Sales Tax For Car In California

Understanding the sales tax for a car purchase in California is crucial for anyone looking to buy a vehicle in the Golden State. With its unique tax system and regulations, California presents a complex landscape for both buyers and sellers. In this comprehensive guide, we'll delve into the specifics of sales tax for cars in California, covering everything from rates and exemptions to payment processes and potential discounts.

The Complexity of California’s Sales Tax System

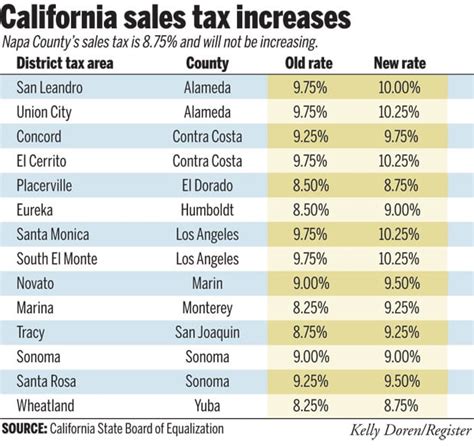

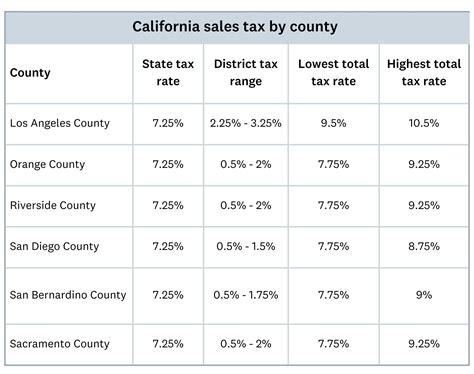

California’s sales tax system is a multi-layered structure, with taxes applied at both the state and local levels. The state sales tax rate stands at 7.25%, but this is just the beginning. Each of California’s 58 counties has the authority to add their own district taxes, which can significantly increase the overall tax burden.

For instance, in the city of Los Angeles, the district tax rate is 2.25%, resulting in a combined sales tax rate of 9.5% for vehicle purchases. Similarly, San Francisco imposes an additional 1.25% district tax, bringing the total sales tax to 8.5%. These variations make it essential for car buyers to be aware of the specific tax rates in their counties and cities.

| County/City | District Tax Rate | Combined Sales Tax Rate |

|---|---|---|

| Los Angeles | 2.25% | 9.5% |

| San Francisco | 1.25% | 8.5% |

| San Diego | 0.75% | 8% |

| Orange County | 1% | 8.25% |

| Sacramento | 1% | 8.25% |

Vehicle Sales Tax Calculation

Calculating the sales tax on a car purchase in California involves a straightforward formula. First, you multiply the purchase price of the vehicle by the applicable sales tax rate (state rate plus district tax rate). This gives you the total sales tax amount. For instance, if you’re buying a car in Los Angeles for $30,000, the sales tax calculation would be as follows:

Sales Tax Amount = Purchase Price x (State Rate + District Rate)

Sales Tax Amount = $30,000 x (0.0725 + 0.0225) = $2,475

So, in this scenario, the sales tax due on the vehicle purchase would be $2,475, making the total cost of the car $32,475.

Sales Tax Exemptions and Discounts

While the sales tax rates in California can be substantial, there are certain exemptions and discounts that can reduce the tax burden for eligible buyers. Here are some key exemptions and discounts to be aware of:

Vehicle Trade-In Discount

If you’re trading in your old vehicle as part of the purchase, you can receive a discount on the sales tax. The discount is calculated based on the trade-in value of your old vehicle. For instance, if your trade-in value is 5,000</strong>, the sales tax would be calculated on the difference between the purchase price and the trade-in value, which is <strong>25,000 in this case.

Sales Tax Amount = ($30,000 - $5,000) x (0.0725 + 0.0225) = $1,912.50

So, with the trade-in discount, the sales tax would be $1,912.50, resulting in a savings of $562.50 compared to the previous example.

Disability Exemption

Individuals with a permanent disability or a disabled veteran status may be eligible for a sales tax exemption on their vehicle purchase. This exemption applies to the first $10,000 of the vehicle’s purchase price. To qualify, you must obtain a Certificate of Exemption for Persons with Disabilities from the California State Board of Equalization.

First-Time Buyer Exemption

California offers a sales tax exemption for first-time vehicle buyers. To qualify, you must not have owned a vehicle registered in California within the past 12 months and the vehicle being purchased must be new. This exemption applies to the first $1,000 of the purchase price.

Military Exemption

Active-duty military personnel and their spouses are eligible for a sales tax exemption on vehicle purchases. This exemption applies to the first $15,000 of the vehicle’s purchase price. To claim this exemption, you must provide proof of military service and residency.

Sales Tax Payment Process

When purchasing a vehicle in California, the sales tax is typically paid at the time of the transaction. The seller will calculate the sales tax based on the purchase price and any applicable exemptions or discounts. It’s important to note that the sales tax is a separate payment from the vehicle purchase price and must be paid in full at the time of purchase.

For online or out-of-state purchases, the sales tax is usually paid to the California State Board of Equalization. The buyer is responsible for calculating and remitting the tax based on the county and city where the vehicle will be registered.

Registration and Licensing Fees

In addition to sales tax, there are other fees associated with registering and licensing a vehicle in California. These fees include a registration fee, license plate fee, and smog certification fee. The registration fee is based on the vehicle’s weight and can range from 20</strong> to <strong>120. The license plate fee is a one-time charge of 85</strong>, and the smog certification fee varies depending on the type of vehicle and can be as high as <strong>83.

Conclusion: Navigating California’s Sales Tax Landscape

Understanding the sales tax system for car purchases in California is essential for making informed decisions. With varying rates and potential exemptions, it’s crucial to be aware of the specifics in your county and city. By calculating the sales tax accurately and exploring available discounts, buyers can optimize their vehicle purchase experience in California.

What happens if I don’t pay the sales tax on my vehicle purchase in California?

+Failing to pay the sales tax on a vehicle purchase in California can result in penalties and interest. The California State Board of Equalization may impose late fees and interest on the unpaid tax, which can accumulate over time. Additionally, non-payment of sales tax can lead to legal consequences, including the suspension of your vehicle registration.

Are there any other fees or charges associated with vehicle purchases in California?

+Yes, apart from sales tax, there are several other fees and charges associated with vehicle purchases in California. These include registration fees, license plate fees, smog certification fees, and, in some cases, documentary fees charged by dealerships. It’s important to factor these additional costs into your overall budget when purchasing a vehicle.

Can I negotiate the sales tax on my vehicle purchase in California?

+No, the sales tax on vehicle purchases in California is a mandatory tax and cannot be negotiated. However, you can explore the available exemptions and discounts to reduce the overall tax burden. Additionally, you can negotiate the vehicle’s purchase price with the seller, which can indirectly impact the sales tax amount.