most current and accurate information.

Deductions and Credits

Pennsylvania offers a range of deductions and credits to help reduce your tax liability. Understanding these deductions and credits is crucial, as they can significantly impact the amount of tax you owe or the refund you receive.

Common Deductions

- Standard Deduction: Pennsylvania offers a standard deduction that reduces your taxable income. The amount of the standard deduction varies based on your filing status.

- Itemized Deductions: If your itemized deductions exceed the standard deduction, you may opt to claim them instead. Itemized deductions can include medical expenses, state and local taxes, mortgage interest, charitable contributions, and more.

- Personal Exemptions: Pennsylvania allows a personal exemption deduction for each taxpayer and dependent. This deduction helps reduce your taxable income.

Notable Credits

- Property Tax/Rent Rebate: Eligible Pennsylvania residents can claim a rebate on property taxes or rent paid. This credit provides financial relief to homeowners and renters.

- PA Sales Tax Credit: Individuals who meet certain income criteria can claim a credit for sales tax paid on purchases made in Pennsylvania.

- Education Credits: Pennsylvania offers several education-related credits, including the Education Expense Credit and the Opportunity Scholarship Tax Credit. These credits support educational expenses and contribute to the state’s educational initiatives.

It's crucial to review all available deductions and credits and determine which ones apply to your situation. Consulting with a tax professional or utilizing tax preparation software can help ensure you maximize your deductions and credits, ultimately reducing your tax burden.

Filing Your PA Tax Return: Step-by-Step Guide

- Gather Your Documents: Collect all necessary tax documents, including W-2s, 1099s, and records of income, deductions, and credits.

- Choose Your Filing Method: Decide whether you’ll file electronically or use paper forms. Electronic filing is generally faster and more secure.

- Complete the PA-40: Fill out the standard personal income tax return form accurately and completely. Include all relevant schedules and attachments.

- Calculate Your Deductions and Credits: Determine which deductions and credits you’re eligible for and calculate their amounts. This step is crucial for reducing your tax liability.

- E-File or Mail Your Return: If filing electronically, use the Department of Revenue’s system or an authorized e-file provider. If using paper forms, ensure they’re mailed to the correct address.

- Payment or Refund: Depending on your tax liability, you may need to make a payment with your return or await a refund. Ensure you understand the process and deadlines for both.

- Keep Records: Maintain a copy of your filed return and all supporting documents. This practice ensures you have the necessary information for future reference and potential audits.

Seeking Professional Assistance

While the PA tax return process can be straightforward for many individuals, certain situations may warrant professional assistance. If you have complex financial circumstances, multiple sources of income, or are claiming various deductions and credits, consulting a tax professional can provide valuable guidance and ensure your return is accurate and compliant.

Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have extensive knowledge of tax laws and regulations. They can help navigate the intricacies of Pennsylvania's tax system, maximizing deductions and credits while minimizing your tax liability. Additionally, they can provide advice on tax planning strategies to optimize your financial situation.

Conclusion

Filing your PA tax return is an essential responsibility for all Pennsylvania residents. By understanding the process, forms, and potential deductions and credits, you can ensure a smooth and accurate filing. Remember to stay organized, keep accurate records, and seek professional assistance when needed. With careful preparation and attention to detail, you can navigate the PA tax return process with confidence and ensure compliance with state tax laws.

What is the Pennsylvania tax rate for the current year?

+The Pennsylvania tax rate for the current year (2023) is 3.07% for the first 35,300 of taxable income, 3.32% for income between 35,300 and 88,250, 3.52% for income between 88,250 and 150,000, and 3.70% for income over 150,000.

Are there any deductions available for homeowners in Pennsylvania?

+Yes, Pennsylvania offers the Property Tax/Rent Rebate, which provides eligible residents with a rebate on property taxes or rent paid. This credit aims to provide financial relief to homeowners and renters.

Can I e-file my PA tax return?

+Absolutely! Pennsylvania encourages electronic filing as it’s faster, more secure, and reduces errors. You can use the Department of Revenue’s system or select from various authorized e-file providers.

What is the deadline for filing my PA tax return?

+The tax return filing deadline for Pennsylvania typically aligns with the federal deadline, which is April 15th. However, it’s essential to verify the exact deadline for the current tax year, as it can change based on the day of the week and other factors.

How can I maximize my tax savings in Pennsylvania?

+To maximize your tax savings, it’s crucial to understand all available deductions and credits and determine which ones apply to your situation. Consulting with a tax professional or using tax preparation software can help you identify and claim all eligible deductions and credits, reducing your tax liability.