Slc Sales Tax

Understanding the intricacies of sales tax is crucial for businesses, especially when operating in diverse regions. This comprehensive guide delves into the specifics of the sales tax system in Salt Lake City (SLC), Utah, providing an in-depth analysis of the rates, regulations, and key considerations for businesses and consumers alike.

The SLC Sales Tax Ecosystem

Sales tax in Salt Lake City is a critical component of the city’s revenue generation, with rates and regulations that are designed to fund various public services and initiatives. As of the latest update, the sales tax rates in SLC offer a nuanced insight into the city’s fiscal policy.

Sales Tax Rates: A Detailed Breakdown

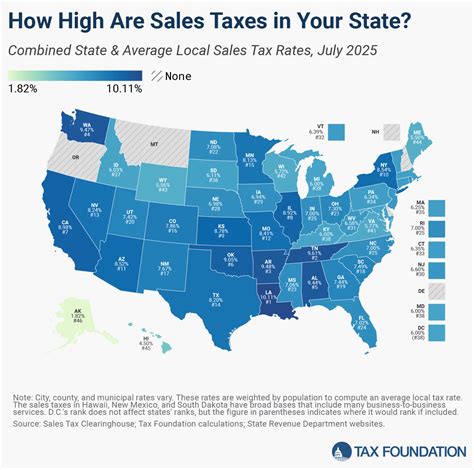

The sales tax rates in Salt Lake City are structured to include both state and local taxes. As of the latest data, the state sales tax rate stands at 4.70%, a figure that remains consistent across Utah. However, it is the city and county sales tax rates that introduce regional variations.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| Salt Lake County | 1.25% |

| Salt Lake City | 1.75% |

| Combined (State, County, City) | 7.70% |

This means that when you make a purchase in Salt Lake City, you'll pay a total sales tax of 7.70%, which includes the state, county, and city taxes. This rate is among the higher end of the spectrum when compared to other major cities in the United States.

Exemptions and Special Considerations

While the majority of tangible goods and services are subject to sales tax in SLC, there are specific exemptions and special cases that businesses and consumers should be aware of. These include:

- Food and Groceries: Sales tax is generally not applied to unprepared food items, including produce, meat, dairy, and other staples. However, prepared foods and meals may be subject to tax.

- Prescription Medications: Medications that require a prescription are typically exempt from sales tax, offering a financial relief for those with medical needs.

- Non-Profit Organizations: Certain sales and purchases made by recognized non-profit organizations may be exempt from sales tax, provided they have the necessary documentation and meet specific criteria.

- Industrial Machinery: Machinery and equipment used in industrial processes may be eligible for sales tax exemptions or reduced rates, particularly if they are considered capital investments.

It's important to note that these exemptions can vary based on specific circumstances and the nature of the transaction. Therefore, businesses and consumers should consult with tax professionals or refer to official tax guides to ensure compliance and take advantage of any applicable exemptions.

Compliance and Reporting

Sales tax compliance is a critical aspect of doing business in Salt Lake City. Businesses are responsible for collecting, reporting, and remitting sales tax to the Utah State Tax Commission. This process involves regular tax filings, typically on a monthly or quarterly basis, depending on the business’s sales volume and tax liability.

To ensure compliance, businesses should maintain accurate records of sales transactions, including the tax amounts collected. They should also stay updated with any changes in sales tax rates or regulations, which can occur annually or in response to legislative changes. The Utah State Tax Commission provides resources and guidance to help businesses navigate these requirements.

Impact on Businesses and Consumers

The sales tax system in Salt Lake City has significant implications for both businesses and consumers. For businesses, the tax not only affects their pricing strategies and profitability but also their administrative burden. Accurate tax collection and reporting are essential to avoid penalties and maintain a positive relationship with the tax authorities.

Consumers, on the other hand, bear the direct impact of sales tax through increased prices. While the tax is a necessary revenue source for the city, it can influence consumer behavior, potentially leading to shifts in purchasing patterns and preferences. Understanding the sales tax rates and exemptions can help consumers make informed decisions and plan their budgets accordingly.

Strategic Considerations for Businesses

For businesses operating in SLC, there are several strategic considerations to navigate the sales tax landscape effectively:

- Pricing Strategies: Businesses should carefully consider their pricing strategies to account for the sales tax rate. Transparent pricing that includes tax can enhance customer trust and reduce confusion at the point of sale.

- Tax Software and Tools: Utilizing specialized tax software or accounting tools can streamline the tax collection and reporting process, reducing the administrative burden and minimizing the risk of errors.

- Exemption Awareness: Being aware of the various sales tax exemptions and special cases can help businesses offer competitive pricing or tailored solutions to specific customer segments, particularly in industries with eligible exemptions.

- Regular Tax Updates: Staying informed about changes in sales tax rates and regulations is essential. Businesses should subscribe to relevant newsletters or alerts from the Utah State Tax Commission to ensure they are always compliant.

Consumer Perspectives and Behavior

From a consumer perspective, understanding the sales tax system in Salt Lake City is crucial for financial planning and decision-making. Here are some key considerations for consumers:

- Budgeting and Price Comparisons: Consumers should factor in the sales tax rate when budgeting for purchases, particularly for high-value items. Comparing prices across different retailers, both online and offline, can help identify the best deals.

- Exemptions and Discounts: Being aware of sales tax exemptions, particularly for essential items like groceries and medications, can lead to significant savings. Additionally, consumers should look out for tax-free shopping events or discounts that can further reduce their tax burden.

- Online Shopping Considerations: When shopping online, consumers should be mindful of sales tax implications. While some online retailers may offer free shipping or reduced prices, they may also charge sales tax, which can impact the overall cost of the purchase.

The Future of SLC Sales Tax

As Salt Lake City continues to evolve, so too will its sales tax system. The city’s fiscal policy is subject to ongoing review and adjustment, driven by economic trends, legislative changes, and public sentiment. Here are some potential future developments and their implications:

Economic Growth and Tax Revenues

Salt Lake City’s economic growth, particularly in sectors like technology, tourism, and retail, can significantly impact sales tax revenues. As the city’s economy expands, it may lead to increased tax collections, which can fund further public improvements and initiatives. However, managing these revenues effectively to balance the needs of different sectors and communities will be a key challenge for policymakers.

Legislative Changes and Policy Adjustments

The sales tax system in SLC is not static and can be influenced by legislative changes at the state and local levels. These changes can include adjustments to tax rates, the introduction of new exemptions, or the removal of existing ones. Businesses and consumers should stay informed about these potential shifts to ensure they are prepared for any changes that may impact their operations or purchasing decisions.

Technological Advancements and E-Commerce

The rise of e-commerce and digital platforms has transformed the retail landscape, and its impact on sales tax is significant. As more transactions move online, the challenge of collecting and remitting sales tax accurately becomes more complex. Salt Lake City, like many other regions, may need to adapt its sales tax policies and enforcement mechanisms to keep pace with these digital shifts.

Public Opinion and Tax Reform

Public opinion plays a critical role in shaping tax policies. As residents and businesses in Salt Lake City express their views on sales tax, it can influence the direction of future reforms. This includes considerations such as simplifying the tax system, introducing new tax incentives, or reallocating tax revenues to address specific community needs.

FAQs (Frequently Asked Questions)

Are there any plans to reduce the sales tax rate in Salt Lake City?

+While there have been discussions about tax reforms, including potential reductions, the current sales tax rate remains unchanged. Any significant changes would require legislative action and public support.

How often do sales tax rates change in SLC?

+Sales tax rates can change annually, typically as part of the state’s budgetary process. However, unexpected changes can also occur due to special legislative sessions or emergency measures.

Are there any upcoming tax-free shopping events in Salt Lake City?

+While there are no specific tax-free events currently scheduled, the city often participates in statewide initiatives, such as the Back-to-School Sales Tax Holiday, which offers tax exemptions on certain items during specific periods.