Trust Tax Rates

Welcome to a comprehensive exploration of the intricate world of Trust Tax Rates, a critical aspect of financial planning and wealth management. Trusts are versatile legal entities that serve a multitude of purposes, and understanding the tax implications is essential for both trustees and beneficiaries. This article aims to demystify the tax landscape surrounding trusts, providing an in-depth analysis of rates, structures, and strategies to optimize tax efficiency. By the end of this journey, you'll possess a nuanced understanding of trust tax rates, empowering you to make informed decisions and navigate the complex web of regulations with confidence.

The Fundamentals of Trust Tax Rates

At its core, a trust is a fiduciary relationship in which one party, known as the trustee, holds assets for the benefit of another party, the beneficiary. Trusts are governed by a set of rules and regulations, and one of the key considerations is the tax treatment. The Internal Revenue Service (IRS) imposes taxes on trusts, and the rates and rules can vary depending on the type of trust, its income, and the jurisdiction.

Trust tax rates are a critical component of wealth management, impacting the overall financial strategy and the distribution of assets. Misunderstanding or overlooking these rates can lead to significant tax liabilities and a reduction in the overall value of the trust. Therefore, a thorough understanding of trust tax rates is essential for anyone involved in trust administration, whether as a trustee, beneficiary, or financial advisor.

Key Concepts and Definitions

- Grantor Trust: A trust in which the person who sets up the trust (the grantor) is also treated as the owner of the trust’s assets for tax purposes. This means that the grantor pays income tax on the trust’s income during their lifetime.

- Non-Grantor Trust: In contrast, a non-grantor trust is a separate tax entity, and the trust itself pays taxes on its income. The grantor is not considered the owner of the trust’s assets for tax purposes.

- Revocable Trust: A revocable trust can be changed or revoked by the grantor during their lifetime. It typically does not offer tax benefits during the grantor’s lifetime but can provide estate planning advantages.

- Irrevocable Trust: An irrevocable trust, as the name suggests, cannot be changed or revoked by the grantor after it is established. These trusts often provide more tax benefits but also come with fewer controls for the grantor.

- Income Tax Rates: Trusts, like individuals, are subject to income tax rates. The tax rate applied to a trust’s income depends on the type of trust and the amount of income. For instance, a grantor trust might be taxed at the grantor’s individual tax rate, while a non-grantor trust could face higher rates based on its income bracket.

Navigating Trust Tax Rates: A Comprehensive Guide

Understanding the tax landscape for trusts involves a deep dive into various factors that influence the applicable tax rates. From the structure of the trust to the nature of its income, each element plays a crucial role in determining the tax liability. Let’s explore these aspects in detail to provide a comprehensive understanding of trust tax rates.

Types of Trusts and Their Tax Implications

The first step in navigating trust tax rates is understanding the different types of trusts and how they are taxed. As mentioned earlier, the tax treatment of a trust depends on its structure and the relationship between the grantor and the trust.

| Type of Trust | Tax Treatment |

|---|---|

| Grantor Trust | The grantor is taxed on the trust's income, as the trust's assets are considered owned by the grantor for tax purposes. This means the grantor reports the trust's income on their personal tax return. |

| Non-Grantor Trust | A non-grantor trust is taxed separately from the grantor. The trust files its own tax return and pays taxes on its income. The tax rate depends on the type of income and the amount, with higher income levels facing higher tax rates. |

| Revocable Trust | During the grantor's lifetime, a revocable trust is treated as a grantor trust, with the grantor paying taxes on its income. After the grantor's death, it can become a non-grantor trust, subject to its own tax rates. |

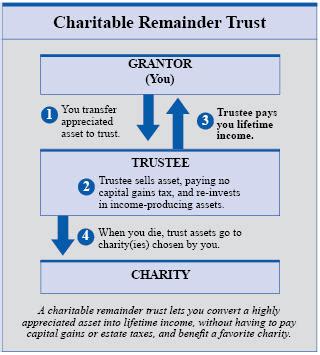

| Irrevocable Trust | Irrevocable trusts are typically taxed as non-grantor trusts, filing their own tax returns and paying taxes on their income. However, there are special types of irrevocable trusts, like Dynasty Trusts and Charitable Trusts, which have unique tax advantages. |

It's important to note that while this table provides a general overview, the tax treatment of trusts can be highly complex and may vary based on jurisdiction and the specific provisions of the trust document. Consulting with a tax professional is essential to understand the precise tax implications for a particular trust.

Income Taxation of Trusts

Trusts, like individuals, are subject to income tax on their earnings. The tax rate applied to a trust’s income depends on the type of income and the amount. For instance, ordinary income, such as interest and dividends, is taxed differently from capital gains and other types of income.

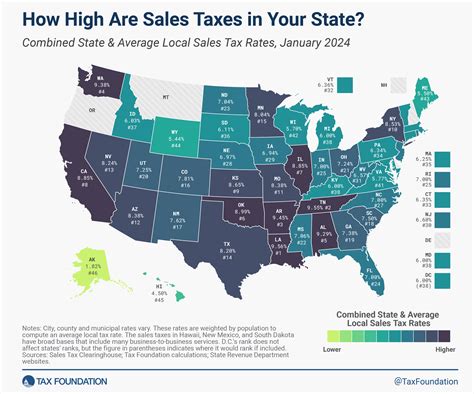

- Ordinary Income: Trusts pay income tax on ordinary income, such as interest, dividends, and certain types of rental income. The tax rate applied to this income is based on a progressive scale, with higher income levels facing higher tax rates. For instance, in the United States, a trust might pay a tax rate of 37% on income over $13,050, similar to the highest individual tax bracket.

- Capital Gains: Trusts also pay tax on capital gains, which is the profit from the sale of assets. The tax rate for capital gains can be lower than ordinary income tax rates, especially for long-term gains (assets held for more than a year). Trusts can benefit from the preferential tax treatment of capital gains, which can lead to significant tax savings.

- Unrelated Business Income: If a trust engages in a trade or business unrelated to its primary purpose, it may be subject to unrelated business income tax (UBIT). This tax is designed to prevent tax-exempt organizations from unfairly competing with taxable businesses. Trusts must carefully manage their business activities to avoid UBIT.

Strategies for Tax Efficiency

Given the complex tax landscape for trusts, implementing effective tax strategies is crucial to optimize the trust’s financial position. Here are some strategies to consider:

- Trust Structuring: The structure of the trust can have a significant impact on its tax liability. For instance, a grantor trust might be more tax-efficient for certain situations, while a non-grantor trust could provide advantages in other scenarios. Consulting with a tax advisor can help determine the most suitable trust structure.

- Income Distribution: Trusts can distribute income to beneficiaries, which can have tax advantages. For instance, distributing capital gains to beneficiaries can reduce the trust's tax liability, as the beneficiaries may be in a lower tax bracket. However, this strategy must be balanced with the trust's overall financial goals and the tax implications for beneficiaries.

- Charitable Contributions: Trusts can make charitable contributions, which can provide tax benefits. These contributions can reduce the trust's taxable income and may also qualify for a charitable deduction. However, the trust must follow specific rules to ensure the contribution is valid for tax purposes.

- Asset Allocation: The trust's asset allocation can impact its tax liability. For instance, holding assets that generate tax-efficient income, such as municipal bonds, can reduce the trust's tax burden. Similarly, holding assets with potential for long-term capital gains can provide tax advantages when sold.

- Estate Planning: Trusts are often used as part of estate planning strategies. By properly structuring the trust and utilizing tax-efficient techniques, it's possible to minimize estate taxes and ensure the maximum value is passed on to beneficiaries.

Trust Tax Rates: A Dynamic Landscape

The world of trust tax rates is dynamic and ever-evolving. Tax laws and regulations can change, and keeping abreast of these changes is essential for effective trust management. Let’s explore some of the key considerations when navigating the dynamic landscape of trust tax rates.

Tax Law Changes and Updates

Tax laws are subject to frequent updates and changes, and staying informed is crucial for trust administrators and beneficiaries. Here are some key aspects to consider:

- Tax Rate Changes: Tax rates can fluctuate over time, and trusts must adapt to these changes. For instance, changes in income tax rates or the introduction of new tax brackets can impact the tax liability of trusts. Staying informed about these changes is essential to ensure compliance and optimize tax efficiency.

- New Regulations: Governments often introduce new regulations to address specific tax issues or to close loopholes. Trusts must comply with these regulations to avoid penalties and ensure the trust's validity. For instance, the introduction of the Foreign Account Tax Compliance Act (FATCA) brought new reporting requirements for trusts with foreign assets.

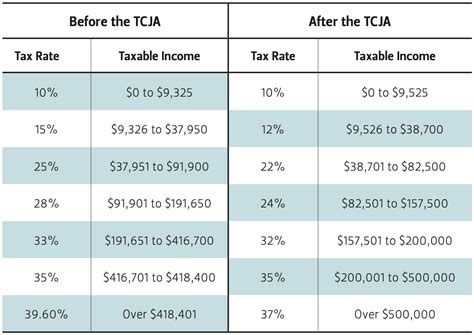

- Tax Reform: Major tax reforms, such as the Tax Cuts and Jobs Act (TCJA) in the United States, can have a significant impact on trust taxation. These reforms can change the tax rates, deductions, and rules for trusts, requiring a review of the trust's strategy and structure.

International Considerations

For trusts with international elements, the tax landscape becomes even more complex. Here are some key considerations:

- Foreign Asset Reporting: Trusts with foreign assets must comply with reporting requirements, such as the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). Failure to report these assets can result in penalties and legal consequences.

- International Tax Treaties: International tax treaties can provide benefits for trusts with assets in multiple countries. These treaties can reduce or eliminate double taxation and provide clarity on the tax residency of the trust.

- Cross-Border Trust Planning: When establishing a trust with international elements, careful planning is required. The trust must comply with the tax laws of both the home country and the foreign jurisdictions involved. Working with tax advisors who specialize in international tax matters is crucial for effective cross-border trust planning.

The Role of Professional Advisors

Navigating the complex world of trust tax rates is a challenging task, and it’s essential to have the right professional support. Here’s how advisors can assist in managing trust tax rates:

- Tax Advisors: Tax advisors, including certified public accountants (CPAs) and tax attorneys, can provide valuable insights into the tax implications of trusts. They can help structure the trust to optimize tax efficiency, prepare tax returns, and stay compliant with tax laws.

- Wealth Managers: Wealth managers can provide a holistic view of the trust's financial position, including its tax liability. They can work with tax advisors to develop a comprehensive financial strategy that aligns with the trust's objectives and minimizes tax burdens.

- Trustees and Fiduciaries: Trustees and fiduciaries have a legal obligation to act in the best interests of the beneficiaries. This includes understanding the tax implications of trust decisions and ensuring compliance with tax laws. Regular consultation with tax advisors can help trustees fulfill their fiduciary duties.

Conclusion: Embracing the Complexity of Trust Tax Rates

Trust tax rates are a complex and dynamic aspect of financial planning, requiring a deep understanding of tax laws and regulations. By navigating the intricate web of trust taxation, trustees and beneficiaries can ensure compliance, optimize tax efficiency, and protect the value of the trust. This comprehensive guide has provided an in-depth exploration of trust tax rates, offering a solid foundation for further exploration and decision-making. Remember, when it comes to trust tax rates, knowledge is power, and staying informed is key to success.

What is the difference between a grantor trust and a non-grantor trust from a tax perspective?

+From a tax perspective, the main difference lies in who is responsible for paying taxes on the trust’s income. In a grantor trust, the grantor (the person who creates the trust) is taxed on the trust’s income as if it were their own. This means the grantor includes the trust’s income on their personal tax return. In contrast, a non-grantor trust is taxed separately from the grantor. The trust itself is responsible for paying taxes on its income, and it files its own tax return.

How do trusts pay taxes on capital gains?

+Trusts pay taxes on capital gains similar to individuals. When a trust sells an asset for a profit (capital gain), it must report and pay tax on that gain. The tax rate for capital gains can vary based on the holding period of the asset (short-term or long-term) and the amount of gain. Trusts can benefit from the preferential tax treatment of capital gains, especially for long-term gains, which are often taxed at lower rates.

What are some strategies to minimize trust tax liabilities?

+There are several strategies to minimize trust tax liabilities, including: structuring the trust to take advantage of tax-efficient provisions, distributing income to beneficiaries who are in lower tax brackets, making charitable contributions to reduce taxable income, optimizing asset allocation to generate tax-efficient income, and utilizing estate planning techniques to minimize estate taxes.

How do international trusts handle tax reporting and compliance?

+International trusts must comply with various tax reporting requirements, such as FATCA and CRS, to report their foreign assets. These trusts may also benefit from international tax treaties that reduce or eliminate double taxation. When establishing an international trust, it’s crucial to work with tax advisors who specialize in cross-border tax planning to ensure compliance and take advantage of any available tax benefits.

What role do professional advisors play in managing trust tax rates?

+Professional advisors, including tax advisors, wealth managers, and trustees, play a crucial role in managing trust tax rates. Tax advisors help structure the trust and prepare tax returns, ensuring compliance and optimizing tax efficiency. Wealth managers provide a holistic view of the trust’s financial position, integrating tax considerations into the overall financial strategy. Trustees, as fiduciaries, have a legal obligation to act in the best interests of the beneficiaries, which includes understanding and managing the tax implications of trust decisions.