New York Property Tax Rate

Property taxes in New York City are a significant aspect of homeownership and play a crucial role in the city's economy and infrastructure. Understanding the New York property tax rate is essential for homeowners, prospective buyers, and anyone interested in the real estate market. This comprehensive guide aims to provide an in-depth analysis of the property tax landscape in New York, shedding light on its intricacies and implications.

The Mechanics of New York Property Taxes

New York City’s property tax system is complex, with rates and regulations varying across the five boroughs. The tax is calculated based on the assessed value of a property, which is determined by the New York City Department of Finance through a process known as tax assessment. This assessment takes into account factors such as the property’s location, size, condition, and recent sales data.

The property tax rate in New York is expressed as a mill rate, which represents the amount of tax owed per $1,000 of assessed value. For instance, a mill rate of 1000 would mean that a property owner pays $1000 in taxes for every $1,000 of assessed value. This rate is then applied to the taxable assessed value of the property to determine the annual tax bill.

It's important to note that New York City operates on a fiscal year that runs from July 1st to June 30th of the following year. Property taxes are due in two installments, with the first payment typically due by January 1st and the second by July 1st. Failure to pay on time can result in penalties and interest charges.

Understanding the Tax Assessment Process

The tax assessment is a critical step in determining a property’s tax liability. The Department of Finance conducts this process every two years, with the next scheduled assessment expected in 2024. During an assessment, the city evaluates properties to ensure the taxable value aligns with current market conditions.

Property owners have the right to review their assessment and dispute it if they believe it is inaccurate. The process involves submitting evidence, such as recent sales data or appraisals, to support the claim. It's crucial for property owners to stay informed about their assessment and take advantage of the appeal process if necessary.

Appealing Your Property Tax Assessment

If you believe your property’s assessed value is too high, you can file an appeal with the New York City Tax Commission. The appeal process involves submitting a Notice of Petition and Petition for Review, along with supporting documentation. The Tax Commission then schedules a hearing where you can present your case.

To strengthen your appeal, it's advisable to consult with a tax professional or attorney who specializes in property tax matters. They can guide you through the process and help gather the necessary evidence to support your claim.

| Property Tax Appeal Timeline | Key Dates |

|---|---|

| Notice of Assessment Mailing | Late March to Mid-April |

| Deadline for Filing Appeal | May 15th |

| Hearing Dates | July to September |

| Decision Release | October to November |

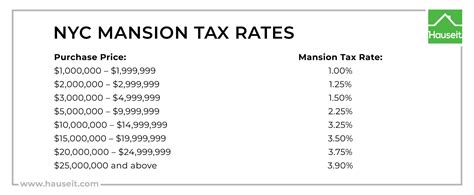

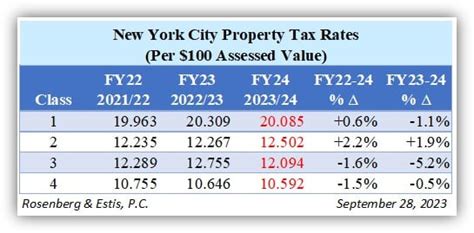

Current Property Tax Rates in New York

The New York City property tax rate varies depending on the borough and the type of property. As of my last update in January 2023, here’s a breakdown of the current mill rates:

Manhattan

The Manhattan borough has a mill rate of 19.51 for residential properties and 24.85 for commercial properties. This means that for every 1,000 of assessed value, residential property owners pay 195.10 in taxes, while commercial property owners pay $248.50.

Brooklyn

In Brooklyn, the mill rate is 19.45 for residential properties and 23.62 for commercial properties. This translates to a tax bill of 194.50 for every 1,000 of assessed value for residential owners and $236.20 for commercial owners.

Queens

Queens has a slightly lower mill rate compared to Manhattan and Brooklyn. The current rate is 18.79 for residential properties and 22.97 for commercial properties, resulting in tax bills of 187.90 and 229.70 per $1,000 of assessed value, respectively.

Bronx

The Bronx has a mill rate of 19.49 for residential properties and 23.62 for commercial properties. This means that residential property owners pay 194.90 in taxes for every 1,000 of assessed value, while commercial owners pay $236.20.

Staten Island

In Staten Island, the mill rate is 18.88 for residential properties and 22.97 for commercial properties. This results in tax bills of 188.80 and 229.70 per $1,000 of assessed value, respectively.

Impact of Property Taxes on Homeownership

Property taxes are a significant financial obligation for homeowners in New York City. They contribute to the city’s infrastructure, including schools, public transportation, and essential services. However, the burden of these taxes can vary significantly depending on the property’s location and value.

For instance, a homeowner in Manhattan's Upper East Side with a residential property valued at $2 million can expect to pay approximately $39,020 in annual property taxes. On the other hand, a homeowner in Staten Island with a similar-valued property might pay around $37,760 in taxes.

Property Tax Incentives and Exemptions

New York City offers various property tax incentives and exemptions to eligible homeowners. These programs aim to provide relief to specific groups and encourage homeownership.

- Senior Citizen Rent and Property Tax Relief Program: Provides income-eligible seniors with a partial property tax exemption. The exemption amount depends on the homeowner's income and property value.

- School Tax Relief (STAR): Offers a reduction in school taxes for primary residences. Homeowners can apply for the basic STAR exemption, which provides a savings of up to $3,050 on their school tax bill.

- Veterans' Exemption: Honors veterans by offering a partial property tax exemption. The amount of the exemption depends on the veteran's service record and disability status.

The Future of Property Taxes in New York

As New York City continues to evolve, the property tax landscape is likely to experience changes. The upcoming 2024 tax assessment will provide an updated valuation of properties, potentially impacting tax rates and bills. Additionally, the city’s ongoing efforts to improve infrastructure and services may influence future tax rates.

It's crucial for property owners and prospective buyers to stay informed about these changes and understand their implications. Regularly reviewing property tax rates and staying engaged with the local government can help ensure fair taxation and provide an opportunity to voice concerns or suggestions.

Conclusion

Understanding the New York property tax rate is a vital aspect of homeownership and real estate investment in the city. From the complex assessment process to the varying tax rates across boroughs, this guide has provided an in-depth look at the intricacies of property taxation in New York. By staying informed and proactive, homeowners can navigate the tax landscape effectively and ensure their financial obligations are met.

What is the average property tax rate in New York City?

+The average property tax rate in New York City varies by borough and property type. As of January 2023, the average mill rate for residential properties is approximately 19.40, while for commercial properties, it is around 23.60.

How often are property taxes due in New York City?

+Property taxes in New York City are due in two installments. The first payment is typically due by January 1st, and the second by July 1st of the same fiscal year.

Can I appeal my property tax assessment in New York City?

+Yes, property owners have the right to appeal their tax assessment if they believe it is inaccurate. The appeal process involves submitting an application and supporting documentation to the New York City Tax Commission.

Are there any property tax incentives or exemptions in New York City?

+Yes, New York City offers various property tax incentives and exemptions to eligible homeowners. These include programs for senior citizens, veterans, and those seeking school tax relief.