Tax Advantages Of Marriage

Marriage is a significant life event with various implications, and one aspect that often sparks curiosity is its financial impact, particularly when it comes to taxes. Understanding the tax advantages of marriage can provide valuable insights into potential financial benefits and strategies for married couples. This article aims to delve into the intricacies of marriage and its tax benefits, offering a comprehensive guide for individuals and couples seeking to optimize their financial planning.

Navigating the Tax Landscape for Married Couples

The tax system in most countries recognizes the legal status of marriage and offers a range of benefits to married couples. These advantages are designed to promote financial stability and provide incentives for long-term commitments. By understanding these tax advantages, married couples can make informed decisions to maximize their financial gains and plan for a secure future.

Tax Benefits: A Comprehensive Overview

Marriage opens the door to a myriad of tax advantages, and being aware of these benefits can significantly impact a couple’s financial planning. Here’s a detailed look at some of the key tax benefits associated with marriage:

1. Joint Filing Status

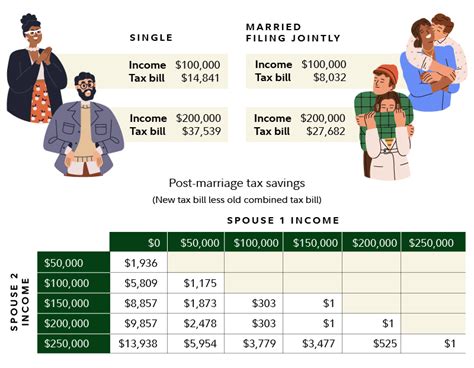

One of the most significant advantages of marriage is the option to file taxes jointly. Joint filing allows couples to combine their incomes and expenses, which can result in a lower overall tax liability. This is particularly beneficial for couples with varying income levels, as it allows for a more balanced tax burden. For instance, if one spouse has a higher income and the other has a lower income, joint filing can reduce the overall tax rate applied to their combined income.

| Filing Status | Tax Bracket |

|---|---|

| Married Filing Jointly | 10%, 12%, 22%, 24%, 32%, 35%, 37% |

| Single | 10%, 12%, 22%, 24%, 32%, 35%, 37% |

2. Tax Credits and Deductions

Marriage often unlocks access to a range of tax credits and deductions that can further reduce a couple’s tax liability. These include:

- Child Tax Credit: Married couples with children may be eligible for a credit based on the number of qualifying children they have. This credit can provide a significant reduction in tax liability.

- Education Credits: If a couple has dependent children in college, they may be able to claim education credits, such as the American Opportunity Tax Credit or the Lifetime Learning Credit.

- Deductions for Medical Expenses: Married couples can combine their medical expenses and potentially deduct them if they exceed a certain threshold of their adjusted gross income.

- Mortgage Interest Deduction: Owning a home together can lead to tax benefits, as mortgage interest payments are often deductible. This deduction can significantly reduce a couple's taxable income.

3. Spousal IRA Contributions

Marriage allows for spousal Individual Retirement Account (IRA) contributions, which can be particularly advantageous if one spouse has little or no earned income. The working spouse can contribute to an IRA on behalf of the non-working spouse, up to the annual contribution limit, thus building retirement savings for both.

4. Social Security Benefits

Marriage can impact Social Security benefits. Spouses may be eligible for spousal benefits, which allow them to receive a percentage of their spouse’s Social Security benefits while still working or if their own benefit amount is lower. Additionally, upon the death of a spouse, the surviving spouse may be entitled to survivor benefits, ensuring continued financial support.

5. Estate and Gift Tax Advantages

Married couples enjoy significant estate and gift tax advantages. There is an unlimited marital deduction, which allows a spouse to leave an inheritance to the other spouse without incurring federal estate tax. This can be a powerful tool for estate planning and ensuring financial security for a surviving spouse.

Maximizing Tax Advantages: Strategies for Married Couples

To fully leverage the tax advantages of marriage, couples should consider the following strategies:

- Evaluate Filing Status: While joint filing is often advantageous, it's essential to compare it with other filing statuses, such as Married Filing Separately or Head of Household, to determine the most beneficial option for the couple's specific circumstances.

- Optimize Tax Credits and Deductions: Understand the eligibility criteria for various tax credits and deductions and ensure that the couple maximizes these benefits by claiming all applicable credits and deductions.

- Strategic Retirement Planning: Utilize spousal IRA contributions to build retirement savings for both spouses, especially if one spouse has limited or no earned income. This can ensure a more comfortable retirement for both individuals.

- Estate Planning: Work with a financial advisor or estate planning attorney to understand the estate and gift tax advantages of marriage. Develop a comprehensive plan that leverages these benefits to protect the couple's assets and provide for their loved ones.

Conclusion: Financial Benefits of Marriage

Marriage brings with it a range of financial considerations, and understanding the tax advantages is crucial for effective financial planning. By exploring the tax landscape and implementing strategic financial decisions, married couples can maximize their benefits and secure their financial future. From joint filing to accessing various tax credits and deductions, marriage offers a unique opportunity to optimize one’s financial situation.

Can unmarried couples benefit from similar tax advantages?

+Unmarried couples, including those in domestic partnerships or civil unions, may have access to some tax benefits similar to those enjoyed by married couples. However, the specific benefits and eligibility criteria can vary by jurisdiction. It’s essential to consult with a tax professional to understand the available options and potential advantages.

How does marriage impact tax liabilities for high-income earners?

+For high-income earners, marriage can result in a higher overall tax liability due to the progressive nature of the tax system. However, there are strategies, such as optimizing investment strategies or utilizing tax-efficient accounts, that can help mitigate this impact and ensure a more favorable tax outcome.

Are there any disadvantages to filing taxes jointly as a married couple?

+While joint filing offers several advantages, there can be potential disadvantages. For instance, if one spouse has substantial medical expenses or legal issues, joint filing could make both spouses jointly responsible for these expenses or liabilities. It’s crucial to carefully evaluate individual circumstances and consult with a tax professional.