Sales Tax Illinois

Understanding sales tax in Illinois is crucial for businesses and consumers alike. With a unique tax system and various rates across the state, it's essential to grasp the intricacies to ensure compliance and make informed financial decisions. This comprehensive guide will delve into the world of sales tax in Illinois, covering everything from its history and structure to practical tips for businesses and taxpayers.

A Comprehensive Guide to Sales Tax in Illinois

Illinois, known for its vibrant cities and diverse landscapes, also boasts a complex sales tax system. The state's tax landscape is shaped by its rich history, diverse economy, and unique regional characteristics. This guide aims to provide an in-depth exploration of sales tax in Illinois, shedding light on its intricacies and offering practical insights for those navigating this essential aspect of the state's financial ecosystem.

The Historical Perspective: Evolution of Sales Tax in Illinois

The journey of sales tax in Illinois began with the Retailers' Occupation Tax Act, enacted in 1933. This legislation imposed a 2% tax on the gross receipts of retailers, marking a significant shift in the state's revenue generation strategies. Over the decades, the tax rate has evolved, influenced by economic trends, political decisions, and the need for sustainable funding.

A notable milestone was the introduction of local sales taxes in the 1970s. This move decentralized the tax system, allowing counties and municipalities to impose additional taxes, creating a patchwork of rates across the state. Today, Illinois boasts one of the most complex sales tax structures in the nation, with rates varying not just by jurisdiction but often by the type of product or service being sold.

The recent past has seen further complexities with the rise of e-commerce and remote sales. Illinois, like many states, has had to adapt its tax laws to ensure that online retailers contribute to the state's revenue. This has led to a focus on nexus rules, determining when out-of-state sellers have sufficient connections to Illinois to be subject to its sales tax laws.

The Illinois Sales Tax Structure: A Deep Dive

At its core, the Illinois sales tax system comprises two main components: the state sales tax and the local sales tax. The state sales tax is a flat rate applicable across the state, while the local sales tax varies depending on the jurisdiction in which the sale takes place.

The state sales tax in Illinois currently stands at 6.25%, effective since July 2019. This rate is applied uniformly to most retail sales, with a few exceptions for specific items or services. The state sales tax is a crucial source of revenue for Illinois, funding various public services and infrastructure projects.

However, it's the local sales tax that adds complexity to the system. Local governments, including counties, municipalities, and special taxing districts, have the authority to levy additional sales taxes. These local rates can range from 0% to over 3%, creating a mosaic of tax rates across the state. For instance, while the city of Chicago has a local sales tax rate of 1.25%, the neighboring suburb of Evanston has a rate of 1.75%.

This variability is further compounded by the home rule authority granted to certain municipalities in Illinois. These jurisdictions have the power to set their own sales tax rates, often leading to unique tax rates in specific areas. For example, the city of Rockford has a 1.25% local sales tax, in addition to the state and county rates, creating a total sales tax rate of 9.5% within its boundaries.

The sales tax structure in Illinois also accommodates special tax districts, such as transit authorities or regional development districts, which can impose their own sales taxes. These districts are often created to fund specific public projects or initiatives, adding another layer of complexity to the tax landscape.

To illustrate the diversity of sales tax rates in Illinois, consider the following table, showcasing a snapshot of rates in select jurisdictions:

| Jurisdiction | State Tax Rate | Local Tax Rate | Total Tax Rate |

|---|---|---|---|

| Chicago | 6.25% | 1.25% | 7.50% |

| Cook County | 6.25% | 1.75% | 8.00% |

| DuPage County | 6.25% | 1.75% | 8.00% |

| Will County | 6.25% | 1.75% | 8.00% |

| Rockford | 6.25% | 3.25% | 9.50% |

This table highlights the variation in tax rates, even within a single county. For instance, while Cook County, DuPage County, and Will County all have the same state and local tax rates, resulting in a total tax rate of 8%, the city of Chicago, located within Cook County, has a lower local tax rate, leading to a total rate of 7.5% within city limits.

The complexity of the Illinois sales tax system extends beyond the rates themselves. The state also imposes different tax rates on various categories of goods and services. For instance, prepared food and restaurant meals are taxed at a 9% rate in Chicago, a combination of the state, county, and city tax rates. In contrast, unprepared food, such as groceries, is exempt from sales tax in Illinois.

Sales Tax Obligations for Businesses in Illinois

For businesses operating in Illinois, understanding and adhering to sales tax obligations is crucial. Here are some key considerations:

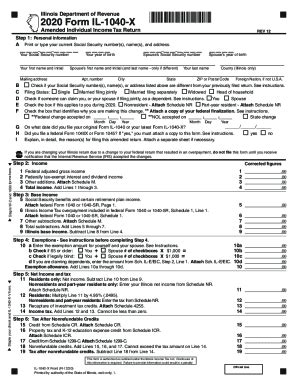

- Registration: All businesses making taxable sales in Illinois must register with the Illinois Department of Revenue to obtain a Retailers' Occupation Tax number. This registration process ensures that businesses can remit the appropriate taxes to the state.

- Tax Collection: Businesses are responsible for collecting the correct sales tax rate based on the location of the sale. This involves understanding the complex web of state, county, and local tax rates and ensuring accurate tax calculation.

- Tax Remittance: Sales tax collected by businesses must be remitted to the state on a regular basis, typically quarterly or monthly, depending on the business's tax liability. Late or incorrect remittances can result in penalties and interest.

- Record-Keeping: Maintaining accurate records of sales transactions and tax payments is essential. This includes keeping track of the various tax rates applied to different sales and ensuring compliance with record-keeping requirements set by the Illinois Department of Revenue.

- Nexus: With the rise of e-commerce, understanding when an out-of-state business has a nexus in Illinois is crucial. If a business has sufficient connections to the state, it may be required to register, collect, and remit sales tax on sales made to Illinois residents.

Navigating these obligations can be complex, especially for businesses operating in multiple jurisdictions or selling online. Professional guidance, such as that offered by CPA firms specializing in sales tax, can be invaluable in ensuring compliance and avoiding costly errors.

Sales Tax Tips for Consumers in Illinois

For consumers in Illinois, understanding sales tax can help make informed purchasing decisions and ensure compliance with tax laws. Here are some tips for consumers:

- Know the Tax Rates: Familiarize yourself with the sales tax rates in your area. This knowledge can help you budget effectively and compare prices accurately, especially when shopping online or in different jurisdictions.

- Understand Taxable Items: Illinois has specific rules on what is taxable and what is not. For instance, groceries are exempt, while prepared food and certain services are taxable. Understanding these distinctions can help you estimate your tax obligations accurately.

- Online Shopping: When shopping online, ensure that the website is collecting the correct sales tax based on your shipping address. If you notice discrepancies, you can report them to the Illinois Department of Revenue.

- Tax Exemption Certificates: If you are eligible for tax exemptions, such as for certain business purchases or as a tax-exempt organization, ensure you have the appropriate tax exemption certificate and provide it to the seller.

- Sales Tax Holidays: Illinois occasionally offers sales tax holidays, during which certain items are exempt from sales tax for a specified period. Stay informed about these events to take advantage of tax-free shopping.

By staying informed about sales tax rates and rules, consumers can make more informed choices and contribute to a fair and compliant tax system in Illinois.

The Future of Sales Tax in Illinois: Trends and Predictions

As we look to the future, several trends and factors will likely shape the evolution of sales tax in Illinois. Here are some key considerations:

- Economic Growth and Development: As Illinois continues its economic recovery and growth, the state's sales tax revenue is expected to increase. This growth will be driven by a rise in consumer spending and business activity, particularly in the retail and e-commerce sectors.

- E-Commerce Expansion: The rapid growth of e-commerce is a significant factor influencing the future of sales tax. Illinois, like many states, is working to ensure that online retailers contribute fairly to the state's tax revenue. This may lead to further developments in nexus rules and the adoption of new technologies for tax collection and compliance.

- Local Government Needs: Local governments in Illinois rely on sales tax revenue to fund essential services and infrastructure. As these needs evolve, local governments may seek to adjust their sales tax rates to meet funding requirements, leading to potential changes in the local tax landscape.

- Tax Reform Initiatives: Illinois has seen ongoing discussions about tax reform, including proposals to simplify the sales tax system. While the future of these initiatives is uncertain, they could lead to significant changes in the way sales tax is structured and administered in the state.

- Consumer Behavior: Shifts in consumer behavior, such as a preference for online shopping or a move towards sustainable and ethical consumption, could impact sales tax revenue. Businesses and policymakers will need to adapt to these changing trends to ensure a sustainable tax base.

The future of sales tax in Illinois is complex and multifaceted, influenced by economic, technological, and societal trends. While it's challenging to predict specific outcomes, these factors will undoubtedly shape the tax landscape in the years to come.

Conclusion: Navigating the Complex World of Sales Tax in Illinois

The sales tax system in Illinois is a fascinating yet complex aspect of the state's financial landscape. From its historical evolution to the intricacies of its current structure, understanding sales tax is crucial for businesses, consumers, and policymakers alike.

This guide has aimed to provide a comprehensive overview, shedding light on the unique challenges and opportunities presented by Illinois' sales tax system. By staying informed and engaged, stakeholders can contribute to a fair and efficient tax system that supports the state's economic growth and development.

As we continue to navigate the ever-evolving world of sales tax, staying abreast of the latest developments and best practices is essential. Whether you're a business owner, consumer, or policy advisor, understanding sales tax in Illinois is a key step towards financial literacy and responsible citizenship.

What is the current state sales tax rate in Illinois?

+The current state sales tax rate in Illinois is 6.25%, effective since July 2019.

How do local sales tax rates vary in Illinois?

+Local sales tax rates in Illinois can range from 0% to over 3%, depending on the jurisdiction. For instance, the city of Chicago has a local sales tax rate of 1.25%, while some suburban areas have rates up to 1.75%.

Are there any special categories of goods or services that have different tax rates in Illinois?

+Yes, Illinois has different tax rates for certain categories of goods and services. For example, prepared food and restaurant meals are taxed at a higher rate, while groceries are exempt from sales tax.

How often do businesses need to remit sales tax in Illinois?

+Businesses in Illinois typically remit sales tax quarterly or monthly, depending on their tax liability. The Illinois Department of Revenue provides specific guidelines based on each business’s sales volume and tax obligations.

Are there any sales tax holidays in Illinois?

+Yes, Illinois occasionally offers sales tax holidays during which certain items are exempt from sales tax for a specified period. These holidays are typically announced in advance and provide an opportunity for tax-free shopping.