City Tax Rate Los Angeles

Welcome to our in-depth exploration of the city tax rates in Los Angeles, a topic of great importance for both residents and businesses operating within this vibrant metropolis. The tax landscape in Los Angeles is a complex one, with various types of taxes contributing to the city's revenue and influencing economic decisions. In this article, we will delve into the specifics of the Los Angeles city tax rate, providing a comprehensive understanding of its structure, implications, and unique features.

Understanding the Los Angeles City Tax Rate

The city of Los Angeles, known for its diverse culture, thriving industries, and iconic landmarks, operates under a unique tax system that funds essential public services and infrastructure development. This system comprises a range of taxes, each with its own rate and purpose, which collectively contribute to the city’s fiscal health.

One of the primary taxes levied by the city is the Los Angeles Business Tax, often referred to as the Business Tax or Business License Tax. This tax is imposed on businesses operating within the city limits, regardless of their physical presence or incorporation status. It is a crucial source of revenue for the city, enabling the funding of vital services such as public safety, transportation, and healthcare.

The Business Tax: A Key Component

The Business Tax in Los Angeles is a complex levy, designed to capture a wide range of economic activities. It is calculated based on various factors, including the nature of the business, its location, and its gross receipts or revenue. This tax is a significant consideration for businesses operating in the city, as it directly impacts their operational costs and profitability.

To illustrate, consider a hypothetical scenario where a tech startup, Innovate Inc., is planning to establish its headquarters in Los Angeles. The company's gross receipts for the year are projected to be $5 million. According to the Los Angeles Business Tax guidelines, Innovate Inc. would be subject to a tax rate of 0.12% on its gross receipts, resulting in a tax liability of $6,000 for the year.

| Business Type | Tax Rate | Gross Receipts ($) | Estimated Tax Liability ($) |

|---|---|---|---|

| Tech Startup | 0.12% | 5,000,000 | 6,000 |

| Retail Store | 0.15% | 3,000,000 | 4,500 |

| Service Provider | 0.08% | 800,000 | 640 |

Tax Exemptions and Credits

While the Los Angeles Business Tax is a substantial levy, the city also recognizes the importance of supporting small businesses and encouraging economic growth. As such, it offers a range of tax exemptions and credits to eligible businesses. These incentives can significantly reduce the tax burden on businesses, making Los Angeles an attractive location for entrepreneurs and established enterprises alike.

For instance, start-up businesses may be eligible for a tax exemption during their first year of operation, providing them with a much-needed financial boost as they establish their presence in the city. Additionally, businesses that create new jobs or invest in community development projects may qualify for tax credits, further incentivizing their positive contributions to the local economy.

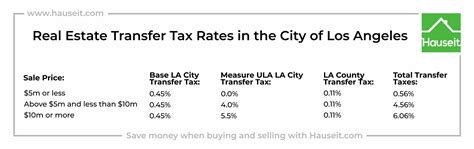

Real Estate Taxes

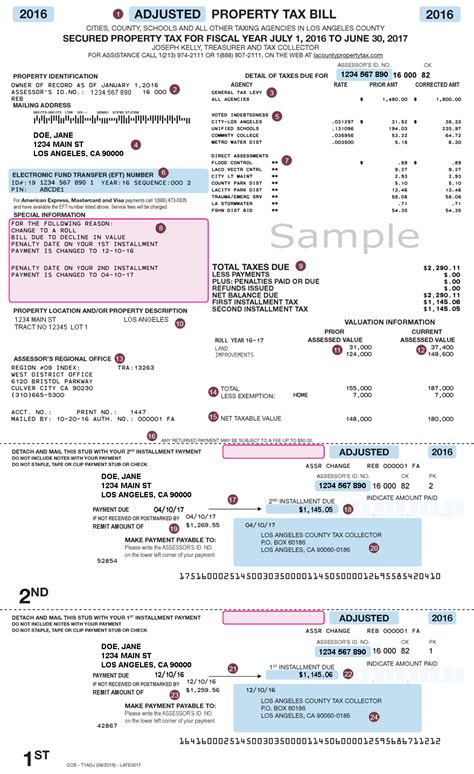

Beyond the Business Tax, Los Angeles also imposes taxes on real estate properties within its jurisdiction. These taxes, often referred to as property taxes, are levied on both residential and commercial properties and are a significant source of revenue for the city’s infrastructure and public services.

The property tax rate in Los Angeles is typically calculated as a percentage of the assessed value of the property. This assessment takes into account factors such as the property's size, location, and recent sales data. The resulting tax liability is then divided into annual installments, due at specific intervals throughout the year.

Consider the example of a residential property in Los Angeles with an assessed value of $800,000. Based on the city's property tax rate of 0.75%, the annual tax liability for this property would amount to $6,000. This tax is essential for maintaining and improving the city's infrastructure, including roads, schools, and public facilities.

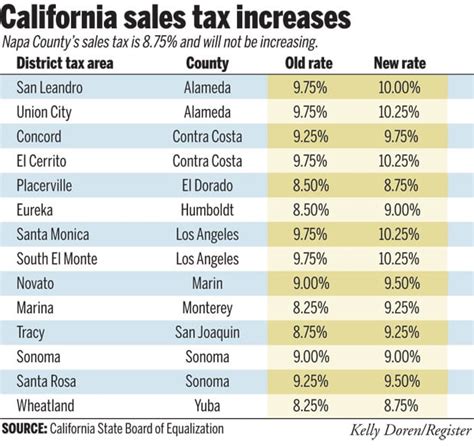

Sales and Use Taxes

In addition to business and property taxes, Los Angeles also collects sales and use taxes, which are an important source of revenue for the city and the state of California. These taxes are applied to the sale of goods and services and are typically included in the final price paid by consumers.

The sales tax rate in Los Angeles is comprised of both city and state components. As of the latest data, the combined sales tax rate in Los Angeles is 9.5%, which includes a city rate of 2.5%, a county rate of 1%, and a state rate of 6%. This rate is subject to change, and businesses must stay informed about any updates to ensure compliance.

For instance, a consumer purchasing a new laptop in Los Angeles for $1,000 would pay an additional $95 in sales tax, bringing the total cost of the laptop to $1,095. This tax revenue is crucial for funding various public services and infrastructure projects in the city.

Tax Compliance and Enforcement

The City of Los Angeles takes tax compliance seriously, with dedicated departments and agencies responsible for enforcing tax laws and collecting revenues. These entities ensure that businesses and individuals meet their tax obligations, maintaining a fair and equitable tax system.

Businesses operating in Los Angeles are required to register for the appropriate taxes and obtain the necessary licenses and permits. Failure to comply with these regulations can result in penalties, fines, and even legal consequences. Therefore, it is imperative for businesses to understand their tax obligations and seek professional guidance when needed.

The Impact of Los Angeles City Taxes

The tax system in Los Angeles has a profound impact on the city’s economic landscape and the lives of its residents. It shapes investment decisions, influences business operations, and funds essential public services that enhance the quality of life for all Angelenos.

Attracting Investments and Businesses

The tax structure in Los Angeles plays a crucial role in attracting new businesses and investments to the city. While the Business Tax is a significant consideration, the city’s overall tax environment, including incentives and credits, can make it an attractive destination for entrepreneurs and established companies alike.

For instance, Los Angeles offers a Film and Television Tax Credit program, which provides tax incentives for film and television productions. This program has successfully attracted numerous entertainment projects to the city, boosting the local economy and creating jobs. Similarly, the city's Research and Development Tax Credit encourages innovation and technological advancements, making Los Angeles a hub for cutting-edge industries.

Funding Essential Services

The revenue generated through city taxes is a critical source of funding for essential public services and infrastructure projects. These taxes enable the city to maintain and improve its transportation networks, including roads, public transit, and airports. They also support the city’s renowned healthcare system, education institutions, and public safety initiatives.

Consider the example of the Los Angeles County Metropolitan Transportation Authority (Metro), which relies heavily on tax revenues to fund its extensive network of buses, trains, and subways. These public transportation options not only reduce traffic congestion but also provide affordable and accessible mobility for residents and visitors alike.

Economic Development and Community Growth

Beyond funding public services, the city’s tax revenues also contribute to economic development and community growth initiatives. These funds are often directed towards revitalizing neighborhoods, supporting small businesses, and investing in education and workforce development programs.

For instance, the Los Angeles Cleantech Incubator (LACI) is a program that provides resources and support to cleantech startups, helping them grow and contribute to the city's sustainability goals. Similarly, the Los Angeles Community Development Department focuses on revitalizing underserved communities, improving housing conditions, and promoting economic opportunities.

Future Outlook and Considerations

As Los Angeles continues to evolve and adapt to changing economic and social landscapes, the city’s tax system will play a pivotal role in shaping its future. While the current tax structure has proven effective in funding essential services and attracting investments, ongoing analysis and adjustments are necessary to ensure its continued relevance and fairness.

Potential Tax Reforms

As the city’s economic landscape evolves, there may be calls for tax reforms to address emerging challenges and opportunities. These reforms could include adjustments to tax rates, the introduction of new taxes, or the modification of existing tax structures to better align with the city’s economic goals.

For instance, as the city embraces technological advancements and the gig economy, there may be discussions around the taxation of digital services and the sharing economy. These emerging industries present unique challenges and opportunities for tax authorities, and finding the right balance between revenue generation and fostering innovation will be crucial.

Ensuring Equity and Fairness

A critical aspect of any tax system is ensuring equity and fairness for all taxpayers. Los Angeles, with its diverse population and economic landscape, must continually evaluate its tax policies to prevent undue burdens on specific groups or industries.

As the city considers tax reforms, it must carefully assess the potential impact on different segments of the population. This includes evaluating the effects on low-income households, small businesses, and industries that are vital to the city's economy but may face unique challenges.

Collaborative Governance

Effective tax governance in Los Angeles requires collaboration and communication between various stakeholders, including city officials, tax authorities, businesses, and community leaders. By fostering an open dialogue, the city can gather valuable insights and feedback, leading to informed decision-making and the development of tax policies that benefit all Angelenos.

For instance, the city could establish advisory boards or committees that bring together representatives from different industries and community sectors. These collaborative platforms can provide valuable perspectives on the tax system's effectiveness, potential areas for improvement, and the impact of tax policies on various aspects of the city's economy and society.

Conclusion: Navigating the Complex Tax Landscape

In conclusion, the city tax rate in Los Angeles is a multifaceted and dynamic system that plays a pivotal role in the city’s economic and social fabric. From the Business Tax to real estate and sales taxes, each component contributes to the city’s fiscal health and influences the lives of its residents and businesses.

As we've explored in this article, understanding the intricacies of Los Angeles' tax system is essential for both individuals and businesses. It enables informed decision-making, compliance with tax regulations, and the ability to take advantage of available incentives and credits. By staying informed and engaged, Angelenos can actively participate in shaping the city's tax landscape and ensuring its continued prosperity.

What is the current Business Tax rate in Los Angeles?

+The current Business Tax rate in Los Angeles varies based on the nature of the business and its gross receipts. As of our latest data, the rate ranges from 0.08% to 0.15%. It’s important to consult the official Los Angeles City website or seek professional advice for the most up-to-date information.

Are there any tax incentives or credits available for businesses in Los Angeles?

+Yes, Los Angeles offers various tax incentives and credits to support businesses. These include start-up tax exemptions, job creation credits, and industry-specific tax credits. It’s recommended to consult with a tax professional or the city’s economic development office for detailed information on these incentives.

How does Los Angeles calculate property taxes for residential properties?

+Property taxes in Los Angeles are calculated based on the assessed value of the property. The assessed value is determined by the Los Angeles County Assessor’s Office and takes into account factors such as property size, location, and recent sales data. The tax rate is then applied to the assessed value to determine the annual tax liability.

Are there any tax benefits for homeowners in Los Angeles?

+Yes, Los Angeles offers several tax benefits for homeowners. These include property tax deductions on federal tax returns, the California homeowner’s exemption, and potential property tax breaks for seniors and disabled individuals. It’s advisable to consult a tax professional or the city’s official website for more details on these benefits.

How often are property taxes assessed in Los Angeles?

+Property taxes in Los Angeles are assessed annually. The assessment is typically based on the property’s value as of the lien date, which is usually the first of the year. The assessed value is then used to calculate the tax liability for the upcoming year.