Trump Child Tax Credit 2025

In the world of fiscal policies and government initiatives, the Trump Child Tax Credit (CTC) stands as a significant measure introduced during the Trump administration. This policy, designed to provide financial support to families with children, has had a notable impact on American households. As we approach 2025, it is crucial to delve into the details, implications, and potential future directions of this credit to understand its role in shaping the financial landscape for families.

Understanding the Trump Child Tax Credit

The Trump Child Tax Credit was a key component of the Tax Cuts and Jobs Act (TCJA) of 2017, a comprehensive tax reform package signed into law by President Donald Trump. The CTC aimed to reduce the tax burden on families with children by providing a refundable credit, offering a significant boost to household incomes. Here’s a deeper dive into the specifics of this credit:

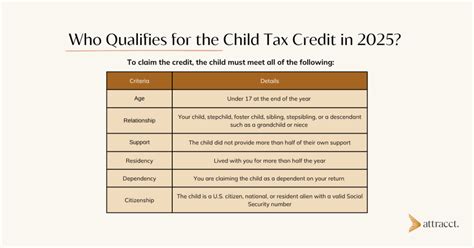

Eligibility and Criteria

To be eligible for the Trump CTC, taxpayers must have a qualifying child under the age of 17. The credit is non-refundable, meaning it can reduce a taxpayer’s liability to zero but cannot result in a refund beyond that amount. However, for taxpayers with earnings above a certain threshold, the credit becomes partially refundable, allowing for a refund of a portion of the credit amount.

| Eligibility Criteria | Details |

|---|---|

| Qualifying Child | Must be under 17 years old as of the end of the tax year. |

| Taxpayer Earnings | Income thresholds vary based on filing status. For example, for married filing jointly, the phase-out begins at $400,000 in adjusted gross income (AGI), and for single filers, it starts at $200,000 in AGI. |

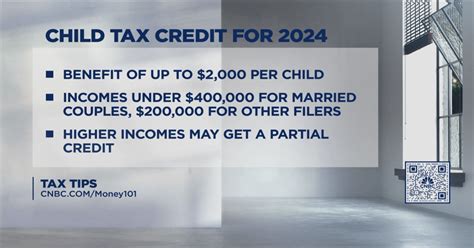

Credit Amounts and Calculation

The Trump CTC offers a credit of 2,000 per qualifying child</strong>, a substantial increase from the previous credit amount. This credit is claimed on Form 1040 and is calculated based on the taxpayer's adjusted gross income (AGI) and other relevant factors. The credit amount begins to phase out for higher-income taxpayers, reducing by 50 for every $1,000 (or fraction thereof) above the threshold.

For example, a married couple filing jointly with an AGI of $405,000 would receive a credit of $1,500 ($2,000 - ($5,000 x $50)), as their income exceeds the phase-out threshold by $5,000.

Impact and Benefits

The Trump CTC has had a substantial impact on the financial well-being of families. According to a study by the Tax Policy Center, the CTC and other family tax benefits under the TCJA reduced the child poverty rate by approximately 12% in 2018. This credit has provided a much-needed financial cushion for families, helping them cover essential expenses such as childcare, education, and healthcare.

Future Outlook and Potential Changes

As we look ahead to 2025, the future of the Trump CTC remains a topic of discussion and potential reform. Here are some key considerations and potential scenarios:

Expanding Eligibility and Credit Amounts

There have been ongoing debates and proposals to expand the eligibility criteria for the CTC. Some policymakers advocate for including older children and young adults, particularly those in college or facing financial challenges. Extending the credit to cover a broader age range could provide additional support to families facing rising costs of higher education.

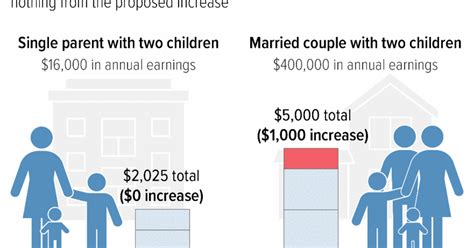

Additionally, proposals to increase the credit amount to $3,000 or even $3,600 per child have gained traction. These higher credit amounts would provide a more substantial financial boost to families, especially those with multiple children.

Making the Credit Fully Refundable

One of the key criticisms of the Trump CTC is its partial refundability. Making the credit fully refundable would ensure that all eligible families receive the full benefit, regardless of their tax liability. This change would be particularly beneficial to low-income families who often face financial barriers to claiming tax credits.

Automatic CTC Payments

Building on the success of the American Rescue Plan Act of 2021, which introduced advance monthly payments for the CTC, there is a possibility of making these payments automatic and ongoing. This approach would provide families with a steady stream of income throughout the year, rather than a lump-sum refund at tax time. Automatic payments could streamline the process and ensure that families receive the support they need when they need it most.

Inflation Adjustments

With inflation rates on the rise, adjusting the CTC for inflation could be crucial to maintaining its purchasing power. By indexing the credit amount and eligibility thresholds to inflation, the CTC would retain its value over time, ensuring that families continue to receive adequate support.

Real-World Impact Stories

To understand the true impact of the Trump CTC, let’s look at some real-life stories:

Sarah's Story: Sarah, a single mother of two, saw a significant boost in her financial stability after claiming the CTC. The credit allowed her to cover her children's extracurricular activities and helped her save for their future education. With the potential increase in credit amounts, Sarah could further invest in her children's development and ensure a brighter future.

John and Emily's Story: This married couple, with a combined income above the phase-out threshold, received a reduced CTC. However, with the proposed changes to make the credit fully refundable, they would receive the full $4,000 benefit, providing them with more financial flexibility to plan for their family's future.

Technical Insights and Specifications

For those seeking a deeper understanding of the technical aspects of the Trump CTC, here are some key specifications:

Tax Forms and Instructions

- Form 1040: This is the primary tax form used to claim the CTC. Taxpayers must complete the relevant sections and provide information about their qualifying children.

- Instructions for Form 1040: The IRS provides detailed instructions on how to calculate and claim the CTC. These instructions cover eligibility, credit amount, and any applicable limitations.

Tax Software Integration

Most popular tax preparation software, such as TurboTax and H&R Block, have integrated the Trump CTC into their platforms. These tools guide taxpayers through the process of claiming the credit, ensuring accuracy and ease of use.

Online Resources

The IRS website offers a wealth of information and resources related to the Trump CTC. Taxpayers can find detailed explanations, FAQs, and interactive tools to help them understand their eligibility and calculate their credit amount.

FAQs: Trump Child Tax Credit

How often is the Child Tax Credit paid out in 2025?

+

The frequency of Child Tax Credit payments in 2025 will depend on the specific legislation or program in place. Under the American Rescue Plan Act of 2021, advance monthly payments were issued for 2021, but the future frequency may vary.

What is the maximum Child Tax Credit amount in 2025?

+

The maximum Child Tax Credit amount in 2025 will be determined by the applicable tax law at that time. As of 2021, the maximum credit is $2,000 per qualifying child, but future legislation could change this amount.

Are there any income limits for claiming the Child Tax Credit in 2025?

+

Income limits for claiming the Child Tax Credit can vary depending on the tax year and specific legislation. Generally, there are phase-out thresholds for higher-income taxpayers. The income limits for 2025 will be defined by the tax laws in effect at that time.

How do I apply for the Child Tax Credit in 2025 if I didn’t receive it automatically?

+

If you didn’t receive the Child Tax Credit automatically, you’ll need to claim it when filing your tax return for the applicable tax year. The process involves completing the necessary tax forms, such as Form 1040 and Schedule 8812, and providing information about your qualifying children.

Can the Child Tax Credit be used to reduce my tax liability to zero in 2025?

+

Yes, the Child Tax Credit can reduce your tax liability to zero in 2025. It’s a non-refundable credit, meaning it can offset your tax liability up to the full amount of the credit. Any excess credit beyond your tax liability cannot be refunded.

As we navigate the fiscal landscape in 2025 and beyond, the Trump Child Tax Credit continues to be a vital tool for supporting families and reducing financial burdens. With potential reforms on the horizon, the future of this credit looks promising, offering greater benefits and stability to American households.