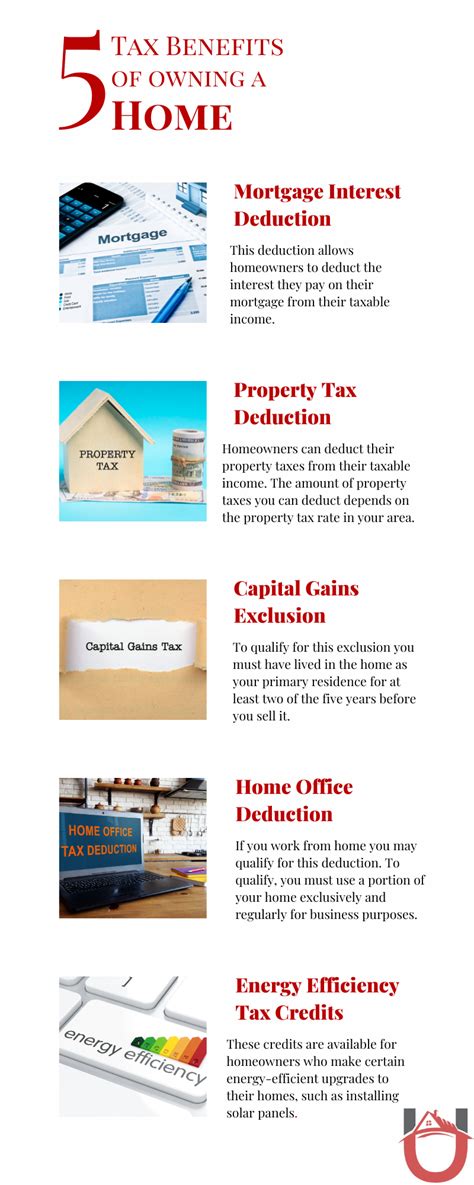

Tax Benefits Of Owning A Home

The concept of homeownership carries significant weight in personal financial planning, offering a range of advantages that extend beyond the mere satisfaction of owning a property. One of the most notable benefits is the access to various tax deductions and credits, which can significantly reduce the overall cost of homeownership and provide substantial savings over time. In this article, we delve into the intricate world of tax benefits associated with owning a home, exploring the specific advantages, the eligibility criteria, and the practical implications for homeowners.

Unraveling the Tax Benefits of Homeownership

The tax advantages associated with homeownership are a result of government incentives aimed at encouraging property ownership and stabilizing the housing market. These benefits can vary based on the country, state, or region, but they often provide considerable savings for homeowners.

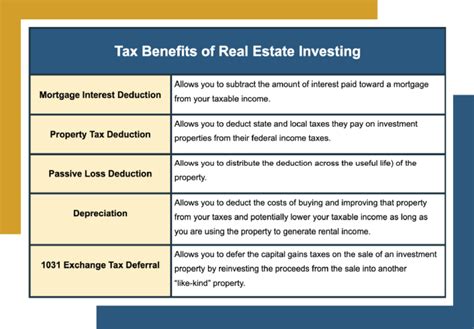

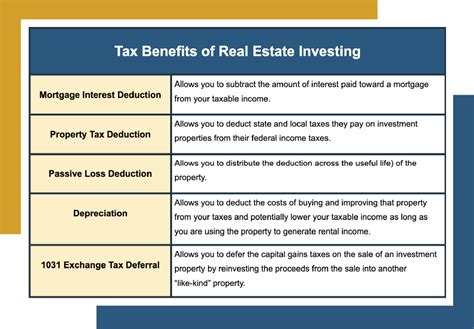

Mortgage Interest Deduction

One of the most well-known tax benefits is the mortgage interest deduction. When you own a home and have a mortgage, you can deduct the interest you pay on your loan from your taxable income. This deduction can be especially significant for those in the higher tax brackets, as it reduces the overall tax liability. For instance, if you pay $10,000 in mortgage interest in a year and fall into the 25% tax bracket, this deduction could save you $2,500 in taxes.

To illustrate, consider the case of Sarah, a single homeowner with an annual income of $75,000. In her first year of homeownership, she pays $12,000 in mortgage interest. By deducting this amount, she reduces her taxable income to $63,000. This deduction not only lowers her tax liability but also puts more money back into her pocket, which can be reinvested into her home or other financial goals.

Property Taxes

Another tax benefit for homeowners is the ability to deduct property taxes. Property taxes are an annual expense paid to local governments and are typically based on the assessed value of your home. By deducting these taxes from your federal income tax, you can further reduce your taxable income and decrease your overall tax burden.

| Property Tax Rates by State | Average Effective Property Tax Rate |

|---|---|

| New Jersey | 2.45% |

| Illinois | 2.31% |

| New Hampshire | 2.24% |

| Texas | 1.95% |

| Connecticut | 1.82% |

Let's consider an example. John, a homeowner in Illinois, pays an annual property tax of $3,000 on his home, which has an assessed value of $130,000. By deducting this amount, he effectively reduces his taxable income, which can result in substantial savings, especially when combined with other tax deductions.

Capital Gains Exclusion

When it comes to selling your home, another tax benefit comes into play: the capital gains exclusion. This benefit allows homeowners to exclude a portion of the profits from the sale of their primary residence from federal income tax. The exclusion amount depends on your filing status and the length of time you've owned and lived in the property.

| Filing Status | Exclusion Amount |

|---|---|

| Single/Head of Household | $250,000 |

| Married Filing Jointly | $500,000 |

For example, imagine Emily, a single homeowner who bought her house for $300,000 and, after several years, decides to sell it for $500,000. Due to the capital gains exclusion, she can exclude up to $250,000 from her federal income tax, resulting in a significant tax savings.

Other Potential Deductions

In addition to the aforementioned benefits, homeowners may also be eligible for deductions related to mortgage insurance premiums, energy-efficient home improvements, and certain expenses associated with home offices or rental properties. These deductions can further enhance the financial advantages of homeownership.

Eligibility and Considerations

While the tax benefits of homeownership are substantial, it's essential to understand the eligibility criteria and potential limitations. Here are some key considerations:

- Income Level: The tax benefits are often more advantageous for those in higher tax brackets, as they can deduct a larger portion of their income.

- Ownership Period: Certain benefits, like the capital gains exclusion, are tied to the length of time you've owned and lived in the property.

- Filing Status: Your filing status, such as single, married filing jointly, or head of household, can impact the specific deductions and exclusions available to you.

- State and Local Regulations: Tax benefits can vary significantly by state and locality, so it's crucial to understand the specific regulations in your area.

Maximizing Tax Benefits

To make the most of the tax benefits associated with homeownership, consider the following strategies:

- Stay Informed: Keep yourself updated on the latest tax laws and regulations. Changes in tax policies can impact the deductions and credits you're eligible for.

- Consult a Professional: Work with a tax advisor or accountant who can provide personalized guidance based on your specific circumstances.

- Track Your Expenses: Maintain accurate records of your mortgage interest, property taxes, and other eligible deductions. This documentation is crucial when filing your taxes.

- Plan for the Future: Consider the long-term benefits of homeownership, such as the potential for increased equity and the ability to leverage tax savings for future financial goals.

Conclusion

Homeownership offers a plethora of financial advantages, and the tax benefits are a significant part of this package. From mortgage interest deductions to property tax savings and capital gains exclusions, homeowners can enjoy substantial tax savings. However, it's important to navigate these benefits with a clear understanding of the eligibility criteria and potential limitations. By staying informed and seeking professional guidance, homeowners can make the most of these advantages, turning their homes into a solid foundation for their financial future.

How often can I claim the capital gains exclusion on my primary residence?

+

The capital gains exclusion on your primary residence can generally be claimed once every two years. This means you can take advantage of the exclusion every time you sell your primary residence, provided you meet the ownership and use requirements.

Are there any limitations on the mortgage interest deduction for second homes or rental properties?

+

Yes, the rules for mortgage interest deductions on second homes and rental properties are different from those on primary residences. For second homes, you can deduct interest on up to $750,000 in mortgage debt, while for rental properties, you can deduct interest on the entire mortgage debt. However, there are additional rules and considerations, such as the passive activity loss rules, that come into play with rental properties.

Can I deduct the interest on my home equity loan or line of credit (HELOC)?

+

The deductibility of interest on home equity loans and lines of credit depends on how the funds are used. If the funds are used for home improvements or substantial renovations, the interest is generally deductible. However, if the funds are used for personal expenses, the deductibility may be limited or eliminated, especially under the Tax Cuts and Jobs Act of 2017.