Ms State Tax Refund Status

Tax refunds are a critical aspect of financial planning for many individuals and businesses, especially when dealing with state-specific tax systems. In the United States, each state has its own set of tax regulations and processes, which can often lead to complexities and unique scenarios for taxpayers. Understanding how to navigate the state tax refund system is essential to ensuring timely and accurate financial management.

This comprehensive guide aims to provide an in-depth analysis of the Ms State Tax Refund Status process, offering valuable insights and practical advice for taxpayers. By exploring the intricacies of this state's tax refund system, we aim to empower taxpayers with the knowledge and tools needed to efficiently track and manage their refunds.

The Ms State Tax System: An Overview

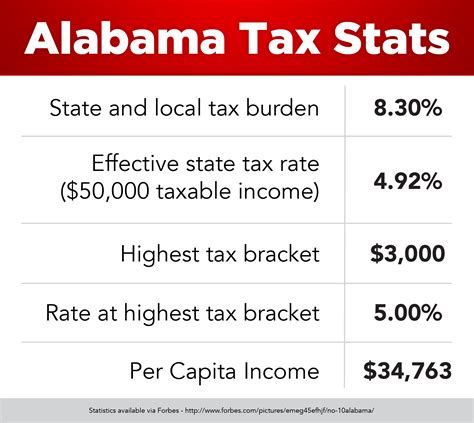

The tax system of Ms State is designed to generate revenue for the state’s various operations and services. It involves a range of taxes, including income tax, sales tax, property tax, and various other levies. The state’s income tax structure is particularly notable, with progressive rates that vary based on individual or business income brackets.

Understanding the Ms State tax system is the first step toward navigating the refund process effectively. The state's Department of Revenue plays a pivotal role in managing tax collections and refunds, ensuring compliance with state tax laws, and providing support to taxpayers.

Key aspects of the Ms State tax system include:

- Progressive Income Tax Rates: Ms State's income tax rates increase with higher income levels, encouraging a fair distribution of tax burdens.

- Sales Tax: The state levies sales tax on various goods and services, contributing significantly to its revenue.

- Property Tax: Property owners in Ms State are subject to property taxes, which vary based on the assessed value of their properties.

- Tax Filing Deadlines: Ms State sets specific deadlines for tax filings, usually aligning with federal tax deadlines for individual and business taxpayers.

Tax Refund Eligibility and Criteria

Not all taxpayers are eligible for tax refunds in Ms State. Refunds are typically issued when the taxes paid by an individual or business exceed their actual tax liability for a given period. This can occur due to various reasons, such as overpayment, changes in tax laws, or qualifying for specific tax credits or deductions.

To be eligible for a tax refund in Ms State, taxpayers must meet certain criteria. These criteria include:

- Timely Tax Filing: Taxpayers must file their tax returns by the designated deadline to be considered for a refund.

- Correct and Accurate Information: The tax return must contain accurate and truthful information about the taxpayer's income, deductions, and credits.

- Compliance with State Tax Laws: Taxpayers must adhere to all state tax regulations to qualify for a refund.

- No Outstanding Liabilities: Taxpayers with outstanding tax liabilities, penalties, or fees may have their refunds applied to clear these obligations first.

Tracking Your Ms State Tax Refund: A Step-by-Step Guide

Knowing how to track the status of your Ms State tax refund is crucial for effective financial management. The state’s Department of Revenue offers several methods for taxpayers to check their refund status, ensuring transparency and convenience.

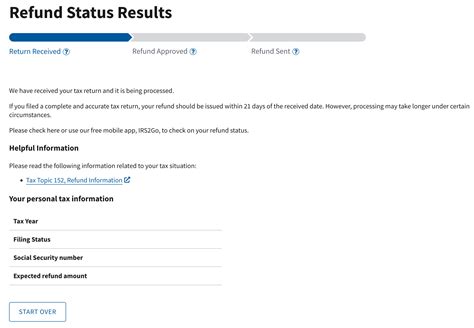

Online Refund Status Check

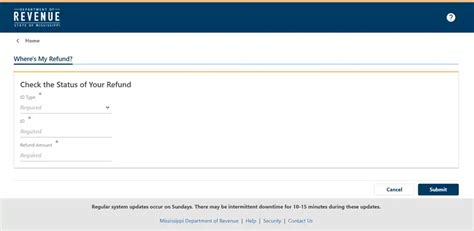

The most efficient way to track your Ms State tax refund is through the state’s official website. The Department of Revenue provides an online portal where taxpayers can log in and access their refund information. Here’s a step-by-step guide to checking your refund status online:

- Visit the Ms State Department of Revenue Website.

- Navigate to the "Taxpayer Services" section and select "Check Refund Status."

- Enter your Taxpayer Identification Number (TIN) or Social Security Number (SSN) and your refund amount from the previous year's tax return.

- Click "Submit" to retrieve your refund status.

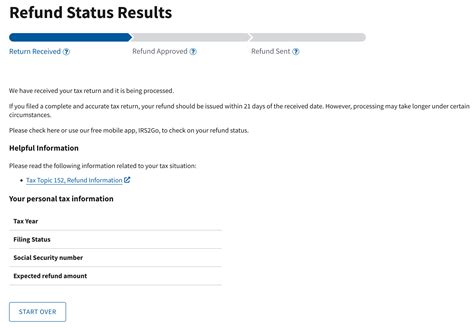

- The portal will display the current status of your refund, including the date it was processed and the expected delivery date.

Telephone Refund Inquiry

For taxpayers who prefer a more personal approach, the Ms State Department of Revenue offers a telephone refund inquiry service. This option is especially useful for those who may not have access to the internet or prefer speaking directly with a representative.

- Dial the Ms State Tax Refund Hotline at 1-800-MS-TAX-REFUND (1-800-678-2973).

- Follow the automated prompts to enter your TIN or SSN and refund amount from the previous year's tax return.

- The automated system will provide you with your refund status, including any relevant updates.

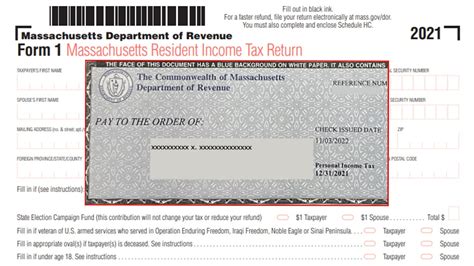

Mail-in Refund Inquiry

While less common, taxpayers can also inquire about their refund status via mail. This method is ideal for those who prefer traditional communication channels or have concerns about the security of online platforms.

- Download and print the Ms State Tax Refund Inquiry Form from the Department of Revenue's website.

- Fill out the form with your TIN or SSN, refund amount, and any other requested information.

- Mail the completed form to the Ms State Department of Revenue at the address provided on the form.

- Allow 10-14 business days for a response from the Department of Revenue.

Ms State Tax Refund Processing Times: What to Expect

Understanding the typical processing times for Ms State tax refunds is essential for managing expectations and financial planning. The state’s Department of Revenue aims to process refunds promptly, but various factors can influence the timeline.

Standard Refund Processing Times

Under normal circumstances, Ms State processes tax refunds within 6-8 weeks of receiving a complete and accurate tax return. This timeframe includes the time needed for the Department of Revenue to review the return, calculate the refund amount, and issue the refund.

It's important to note that the processing time may vary based on the complexity of the tax return and the volume of refunds being processed during a particular period. For instance, refunds filed during the peak tax season (typically January to April) may take longer due to the high volume of returns being processed.

Factors Affecting Refund Processing Times

Several factors can impact the processing time of Ms State tax refunds. These include:

- Error or Incomplete Information: If your tax return contains errors or incomplete information, the Department of Revenue may need additional time to verify the details, which can delay the processing of your refund.

- Tax Law Changes: Significant changes in tax laws can impact the processing of refunds, as the Department of Revenue needs to adjust its systems and processes accordingly.

- Identity Verification: In some cases, the Department of Revenue may require additional identity verification to prevent fraud. This process can extend the refund processing time.

- Refund Amount: Larger refund amounts may undergo additional scrutiny, which can lengthen the processing time.

Maximizing Your Ms State Tax Refund: Strategies and Tips

While the primary focus of this guide is on understanding and tracking your Ms State tax refund, it’s also essential to consider strategies that can help maximize your refund amount. Here are some tips and strategies to consider:

Understand Tax Deductions and Credits

Ms State offers a range of tax deductions and credits that can reduce your tax liability and increase your refund. These include:

- Standard Deductions: Ms State allows taxpayers to deduct a standard amount from their taxable income, which can vary based on filing status.

- Itemized Deductions: Taxpayers can choose to itemize their deductions, claiming specific expenses such as mortgage interest, medical expenses, and charitable donations.

- Tax Credits: Ms State offers various tax credits, including the Child Tax Credit, Education Tax Credit, and Low-Income Tax Credit, which can significantly reduce your tax liability.

Utilize Tax Preparation Software

Investing in tax preparation software can be a wise decision for taxpayers. These tools can help you identify deductions and credits you may be eligible for, ensuring you receive the maximum refund possible. Additionally, tax software can streamline the tax filing process, reducing the risk of errors and ensuring a more accurate tax return.

Stay Informed About Tax Law Changes

Tax laws are subject to change, and staying informed about these changes can help you optimize your tax strategy. The Ms State Department of Revenue provides resources and updates on its website, including information on recent tax law changes and their implications for taxpayers.

Common Issues and Resolutions: Navigating Ms State Tax Refund Challenges

Despite your best efforts, you may encounter issues or challenges with your Ms State tax refund. Understanding common problems and their resolutions can help you navigate these situations effectively.

Delayed Refunds

One of the most common issues taxpayers face is a delayed refund. While Ms State aims to process refunds within the standard timeframe, various factors can cause delays. If your refund is taking longer than expected, consider the following steps:

- Check your refund status using the methods outlined earlier in this guide.

- Review your tax return for errors or incomplete information. If found, amend your return and resubmit it to the Department of Revenue.

- Contact the Ms State Taxpayer Assistance Center for further guidance. They can provide personalized support and help resolve any issues causing the delay.

Refund Discrepancies

In some cases, taxpayers may receive a refund that differs from the expected amount. This can occur due to various reasons, such as changes in tax laws, adjustments made by the Department of Revenue, or errors in the taxpayer’s calculations.

- Review your tax return and compare it with your refund amount. Identify any discrepancies and understand the reasons for the difference.

- If you believe the discrepancy is due to an error, contact the Ms State Department of Revenue to discuss the issue and request a review.

- Keep detailed records of your tax calculations and any supporting documentation to facilitate the resolution process.

Missing or Stolen Refunds

Unfortunately, taxpayers may sometimes face the unfortunate situation of a missing or stolen refund. This can occur due to various reasons, including mail theft, identity theft, or processing errors.

- If you suspect your refund is missing or has been stolen, contact the Ms State Department of Revenue immediately. They can help you track the status of your refund and guide you through the necessary steps to resolve the issue.

- Consider filing a police report if you suspect identity theft or fraud. This can help protect your financial interests and facilitate the resolution process.

- Keep detailed records of all communications with the Department of Revenue and any supporting documentation to support your claim.

Conclusion: Empowering Taxpayers with Knowledge

Navigating the Ms State tax refund system can be a complex process, but with the right knowledge and tools, taxpayers can effectively track and manage their refunds. This guide has provided an in-depth analysis of the Ms State tax refund status process, offering practical insights and strategies to empower taxpayers.

By understanding the state's tax system, eligibility criteria, and tracking methods, taxpayers can ensure timely and accurate refund management. Additionally, by employing strategies to maximize their refunds and staying informed about tax law changes, taxpayers can optimize their financial planning and ensure a smoother tax season.

Remember, the Ms State Department of Revenue is a valuable resource for taxpayers, offering support and guidance throughout the tax refund process. By leveraging these resources and staying informed, taxpayers can confidently navigate the state's tax system and make the most of their tax refunds.

How often does Ms State update the status of tax refunds on its website?

+The Ms State Department of Revenue updates the status of tax refunds on its website daily. This ensures that taxpayers have access to the most current information about their refunds.

Can I check my Ms State tax refund status by phone if I don’t have access to the internet?

+Absolutely! The Ms State Tax Refund Hotline provides a convenient alternative for taxpayers who prefer a phone-based inquiry. Simply dial the hotline number and follow the automated prompts to retrieve your refund status.

What should I do if I receive a refund amount that is different from what I expected?

+If you receive a refund amount that differs from your expectations, it’s essential to review your tax return and compare it with the refund amount. If you identify any discrepancies, contact the Ms State Department of Revenue for further assistance and a detailed review of your case.

Are there any penalties for late tax filing in Ms State?

+Yes, Ms State imposes penalties for late tax filing. These penalties can include interest charges on the outstanding tax liability and potential fines. It’s crucial to file your tax return by the designated deadline to avoid these penalties and ensure timely refund processing.

Can I request an extension for filing my Ms State tax return if I need more time?

+Ms State does offer the option to request an extension for filing your tax return. To do so, you need to submit Form Ms-4868 before the original filing deadline. However, it’s important to note that requesting an extension does not extend the deadline for paying any taxes owed. You must pay any taxes due by the original filing deadline to avoid penalties and interest.