Free Pa State Tax Filing

In today's fast-paced world, staying on top of personal finances and tax obligations is crucial. For residents of Pennsylvania, the state government offers a convenient and cost-effective way to file taxes with its free tax filing program. This comprehensive guide will explore the ins and outs of free Pa state tax filing, providing valuable insights and step-by-step instructions to ensure a smooth and successful filing process.

Understanding Pennsylvania’s Free Tax Filing Program

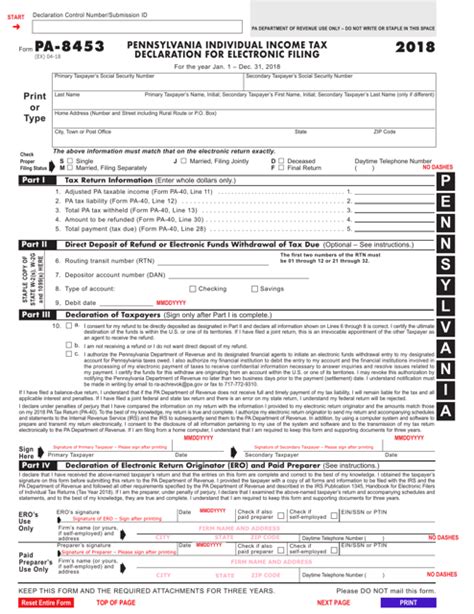

The Pennsylvania Department of Revenue has implemented a user-friendly online platform to facilitate free state tax filing for eligible individuals and businesses. This initiative aims to simplify the tax filing process, making it more accessible and cost-efficient for taxpayers.

The program is designed to cater to a wide range of taxpayers, including individuals, families, and small businesses. By offering a secure and intuitive online platform, the state government aims to streamline the tax filing process, reduce errors, and provide timely refunds to eligible taxpayers.

Eligibility Criteria

Not everyone is eligible for free Pa state tax filing. The program has specific criteria that taxpayers must meet to qualify. Generally, individuals with a household income below a certain threshold are eligible. This threshold is updated annually to reflect the cost of living and inflation.

For the tax year 2023, the income limit for eligibility is set at $66,000 for single filers and $73,000 for married couples filing jointly. It's important to note that this limit applies to adjusted gross income (AGI), which is the total income reported on your federal tax return after deductions and adjustments.

In addition to income requirements, there are other eligibility criteria. Taxpayers must be residents of Pennsylvania and cannot have complex tax situations, such as business income, rental properties, or multiple sources of income.

Benefits of Free State Tax Filing

The benefits of opting for free Pa state tax filing are numerous. Firstly, it saves taxpayers significant amounts of money that would otherwise be spent on hiring professional tax preparers or using commercial tax software.

Secondly, the online platform provided by the state government is designed to be user-friendly and intuitive. It guides taxpayers through the filing process step by step, ensuring that even those with limited tax knowledge can complete their filings accurately.

Additionally, the free tax filing program offers real-time error checking, which helps taxpayers identify and correct any mistakes before submitting their returns. This feature significantly reduces the risk of errors and potential audits.

Lastly, eligible taxpayers can receive their refunds faster through direct deposit, which is a convenient and secure method offered by the program.

Step-by-Step Guide to Free Pa State Tax Filing

Now that we understand the basics of the free tax filing program, let’s delve into a detailed step-by-step guide to ensure a seamless filing experience.

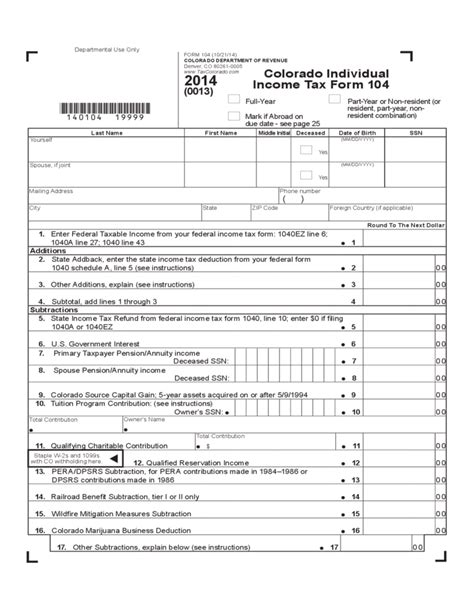

Step 1: Gather Your Documents

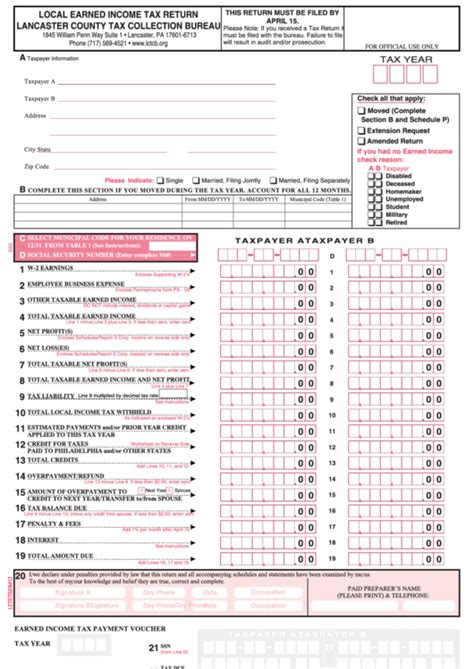

Before beginning the filing process, it’s crucial to have all the necessary documents organized and readily available. These documents include:

- Social Security numbers for yourself, your spouse, and any dependents.

- W-2 forms from all employers.

- 1099 forms for any other income, such as interest or dividends.

- A copy of your previous year's federal and state tax returns.

- Records of any deductions or credits you plan to claim, such as medical expenses, charitable donations, or education expenses.

Having these documents organized will make the filing process more efficient and ensure that you don't miss out on any potential deductions or credits.

Step 2: Access the Online Platform

The Pa state tax filing platform is accessible through the official website of the Pennsylvania Department of Revenue. Visit the website and navigate to the “Free File” section. Here, you will find detailed instructions and a user-friendly interface to guide you through the filing process.

The platform is designed to be intuitive, with clear instructions and helpful tips along the way. It will prompt you to enter your personal information, income details, and any deductions or credits you are eligible for.

Step 3: Enter Your Personal Information

The first step in the filing process is to provide your personal details. This includes your name, address, date of birth, and contact information. Ensure that you enter accurate information to avoid any delays in processing your return.

If you are filing jointly with your spouse, you will need to provide their personal information as well. The platform will guide you through this process, ensuring that all necessary details are captured accurately.

Step 4: Input Your Income Details

Next, you will be prompted to enter your income details. This includes wages, salaries, tips, and any other forms of income you received during the tax year. The platform will guide you through each income category, providing clear instructions and examples to ensure accuracy.

It's important to double-check the amounts and ensure that all sources of income are accounted for. The platform may also provide helpful tips on how to calculate certain types of income, such as self-employment income or rental income.

Step 5: Claim Deductions and Credits

Pennsylvania offers various deductions and credits to eligible taxpayers. These can significantly reduce your taxable income and the amount of tax you owe. The Pa state tax filing platform will guide you through the process of claiming these deductions and credits.

Some common deductions and credits include the standard deduction, itemized deductions (such as medical expenses or state and local taxes paid), and credits for education expenses, child and dependent care, or retirement contributions.

The platform will provide detailed explanations and examples for each deduction and credit, ensuring that you can maximize your savings.

Step 6: Review and Submit Your Return

Once you have entered all your information and claimed your deductions and credits, it’s time to review your return. The platform will provide a summary of your taxable income, deductions, and the amount of tax you owe or the refund you are entitled to.

Take the time to carefully review this summary, ensuring that all the information is accurate and complete. If you notice any errors or discrepancies, you can easily make corrections and update your return before submission.

Once you are satisfied with your return, you can proceed to submit it electronically. The platform will guide you through the final steps, including selecting your refund preference (direct deposit or check) and providing your electronic signature.

Tips for a Successful Free State Tax Filing

To ensure a smooth and successful Pa state tax filing experience, here are some additional tips to keep in mind:

- Stay organized: Keep all your tax-related documents in one place, making it easier to reference them during the filing process.

- Double-check your calculations: While the online platform provides error checking, it's always a good idea to review your calculations manually to ensure accuracy.

- Understand the deadlines: Be aware of the filing deadlines for both federal and state taxes. Pennsylvania typically follows the federal filing deadline, which is usually around April 15th of each year.

- Seek professional assistance: If you have a complex tax situation or are unsure about certain deductions or credits, consider seeking advice from a tax professional. They can provide guidance and ensure you maximize your savings.

- Stay updated: Keep an eye on any changes or updates to the tax laws and regulations in Pennsylvania. The state government may introduce new deductions or credits, or make adjustments to existing ones.

Future Implications and Potential Changes

The free Pa state tax filing program has proven to be a valuable initiative, benefiting thousands of taxpayers in Pennsylvania. As technology advances and tax laws evolve, the program is likely to undergo further improvements and enhancements.

One potential area of improvement is the expansion of eligibility criteria. As the cost of living continues to rise, the income threshold for eligibility may need to be adjusted to ensure that more taxpayers can benefit from the program.

Additionally, the program may incorporate more advanced features, such as real-time data integration with financial institutions, further simplifying the process of gathering income and deduction information.

The state government may also explore partnerships with commercial tax software providers to offer additional support and guidance to taxpayers, particularly those with more complex tax situations.

Conclusion

Free Pa state tax filing is a valuable resource for eligible taxpayers in Pennsylvania. By offering a user-friendly online platform, the state government has made it easier and more accessible for individuals and businesses to meet their tax obligations. With the step-by-step guide provided in this article, taxpayers can navigate the filing process with confidence and ensure a successful outcome.

As the tax landscape continues to evolve, it's essential for taxpayers to stay informed and take advantage of initiatives like the free tax filing program. By staying organized, understanding the eligibility criteria, and following the tips outlined in this guide, taxpayers can maximize their savings and simplify their tax filing experience.

Frequently Asked Questions

Can I file my state taxes for free if I use a paid tax preparation software for my federal taxes?

+Yes, even if you use a paid tax preparation software for your federal taxes, you can still take advantage of the free Pa state tax filing program. The program is specifically designed to offer a cost-effective solution for state tax filing, regardless of how you choose to file your federal taxes.

What happens if I make a mistake while filing my state taxes online?

+If you realize you’ve made a mistake while filing your state taxes online, don’t panic. The Pa state tax filing platform allows you to correct any errors before submitting your return. Simply go back to the relevant section, make the necessary changes, and ensure your return is accurate before final submission.

Are there any additional fees or charges associated with the free state tax filing program?

+No, the free Pa state tax filing program is indeed free. There are no hidden fees or charges associated with using the online platform. However, it’s important to note that if you choose to use additional services, such as expedited refund processing or tax preparation assistance, there may be associated fees.

Can I file my state taxes if I am a non-resident of Pennsylvania?

+The free Pa state tax filing program is primarily designed for residents of Pennsylvania. However, if you have income or business activities within the state, you may still be required to file state taxes. In such cases, you should consult a tax professional to ensure you meet your tax obligations accurately.

How long does it typically take to receive my state tax refund after filing online?

+The processing time for state tax refunds can vary depending on various factors, such as the complexity of your return and the volume of filings during the tax season. Generally, you can expect to receive your refund within 4-6 weeks after filing online. However, if you choose direct deposit as your refund method, you may receive your refund even faster.