What factors influence the NYS income tax rate this year

Harold adjusted his glasses and stared intently at his paper, trying to make sense of the latest state tax brackets, but even his decades of accounting experience couldn't stop the cloud of confusion over New York State's income tax rate changes this year. His story, familiar to many, underscores a broader reality: navigating the intricacies of state income tax systems in a landscape of fiscal policy shifts, economic oscillations, and legislative reforms can feel like decoding a complex cipher. For residents, business owners, and financial planners alike, understanding what factors influence the NYS income tax rate each year is paramount—not just for compliance but for strategic financial planning, investment decisions, and personal budgeting. This article delves into the multifaceted elements shaping the New York State income tax landscape in 2024, providing a comprehensive map through which stakeholders can better comprehend and anticipate the fiscal currents impacting their financial lives.

Understanding the Core Components Governing NYS Income Tax Rates

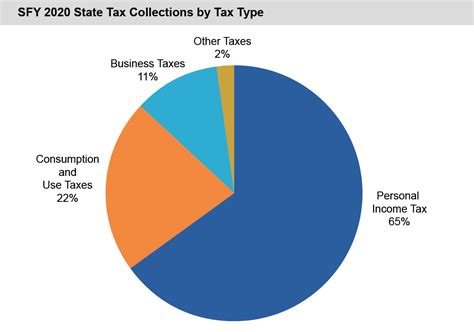

At its core, the New York State income tax system operates within a framework determined by legislative thresholds, economic metrics, and policy priorities, all of which fluctuate annually. The key factors influencing the tax rate in any given year include legislative amendments to tax brackets, economic performance indicators, inflation adjustments, and state fiscal policy objectives. To appreciate these influences, it’s helpful to trace the evolution of the NYS income tax structure as a layered construct, not only shaped by revenue needs but also by socio-economic objectives and political will.

Legislative Amendments and Policy Reforms

Legislative action remains the primary driver of changes to NYS income tax rates. Each year, the New York State Legislature evaluates the revenue needs of the state vis-à-vis economic projections, considering how tax policy can stimulate growth or address deficits. For 2024, authorities enacted several amendments, notably adjusting tax brackets and rates in response to projected budget deficits and revenue shortfalls. For example, the state’s budget included provisions for increasing the top rate for high-income earners, reflecting a policy shift aimed at progressive taxation.

Historical data reveal that legislative changes often correlate strongly with political outlooks—more progressive administrations tend to favor higher taxes on the wealthy, while fiscally conservative governments might implement rate reductions or bracket adjustments to foster economic activity. The complexity of such reforms stems from balancing revenue needs with economic competitiveness and political accountability, with each legislative cycle potentially restructuring the tax landscape.

| Factor | Impact on NYS Income Tax Rate |

|---|---|

| Legislative reforms | Alteration of tax brackets and rates based on policy priorities |

| Fiscal policy objectives | Adjusting tax rates to address budget deficits or surplus |

| Tax credits and deductions | Modifies effective tax rate for different income groups |

| Inflation adjustments | Ranges and brackets are often indexed for inflation, impacting overall tax owed |

| Economic conditions | Recession or growth periods influence tax rate adjustments to stabilize revenue |

Economic Performance and Its Role in Shaping Tax Rates

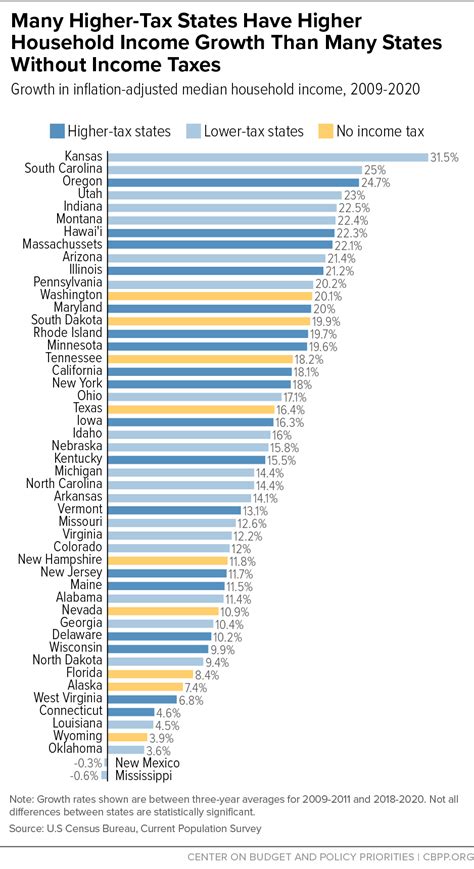

Beyond governmental policy, economic indicators signal when adjustments might be necessary. Strong economic growth generally results in increased taxable income across sectors, which can lead to higher tax rates if public expenditures expand accordingly. Conversely, economic downturns often compel state governments to either freeze rate increases or even temporarily cut rates to preserve economic stability.

For NYS, economic performance, measured via metrics like gross domestic product (GDP), unemployment rates, and income growth, exerts powerful influence over tax rate decisions. The state’s reliance on income tax revenue means that fluctuations in employment levels or wage growth can prompt recalibrations of the tax schedule to align with revenue forecasts. For 2024, amid signs of moderate economic acceleration, policymakers debated whether to increase rates on high-income brackets to fund social programs without overburdening middle-income residents. The deliberation exemplifies how economic cycles and fiscal sustainability considerations underpin tax rate determinations.

The Interplay of Budget Needs and Economic Context

In economic contexts of inflationary pressures, tax brackets are often indexed to prevent “bracket creep,” which happens when inflation pushes taxpayers into higher brackets without actual income growth. This phenomenon requires adjustments in the statutory rates to prevent unintended tax hikes and ensure that revenue forecasts remain accurate. For 2024, inflation adjustments facilitated a slight increase in bracket thresholds, cushioning middle-income taxpayers from disproportionate burdens while maintaining revenue stability.

| Economic Metric | Effect on Tax Rate Adjustments |

|---|---|

| GDP growth | Potentially enables higher rate thresholds and increased revenue |

| Unemployment rates | Higher unemployment may prompt rate reductions or hold steady to stimulate employment |

| Income growth | Supports higher brackets, potentially increasing the top marginal rate for the wealthy |

| Inflation level | Adjusts bracket thresholds to prevent bracket creep, stabilized effective rates |

Inflation Indexing and Its Effects on Tax Brackets

Inflation indexing in New York State plays a vital role in tempering the impact of rising consumer prices on taxpayers’ liabilities. Since 2010, annual adjustments to tax brackets have been implemented based on the change in the Consumer Price Index (CPI). For 2024, the CPI experienced a 3.2% increase, leading to a corresponding adjustment in tax brackets. This mechanism helps maintain the real value of thresholds, preventing taxpayers from being pushed into higher brackets solely because of inflation.

However, indexing also influences taxpayer behavior and government revenue. When brackets are automatically raised, the effective tax rate for many middle-income earners remains stable, while the tax base shifts subtly upward due to wage inflation and additional income streams. This interplay often necessitates legislative oversight to ensure that tax policies align with fiscal targets rather than merely inflation adjustments.

Impact on taxpayers and state revenue

The real-world impact manifests as a slight easing of tax burdens for middle-income groups, which can be critical during economic downturns or periods of slow wage growth. Analysts observe that inflation adjustments can sometimes delay necessary tax rate increases but are crucial for maintaining fairness and economic stability.

| Inflation Rate | Bracket Adjustment Effect |

|---|---|

| 3.2% (2024) | Bracket thresholds increased proportionally |

| Wage growth correlation | Enhances taxpayers’ capacity to manage rising costs without facing higher marginal rates |

| Revenue implications | Moderates potential revenue fluctuations due to inflation alone |

Political and Social Considerations in Tax Policy

Tax rates rarely float in a vacuum; they are entangled deeply within the political and social fabric of New York. Tax policy debates often reflect broader ideological battles—progressives advocate for higher top rates to fund social services, while conservatives seek to lower rates to stimulate growth. These ideological currents influence not just annual adjustments but long-term fiscal strategies, often leading to contentious legislative sessions.

For 2024, public discourse highlighted demands for increased transparency and fairness, particularly targeting high-income earners and corporations. Such pressures prompted policymakers to consider increasing top marginal rates while providing exemptions and credits aimed at middle-class voters. These social considerations often complicate the straightforward economic calculus, making tax rate determination a process shaped by competing interests.

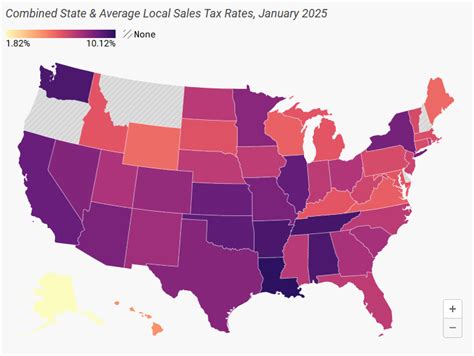

Influence of Voter Preferences and Lobbying

Political contributions from interest groups, lobbying by business associations, and voter referenda can sway legislative decisions. Recent years saw a shift towards more progressive taxation in urban centers like New York City, contrasting with suburban and rural areas favoring rate reductions. These regional differences often reflect the values and economic realities of their populations, further complicating statewide tax policies.

| Political Factor | Impact |

|---|---|

| Voter influence | Shaping legislative priorities toward fairness or growth-centric policies |

| Interest group lobbying | Driving the inclusion of credits, deductions, or rate changes |

| Regional disparities | Creating varied tax burdens across urban and rural constituencies |

Final Reflections: A Dynamic Fiscal Ecosystem

What factors influence the NYS income tax rate in 2024? The answer spans an intricate web—legislative decisions shaped by political ideologies, economic indicators reflecting the health of the state, inflation adjustments that preserve fairness, and social pressures to align tax policy with societal values. Each element interlaces within a complex ecosystem continually evolving with the state’s fiscal health and political climate. For those navigating the financial landscape of New York, understanding this interdependence is key to making informed decisions, whether as individuals, business leaders, or policymakers. The tapestry of influences underscores that tax policy isn’t static but a reflection—sometimes subtle, sometimes sweeping—of the broader economic and political currents at play.