Sales Tax Car Nc

Understanding sales tax on cars in North Carolina is essential for both buyers and sellers. This comprehensive guide delves into the intricacies of the North Carolina sales tax system, offering a detailed breakdown of rates, applicable scenarios, and exemptions. With a focus on clarity and specificity, we aim to provide valuable insights for anyone navigating the state's automotive sales tax landscape.

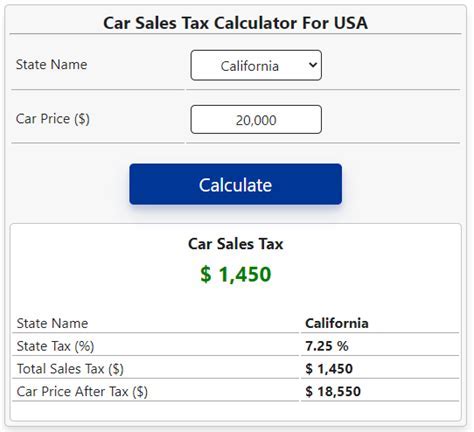

Sales Tax Rates and Calculations

North Carolina imposes a statewide sales tax rate of 4.75% on vehicle purchases. This base rate is consistent across the state, but it’s important to note that local municipalities can add additional taxes, leading to a higher overall tax burden. For instance, the city of Charlotte levies a 2% local sales tax, resulting in a combined rate of 6.75% for car buyers in that area.

The sales tax is calculated based on the purchase price of the vehicle, including any additional costs like dealer preparation fees and delivery charges. However, it's crucial to exclude certain expenses, such as trade-in value and down payments, as these are not subject to sales tax.

Example Calculation

Consider a scenario where a buyer purchases a new car for $30,000 in the city of Charlotte. The sales tax calculation would proceed as follows:

| Sales Tax Calculation | Amount |

|---|---|

| Base Sales Tax (4.75%) | $1,425 |

| Local Sales Tax (2%) | $600 |

| Total Sales Tax | $2,025 |

Exemptions and Special Considerations

While the sales tax is a standard part of vehicle purchases, certain transactions or situations may qualify for exemptions or special treatments. Here are some key considerations:

Vehicle Trade-Ins

When trading in a vehicle, the sales tax is typically calculated based on the difference between the trade-in value and the new vehicle’s purchase price. If the trade-in value exceeds the new car’s price, the tax may be reduced or eliminated. However, it’s important to note that this process can vary based on the specific policies of the dealership and the state’s tax laws.

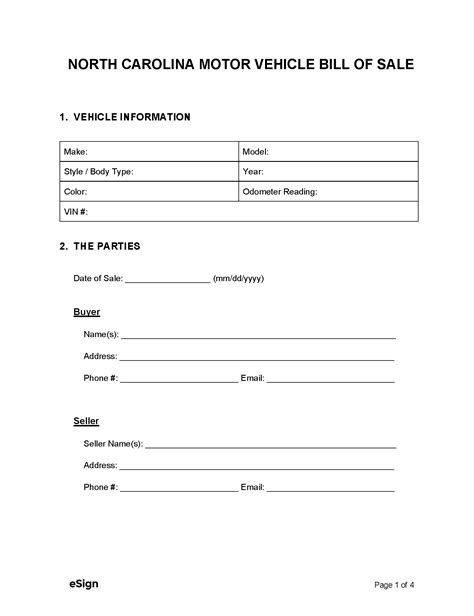

Vehicle Transfers

In the case of vehicle transfers, such as gifting a car to a family member or inheriting one, the sales tax treatment can be complex. North Carolina generally does not require sales tax on inherited vehicles, but for gifted vehicles, the tax liability depends on whether the gift is considered a sale or a gift under state law. It’s advisable to consult with a tax professional for accurate guidance in these scenarios.

Leased Vehicles

For leased vehicles, the sales tax is usually calculated as a percentage of the lease payments, rather than the vehicle’s purchase price. This can result in a lower tax burden for lessees, but it’s essential to review the lease agreement and consult with the leasing company to understand the specific tax obligations.

Tax Exemptions for Specific Groups

North Carolina offers sales tax exemptions for certain groups, including:

- Active-duty military personnel can claim an exemption if they provide a valid military ID and complete the necessary paperwork.

- Certain government entities, such as state and local governments, may be exempt from sales tax on vehicle purchases.

- Charitable organizations may also be eligible for exemptions, depending on the specific use of the vehicle.

Sales Tax Registration and Payment

For sellers, understanding the sales tax registration process and payment requirements is crucial. In North Carolina, sellers are generally required to register with the North Carolina Department of Revenue and obtain a sales tax permit. This permit allows them to collect and remit sales tax on behalf of the state.

The sales tax collected from vehicle purchases must be remitted to the state on a regular basis, typically monthly or quarterly. Sellers are responsible for accurately calculating and reporting the tax collected, and late payments or underreporting can result in penalties and interest charges.

Sales Tax Returns

Sellers must file sales tax returns with the North Carolina Department of Revenue, providing details on the sales made and the tax collected during a specified period. These returns are typically due one month after the end of the reporting period, and the sales tax collected must be paid at the same time. Failure to file accurate returns can lead to serious consequences, including fines and potential legal action.

Future Outlook and Potential Changes

The sales tax landscape in North Carolina, like in many states, is subject to potential changes and updates. While it’s challenging to predict specific amendments, here are some trends and possibilities to consider:

Increased Tax Rates

In recent years, there has been a trend of local governments raising sales tax rates to fund specific projects or address budget deficits. While the statewide sales tax rate has remained stable, local governments have the authority to adjust their rates, leading to variations across different regions.

Online Sales Tax Collection

With the growth of e-commerce, states are increasingly focusing on collecting sales tax from online transactions. North Carolina has already implemented measures to ensure online retailers collect and remit sales tax on purchases made by state residents. This trend is likely to continue, with a focus on ensuring fair taxation for both online and offline retailers.

Simplification of Tax Laws

Efforts to simplify tax laws and reduce complexities are ongoing. While it’s challenging to predict specific changes, there is a possibility that North Carolina may introduce measures to make the sales tax system more straightforward for both buyers and sellers.

Conclusion

Understanding the sales tax landscape in North Carolina is essential for anyone involved in automotive transactions. From calculating sales tax rates to navigating exemptions and staying updated on potential changes, this guide aims to provide a comprehensive overview. By staying informed and seeking professional advice when needed, buyers and sellers can navigate the state’s sales tax system with confidence.

How often do sales tax rates change in North Carolina?

+Sales tax rates in North Carolina can change periodically, typically as a result of legislative actions. While the statewide rate has remained stable in recent years, local governments have the authority to adjust their rates, leading to variations across different regions.

Are there any special considerations for out-of-state vehicle purchases in North Carolina?

+Yes, when purchasing a vehicle out of state and registering it in North Carolina, you may be required to pay use tax. This ensures that you comply with North Carolina’s tax laws, even if the purchase occurred in another state.

Can I deduct sales tax on my vehicle purchase from my federal taxes?

+Generally, no. The deduction for state and local sales taxes as an itemized deduction on federal tax returns was suspended for tax years 2021 through 2025. However, it’s advisable to consult with a tax professional for the most current information.