Arizona Automobile Sales Tax

The Arizona automobile sales tax is an essential component of the state's revenue system, contributing significantly to its financial landscape. This tax is levied on the sale or lease of vehicles, playing a crucial role in funding various state initiatives and services. Understanding the intricacies of this tax is vital for both consumers and businesses operating within the automotive industry in Arizona.

The Mechanics of Arizona’s Automobile Sales Tax

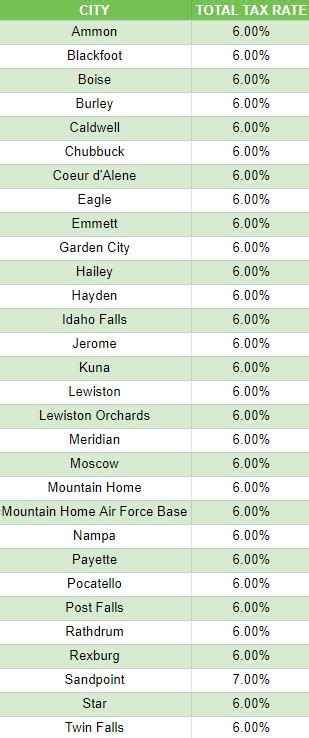

Arizona imposes a sales tax on the purchase price of a vehicle, which includes the base price, any additional features, and the sales tax itself. This tax is calculated as a percentage of the total cost and is paid by the buyer to the dealer, who then remits it to the state. The current sales tax rate in Arizona for vehicles is 5.6%, which is composed of a state sales tax rate of 5.1% and an additional county and municipal tax rate that varies depending on the location of the purchase.

For instance, if a vehicle with a base price of $25,000 is purchased in Maricopa County, which has a county and municipal tax rate of 1.5%, the total sales tax would be calculated as follows: $25,000 (base price) x 0.056 (state and county tax rate) = $1,400. Thus, the total cost of the vehicle, including tax, would be $26,400.

Exemptions and Special Cases

While the general rule applies to most vehicle purchases, there are certain exemptions and special cases to consider. For example, vehicles purchased for resale or leased by businesses are subject to different tax rates and regulations. Additionally, some vehicles, such as those used exclusively for agricultural purposes, may be exempt from the sales tax altogether.

Moreover, Arizona offers a trade-in allowance, which can reduce the taxable value of a new vehicle. If a buyer trades in their old vehicle, the trade-in value is subtracted from the purchase price of the new vehicle before calculating the sales tax. This can significantly lower the tax liability for the buyer.

Revenue Generation and Allocation

The revenue generated from the Arizona automobile sales tax is a critical source of funding for various state programs and services. A significant portion of this tax revenue is allocated to the state’s General Fund, which supports a wide range of public services, including education, healthcare, and infrastructure development.

Additionally, a certain percentage of the sales tax is earmarked for specific funds, such as the State Highway Fund, which is dedicated to maintaining and improving Arizona's road network. This ensures that a portion of the tax revenue directly benefits the automotive infrastructure that supports the state's transportation needs.

| Revenue Allocation | Percentage of Sales Tax |

|---|---|

| General Fund | 50% |

| State Highway Fund | 15% |

| Other Designated Funds | 35% |

Economic Impact

The Arizona automobile sales tax not only provides revenue for the state but also influences the automotive market within the state. It can affect consumer behavior, vehicle pricing, and the overall health of the automotive industry. For instance, the tax can impact the affordability of vehicles for consumers, potentially affecting sales volumes and dealer profitability.

Comparative Analysis: Arizona vs. Other States

Arizona’s automobile sales tax rate is relatively moderate compared to some other states. For instance, neighboring states like California have a sales tax rate of 7.25%, while some eastern states, such as Massachusetts, have rates as high as 6.25%. On the other hand, certain southern states like Texas have no state-level sales tax on vehicles, although local taxes may still apply.

This variation in sales tax rates can significantly impact the price of vehicles across different states. For example, a vehicle purchased in Arizona might cost less than the same vehicle purchased in California due to the difference in sales tax rates. This can influence consumer choices and even affect the resale value of vehicles in different regions.

| State | Sales Tax Rate |

|---|---|

| Arizona | 5.6% |

| California | 7.25% |

| Massachusetts | 6.25% |

| Texas | 0% (state level) |

State-Specific Considerations

While Arizona’s sales tax rate is relatively competitive, the state’s automotive industry faces unique challenges and opportunities. For instance, Arizona’s strong tourism industry and sunny climate make it an attractive market for recreational vehicles and classic car collectors. However, the state’s rapid population growth also puts pressure on its infrastructure, requiring significant investment in road maintenance and expansion.

Additionally, Arizona's proximity to Mexico and its strong trade relations present opportunities for the automotive industry, particularly in the realm of cross-border trade and manufacturing.

Future Implications and Potential Changes

The Arizona automobile sales tax, like many other taxes, is subject to potential changes and reforms. These changes can be driven by various factors, including shifts in state revenue needs, changes in the automotive market, or shifts in political priorities.

Potential Reform Scenarios

One potential scenario involves a reform that aims to simplify the tax system by standardizing the sales tax rate across all counties within the state. This could provide more consistency for consumers and businesses and make the tax system more efficient to administer. However, such a reform might also lead to variations in the tax burden across different regions, potentially affecting certain areas more than others.

Another possible reform could involve restructuring the allocation of sales tax revenue to prioritize certain sectors or initiatives. For instance, increasing the allocation to the State Highway Fund could accelerate road infrastructure projects, benefiting the automotive industry and the state's overall transportation network.

The Impact of Technological Advancements

The rise of electric vehicles (EVs) and autonomous driving technologies presents a unique challenge and opportunity for the Arizona automobile sales tax. As the market for EVs grows, the state might consider adapting its tax system to accommodate these changes. This could involve reevaluating tax rates and incentives to encourage the adoption of cleaner technologies and support the state’s sustainability goals.

Additionally, the potential for autonomous vehicles to disrupt traditional automotive business models might also influence tax policies. As the industry evolves, Arizona will need to adapt its tax system to ensure it remains fair, efficient, and supportive of innovation.

Conclusion

The Arizona automobile sales tax is a vital component of the state’s financial landscape, influencing both the automotive market and the provision of public services. Understanding its mechanics, impact, and potential future changes is essential for stakeholders across the automotive industry, from consumers and dealers to policymakers and infrastructure planners. As Arizona continues to evolve, so too will its tax system, shaping the state’s economic trajectory and automotive future.

What is the current sales tax rate for vehicles in Arizona?

+

The current sales tax rate for vehicles in Arizona is 5.6%, which includes a state sales tax rate of 5.1% and additional county and municipal tax rates that vary by location.

Are there any exemptions or special cases for the Arizona automobile sales tax?

+

Yes, certain vehicles, such as those used exclusively for agricultural purposes, may be exempt from the sales tax. Additionally, vehicles purchased for resale or leased by businesses are subject to different tax rates and regulations.

How is the revenue generated from the Arizona automobile sales tax allocated?

+

A significant portion of the revenue is allocated to the state’s General Fund, supporting various public services. A specific percentage is also designated for the State Highway Fund and other designated funds.

How does Arizona’s automobile sales tax compare to other states?

+

Arizona’s sales tax rate is relatively moderate compared to some other states. While states like California and Massachusetts have higher rates, certain southern states like Texas have no state-level sales tax on vehicles.

What potential changes or reforms might the Arizona automobile sales tax undergo in the future?

+

Potential reforms could include standardizing tax rates across counties or restructuring revenue allocation to prioritize certain sectors. Additionally, the rise of electric vehicles and autonomous driving technologies might prompt tax adaptations to support these emerging markets.