What Is Sales Tax In Az

Sales tax in Arizona is a crucial aspect of the state's revenue system and plays a significant role in funding various public services and infrastructure projects. Understanding how sales tax works in Arizona is essential for both businesses and consumers alike. This comprehensive guide aims to delve into the intricacies of sales tax in the Grand Canyon State, shedding light on its history, current rates, exemptions, and its impact on the local economy.

A Brief History of Sales Tax in Arizona

The history of sales tax in Arizona dates back to the early 20th century. The state first imposed a sales tax in 1933, during the Great Depression, as a measure to generate much-needed revenue for the government. Initially, the sales tax rate was set at 2%, and it was applied to the sale of tangible personal property. Over the years, the sales tax system has evolved, and the state has implemented various changes to the tax code, reflecting the changing economic landscape and the needs of the state.

One notable development was the introduction of the Transaction Privilege Tax (TPT) in 1935. This tax was levied on the privilege of engaging in business in Arizona and replaced the previous sales tax. The TPT is a unique feature of Arizona's tax system and is often cited as a significant factor in the state's economic growth and development.

Since then, Arizona has witnessed numerous amendments and modifications to its sales tax laws. The most recent significant change occurred in 2018, when the state implemented a temporary sales tax increase to fund various infrastructure projects. This increase, which expired in 2020, added an additional 0.6% to the state's sales tax rate, bringing it to a total of 6.6% for a brief period.

Current Sales Tax Rates in Arizona

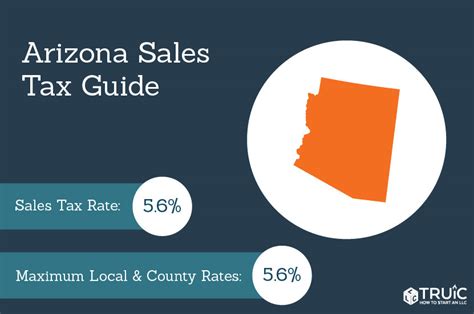

As of my last update in January 2023, the state sales tax rate in Arizona stands at 5.6%. This state-wide rate is applicable to most tangible personal property and certain services. However, it’s important to note that Arizona, like many other states, allows local jurisdictions to levy additional sales taxes, resulting in varying tax rates across different cities and counties.

For instance, in the bustling city of Phoenix, the combined sales tax rate is 8.1%, which includes the state sales tax of 5.6% and a 2.5% city sales tax. Similarly, in the vibrant city of Tucson, the combined sales tax rate is 6.1%, with an additional 0.5% levied by the city on top of the state sales tax.

Here's a table illustrating the sales tax rates in some of Arizona's major cities:

| City | State Sales Tax Rate | Local Sales Tax Rate | Combined Sales Tax Rate |

|---|---|---|---|

| Phoenix | 5.6% | 2.5% | 8.1% |

| Tucson | 5.6% | 0.5% | 6.1% |

| Mesa | 5.6% | 1.0% | 6.6% |

| Scottsdale | 5.6% | 1.4% | 7.0% |

| Glendale | 5.6% | 1.5% | 7.1% |

Local Sales Tax Jurisdictions

Arizona is divided into various sales tax jurisdictions, with each jurisdiction having the authority to impose its own sales tax rates. These jurisdictions typically align with city or county boundaries. As a result, businesses operating in multiple locations within Arizona must be aware of the specific sales tax rates applicable to each jurisdiction.

Use Tax in Arizona

In addition to sales tax, Arizona also imposes a use tax on purchases made outside the state but used within Arizona. This tax is designed to ensure that all purchases are subject to taxation, regardless of where they are made. The use tax rate mirrors the sales tax rate and is typically applied to online purchases, purchases made out of state, or purchases made from remote sellers.

Sales Tax Exemptions and Special Considerations

While sales tax is a broad-based tax, Arizona does offer certain exemptions and special considerations to specific types of goods and services. Understanding these exemptions is crucial for businesses to ensure compliance and for consumers to make informed purchasing decisions.

Food and Groceries

One notable exemption in Arizona’s sales tax law is the exemption on unprepared food and groceries. This means that when you purchase items like fresh produce, meat, dairy, and other staple food items, you are not subject to sales tax. However, it’s important to note that prepared foods, such as hot meals from a restaurant or deli, are taxable.

Prescription Drugs

Sales tax is also not applied to prescription drugs and certain medical devices in Arizona. This exemption aims to reduce the financial burden on individuals requiring essential medications and healthcare products.

Clothing and Shoes

Another significant exemption is on clothing and footwear. In Arizona, sales tax is not levied on clothing and shoes priced under $100. This exemption provides a much-needed relief to consumers, especially those with limited budgets.

Art and Collectibles

Sales tax in Arizona does not apply to original works of art, including paintings, sculptures, and collectibles. This exemption encourages the development of the art industry and supports local artists and galleries.

Construction Materials

Certain construction materials used in the construction, remodeling, or repair of a home or building are exempt from sales tax in Arizona. This exemption is designed to promote construction and renovation activities within the state.

Impact of Sales Tax on Arizona’s Economy

Sales tax plays a vital role in Arizona’s economy, contributing significantly to the state’s revenue stream. The revenue generated from sales tax is used to fund various public services and infrastructure projects, benefiting both residents and businesses alike.

Public Services and Infrastructure

A large portion of sales tax revenue is allocated towards funding public services, including education, healthcare, public safety, and transportation. These funds ensure that Arizona’s residents have access to quality public services and infrastructure, which are essential for the state’s economic growth and development.

Economic Growth and Development

Sales tax revenue also plays a crucial role in supporting economic growth and development initiatives. The state uses these funds to attract new businesses, invest in innovative industries, and create job opportunities. Additionally, sales tax revenue is often directed towards promoting tourism, a significant industry in Arizona, by funding marketing campaigns and developing attractions.

Regional Disparities

The varying sales tax rates across different jurisdictions in Arizona can lead to regional disparities in economic development. Cities with higher sales tax rates may have access to more revenue for local projects and initiatives, potentially leading to better infrastructure and public services. On the other hand, cities with lower sales tax rates may face challenges in funding local projects, which could impact their economic growth.

Compliance and Reporting for Businesses

For businesses operating in Arizona, understanding and complying with sales tax laws is essential. Businesses are responsible for collecting and remitting sales tax to the state and local jurisdictions, ensuring accurate reporting and timely payment of taxes.

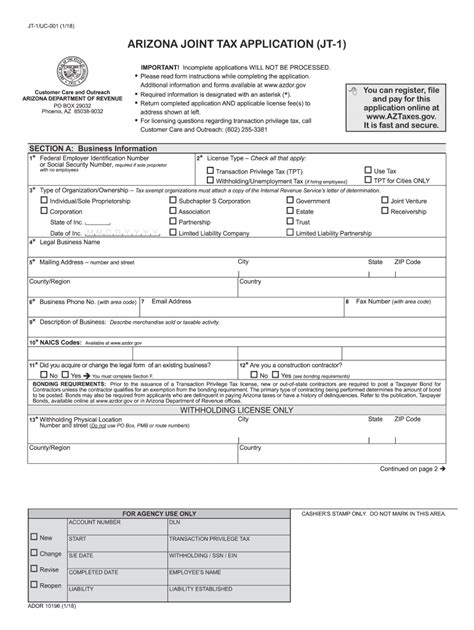

Sales Tax Registration

Businesses are required to register for a Transaction Privilege Tax (TPT) license with the Arizona Department of Revenue. This license allows businesses to collect and remit sales tax legally. The registration process involves completing the necessary forms and providing information about the business’s operations and sales.

Sales Tax Calculation and Collection

Businesses must calculate sales tax based on the applicable rate for their jurisdiction and the type of goods or services they provide. They are responsible for collecting the sales tax from customers at the point of sale and ensuring accurate recording of sales tax transactions.

Sales Tax Remittance

Businesses are required to remit the collected sales tax to the appropriate taxing jurisdictions. The frequency of remittance depends on the business’s sales volume and may range from monthly to quarterly. Late payments or non-compliance with sales tax laws can result in penalties and interest charges.

Future Implications and Potential Changes

As Arizona’s economy continues to evolve, so too may its sales tax system. Here are some potential future implications and changes to consider:

Sales Tax Rate Adjustments

The state sales tax rate in Arizona has remained relatively stable in recent years, but future economic conditions or budget constraints may lead to adjustments in the tax rate. Local jurisdictions may also consider changes to their sales tax rates to meet specific funding needs.

Expansion of Sales Tax Base

As the economy evolves, there may be discussions around expanding the sales tax base to include additional goods and services. This could impact the types of products and services subject to sales tax and affect both businesses and consumers.

Simplification of Sales Tax Laws

There have been ongoing efforts to simplify Arizona’s sales tax laws, making them more accessible and understandable for businesses and consumers. Simplification could involve streamlining the registration process, improving compliance guidance, and enhancing the online reporting system.

Digital Economy and Remote Sellers

The rise of the digital economy and remote sellers has presented challenges for sales tax collection. Arizona, like many other states, is exploring ways to effectively tax remote sellers and ensure that all online purchases are subject to the appropriate sales tax. This could involve implementing new laws or joining multi-state agreements to address this issue.

Conclusion

Sales tax in Arizona is a dynamic and ever-evolving component of the state’s revenue system. From its early days as a revenue-generating measure during the Great Depression to its current role in funding essential public services, sales tax has played a crucial part in Arizona’s economic growth and development.

For businesses and consumers, understanding the intricacies of sales tax is essential for compliance and informed decision-making. By staying informed about sales tax rates, exemptions, and compliance requirements, individuals and businesses can navigate Arizona's tax landscape with confidence. As the state continues to adapt to changing economic conditions, the future of sales tax in Arizona remains an intriguing topic, with potential for further adjustments and reforms.

What is the current state sales tax rate in Arizona?

+

The current state sales tax rate in Arizona is 5.6%.

Are there any sales tax exemptions in Arizona?

+

Yes, Arizona offers exemptions for certain goods and services, including unprepared food, prescription drugs, clothing and shoes under $100, original works of art, and certain construction materials.

How often do businesses need to remit sales tax in Arizona?

+

The frequency of sales tax remittance depends on the business’s sales volume. Businesses with high sales volumes may need to remit sales tax monthly, while others may remit quarterly. It’s essential to check with the Arizona Department of Revenue for specific guidelines.

Can I apply for a sales tax refund if I overpay my sales tax in Arizona?

+

Yes, if you overpay your sales tax, you can apply for a refund. The process involves completing the necessary forms and providing supporting documentation. It’s advisable to consult the Arizona Department of Revenue’s website for detailed instructions and guidelines.