Inheritance Tax Ny

Inheritance tax, often a complex and nuanced aspect of estate planning, varies significantly across different jurisdictions. New York, being one of the most populous and economically diverse states in the United States, has its own set of rules and regulations surrounding inheritance taxation. Understanding these intricacies is crucial for individuals and families aiming to navigate the estate planning process effectively and ensure their assets are passed on smoothly to their heirs.

The Basics of Inheritance Tax in New York

In New York, the inheritance tax is a state-level tax levied on the transfer of property or assets from a deceased person’s estate to their beneficiaries. Unlike the federal estate tax, which is imposed by the Internal Revenue Service (IRS) on the overall value of an estate, the inheritance tax is a tax on the recipient of the inheritance.

The inheritance tax in New York applies to various types of property, including real estate, personal property, cash, stocks, and other assets. However, it's important to note that not all inheritances are subject to this tax. The taxability of an inheritance depends on several factors, including the relationship between the decedent (the person who has died) and the beneficiary, the value of the inheritance, and the residency status of both parties.

Tax Exemptions and Exclusions

New York offers several exemptions and exclusions that can significantly reduce or eliminate the inheritance tax liability. Here are some key considerations:

- Spouse Exemption: Inheritances received by a surviving spouse are typically exempt from inheritance tax. This means that a spouse can inherit assets from their deceased partner without incurring any tax liability.

- Close Relatives: Inheritances received by close relatives, such as children, parents, grandparents, and siblings, are also exempt from inheritance tax up to a certain threshold. This threshold varies depending on the relationship and the county in which the decedent resided.

- Charitable and Nonprofit Gifts: Transfers of property to charitable organizations or nonprofit entities are generally exempt from inheritance tax, encouraging individuals to support these causes as part of their estate planning.

- Small Estates: Inheritances below a certain value are exempt from inheritance tax. As of [year], this exemption amount stands at $50,000 for spouses and $37,500 for other beneficiaries.

| Relationship | Inheritance Tax Exemption |

|---|---|

| Spouse | $1,000,000 |

| Children | $50,000 |

| Parents | $50,000 |

| Siblings | $37,500 |

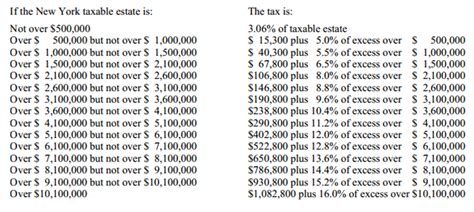

Inheritance Tax Rates and Calculations

The inheritance tax rates in New York are progressive, meaning the tax rate increases as the value of the inheritance rises. The tax rates vary based on the relationship between the decedent and the beneficiary. Here’s a simplified breakdown of the tax rates as of [year]:

| Relationship | Tax Rate |

|---|---|

| Spouse | 0% |

| Children, Parents, Grandparents, and Lineal Descendants | 0% - 16% |

| Siblings and Other Relatives | 0% - 16% |

| Non-relatives and Other Beneficiaries | 0% - 16% |

The tax rates are applied to the value of the inheritance exceeding the applicable exemption amount. For example, if a non-spouse beneficiary receives an inheritance valued at $100,000, they would be exempt from tax on the first $37,500 (assuming they are not a close relative) and would pay a progressive tax rate on the remaining $62,500.

Tax Due Dates and Payment Methods

Inheritance tax returns in New York are due within nine months of the decedent’s death. However, it’s important to note that the tax is due even if the estate is still in the process of being probated. Payment of the inheritance tax can be made through various methods, including checks, money orders, and electronic funds transfer.

It's worth mentioning that New York also allows for the installment payment of inheritance taxes in certain circumstances. This option is typically available for estates that are unable to pay the full tax liability at once. However, interest accrues on the unpaid balance, and a penalty may be imposed if the installments are not paid on time.

Estate Planning Strategies to Minimize Inheritance Tax

Given the complexity and potential financial burden of inheritance taxes, individuals and families often seek strategies to minimize their tax liability. Here are some effective approaches to consider:

Utilizing Exemptions and Exclusions

Understanding and maximizing the available exemptions and exclusions is a key strategy. For instance, gifting assets during one’s lifetime can help reduce the value of the estate and potentially eliminate the need to pay inheritance tax. Additionally, making charitable donations or establishing charitable trusts can leverage the exemption for gifts to charitable organizations.

Creating a Trust

Establishing a trust can provide significant tax benefits. A trust allows for the transfer of assets while maintaining control over how and when those assets are distributed. Certain types of trusts, such as irrevocable trusts, can remove assets from the taxable estate, thereby reducing the overall inheritance tax liability.

Gifting Strategies

Gifting assets to beneficiaries during one’s lifetime can be an effective way to reduce the value of the estate. New York, like many other states, allows for annual gift tax exclusions. This means that individuals can gift a certain amount to each beneficiary each year without incurring gift taxes. By strategically utilizing these exclusions, individuals can gradually transfer assets and potentially reduce the overall inheritance tax burden.

Life Insurance and Annuities

Life insurance policies and annuities can be structured in a way that provides tax benefits. For example, permanent life insurance policies can be used to pay for estate taxes, ensuring that the beneficiaries receive the full inheritance without having to pay taxes on it. Annuities, on the other hand, can provide a steady stream of income to beneficiaries, which may be subject to more favorable tax rates than a lump-sum inheritance.

Working with Professionals

Given the complexity of inheritance tax laws and the potential financial implications, it is highly advisable to seek guidance from experienced professionals. Estate planning attorneys and tax advisors can provide tailored strategies based on an individual’s unique circumstances, ensuring compliance with the law and maximizing tax efficiency.

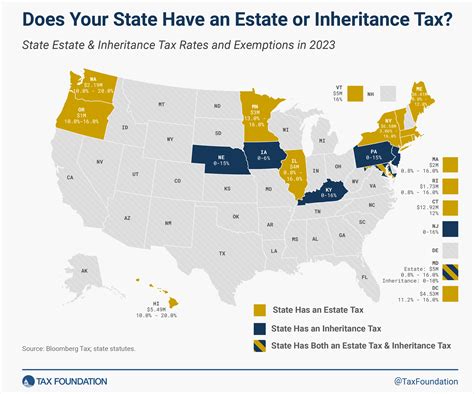

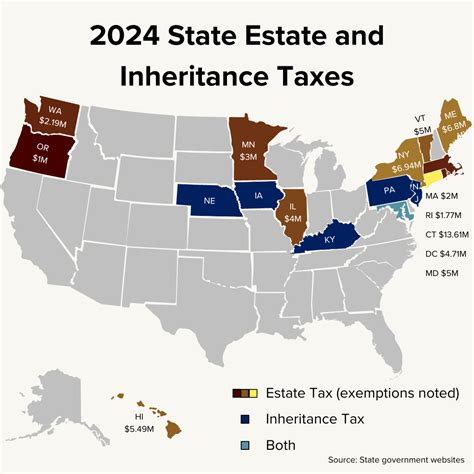

The Future of Inheritance Taxation in New York

Inheritance tax laws are subject to change, and keeping up with the latest developments is essential for effective estate planning. As of [year], there have been no significant changes to New York’s inheritance tax laws. However, it’s important to monitor any proposed legislation or policy shifts that could impact inheritance taxation in the future.

Furthermore, the state's budgetary needs and economic landscape can influence tax policies. Understanding the broader economic context and staying informed about potential changes can help individuals and families adapt their estate planning strategies accordingly.

Potential Reforms and Trends

While it’s challenging to predict specific reforms, some trends and potential developments in inheritance taxation are worth noting:

- Increasing Exemptions: There has been a growing trend across states to increase inheritance tax exemptions, especially for close relatives. This trend may continue in New York, making it more beneficial for individuals to pass on assets to their loved ones.

- Simplification of Tax Codes: Simplifying tax codes and reducing complexity is a common goal among policymakers. This could lead to more straightforward inheritance tax laws, making it easier for individuals to understand and comply with their tax obligations.

- Enhanced Tax Enforcement: As governments seek to maximize revenue, there may be a greater focus on enforcing inheritance tax laws. This could include more rigorous audits and increased penalties for non-compliance.

Conclusion: Navigating Inheritance Tax in New York

Inheritance tax in New York is a complex yet crucial aspect of estate planning. By understanding the exemptions, tax rates, and available strategies, individuals can minimize their tax liability and ensure a smooth transfer of assets to their beneficiaries. Working with professionals and staying updated on tax law changes are essential steps in this process.

As the economic landscape and tax policies evolve, staying informed and adaptable is key to effective estate planning. Whether through strategic gifting, establishing trusts, or leveraging charitable donations, individuals can navigate the complexities of inheritance taxation and secure a brighter financial future for their loved ones.

Is there an inheritance tax in New York State?

+Yes, New York State imposes an inheritance tax on certain inheritances received by beneficiaries from a deceased individual’s estate. The tax is levied based on the relationship between the decedent and the beneficiary, as well as the value of the inheritance.

Who is exempt from paying inheritance tax in New York?

+Spouses and certain close relatives, such as children, parents, and siblings, are typically exempt from paying inheritance tax in New York. Additionally, inheritances below a certain value (as of [year], this threshold is 50,000 for spouses and 37,500 for other beneficiaries) are also exempt.

How are inheritance tax rates determined in New York?

+Inheritance tax rates in New York are progressive, meaning the tax rate increases as the value of the inheritance rises. The rates vary based on the relationship between the decedent and the beneficiary, with higher rates applied to inheritances received by more distant relatives or non-relatives.

When is the inheritance tax due in New York?

+Inheritance tax returns in New York are due within nine months of the decedent’s death. It’s important to note that the tax is due even if the estate is still in the process of being probated.

Are there any strategies to minimize inheritance tax in New York?

+Yes, there are several strategies to minimize inheritance tax in New York. These include maximizing available exemptions and exclusions, creating trusts, utilizing gifting strategies, and seeking professional guidance from estate planning attorneys and tax advisors.